Revolut Launches Crypto Trading Platform Revolut X

Hey FinTech Fanatic!

It's official: Revolut launched a standalone crypto trading platform, called Revolut X, for UK retail customers.

The rollout marks Revolut’s renewed interest in crypto service offerings following the halt of crypto trading for its UK business clients and the termination of its U.S. crypto services amid a challenging regulatory environment.

Today's newsletter is packed with big FinTech funding rounds, and Crypto news. I highly recommend checking out those segments below👇

Have a great day and I'll be back in your inbox with more FinTech industry news updates tomorrow!

Cheers,

P.s. If you like this newsletter and/or my other content, you can support me by becoming a member. I'll be forever grateful.

Now let's dive into the news of today:

FINTECH NEWS

🇲🇽 EKT, a new FinTech from Grupo Elektra, has received authorization to operate as a payment fund institution in Mexico. The next step is for the company to verify compliance with requirements to formally start operations, at least 30 business days before operating for the first time, as reported by the commission.

🇨🇳 Joint Stock company Kaspi.kz has announced a new partnership with Alipay+ to enable its customers to pay using the Kaspi.kz superapp and QR code throughout China. According to the official announcement, when travelling in China, Kazakhstanis no longer need to take cash or a card with them.

🇺🇸 Block, Inc. announces upsize and pricing of $2.0 billion offering of Senior Notes. The sale of the Notes is expected to settle on May 9, 2024, subject to customary closing conditions. Interest on the Notes will be payable in cash semi-annually in arrears, beginning on November 15, 2024.

PAYMENTS NEWS

🇳🇬 Nigeria’s 1.9 million PoS agents, a key part of the country’s financial inclusion drive, must now be registered with the Corporate Affairs Commission (CAC) as part of plans to improve transparency and reduce fraud. This week’s new rule comes as fraud incidents involving POS terminals are rising.

DIGITAL BANKING NEWS

🇳🇱 Revolut introduces a new savings account offering in the Netherlands. The offering comes under the Flexible Accounts portfolio, launched earlier this year, and will also get included in the digital bank's all-in-one application. Read more

🇨🇴 FinTech Littio launches bank account in the U.S. for Colombians. With this account, Colombians can connect to the banking network of the United States in less than 10 minutes, facilitating the management of finances in dollars and opening new cross-border financial opportunities.

🇺🇸 The Financial Industry Regulatory Authority has censured and fined SoFi Securities $1.1 million for failing to establish and maintain a reasonable Customer Identification Program for SoFi Money, its cash management brokerage account, which resulted in $2.5 million in stolen funds.

🇮🇳 MSME neobank Open aims profitability in a year and a half: Interview with CEO Anish Achuthan. Click here to read the complete interview

🇬🇧 Unlimit has announced the partnership of its Banking as a Service (BaaS) platform with digital banking solutions provider Velmie. The partnership brings together Unlimit's cutting-edge BaaS offering with Velmie's platform to provide users with scalable financial solutions empowered by the Unlimit BaaS API.

🇬🇧 Monese founder says “very pleased” he can focus on just challenger bank after “difficult” time running two businesses. Norris Koppel talks through the decision to split the London-based business into two. The move comes amid mounting losses at Monese, which reported losses of £30.5m in 2022, up 70 per cent on the year.

