Revolut Launches Phone Plans & Apple's Latest Financial Services Update

Hey FinTech Fanatic!

British fintech heavyweight Revolut has unveiled an innovative travel eSIM plan for U.K. customers.

This pioneering initiative, marking Revolut as the first financial services firm in the country—and among the first globally—to offer telecom plans, showcases the digital banking giant's ambition to evolve into a "super app."

By providing access to data abroad without the burden of roaming charges, Revolut is setting a new standard in how we think about financial and travel services intertwined.

Revolut's travel eSIM plans are designed to cater to a broad spectrum of needs, from the casual traveler to the globe-trotting adventurer. For those subscribed to Revolut’s Ultra tier, the offer includes 3GB of global data that refreshes monthly, ensuring seamless connectivity and financial management on the go. This strategic move not only addresses the growing demand for flexible and integrated travel solutions but also reflects Revolut's commitment to enhancing user experience and fostering a more loyal customer base.

Revolut isn’t the first FinTech ever to launch an eSIM offering. Indian credit card startup Zolve, which helps immigrants set up banking before arriving in the U.S., started offering phone plans attached to physical SIMs and eSIMs in August.

Do you know other FinTechs offering this service? Let me know in the comments below👇

Meanwhile, in another significant development in the FinTech space, Apple has introduced a "Virtual Card Number" feature to Apple Cash with its latest iOS 17.4 update.

This feature allows Apple Cash users to generate a virtual card number for online shopping, extending the utility of Apple Cash beyond Apple Pay's reach.

With every transaction secured by a new security code, this advancement underscores the tech giant's focus on security and convenience, further enriching the digital payments landscape.

Read more FinTech Industry updates I listed for you below, and I'll be back in your inbox tomorrow!

Cheers,

PODCAST

🇧🇷 Brazil's Revolutionary CBDC with Fábio Araujo, Drex Coordinator at Banco Central do Brasil. In this interview, Aaron Stanley talks to Fabio Araujo, who provides a comprehensive overview of the project and its ambitions, while giving an update on the 2024 roadmap ahead. Listen to the full podcast episode here.

INSIGHTS

🇺🇸 There is a new dating app just in time for Valentine’s Day, but there’s a catch: You must have at least a 675 credit score to use it. Launched yesterday by financial platform Neon Money Club, Score is a dating app for people with good to excellent credit, and it seeks to help raise awareness about the importance of finances in relationships.

🇺🇸 "Once it’s cash-flow positive, an IPO will follow", Brex Co-Founder Pedro Franceschi said in an exclusive interview with The Information. While the layoffs have cut costs, Franceschi and Henrique Dubugras must now move ahead with a plan to restart growth, which stalled in the second half of 2023—and to reach positive cash flow in “maybe a little less than two years, maybe more like 18 months at this point,” Franceschi said.

FINTECH NEWS

🇬🇧 Lightyear launches Web app with new stock screener feature. The platform announced the full launch of its web application with new stock screeners, a highly requested feature by investors on the platform. The screeners - a directory of instruments with metrics and data - is completely available to the public.

🇲🇽 Dapp, a network connecting merchants with various payment methods, has received authorization from the CNBV to operate as a commission agent administrator in Mexico. This will allow Dapp to expand its network of cash collection points, easing access to financial services for millions of people.

PAYMENTS NEWS

With iOS 17.4, Apple is giving Apple Cash customers a new way to spend their balance even if Apple Pay isn’t available. According to reports on Reddit, Apple Cash users can now set up a virtual card number that can be used for shopping when Apple Pay online isn’t an option. Click here to learn more.

OPEN BANKING NEWS

🇬🇧 Moneyhub boards public sector open banking push. Moneyhub has been named as a supplier on Crown Commercial Service’s (CCS) Open Banking Dynamic Purchasing System (DPS) framework for its account-to-account payment services. Read more

REGTECH NEWS

Nigeria and Togo to require for biometric digital ID on loan schemes. In addition to the National Identification Number (NIN), loan applications in Nigeria will also require a biometric bank verification number (BVN). The NIN will confirm the applicant's Nigerian identity, while the BVN will promote financial inclusion by ensuring each loan applicant has a bank account.

