Key Insights From Mastercard and Visa's Latest Results

Hey FinTech Fanatic!

I'm off for a long hike in Bali today, so I'll keep it short.

Enjoy my list of most important FinTech updates below and I'll be back in your inbox tomorrow!

Cheers,

INSIGHTS

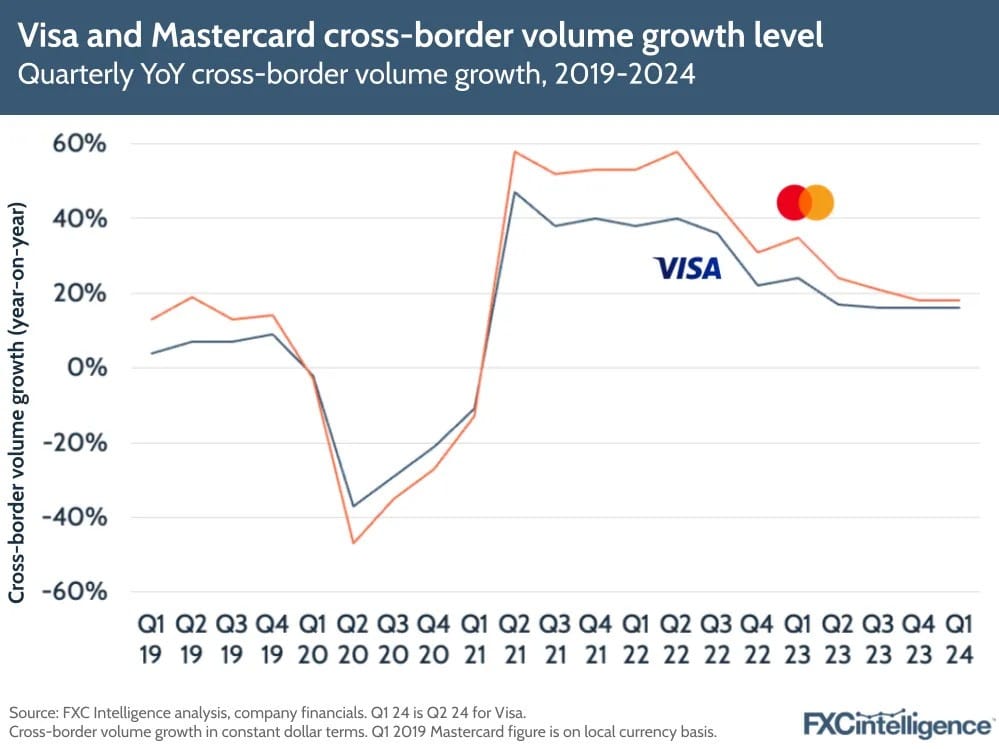

📈 Visa and Mastercard Q1 2024 growth buoyed by cross-border. It has been a positive quarter for the two companies, with net revenue increasing 10% for both players, and notable growth in cross-border transactions, particularly in ecommerce and travel sectors. Click here to learn more