BLOCKCHAIN/CRYPTO NEWS

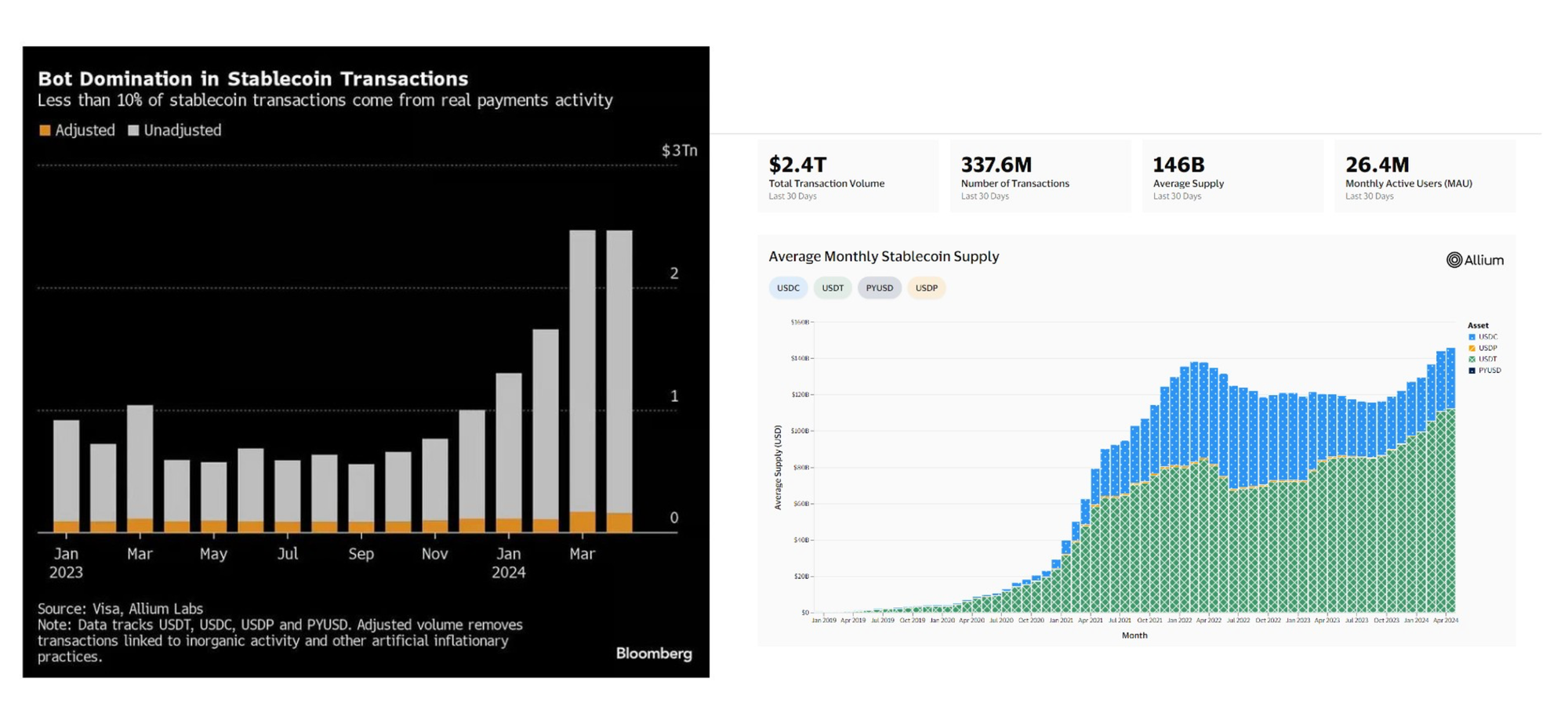

📉 More than 90% of stablecoin transaction volumes aren’t coming from genuine users, analysis co-developed by Visa finds, according to a Bloomberg report. Out of about $2.2 trillion in total transactions in April, just $149 billion originated from “organic payments activity."

Forget Sam Bankman-Fried and Changpeng Zhao! This is the biggest case in crypto right now. Alexey Pertsev, a developer of Tornado Cash, faces charges of laundering $1.2 billion in illicit assets. His case is pivotal for the cryptocurrency industry, as it delves into the intersection of online privacy and the use of technologies like smart contracts for transaction anonymity.

