Introducing the Nu Colombia Cycling Team

Hey FinTech Fanatic!

Today's newsletter brings an exhilarating fusion of my shared passions – the intersection of financial technology and the dynamic world of cycling.

Nubank, a name synonymous with innovative banking solutions, has just embarked on an exciting venture. They are now the official sponsors of the professional Nu Colombia Cycling Team, competing in both the elite and under-23 male categories.

The Nu Colombia team proudly takes its place within the UCI (International Cycling Union) continental category. This is a significant stride not only for the team but also for the visibility of Colombian talent in the international cycling arena.

Spearheading this formidable lineup is none other than Sergio Luis Henao. With a team roster of 17 skilled cyclists, Henao and his team are gearing up to leave their mark in both national and international competitions.

The journey for this ambitious team begins with the National Road Championships in January, setting the stage for their appearance in the highly anticipated Tour Colombia starting February.

In my opinion, this sponsorship is a strategic masterpiece by Nubank. It's a brilliant move to elevate brand awareness, especially as their purple jerseys make a splash in the peloton this season.

I, for one, can’t wait to see these athletes in action, representing a harmonious blend of financial innovation and sporting excellence.

Stay tuned for more updates as we follow the Nu Colombia Cycling Team on their journey to success.

Don't worry if you are only interested in FinTech news. I have listed more of that for you below👇

I'll be back with more tomorrow!

Cheers,

ARTICLE OF THE DAY

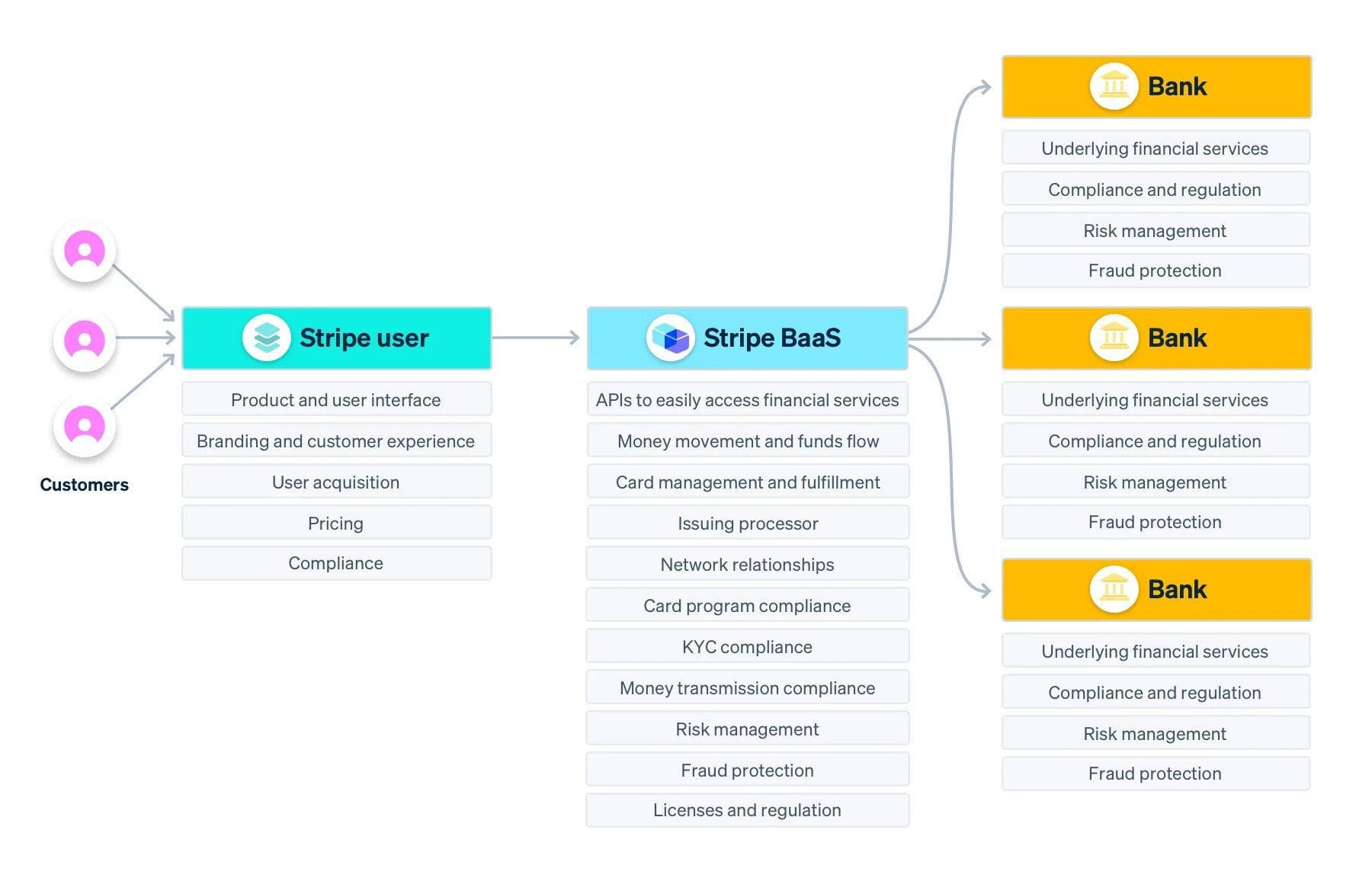

Understanding Stripe's Banking As A Service (BaaS). Traditionally, financial services like opening accounts or applying for loans were strictly bank-centric. However, Stripe's BaaS model facilitates these services through various digital platforms, allowing businesses to seamlessly integrate financial services into their existing products. Access the complete article here

