Post-Bankruptcy: Most FTX Users to Get Their Money Back

Hey FinTech Fanatic!

According to a recently filed reorganization plan in court, most account holders of the defunct cryptocurrency exchange FTX are poised to recover their funds fully, with some receiving more than their initial claims.

The exchange has reportedly amassed approximately $15 billion, largely through the disposal of venture capital investments held by FTX and its affiliate, Alameda Research.

This capital will enable the payout of 118% of the claimed amounts to 98% of creditors whose claims do not exceed $50,000. All other creditors are expected to receive full compensation, corresponding to 100 cents on the dollar.

FTX's downfall in November 2022 created a significant financial void in customer accounts, amounting to billions of dollars, and significantly impacted the broader cryptocurrency market. The collapse also led to the conviction and subsequent 25-year federal prison sentence of its founder, Sam Bankman-Fried, on charges of fraud.

Meanwhile, Nubank announces the crossing of 𝟭𝟬𝟬 𝗠𝗶𝗹𝗹𝗶𝗼𝗻 customers 🤯

There is lots more BIG FinTech, and Crypto industry news listed for you below, and I'll be back with more tomorrow!

Cheers,

#FINTECHREPORT

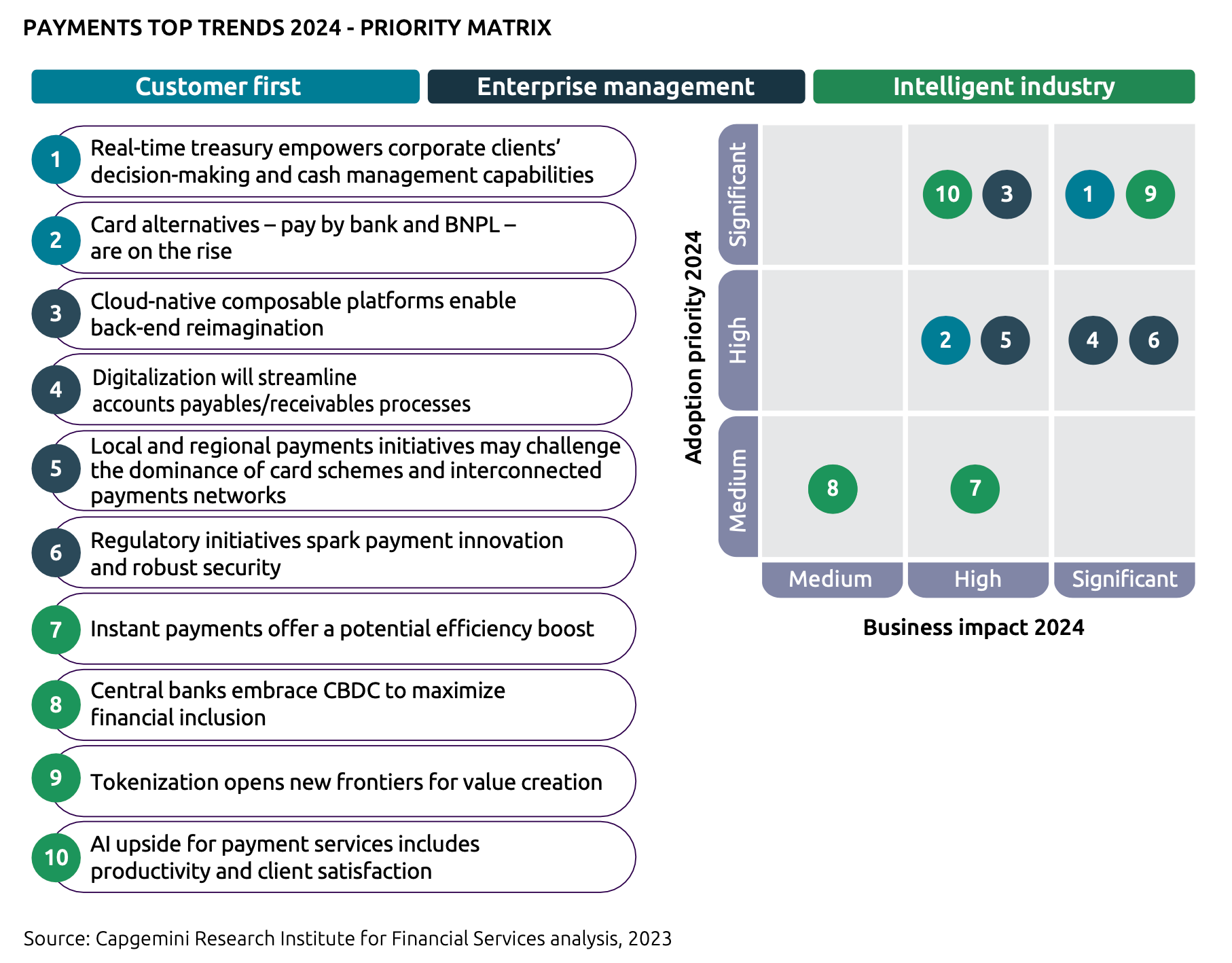

📊 Check out the latest Payments Trends 2024 FinTech report by Capgemini.

INSIGHTS