FINTECH NEWS

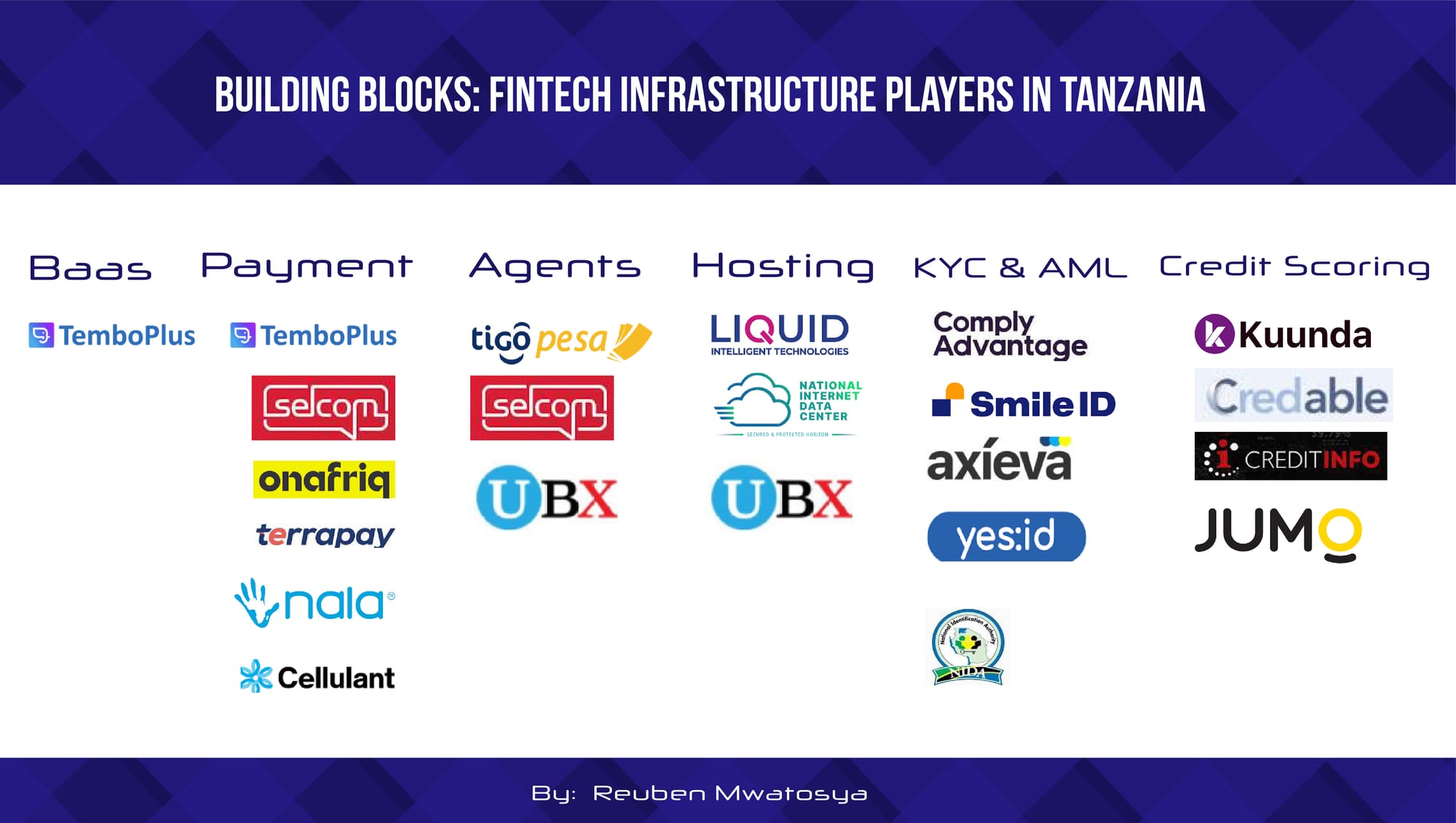

🇹🇿 Main API providers for FinTechs, challenger banks and neobanks in Tanzania: Take a look at a list of reputable API providers here

🇦🇷 LatAm’s Mercado Libre plows ahead with 50M FinTech clients. Despite challenges like high-interest rates and sluggish GDP growth in Latin American economies, the Buenos Aires-based firm, one of the region’s largest publicly-traded companies, boasted 49 million active FinTech users in the first quarter of 2024

🇮🇩 GoTo loses money in Q1 but FinTech unit performs well. GoTo lost US$6.3 million, though the company claims that it is on track for EBITDA profitability this year. The firm seems to be betting big on the integration of TikTok and Tokopedia, which it believes will lead to significant e-commerce synergies.

🇨🇭 Neon and Invesco launch free ETF savings plans for Switzerland. The joint initiative aims to further democratize access to ETFs and to give investors the opportunity to implement their asset accumulation much more easily and efficiently. Read more

🇮🇹 Italian antitrust ruling puts halt on Intesa Sanpaolo’s FinTech ambitions. Finance Yahoo reports Intesa Sanpaolo's migration efforts encountered setbacks, with only 350,000 customers shifted, far below the 2.3 million target by March. Nonetheless, the bank remains committed to onboarding one million new clients through Isybank by next year.

