UPI is Now Accepted in France

Hey FinTech Fanatic!

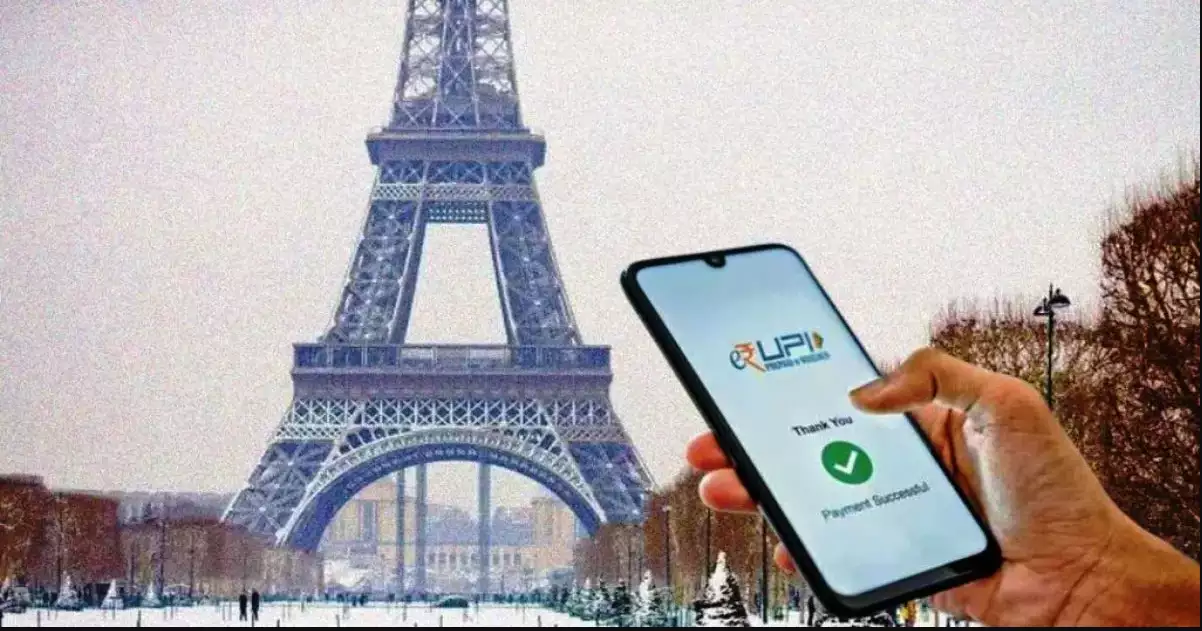

Let's start with interesting news from the Payments industry, where India’s unified payments interface (UPI) has now gone live in France.

NPCI International Payments Limited (NIPL) in partnership with Lyra, a French leader in securing e-commerce and proximity payments, has announced the acceptance of the UPI payment mechanism in France starting with the iconic Eiffel Tower.

Indian tourists can now book their visit to the Eiffel Tower by purchasing tickets online using UPI — making the transaction process quick, easy, and hassle-free. This announcement is of particular significance as Indian tourists rank the second largest group of international visitors to the Eiffel Tower.

The official announcement was made in Paris at an event organized by the Indian Embassy in France to celebrate the Republic Day of India on Friday.

Have a great start to the week, and I'll be back with more news updates tomorrow!

Cheers,

POST OF THE DAY

The Q4 2023 reports are in: Visa 🆚 Mastercard

BREAKING NEWS

Tata in frame to take over UK's Faster Payments network. An arm of the Indian conglomerate is a leading contender to replace Vocalink as the administrator of the service in a process being scrutinised by regulators and the Bank of England, according to Sky News.

FEATURED NEWS

Apple Vision Pro and the metaverse economy. The Financial Revolutionist team is not acquiring the Apple Vision Pro headset, priced at $3,499, for review, deeming it an inefficient allocation of resources. They also have covered the metaverse’s ups and downs: from Meta’s hopes, to public disinterest in metaverse initiatives. Delve into this insightful article to learn more.

