Stop trying to fix female founders – fix the funding system says Anne Boden

Hey FinTech Fanatic!

Still in Vegas for FinTech Meetup, so I'll keep it short.

Enjoy the list of news updates I sourced for you this morning and I'll be back in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

POST OF THE DAY

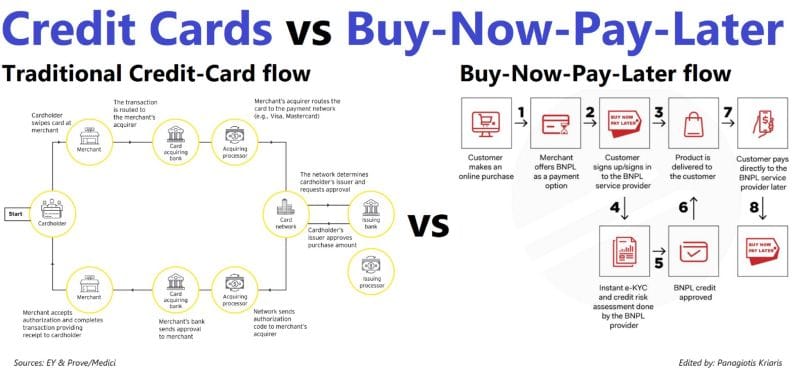

Can Buy-Now-Pay-Later challenge Credit Card Payments?

FEATURED NEWS

🇺🇸 American Express is writing to customers warning them that their account information may have been compromised in a data breach at a third party service provider. The firm has filed a data breach notification to the state of Massachusetts, confirming a hack on a service provider utilized by its travel services division, American Express Travel Related Services Company.

#FINTECHREPORT

2024 Payment Trends in Latin America by Kushki.

Spoiler Alert: Real-Time Payments is one of them

INSIGHTS

🇬🇧 ‘Don’t try to fix the women — fix the system’. Anne Boden, who is leading a government taskforce reviewing the barriers to women leadership, said there was almost too much of a “spotlight” on women. The taskforce, led by Starling Bank's founder, supports current industry efforts to boost women's presence in senior VC roles. Learn more

FINTECH NEWS

🇬🇧 FinTech savings platform Flagstone recorded a fifth consecutive quarter of profitability at the start of 2024, amid faster adoption of the company’s FinTech solution by consumers, advisers, brands and banks, and heightened demand among consumers for competitive cash savings options.

🇺🇸 PensionBee to enter the US market. The UK-based online pension provider is to expand into the $22.5 trillion Defined Contribution pension market in the US. It has entered into an exclusive term sheet with a major US-based financial institution for marketing support and expertise to enter the US market.

🇮🇳 Paytm's banking business has been fined 55 million rupees (about $663,000) by an Indian regulator on money laundering charges. The country's Financial Intelligence Unit says it issued the fine after a review of Paytm Payments Bank found businesses involved in illegal activities, including online gambling, channeled funds through accounts with the unit.

🇳🇬 Nigerian FinTech Brass blames funding winter for customer withdrawal delays. “The funding winter and the economic situation in Nigeria affect the abilities of companies of our kind to support many customers after some time,” said Sola Akindolu, the company’s CEO.

PAYMENTS NEWS

🇮🇪 Irish central bank sets new payments strategy as country lags rest of Europe. The Central Bank has outlined a new multi-year payments strategy amid concerns that banks are failing to grasp the opportunities presented by instant payments. More on that here.

🇳🇬 Nigerian businesses increasingly skip traditional banks and turn to Moniepoint. Customers say it has lower transaction decline rates and instantly reverses transactions if payments fail. The firm’s payment machines have become ubiquitous across Nigeria. But the company faces competition from Chinese-backed OPay.

🇯🇵 HIVEX Payment Network launches merchant-scan payment method in Japan and welcomes PXPay Plus users. "This is the first time Japan’s largest payment brand has shared their extensive CPM merchants with any partner. The CPM launch reflects their recognition of HIVEX’s stability and reliability.”— Ling Wu, Founder and CEO of TBCASoft.