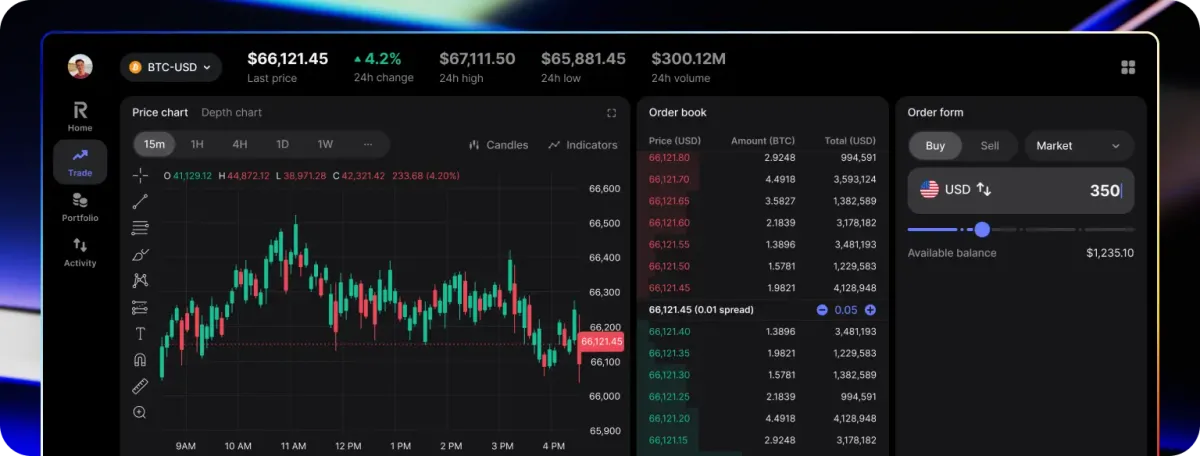

🇬🇧 Revolut launches standalone crypto trading platform for UK retail customers. Revolut said the new platform was aimed at competing with leading crypto exchanges by offering easy on/off-ramping and low fees, according to a statement shared with The Block.

🇺🇸 The SEC added another company to its list of crypto targets, this time taking aim at the popular stock trading app Robinhood. Robinhood's May 4 8-K filing disclosed a Wells Notice from the SEC, suggesting potential enforcement action against its crypto business for alleged securities violations. Possible consequences include a cease-and-desist order and civil penalties.

🇯🇴 Tamatem Plus partners with Triple-A to introduce cryptocurrency payments for gamers. This partnership enhances the gaming experience for users of the Tamatem Plus platform by offering a secure and efficient way to purchase game vouchers in digital currencies across the globe.

🇳🇬 Binance CEO provides key details on how execs were arrested and jailed in Nigeria. Breaking 10 weeks of silence on Binance’s ongoing crisis in Nigeria, CEO Richard Teng posted a lengthy blog on the exchange’s website Tuesday decrying the arrest and imprisonment of executive Tigran Gambaryan.

🇩🇪 Kraken expands European footprint with German partnership. Kraken doubles down on its European expansion strategy by announcing a new strategic partnership that enables it to actively enhance its product offering in Germany, a key market for European crypto adoption.

DONEDEAL FUNDING NEWS

🇱🇺 Fundcraft, a leading provider of digital infrastructure for asset management, announces that it has closed a €5 million Series A funding round. The funds will be used for product development and to fuel fundcraft’s international expansion.

🇩🇰 Danske Bank has acquired a stake in the Danish company United FinTech, thereby avoiding the need to develop all digitalization programs in-house. By injecting a bag of money into United FinTech and simultaneously seizing a position on the board, Danske Bank has chosen to become the third international investor on par with Citi and BNP Paribas.

🇨🇦 Cashco Financial closes debt investment of $50 Million. This will empower Cashco to strengthen its market position, drive growth in lending products, and set the stage for enhanced consumer protection, innovative product development, and technological advancement.

🇵🇭 To help expand financial inclusion in the Philippines, the International Finance Corporation (IFC) has invested USD 7 million in the country’s FinTech firm Salmon. The capital is intended to enable Salmon to develop new credit products and a lifestyle banking offering, which it plans to launch in the second half of 2024.

🇬🇧 Iwoca, which claims to be one of Europe’s largest SME lenders, has announced a £270 million package of debt funding. The investment will support iwoca in meeting the growing demand for finance from SMEs. Keep reading

🇬🇧 UK AI-led FinTech Abound announces new funding round of £0.8bn to increase access to fair credit, expanding total funding to up to £1.3bn. Abound plans to expand its offer of smart, affordable loans to more UK customers.

M&A

🇹🇷 Turkey-based payment FinTech iyzico, the local arm of PayU, acquired peer local payment services provider Paynet Ödeme for a consideration of USD 87m, which will be adjusted at the time of closing, as per a public disclosure platform announcement. Read more

🇵🇭 Filipino digital challenger GoTyme Bank has announced that it has acquired Manila-based lendtech SAVii to help boost the bank’s expansion into payroll-enabled financial products. The agreement will enable the bank to integrate SAVii’s credit offering into its lending and payroll services.

🇫🇷 Atos said it has received four new financial restructuring proposals as part of its refinancing process, aimed to trim its debt pile and restore profitability. Read the full article here

MOVERS & SHAKERS

🇱🇺 Mangopay appoints Ariel Shoham as Vice President of Risk Product. Shoham is joining to lead the product vision, strategy and roadmap for Identity and Fraud Protection at Mangopay, including its award-winning cybersecurity solution. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()