DIGITAL BANKING NEWS

🇬🇧 Digital banking giant Revolut is launching phone plans for travelers in the UK, the company has told CNBC exclusively, making it the first financial services firm in the country to offer telecom plans — and among the first globally. The firm said it will start offering eSIMs this week.

🇿🇦 Absa Bank introduces ChatWallet for WhatsApp banking in South Africa. The move aims to promote financial inclusion and improve access to entry-level banking services in South Africa, particularly for the unbanked population, enabling them to manage their funds conveniently using ChatWallet.

🇮🇳 Airtel Payments Bank sees spike in new customers applying for bank accounts, FASTag. According to CEO Anubrata Biswas, the bank has seen a strong surge in the number of new customers applying online for opening bank accounts and offering like FASTag over the last few days.

🇳🇿 Fintech SquareOne goes from kids’ pocket money to SMEs. SquareOne has changed its name to Emerge and is expanding from teaching kids about money to offering services to SMEs on its way to becoming a neobank. Read more

🇦🇪 Mashreq, a leading financial institution in the MENA region, announced the launch of its new loan product, NEO Credit, specifically designed for salaried individuals. This innovative service offers small loans up to AED 35,000 for immediate financial needs.

🇮🇳 India-based Yes Bank has announced its partnership with fintech startup LeRemitt in order to deliver optimised cross-border transactions for MSMEs. The companies will focus on introducing a cross-border platform, aimed at providing MSMEs with the possibility to conduct international transactions and payments in key currencies.

🇰🇭 Wing Bank accelerates access to finance with digital loan surge. The bank has set a record by accelerating to almost a million digital loan applications in Cambodia since its commercial launch as a Bank 21 months ago, surpassing its initial targets.

🇨🇭 Yuh, the mobile banking app operated by Swissquote and Postfinance, has experienced significant growth in recent months. Yuh has seen a surge in growth, with the number of customers, referred to by the company as "Yuhser," exceeding 200,000. Customer assets under management currently exceed 1.5 billion Swiss Francs. Yuh had already reached the milestone of 100,000 customers in December 2022.

🇲🇽 Hey Banco, aiming to diversify its portfolio and reach, has announced its plan to focus on the small and medium-sized enterprise (SME) segment in Mexico by 2024. Having already established a comprehensive suite of services and products for individual customers, Hey Banco is now set to offer a robust array of banking solutions to SMEs.

🇮🇱 One Zero Bank launches groundbreaking GenAI-powered service platform integrated with AI21, revolutionizing customer interaction. One Zero Bank, Israel's first private digital bank, announces the official launch of its GenAI-based service platform – marking the transition from experimental pilot phases to full-scale implementation.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 A16z’s Chris Dixon on crypto regulation in the UK, open source AI and the coming wave of blockchain products in 2024. The firm's crypto chief argues the “two most important policy issues for keeping the internet open are open source software and blockchains." Read full article

🇮🇳 India tests offline and programmable CBDC. India has been testing a retail CBDC since early last year, enabling person-to-person and person-to-merchant transactions, recently hitting the million transactions a day milestone.

🇩🇪 Crypto Finance AG clinches four BaFin licenses strengthening institutional services. The licenses encompass regulated digital asset trading, settlement, and custody services in Germany. This development further bolsters the company’s position within the regulated European digital asset value chain.

COCA, the pioneering crypto wallet app, has announced the initial rollout of its Virtual Cards, following the success of its Early Access Program which has attracted thousands of eager users across Europe. This strategic move highlights COCA’s dedication to offering seamless, secure, and user-friendly fintech solutions that bridge traditional banking and cryptocurrency.