🇪🇺 Double-edged sword of AI meets EU AI Act: AI, the trillion-dollar game changer, fuels both innovation and growing cyberattacks. While the EU seeks balance with new regulations, this "double-edged sword" still thrives, shaping businesses and lives worldwide.

FINTECH NEWS

🇲🇽 Openpay, the payment platform of BBVA Mexico, has formed an alliance with Kueski, a company dedicated to providing personal loans, to expand electronic payment options for businesses in Mexico. This includes payment alternatives such as credit and debit cards, transfers, cash payments, and features like the "buy now, pay later" option.

UK 🇬🇧 and Singapore 🇸🇬 reaffirm FinTech co-operation pact. Both countries discussed collaboration opportunities in priority areas such as sustainable finance and FinTech and innovation, and exchanged views on recent developments in non-bank financial intermediation (NBFI) as well as efforts to improve cross-border payment connectivity.

🇦🇪 MoneyHash teams up with Visa to empower secure and enhanced digital payment experiences. Working with Visa enables MoneyHash to gain unparalleled access to Visa's extensive suite of digital payment solutions and opens the door to providing sophisticated payment technologies such as network tokenization.

🇺🇸 FIS launches innovative new FinTech platform – Atelio™ by FIS. Almost a year ago FIS acquired embedded finance startup Bond. CEO Roy Ng and much of the team stayed on at FIS. Fast forward to today, FIS has announced the launch of Atelio by FIS, its new embedded finance platform.

