Salt Lake: Utah’s Hub for FinTech Innovation

Hey FinTech Fanatic!

Aspiring entrepreneurs eager to revolutionize FinTech services now have an opportunity to propel their ventures forward with the Stena FintechXstudio. This initiative is an early-stage FinTech incubator and accelerator specifically designed for students and recent graduates from colleges and universities across Utah.

As the first of its kind in the state, the Stena FinTechXstudio offers entrepreneurs a comprehensive suite of resources. Participants gain access to seasoned advisors, modern office space in the historic hardware building in downtown Salt Lake City, startup funding, and essential business services. Additionally, the program connects entrepreneurs with a wide network of FinTech experts, providing invaluable support and guidance. Over the course of a year, cohort companies are given the time and resources to refine and expand their FinTech solutions.

This initiative is a crucial part of a larger strategy to establish Utah as a premier hub for FinTech innovation. The studio collaborates closely with the University of Utah’s Stena Center for Financial Technology, which was launched in January 2023 with substantial backing from the Stena Foundation, committing up to $65 million over the next decade.

Salt Lake City, already known for its significant FinTech history, is home to this groundbreaking incubator. Although I haven’t visited this amazing city yet, the city’s vibrant FinTech ecosystem makes it a compelling destination.

If you have any recommendations on who to connect with or insights on must-visit places in Salt Lake City, please share your thoughts in the comments below👇

Maybe you see me in Salt Lake City soon 😉

Cheers,

P.s. join my Telegram Channel to discuss the news of the day with the FinTech community!

#FINTECHREPORT

📊 The FinTech ecosystem in LATAM and Caribbean recorded growth of more than 340% in the number of technology finance startups created in the last 6 years. Find more 𝗞𝗲𝘆 𝗦𝘁𝗮𝘁𝘀 in the latest report by Finnovista. Download and read here

FINTECH NEWS

🇳🇱 One year after OVpay's nationwide launch in the Netherlands, over 15% of all public transport check-ins are now made using debit or credit cards or mobile wallets. For occasional travelers without a subscription, this figure rises to 36%.

🇺🇸 Acorns will ‘likely’ go public, CEO Noah Kerner says. The firm previously planned to go public with SPAC Pioneer Merger Corp. but canceled in January 2022 due to market conditions. Kerner stated Acorns has sufficient cash, expects profitability by 2025, and has no plans to raise more funds before going public.

🇺🇸 Brex’s compliance head, Ali Rathod-Papier, has left the FinTech startup to join Andreessen Horowitz as a partner. According to her LinkedIn profile, Rathod-Papier now “oversees a16z’s foreign expansion and policy efforts, supporting the government affairs team, managing financial crime and national security risk, as well as overseas operations.”

🇦🇺 In a bold move to transform the travel finance landscape, leading payment solutions provider TravelPay partnered with Australian FinTech innovator Pelikin to introduce TravelPay Money, which offers the best-in-market 22-currency wallet, free and easy sign-up, and long-term commission opportunities for travel professionals.

🇵🇭 Brankas and Global Finteq team on Lending-as-a-Service in the Philippines. Established banks, rural banks, and even non-traditional financial institutions are now able to lend at scale as existing loan products can now exist outside of the traditional channels such as physical bank branches or websites.

🇮🇳 FinTech firm Pine Labs weighs $1 Billion IPO in India. The company may seek a valuation of over $6 billion in an IPO, sources said. Pine Labs may issue new and secondary shares and might consider a pre-IPO fundraising round. Read more

PAYMENTS NEWS

🇨🇳 China said to ask Visa and Mastercard to cut transaction fees. The initiative aims to streamline payments for foreign visitors and increase local merchants' acceptance of international cards. Industry association proposed cutting fees from 2-3% to 1.5%

🇧🇷 Pluggy, a FinTech specializing in Open Finance solutions, has just received authorization from the Central Bank (BC) to operate as a payment institution (PI), specifically as a payment transaction initiator (PTI). It is the first step for the service to be launched by the company.

🇬🇧 Billhop receives FCA approval to be an Authorised Payment Institution in the UK. The authorisation reinforces Billhop’s role as a key provider of innovative payment services to Enterprise customers across Europe and the UK as they navigate the new, post-Brexit payments landscape.

🇬🇧 Worldline UK&I links with Stabiliti for carbon offset payments. This initiative allows consumers to contribute to nature-based carbon removal projects through a simple “round-up” option at points of sale, promoting sustainable transactions and enhancing environmental stewardship.

