Visa Introduces 7 New Payment Features

Hey FinTech Fanatic!

At its yearly Payments Forum, Visa introduced seven new consumer payment products to make its mobile banking app central to digital commerce.

Here's a summary of the updates:

- Visa Payment Passkey Service: This service uses facial or fingerprint scans to authorize online payments, replacing passwords for a smoother shopping experience.

- Flexible Credentials: A single digital card can switch between payment methods (e.g., debit, credit, BNPL), allowing consumers to set preferences and customize payments.

- Tap to Everything: Enhances card capabilities to authenticate identity for online shopping, card provisioning, and peer-to-peer payments by simply tapping the card on a mobile device.

- Pay By Bank: Allows consumers to link bank accounts for direct payments, simplifying the process and maintaining the relationship between consumers and billers.

- Visa Protect Expansion: Extends fraud protection to account-to-account payments by enriching real-time transaction data to flag fraudulent activities.

- Data Tokens: Empowers consumers to control access to their payment data, enabling personalized offers and better data privacy.

- AI-Powered Tokens: Future integration of AI will automate and streamline payment choices, enhancing the consumer experience and driving innovation.

These updates aim to improve the consumer experience and position Visa's mobile banking app as a comprehensive digital wallet.

Do you think these updates are groundbreaking? And if so, which one(s)? Let me know in the comments below👇

Finally, I want to share with you a poll together with my friends at Payquicker:

Delivering seamless payments to a global workforce is becoming increasingly essential with the rise of an on-demand workforce. Payouts come with their own set of challenges — what have you experienced?

Fill in the poll to share your thoughts with the Connecting the dots in FinTech community!

Cheers,

FEATURED NEWS

🇪🇸 PayRetailers announces its expansion to Africa strengthening its presence in emerging markets. With coverage across four countries, the company offers a unified payment solution that will be a game changer for cross-border online merchants looking at Africa as their next move for strategic growth.

#FINTECHREPORT

📊 Digital Banking Features: Must-Haves 🆚 Game-changers by Mobiquity Inc. Link here

FINTECH NEWS

🇺🇸 SoFi and Templum partner for expanded access to alternative assets. Together, both companies are bringing best-in-class technology and infrastructure capabilities to facilitate access to one of the fastest growing sectors of investments. Click here to learn more

🇺🇸 The most powerful woman in FinTech is on the hunt for acquisitions. Just months after completing one of the biggest deals of her career, Stephanie Ferris, the CEO of Fidelity National Information Services, has a message for everyone: FIS isn’t done. Ferris and the company she leads is looking to get back to buying.

🇺🇸 Payments FinTech Payoneer reports record quarterly revenue and profitability in Q1 2024. “We grew ICPs by 8% and generated 21% volume growth, our highest growth rate in nearly 3 years,” said CEO John Caplan. More here

🇸🇬 Ex-staff sues FinTech unicorn Rapyd, alleges $1.1m in unpaid commissions. A former salesperson is suing the FinTech unicorn, according to affidavits filed with the Singapore High Court in 2023. Rapyd has denied the allegations and is contesting the lawsuit.

🇨🇴 Mexican startup Mattilda expands to Colombia, targets school financing. Mattilda will facilitate transactions for schools using an automated collection platform and extend credits through a factoring model, according to Gregorio Sánchez, country manager for Colombia and Ecuador.

🇯🇵 Rakuten logs $213 billion quarterly loss as mobile losses negate FinTech growth. The operating loss marks a strong improvement compared to a year earlier when the e-commerce and FinTech group posted a loss of 76.2 billion yen. Read more

🇬🇧 Global payments provider Paysafe has released its Q1 2024 earnings report, revealing strong financial performance and continued growth across key business segments. The company reported an 8% year-over-year (YoY) increase in revenue, reaching $417.7 million.

🇺🇸 Chipper Cash is "fully operational" in the United States after months of pausing services. The African cross-border payment startup, has resumed and is now "fully operational" in the US following a two-month hiatus, during which it transitioned to a new banking partner and improved its services.

dLocal, a cross-border payment platform specializing in high-growth markets, announced the expansion of its partnership with Deel, a global HR and payroll platform that helps businesses scale their remote workforce capabilities. The significant partnership expansion includes 12 countries.

PAYMENTS NEWS

🇺🇸 After transformational year in payments, VGS surpasses 3 billion tokens. VGS, formerly known as Very Good Security, announced it has surpassed 3 billion tokens stored, reflecting the transformational impact of the company's universal token vault and cementing its position as the leader in payment tokenization.

🇳🇱 Bank Cards in The Netherlands to be Replaced: Payments Without iDeal Possible. Over the coming years, all bank cards in The Netherlands will be replaced by the new Debit Mastercard and Visa Debit cards. The goal is to enable payments in more places with the new cards, making them an upgrade from Mastercard and Visa. Online payments will become easier, eliminating the necessity of using iDeal for online purchases.

🇬🇧 BVNK, the payments infrastructure provider, announced that it has integrated the stablecoin PayPal USD (PYUSD). With this new integration, BVNK customers can create PYUSD wallets, settle suppliers, pay contractors and employees around the world and accept consumer payments in PYUSD.

🇩🇪 Kieran Mongey, Principal Payments Consultant - Merchant Solutions at ACI Worldwide, sheds light on the pivotal role of AI in payments orchestration and other industry trends, during MPE Berlin 2024. Kieran delved into AI's significance in payment orchestration, emphasising its impact on key areas.

