Stripe Unveils New Financial Tools in UK

Hey FinTech Fanatic!

Payments Giant Stripe has introduced new payment tools and financing options in the UK to enhance access to capital and support the growth of UK businesses.

The new features include business financing through Stripe Capital, cost-effective open banking payments, and faster payouts for UK companies.

Last year, only 50% of small business bank loan applications in the UK were successful, down from 80% in 2018. Stripe highlighted that without necessary funds, many small businesses struggle to grow or even survive.

“UK businesses are innovating, but access to timely capital limits their growth,” said John Collison, co-founder of Stripe. “Our new payment tools and financing options will facilitate quicker money movement and easier investment for business growth.”

Stripe Capital now offers flexible financing for UK small businesses to invest in expansion, such as purchasing equipment, hiring staff, or upgrading services. Approved funds are available the next business day, with repayments tied to business earnings. Later this year, UK platforms using Stripe Connect will also offer financing to their users.

Stripe’s expansion in the UK, its second-largest market, includes a new London office at 201 Bishopsgate, housing growing teams in engineering, sales, partnerships, and operations. This location will strengthen relationships with tech companies and financial institutions.

Collison stated, “The UK’s talent and financial center make it a prime location for Stripe. We’re seeing substantial growth among UK businesses eager to modernize and expand globally, affirming our commitment to the UK market.”

Stripe has also introduced 'Pay by Bank', its first open banking-powered payment method in the UK, allowing consumers to pay directly from their bank accounts. Companies like Cinch and AJ Gallagher are using this method to lower payment costs and improve cash flow, potentially saving thousands monthly.

Furthermore, Stripe is enabling quicker fund access for UK businesses through the Faster Payments Scheme, reducing the earnings receipt time from two days to a few hours. These enhancements will extend to the EU and US later this year.

In the past year, Stripe has doubled its supported payment methods from 50 to over 100, including Revolut Pay.

Enjoy more FinTech news updates below and I'll be back in your inbox tomorrow!

Cheers,

#FINTECHREPORT

📊 Check out “Customer Banking Report 2024: The Evolving Role of Banking in Australia 🇦🇺”. A FinTech report by Publicis Sapient. Link here

PODCAST

🎙️ In this FinTech Leaders episode, Miguel Armaza interviewed Oliver Hughes ex Tinkoff CEO and current Head of International Business at TBC Bank, a Central Asian leading bank that’s publicly traded on the London Stock Exchange with a $2Bn current market cap. Listen to the full podcast episode here

FINTECH NEWS

🇹🇭 KBank Visa Credit Card adds Tap-and-Pay service via smartphone, partnering with Google Pay for easy tapping, fast payments, and card-free transactions worldwide. This convenient, fast, and secure method eliminates the need to carry a physical card and allows for payment transactions globally.

PAYMENTS NEWS

🇦🇺 Zip's Larry Diamond returning to Sydney, says US mission accomplished. Diamond will return to Australia in July after two years in the US, where he has led the turnaround of the buy now, pay later player to put it on a more solid financial footing to attack large credit card balances held by US banks.

🇬🇧 Revolut to roll out payment terminal for large businesses. The firm is planning to launch a new payment terminal for large companies in a push to increase its market share among business customers. The payment terminal will be rolled out in the second half of this year.

🇬🇧 SumUp delivers direct debits, providing merchants with an even more streamlined payment experience. The direct debit feature is immediately available for UK-based merchants who have a Business Account, an all-in-one, zero fees solution introduced in 2021.

🇦🇪 Adyen and Addmind announce strategic partnership to enhance guest experience and operational efficiency in the UAE fine dining industry. This collaboration is set to redefine the payment experience across Addmind’s diverse portfolio.

🇩🇪 Nexi and orderbird launch new payment platforms for ISVs in Germany. The platform enables them to manage their business more efficiently, centred around a one-of-a-kind onboarding experience that accelerates the activation of merchant accounts for card payment processing to under 48 hours.