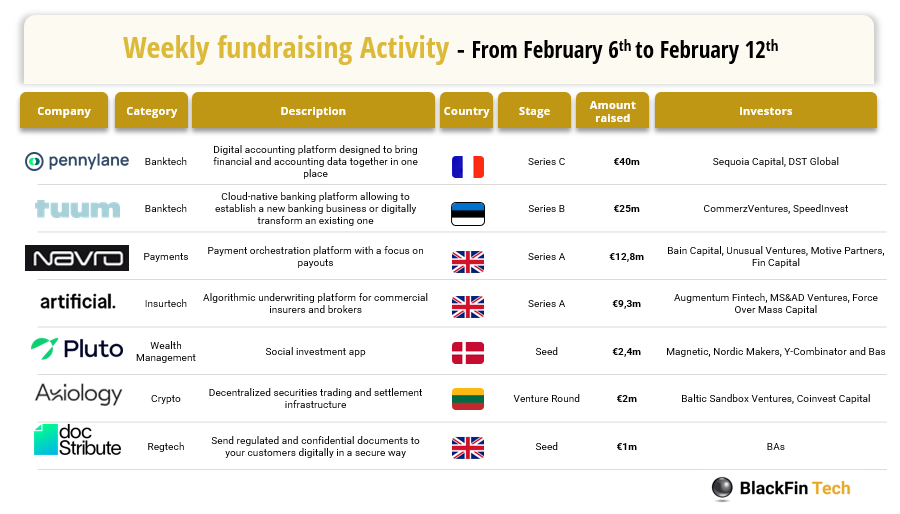

DONEDEAL FUNDING NEWS

🤑Last week we saw 7 official FinTech deals in Europe for a total amount of 92.5m€ raised:

Techreo, an integrated financial services platform, has successfully closed a $3.4 million convertible capital investment round. This funding is earmarked for innovation, expansion, and consolidation efforts in Mexico and Bolivia, highlighting Techreo's commitment to offering accessible and transparent financial products.

🇺🇸 Cascading AI secures $3.9m in pre-seed funding. Following this, Cascading AI plans to expand its team of AI and machine learning experts, accelerate Casca product development, enhance human-in-the-loop, responsible AI features, and onboard a curated selection of new banks.

🇩🇰 Pluto Markets, a Danish fintech startup that offers stock trading, has raised $2.6 million. The Y Combinator-backed Danish fintech startup, founded in 2021 by Joakim Bruchmann and Oscar Vingtoft, wants to offer brokerage services to European countries that don't use the Euro.

🇨🇦 Code raises $6.5m. The Canadian provider of a payments platform that makes it simple for web developers to accept small payments from users globally, raised $6.5m in seed funding. The company intends to use the funds to accelerate the growth of its new global payments platform.

Navro, formerly known as Paytrix, has secured $14m in its latest funding round and has concurrently announced that the Central Bank of Ireland has authorised its EMI licence. The newly raised funds will support its expansion plans and enhance its capabilities to meet the evolving needs of its clients.

🇸🇬 Crypto payments app Oobit raises $25M in series A funding round led by Tether. The round also included participation from Anatoly Yakovenko, the co-founder of Solana. The firm is planning to open up the capability to third-party wallets, which will transition Oobit into a non-custodial crypto payments app.

M&A

Tembo acquired the award-winning Lifetime ISA provider Nude. Their recent acquisition of Nude aligns with their mission to assist first-time buyers in saving for a house fund sooner, marking a significant step forward in their goal of helping more individuals achieve homeownership.

🇨🇦 Payroc elevates Canadian market presence with best-of-breed card-present solutions through SterlingCard acquisition. With this acquisition, Payroc not only expands its capabilities but also welcomes a talented team of 11 individuals, reinforcing its commitment to delivering innovative and comprehensive payment solutions worldwide.

Nordic Capital has signed an agreement to acquire a majority share in Zafin, a leading provider of SaaS core modernization and transformation solutions for financial institutions around the world. The investment is made in close partnership with Zafin’s founders and management.

MOVERS & SHAKERS

The London fintech offering an unusual gift to returning employees. As the fintech talent market continues to fluctuate, bringing alumni back looks a safe bet for some firms. $8.8bn payments fintech Wise says it's seeing a "fantastic trend" of employees returning, and is rewarding their loyalty with a unique gift. Wise calls its returners "Boomerang Wisers," and upon their return gifts them a real boomerang.

🇧🇷 InvestPlay, a fintech specializing in Open Finance solutions, recently announced the hiring of two executives for its product and marketing departments. Nataly Paes has been appointed as the group product manager, while Joana Ribeiro has taken on the role of Chief Marketing Officer (CMO).

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()