🇺🇸 TBD, a part of Block focused on creating open and decentralized technologies to connect the financial world, has partnered with Chipper Cash, a FinTech firm in Africa to accelerate its global cross-border payments. More on that here

OPEN BANKING NEWS

🇧🇷 Currently, Nubank represents over 34% of the approximately 44 million active consents in the Brazilian ecosystem. In less than two years, Nubank reached 15 million consents in Open Finance. For perspective, in January, the digital bank with the purple card had around 13 million consents, compared to the system's total of 42 million.

DIGITAL BANKING NEWS

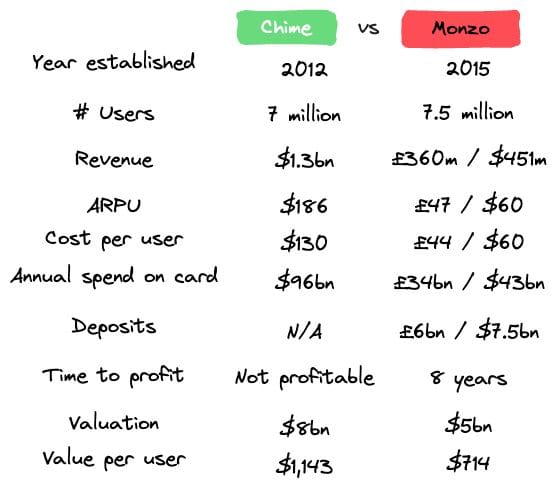

Chime 🆚 Monzo Bank, by Michael J.:

🇺🇸 U.S. digital bank Chime is launching a product that will allow customers to access up to $500 of their wages before payday, the latest move by a financial technology company to enter the fast-growing "earned wage access" market. The upcoming product launch coincides with Chime's plans for an eventual public listing, in the "not too distant future," CEO Chris Britt revealed in an interview with Reuters.

🇲🇾 Grab’s Digibank deposits reach US$479M, driven by growth of Malaysia’s GXBank. The growth was fueled by a doubling of deposit customers for GXBank, which increased from 131,000 at the end of 2023 to 262,000 by March 2024. Notably, over 90% of GXBank’s deposit customers are also Grab users.

BLOCKCHAIN/CRYPTO NEWS

🇦🇺 OKX, a leading global crypto exchange and Web3 technology company, has officially launched its crypto exchange services in Australia. OKX now offers spot (buy & sell) trading for all users and derivatives trading for verified wholesale clients in Australia. It is now the largest global crypto exchange offering direct AUD deposits and withdrawals to Australian users.

🇦🇹 Crypto broker Bitpanda says profit may rebound to record in 2024. Revenue is surging following 2023 net sales of €148 million ($160 million), with Bitpanda already netting more than €100 million of business in the first three months of 2024, the company said in a statement to Bloomberg.

🇮🇱 Israeli FinTech Kima and Mastercard’s FinSec Innovation Lab have launched a project to develop a use case for linking decentralized finance (DeFi) tools and traditional services such as credit cards and bank accounts. Access the complete article here

DONEDEAL FUNDING NEWS

🇬🇧 Credit repayment FinTech Incredible raises $1m. Incredible, founded in 2022, leverages open banking tech and AI, saying it can help its users track, pay and cut the cost of their borrowing. Read more

🇬🇧 London-based climate FinTech, ekko, has successfully closed a $2.5 million funding round led by Fuel Ventures and supported by Sorven Partners, Mishcon de Reya and existing investors. The raise will supercharge ekko’s ability to bring sustainability to the forefront of financial services.

🇺🇸 Cover Genius closes $80 million in series E funding. This funding follows a remarkable year of sustained growth and expansion for Cover Genius and its award-winning global distribution platform, XCover.

🇺🇸 Embedded accounting startup Layer secures $2.3M toward goal of replacing QuickBooks. The company plans to deploy the new funding into expanding its services to additional small business software platforms this year.

🇧🇷 Eyeing generation Z, FinTech NG.Cash raises R$65 Million in a round led by Monashees. The new contribution will be used to maintain the pace of growth of the platform, which moved more than R$2 billion in 2023, a volume 40 times higher than that recorded a year earlier.

🇲🇽 Mexico’s Worky bags $6M series A to transform payroll solutions. The firm intends to utilize the funds to accelerate product development, expand sales and marketing efforts, as well as strengthen the team.

🇸🇦 Riyad Capital launches 1957 Ventures to invest in Saudi FinTech startups. In a statement, the firm highlighted that the launch of the fund emphasizes Riyad Capital and Riyad Bank’s strategic dedication to advancing the Kingdom’s digital transformation.

🇺🇸 Butter raises $10M to combat failed payments. The company, which built itself on top of processing services, says it sees itself bolstering successful transactions for processors. Read on

M&A

🇺🇸 TransNetwork acquires Inswitch to drive the future of banking and cross-border digital payments in LatAm. This strategic acquisition combines TransNetwork’s payments network and instant money movement capabilities with Inswitch’s financial technology solutions offered via an API-based core platform.

🇺🇸 Empower officially closed a deal to acquire Petal according to Sam Elliot. Click here for more info

🇿🇦 Lesaka to acquire FinTech platform Adumo for $85 million. According to Lesaka, the acquisition will give the company a footprint of 1.7 million active consumers and 119,000 merchants across South Africa, Namibia, Botswana, Zambia, and Kenya.

MOVERS & SHAKERS

🇳🇱 BUX appoints Marcel Jongmans as chairman. With extensive experience in leadership and strategic vision, Jongmans will guide BUX Holding into the next phase. Read the full piece here

🇮🇳 BNPL startup Simpl lays off around 160 employees as part of cost-cutting measures. This comes even as the FinTech's monthly cash burn has remained elevated and new user acquisitions have slowed down, according to people aware of the developments.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()