🇲🇾 Grab-led GXBank has entered into a 10-year partnership with Zurich to offer affordable insurance. Their initial product, slated for launch in the third quarter of this year, aims to safeguard customers from unauthorized transactions resulting from cybercrime.

PAYMENTS NEWS

💳 Payment Networks spotlight rise of tokenization and contactless payments. Earnings reports from Mastercard and Visa indicate a surge in payment methodology. Earlier this year, PYMNTS Intelligence data revealed that over half of surveyed consumers still favor using physical cards for in-store purchases.

🇨🇳 China’s Ant Group doubles down on global expansion with cross-border payments offering Alipay+. “What we found is that people want to use their home e-wallets when they travel abroad. So they don’t want to have to load their card into another app that they don’t know as well,” Douglas Feagin, senior vice president of Ant Group, told CNBC.

🇦🇪 Astra Tech patents first-ever palm pay technology, establishing PayBy as the only provider in the region. Palm Pay, the first technology of its kind in the UAE and the region, is a pioneering contactless palm recognition service that enables customers to effortlessly hover their palm over a device to make payments.

REGTECH NEWS

🇺🇸 Unit21's new ACH features unleash safer, faster payments. These new features enable financial institutions to combat faster payment fraud and improve customer experience by unlocking near-instant funds for legitimate customers. More here

DIGITAL BANKING NEWS

🇺🇸 Wells Fargo has joined JP Morgan in revealing that US authorities are investigating the handling of complaints about Zelle. In an SEC filing, Wells says: "Government authorities have been conducting formal or informal inquiries or investigations regarding the handling of customer disputes related to fund transfers made through the Zelle Network."

🇺🇸 JPMorgan offers faster domestic payments via Visa Direct. The collaboration, announced Monday (May 6) is designed to improve merchant experiences and empower cardholders for customers of J.P. Morgan Payments. Find out more

🇬🇧 HSBC customers furious as mobile banking app goes down leaving thousands of them unable to access their accounts. Over 2,800 users have reported issues with the app, according to DownDetector. According to the site, around 57 percent of issues reported are in relation to mobile banking.

🇪🇬 Egypt greenlights its first digital bank. Misr Digital Innovation (MDI), a subsidiary of banking giant Banque Misr, received preliminary approval from the CBE to launch Egypt’s first digital bank, stylised Onebank. The bank will launch later this year—Q4 2024—after completing the second phase of its licensing.

🇿🇦 Michael Jordaan: ‘You need an A-team if you are starting a new bank.’ Click here to read the full interview with the chairperson and co-founder of Bank Zero.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Revolut's new crypto exchange "for Pros" is called Revolut X. Link here

🇸🇬 Crypto.com surpasses 100 million global users. This milestone was reached in the immediate wake of Crypto.com’s latest Fortune Favors the Brave brand film, INEVITABLE, which celebrates conviction, achievement against all odds and staying focused on the additional goals ahead.

DONEDEAL FUNDING NEWS

🇧🇷 Jeeves secures USD$75 Million financing to expand Latin America footprint, including launch of Jeeves Pay Credit in Brazil. With the new credit facility from CIM, Jeeves will double down on expanding Jeeves Pay and other key product offerings in strategic Latin American markets.

🇺🇸 Securitize, a US-based firm that tokenises assets and traditional securities, has successfully completed a $47 million funding round spearheaded by global asset manager BlackRock. The cash injection will be used to fund product development, extend its global footprint and strengthen its “partnerships across the financial services ecosystem”.

M&A

🇪🇸 Spain's Sabadell rejects BBVA merger proposal. Sabadell board meets to consider BBVA's $13 bln offer, sources say. The country's fourth-largest lender by market value said its board believed BBVA's proposal significantly undervalues the potential of Banco Sabadell and its growth prospects, calling the offer unsolicited.

MOVERS & SHAKERS

🇬🇧 TerraPay names Western Union vet Hassan Chatila Head of Network. Chatlia will serve as vice president, global head of network, the company announced in a Monday (May 6) news release. “With over 20 years of experience in cross-border payments, Hassan brings with him a rich legacy of leadership and innovation,” the release said.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()