🇺🇸 Galileo and The Bancorp partner on instant transactions. Using the RTP® network from The Clearing House, Galileo and The Bancorp are delivering instant money movement between bank accounts, enabling FinTechs and brands to solve the longstanding cash flow challenges faced by small businesses (SMBs) and consumers looking to get fast access to their funds.

REGTECH NEWS

🇺🇸 Unit21 launches AI-powered tools for AML and fraud analysts. The innovative Ask Your Data and AI Copilot tools are designed to significantly enhance the decision-making capabilities and operational efficiency of fraud analysts, compliance officers, and risk managers.

DIGITAL BANKING NEWS

🇹🇭 Virtual bank applications to open in March. The Bank of Thailand is scheduled to open the application period for virtual banking licences this month, attracting several business operators. The central bank submitted the draft for virtual banking regulations to the Finance Ministry, with the rules slated for publication in the Royal Gazette.

🇲🇽 Neobank Hey has received authorization from the Secretariat of Finance and Public Credit (SHCP) to become a member of the Banregio Financial Group in Mexico. This marks a significant step in Hey's transition from being the digital arm of Banregio to operating as an independent bank. With this authorization, Hey is expected to begin its operations as an independent multiple banking institution by the end of 2024.

🇵🇹 Revolut is expanding its presence in Portugal by opening a branch and working towards acquiring a national IBAN. This move includes launching new financial products like personal loans, which necessitates the Portuguese IBAN. Revolut is collaborating with the Banco de Portugal to meet regulatory requirements and hopes to secure the IBAN within the year.

🇬🇧 Revolut business customers targeted in sophisticated account takeover scams, losing over £200,000. The business customers have faced significant financial losses after falling victim to sophisticated account takeover scams, utilizing tactics that bypassed the e-money firm's security measures, including its 'selfie' checks.

DONEDEAL FUNDING NEWS

🇺🇸 Synctera announces $18.6M funding boost, appoints new CRO, to support largest new customers’ US expansions. The new funding and the addition of Leigh Gross to their team will help fuel their next phase of growth. Read the full article here

🇮🇩 Wagely, a FinTech out of Indonesia, made a name for itself with earned wage access: a way for workers in Southeast Asian countries to get salary advances without high-interest loans. With half a million people now using the platform, it has expanded that business into a wider “financial wellness” platform, and to give that effort an extra push, the company’s now raised $23 million.

M&A

🇩🇰 CapitalBox, the alternative financing specialist for SMEs in Europe, announced its acquisition of Omniveta Finance’s business. Omniveta is an invoice-purchasing company dedicated to improving lending liquidity for SMEs across Denmark. This acquisition will transform invoice purchasing not only for SMEs in Denmark but across all the markets CapitalBox currently serves.

MOVERS & SHAKERS

🇺🇸 Sam Blond is leaving Founders Fund, as well as the profession of venture capitalist, just 18 months after he joined. In a tweet on Monday, Blond thanked the chance to work at Peter Thiel’s VC firm and explained, “Full time investing / being a VC isn’t the right fit for me and I’ve decided to go back to operating.” That likely means he’s either accepted/about to accept a position at a startup or another tech company, or is in the process of founding one.

🇬🇧 Thredd appoints global CTO. Edwin Poot, seasoned financial technology executive, has been appointed as Global Chief Technology Officer. Edwin will lead the next phase of Thredd’s technological evolution to deliver the company’s robust product expansion roadmap.

🇬🇧 Revolut just lost its algorithmic trading head. Anton Pasiechnikov leaves Revolut after over five years. He joined as the company's head of finance technology in 2018 and has undertaken multiple roles, including deputy CFO and chief investment officer, but has been the firm's head of market making since 2022.

🇬🇧 Simon McNamara joins Ziglu board. McNamara brings over 30 years of experience in the global financial services industry, holding senior leadership roles at major institutions like RBS Group and Standard Chartered Bank. Read more

🇬🇧 OneBanx names Javed Anjum CEO. Javed brings a wealth of local and global experience in multi-channel banking and branch transformation to his new role which will be instrumental as the company renews its focus on supporting the financial industry’s efforts to comply with FCA's upcoming rules around access to cash.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()