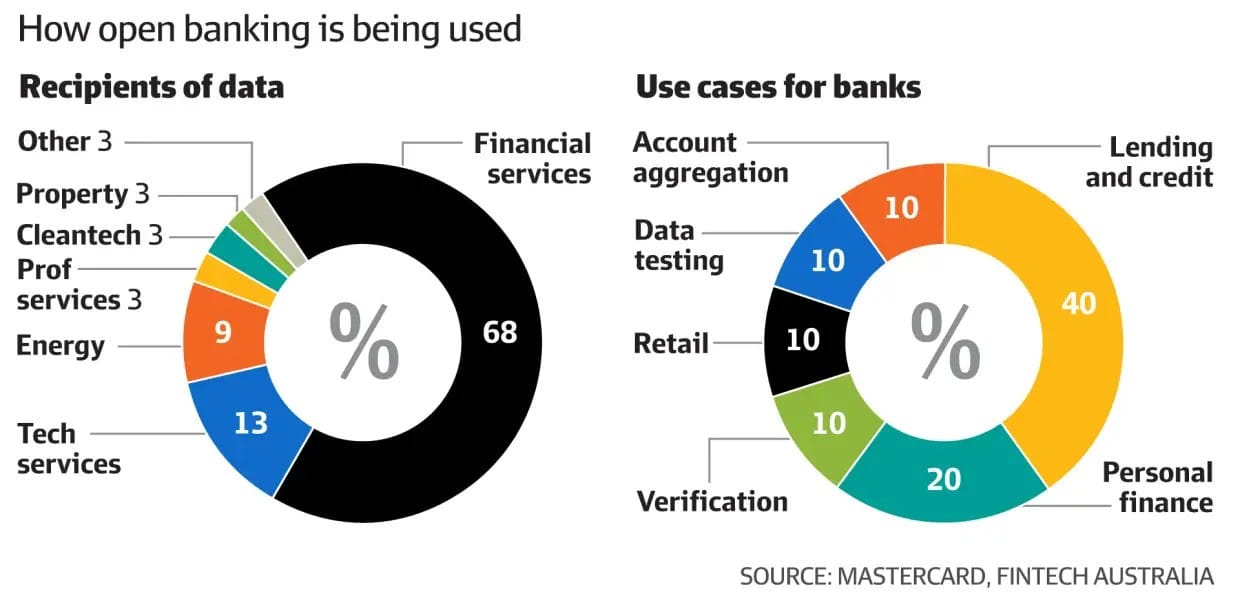

OPEN BANKING NEWS

🇧🇭 The Central Bank of Bahrain (CBB) has introduced significant amendments to its open banking framework, marking a pivotal moment for Bahrain’s financial sector. These changes aim to enhance accessibility and transparency in financial services across the kingdom.

🇫🇷 Tink and Adyen launch "Pay by Bank" in France. Pay by Bank is now available for Adyen merchants in the French market. It is an integrated payment method based on open banking that allows consumers to initiate payments directly from their bank accounts.

🇨🇭Progress in implementing open finance in Switzerland. The latest industry advances are deemed sufficient, negating the need for further regulatory measures. The FDF will continue to monitor financial sector developments based on the Federal Council's December 2022 targets.

REGTECH NEWS

🇳🇬 Flutterwave to establish cyber crime research centre in Nigeria. This strategic initiative aims to intensify the fight against internet crime, enhance the security of business transactions, and provide a sustainable lifeline to youths across the country.

DIGITAL BANKING NEWS

🇳🇱 bunq will compensate customers who have fallen victim to help desk fraud and phishing. The online bank claims to have identified all cases. On average, victims will receive 85 percent of their lost money back. There has been unrest among the bank's customers for weeks.

🇬🇧 While Revolut is expanding its reach in most countries, it has quietly shuttered Revolut Lite services. According to an email sent to the customers of Revolut Lite, seen by Finance Magnates, the company will end the trimmed-down service on 20 July 2024. Read on

🇩🇪 One in four in Germany use prepaid cards to avoid debt, a survey of 2,000 German adults (+18) reveals. Among users, 32% stated they use prepaid cards to maintain financial control, while 27% use them specifically to prevent accumulating debt.

🇬🇧 UK reaches 150 million contactless cards in issue, as revealed by UK Finance in its card spending data for March 2024, covering the monthly value and volume of transactions across debit and credit cards. Find out more here

🇺🇸 Nearly $109 million in deposits held for FinTech Yotta’s customers vanished in Synapse collapse, bank says. Ledgers of the failed FinTech middleman Synapse show that nearly all the deposits held for customers of the banking app Yotta went missing weeks ago, according to one of the lenders involved.

DONEDEAL FUNDING NEWS

🇺🇸 PayPal leads $20m round for Gynger. The company will use the funding to scale its team and operations and accelerate its vision of transforming its embedded financing platform into a full-scale payments solution for buying and selling of technology.

🇬🇭 FinTech Cadana closes $7.1 million seed to accelerate remittance for African talents. Cadana streamlines payroll for several talent marketplaces, staffing companies, and HR providers, enabling them to pay workers in over 32 emerging markets, including Nigeria and Ghana.

🇮🇩 Indonesian FinTech Amartha secures $17.5 million investment from Accion Digital Transformation Fund. This investment aims to support Amartha's expansion efforts, providing tailored financial products and services for underserved women-led small businesses in rural Indonesia, using advanced data and AI tech.

🇧🇷 Kaszek, Latin America's biggest venture capital firm, led a $21 million Series A round for Kanastra, a Brazilian startup that's transforming the asset-backed securities market locally through technology. It's the first investment made from Kaszek's $1 billion fund raised last year for LatAm tech firms.

M&A

🇺🇸 Squarespace announced an agreement to sell restaurant reservation platform Tock to American Express for $400 million. As part of the deal, Squarespace and AmEx will also partner to deliver additional value for SMBs that use AmEx Cards through the Amex Offers program and Card Member benefits.

MOVERS & SHAKERS

🇺🇸 Sammy Nguyen Rivera joins Ingo Payments as the new VP of Strategic Partnerships. Sammy brings extensive FinTech experience in digital banking, BaaS, and embedded finance, with a stellar track record in building and nurturing high-impact relationships.

🇺🇸 FIS CEO and President Stephanie Ferris named one of American Banker’s Most Influential Women in FinTech 2024, and the only CEO of a publicly traded company on the list. The annual list honors inspirational women who are leading and shaping the FinTech industry through their roles in innovation, regulation, partnership, and customer experience.

🇺🇸 Former J.P. Morgan Payments Head Takis Georgakopoulos to join Fiserv. Georgakopoulos will serve as a senior advisor, executive vice president and a member of the management committee, Fiserv said in a press release. Click here to learn more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()