’No money laundering probe on us or CEO': Paytm Payments Bank clears air on ED report. Paytm Payments Bank has clarified that the firm nor Vijay Shekhar Sharma, One97 CEO, were under enforcement directorate scrutiny for money laundering. Keep reading

FINTECH NEWS

🇬🇧 WiseAlpha is expanding into the banking and wealth trading solutions arena. The company has announced a new wealth management portal and white-label solution, making it easier than ever for wealth managers to give clients access to fractional bonds.

🇦🇺 Douugh’s embedded finance activities drive sharp revenue growth in Q2, launches Stakk. Douugh's report highlights strong revenue growth, driven by its successful Embedded Finance (B2B) initiatives and consumer app (B2C) activities in loan origination and share-trading. The company continues to leverage its technology stack through a B2B model under the brand "Stakk."

🇰🇪 Fintech giant Flutterwave secures release of $3 million in Kenya. A Kenyan high court has unfrozen $3 million belonging to fintech giant Flutterwave and two of its associates, ending a legal wrangle that began in 2022. The funds continued to be withheld despite a court order to release them in November 2023.

🇰🇷 Toss kicks off IPO process, eyes 2025 listing. Viva Republica, Toss’ operator, has kicked off procedures for an initial public offering, having selected lead underwriters. The firm has not officially announced its IPO plans yet, but it is expected to debut in the market next year.

UAE sees growing interest from UK Fintechs for dual listings. The United Arab Emirates has seen a pick up in interest from a number of UK Financial Technology firms hoping to pursue a dual listing in the Gulf country. More on that here

Take a look at Nordic Fintech Highlights – January 2024 👇

PAYMENTS NEWS

🇫🇷 India’s Unified Payments Interface (UPI) has now gone live in France. NPCI International Payments Limited (NIPL) in partnership with Lyra, a French leader in securing e-commerce and proximity payments, has announced the acceptance of the UPI payment mechanism in France starting with the iconic Eiffel Tower.

Network International obtains a payment licence from Saudi Central Bank. The procurement of the licence is a milestone that aligns with Network’s strategic objectives that include expanding capabilities to offer a comprehensive suite of payment acceptance solutions within the KSA market which is the largest market in the region.

OPEN BANKING NEWS

🇬🇧 Tymit, a pioneer of instalment credit cards, and leading credit reference agency Equifax have announced a new Open Banking partnership to support affordability decisions and transparency for Tymit’s credit products in the UK. This partnership allows Tymit to improve the accuracy of affordability decisions with real-time insights and more granular transaction data.

🇬🇧 Ecospend, a Trustly company, has announced its partnership with UK-based Hargreaves Lansdown in order to launch its Pay-by-Bank solution on mobile. Both firms will concentrate on delivering solutions to streamline the payment process for users, enhance security, minimize fraud risks, and optimize overall business efficiency and development processes.

DIGITAL BANKING NEWS

HelloMoney now accepted in South Korea, Malaysia, HK. After becoming the first Philippine bank to offer an e-wallet that can be used for cross-border payments, Asia United Bank (AUB) is in a race to expand the coverage of its HelloMoney abroad. Read more

🇧🇷 Nubank announces its newest product developed by Nu Asset: Nu Selic Simples, with a focus on National Treasury bonds. With a majority allocation in post-fixed public bonds from the National Treasury, Nu Selic Simples offers an alternative for conservative profile customers seeking a low-risk investment solution with daily liquidity. The bank is also set to introduce two innovative Open Finance functionalities for its clients in 2024: 1️⃣’ smart transfers' and 2️⃣ ‘app-to-app' payment initiation with single authentication after the second transaction.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Celsius to exit bankruptcy with $3 billion payout. Celsius is working under the eye of federal and state regulators to ensure the distributions are made in a secure and timely manner during its restructuring period. The firm has begun processes to shut down its mobile and web applications.