FEATURED NEWS

🇨🇴 Meet the Nu Colombia Cycling Team: Nubank will be the official sponsor of the professional cycling team Nu Colombia in the elite and under-23 male categories. The team will be part of the UCI (International Cycling Union) continental category.

FINTECH NEWS

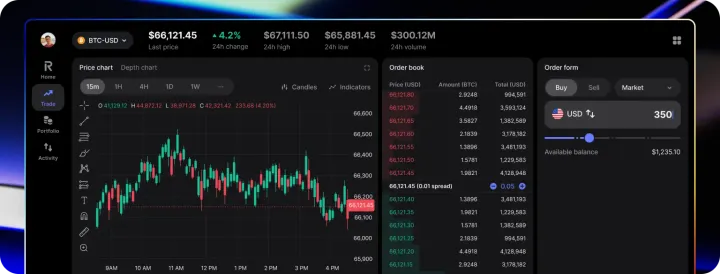

🇨🇦 Webull Corporation announced the launch of brokerage services in Canada. Through licensed financial services trading firm Webull Securities (Canada) Ltd., Canadian residents will be able to trade both Canadian- and US-listed equities through the award-winning Webull app.

PAYMENTS NEWS

🇸🇪 Surfboard Payments and Worldline forge strategic partnership to empower businesses with seamless payment solutions. This collaboration will bring together Surfboard Payments’ cutting-edge payment terminals, SoftPOS solutions, hardware logistics and loyalty platform with Worldline’s extensive expertise in acquiring, processing, and fraud prevention.

🇬🇧 Exactly. integrates with Apple Pay. The integration of Apple Pay offers exactly. customers an even more convenient and secure way to manage their finances and payment methods - enabling purchases through Apple Wallet apps. More here

6 years after the EU 🇪🇺 launch of Apple Pay, over 44% of Europeans use mobile wallets. Link here to learn more

DIGITAL BANKING NEWS

🇬🇧 TCS Group Holding (TCSq.L), owner of Russian bank Tinkoff plans delisting of shares from LSE from Jan. 31. "The LSE suspended the admission of the GDRs to trading on 3 March 2022 and the Company has received no indication since that trading may be recommenced," TCS said in a statement.

🇺🇸 Banking veteran Mary Usategui set to launch new venture BankMiami this year. Scheduled to arrive in Q2 2024, it will be the first de novo bank to be established in the region in 15 years, and will seek to offer what it describes as a “boutique concierge banking experience” from its Miami headquarters.

🇺🇸 US banking licence not on Revolut’s “immediate roadmap” but is long-term ambition, says Revolut’s US boss. In a podcast interview, Sid Jajodia, the US boss of the European fintech giant, revealed details of Revolut’s progress and plans in the US market, where he says it now has close to one million customers after over two years in the US market.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Binance announces ‘Brexit’ but can’t quit noncompliant bad habits. On December 22, Binance announced the removal and cessation of trading pairs involving the British pound as of December 29. The firm offered the usual detail-free explanation behind its decision, saying only that it came following one of its ‘periodic reviews.’

DONEDEAL FUNDING NEWS

🇬🇧 UK FinTech investment in Q4 2023 reaches $1.4bn, more than previous three quarters combined. Check out the key UK FinTech investment stats in Q4 2023:

🇨🇱 Chilean Fintech Levannta raises $10.5M to strengthen its team and prepare for expansion. The startup has the capability to integrate with the financial and subscription information of companies operating under recurring models to address their liquidity and working capital issues.

🇺🇸 Ruth Foxe Blader has left her role as partner at Anthemis Group after nearly seven years to start her own venture firm, Foxe Capital, TechCrunch learned exclusively. Foxe Capital will continue investing on behalf of Anthemis, serving as a sub advisor for the firm, and essentially managing the vehicle she was hired to run in 2017.

🇹🇷 Fimple tops up funding with additional $3.5 million investment. The new funding is considered a strategic move to further enhance Fimple’s cloud-native plug-and-play platform operating on the “Financial Function as a Service” principle, increase its competitive advantage, and provide better services to customers.

MOVERS & SHAKERS

🇬🇧 Starling's chief banking officer Helen Bierton departs for Lloyds where she will run the incumbent's Everyday Banking service, covering retail saving and current accounts across all channels. Read more

🇦🇪 Tarabut hires Munthir Alsheddie as the company’s Country Manager in the Kingdom of Saudi Arabia. Alsheddie brings over a decade of Saudi Arabian banking experience, with a focus on digital transformation, digital products and innovation to enhance the customer experience.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()