OPEN BANKING NEWS

🇺🇸 OpenFinity, the first community dedicated to helping financial services professionals navigate the open finance landscape through community-powered education and support, announced its official launch. More here

DIGITAL BANKING NEWS

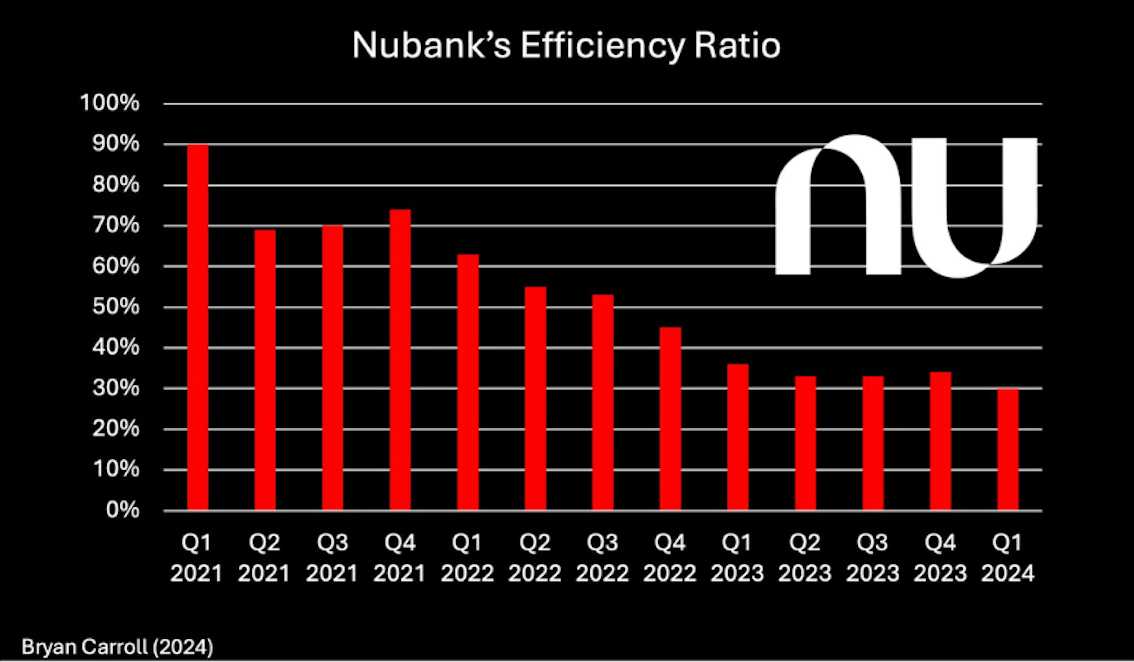

🇧🇷 Nubank's operating unit economics are 🤯

And they keep improving:

🇩🇪 Germany's BaFin fines neobank N26 a further 9.2 million euros. BaFin found that the bank had systematically submitted suspicious money laundering reports late in 2022. N26 was informed about the fine on April 24th. This is not the first time N26 is fined by BaFin about AML.

🇲🇽 Latin American e-commerce giant MercadoLibre's FinTech arm, Mercado Pago, announced that it will apply for a Banking License in Mexico in its bid to become the largest digital bank in the country. The company is in talks with the central bank, the banking regulator and the Finance Ministry as it seeks the license.

🇰🇬 Ukraine-funded FinTech Farm, a company specializing in launching neobanks, is planning to enter the market in Kyrgyzstan. The firm states it has signed a deal with a great bank partner in Kyrgyzstan and is looking to launch a digital bank there in Q2 this year.

🇬🇧 Will TSB be the next challenger bank to go up for sale? A potential sale of TSB Bank is back in focus as its Spanish parent company, Sabadell, grapples with a rare hostile takeover attempt by larger domestic rival BBVA. Continue reading

🇿🇦 Big PayShap surge in South Africa. South African banks have seen a surge in customer transactions using low-cost payment solution PayShap. The South African Reserve Bank and BankServ Africa rolled out the rapid payments system in March 2023.