🇬🇧 Wirex reveals ZK-powered WPay, opening exclusive early access to its decentralised payment network. WPay solves problems related to intermediaries, custody risks, and slow, expensive settlements. WPay ensures a smoother, more secure payment experience, marking a significant advancement in simplifying financial interactions for users.

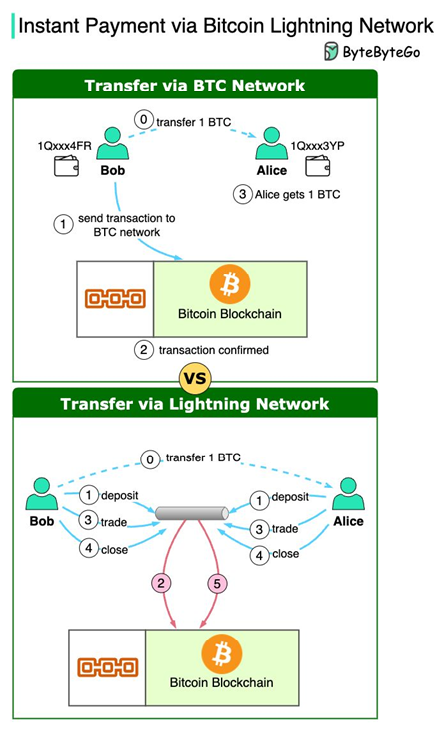

How do we instantly transfer bitcoins via 𝐋𝐢𝐠𝐡𝐭𝐧𝐢𝐧𝐠 𝐍𝐞𝐭𝐰𝐨𝐫𝐤? How can it achieve 1 𝐦𝐢𝐥𝐥𝐢𝐨𝐧 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬 per second (Visa 65k)?

DONEDEAL FUNDING NEWS

🇺🇸 BNPL lender Sunbit secures $310m debt facility with Citi and Ares Management Credit. The fintech says it will use its newly secured credit to appease what it claims is an “ever-increasing consumer demand” for its two offerings. It adds that this demand is represented in its 2.6 million loan customers and approximately $1 billion in annual merchant transactions.

🇺🇸 Metronome’s usage-based billing software finds hit in AI as the startup raises $43M in fresh capital. The startup that helps software companies offer usage-based billing, has raised $43 million in a Series B funding round led by NEA. The company also plans to use its new funding to advance on its product roadmap.

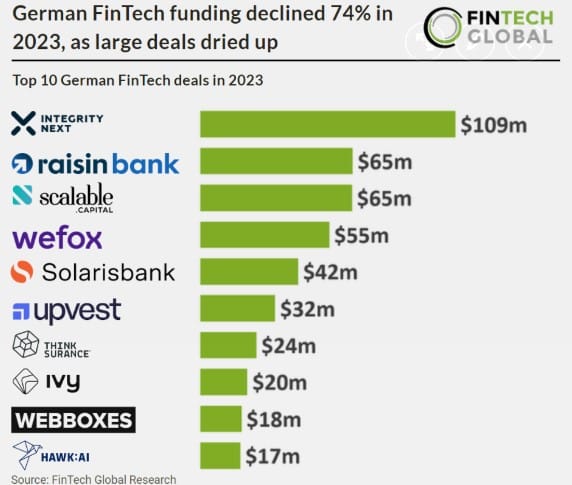

🇩🇪 German FinTech funding declined 74% in 2023. Check out the Key German FinTech investment stats in 2023: Link here

MOVERS & SHAKERS

🇬🇧 CryptoUK hires former FCA head Binu Paul. Binu is the former Head of Digital Assets at UK financial regulator the Financial Conduct Authority (FCA), a role which saw him help establish the FCA’s digital assets regulatory capability and framework. Read more

🇩🇪 Deutsche Bank to cut 3,500 jobs. Following this announcement, the German financial institution mentioned that the decision was made in order to simplify operations and automate work where possible, with the overall aim to result in a major hit to its back-office workforce.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()