PAYMENTS NEWS

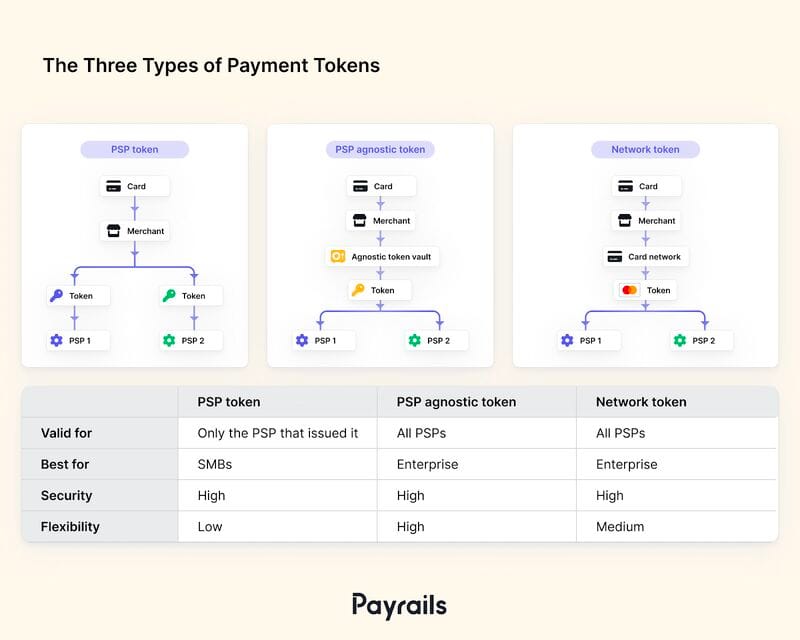

In the Online Payments space, there are 3️⃣ different Tokens that are commonly used:

🇺🇸 Experts weigh FedNow’s role in ‘Mainstreaming’ instant payments. Drew Edwards, CEO of Ingo Payments, and Doug Brown, president of NCR Voyix, told PYMNTS’ Karen Webster that the new instant payments rails will eventually go mainstream now that there are two bank rails in the US up and running — but ubiquity is going to take some time.

OPEN BANKING NEWS

🇦🇺 Banked and NAB partner to accelerate Pay by Bank adoption in Australia. The partnership aims to boost the use of ‘Pay by Bank’ technology – using Australian Payments Plus’ (AP+) PayTo services - making it easier for merchants to give Australians more choice and control in the way they pay.

DIGITAL BANKING NEWS

🇧🇷 Nubank surpasses 100 million customers. The company is the first digital banking platform to surpass this milestone outside of Asia and is honoring its customers in Brazil, Mexico, and Colombia with a tech-first campaign.

🇬🇧 Is Revolut going to launch in the Middle East soon? H.H. Sheikh Maktoum met with Nik Storonsky, Founder and CEO of Revolut on the sidelines of the second Dubai FinTech Summit (DFS). Click here to learn more

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 FTX account holders will get their money back after bankruptcy. Nearly all account holders of the bankrupt cryptocurrency exchange FTX are in line to receive cash worth more than 100 per cent of their official claims, according to a plan of reorganisation filed in court on Tuesday night.

🇳🇬 One month before Tigran Gambrayan's February arrest, Nigerian officials asked him to pay $150 million in crypto, as reported by the NYT. The report suggested that the money was a bribe. Gambrayan and his colleague Nadeem Anjarwallar were given 48 hours to make that payment after meeting with Nigerian legislators. Keep reading

🇦🇪 Bitpanda, Europe's largest crypto platform, is expanding into the Middle East with the launch of Bitpanda MENA. Through Bitpanda Technology Solutions (BTS), the company aims to provide trading infrastructure for banks, FinTechs, and brokers in the region, enabling them to offer their trading solutions.

🇺🇸 Here is why Robinhood would likely win a crypto court case with the SEC: Read on to get the full article

DONEDEAL FUNDING NEWS

🇨🇴 Colombia props up LatAm FinTech investment to increase 52% in Q1 2024.

🇬🇧 British neobank Monzo boosts funding round to $610 million to crack U.S. market, and launch pensions. TS Anil, CEO of Monzo, told CNBC his firm plans to use the cash to build new products and accelerate its international expansion plans. Notably, he said that Monzo’s planning to launch its first pensions product in the next six to nine months.

🇦🇺 Kashcade, a Sydney-based lender to start-ups that fall outside the investment universe of sector incumbents like OneVentures and Marshall Investments, has ruled off a $23 million raise as it expands its book to include loans made against the government’s R&D Tax Incentives.

🇳🇬 Identity company, Seamfix, raises $4.5 million in first funding round to expand outside Nigeria. The firm will use the funding to build a pan-African identity switch that will allow for cross-border identity verification on the continent. Read the full article

🇪🇬 Swypex launches following $4 million seed round. After closing the Seed round, Swypex will launch its operations in the Egyptian market after securing the CBE's licence as a comprehensive platform designed to eliminate financial inefficiencies.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()