🇭🇰 Hong Kong e-CNY pilot expands: residents can open digital-yuan wallets and top up via FPS, no mainland account required. The move aims to broaden a cross-boundary pilot of the Chinese central bank digital currency, conducted by the HKMA and the People’s Bank of China (PBOC) since December 2020.

🇬🇧 Revolut's 22-year-old software engineers may benefit most from $500m cash out. The FinTech titan is said to be preparing a secondary share sale to raise $500m and to allow some company employees to cash out their stock units. Read on

🇿🇦 TymeBank customers can make cash withdrawals from spaza shops across SA. TymeBank customers will be able to withdraw cash at over 172 000 spaza shops and traders across the country. As a result, the bank says it now offers more cash withdrawal options and locations than any other institution in South Africa.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Ether ETFs filing process sees abrupt progress, though approval not guaranteed. Exchanges are being asked to update 19b-4 filings on an accelerated basis by the U.S. Securities and Exchange Commission. Read the full article

🇧🇷 Brazil crypto regulatory framework coming by end of year, nation's central bank says. Brazil’s central monetary authority said in a statement Monday that the development of its crypto regulatory framework will be divided into several phases.

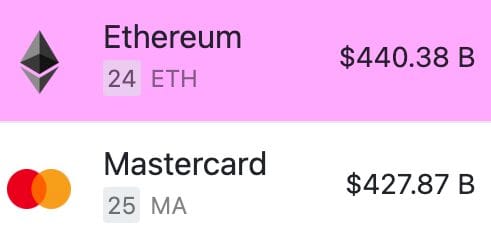

🚀 ETH Flips Mastercard in Market Cap.

DONEDEAL FUNDING NEWS

🇨🇦 Canadian FinTech Teal raises $8M to build ‘Stripe for accounting.’ Teal provides companies with APIs and tools to create custom accounting solutions for SMB customers, enabling them to access real-time cash flow, product profitability insights, file taxes, and receive live bookkeeper support.

🇦🇺 Australian Financial management FinTech WeMoney has raised $3 million in fresh capital from existing investors — and is actively seeking another $10 million if the development of “open banking” via the Consumer Data Right (CDR) can gather momentum.

🇳🇱 Amsterdam-based WeTicket, an all-in-one marketing platform specialising in ticket sales, has raised €750K from Arnout Schuijff, Adyen co-founder and former CTO. The Dutch company will use the funds to scale its company, optimise technologies and help more organisations.

🇺🇸 Vitesse, a payments and treasury management platform for insurers, raises $93M to fuel US expansion. Vitesse offers insurance companies an all-in-one treasury and payment management platform with streamlined international payment connections. Read more

🇺🇸 Capchase secures €105 Million from Deutsche Bank to expand its support for UK and European SaaS businesses through Capchase Grow, which offers eligible companies access to non-dilutive financing, fostering business growth without sacrificing equity.

M&A

🇺🇸 Phantom acquires Bitski, a provider of embedded wallets, to accelerate crypto adoption. With this acquisition, the highly-experienced Bitski team will be joining Phantom to bring embedded wallets to Solana, make onboarding easier for users and developers, and unlock new, exciting use cases.

MOVERS & SHAKERS

🇬🇧 Checkout.com announced Antoine Nougué as new Chief Revenue Officer. Antoine is a true payments expert, spreading his deep passion for payments and customer first mindset across Checkout.com. Find out more here

🇺🇸 DriveWealth hires two new executives: Kyla Murphy, as Chief Product Officer and Lauren Veisz as Head of Operations. In their respective roles, Murphy and Veisz will help to further expand DriveWealth’s footprint in global markets, develop deeper relationships with current and potential partners, and build out the company’s product roadmap.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()