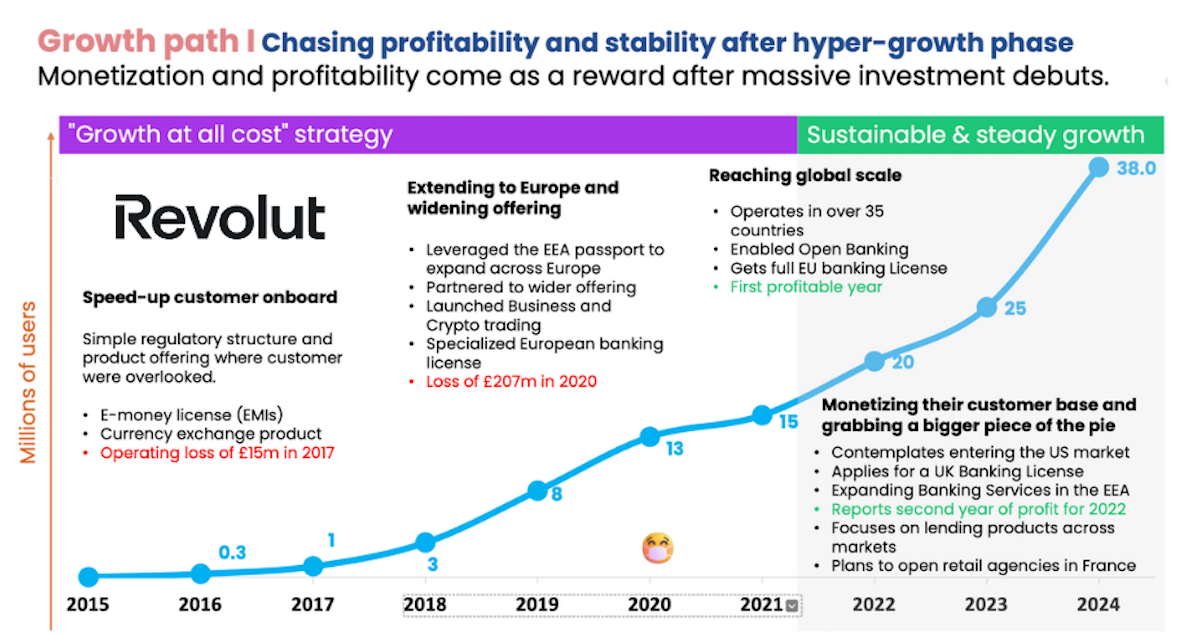

Revolut Hits 40M Customers Milestone: Explore Revolut's Strategy For 2024

Hey FinTech Fanatic!

I'm writing to you amidst the fog of jetlag, so I'll be keeping this introduction brief. today. Below, you'll find our carefully curated list of news to keep you informed.

Peace, out.

#FINTECHREPORT

Time to dive into Revolut's 2024 Strategy: Diversifying and Monetizing amid global digital banking. Read this comprehensive deep-dive, where C-Innovation presents a panoramic view of Revolut's strategic maneuvers as it carves a dominant position in the global digital banking landscape. Click here to learn more

INSIGHTS

🇺🇸 Capital One-Discover deal carries $1.38B termination fee. The fee would apply if Discover chooses another buyer or if either board has a change of heart but not if regulators block the deal. Read more

🇺🇸 Jamie Dimon on Capital One’s $35.3 billion Discover acquisition: ‘Let them compete.’ Dimon acknowledged that if regulators approve the Capital One-Discover deal, his bank will be eclipsed as the nation’s biggest credit card lender. “My view is, let them compete,” Dimon said. “Let them try, and if we think it’s unfair, we’ll complain about that.”

FINTECH NEWS

🇬🇧 Enfuce receives e-money licence to boost UK expansion. With the FCA’s EMI licence, Enfuce will now offer electronic money services, card issuing, and payment solutions directly to new and existing UK customers, ensuring a seamless onboarding experience and providing a comprehensive, secure, efficient, and scalable Enfuce solution.

🇺🇸 Treasure introduces ETFs in its actively managed cash management allocations. By incorporating ETFs into the Treasure Managed Income allocation, Treasure aims to provide its clients with enhanced liquidity, flexibility in asset allocation, and reduced fees.

🇩🇰 Danish FinTech startup Franklin goes live with first payment cards. Franklin helps e-commerce businesses gain full visibility into their finances and marketing, as well as automating manual tasks such as receipt management and reporting. Read on

🇹🇷 Ozan enables shopping loans through partnership with Fingate.io. In collaboration with Fingate.io, Ozan provides a fast and integrated access to credit. The shopping loan is embedded in Ozan’s payment tools, so there’s no integration hassle for merchants.

PAYMENTS NEWS

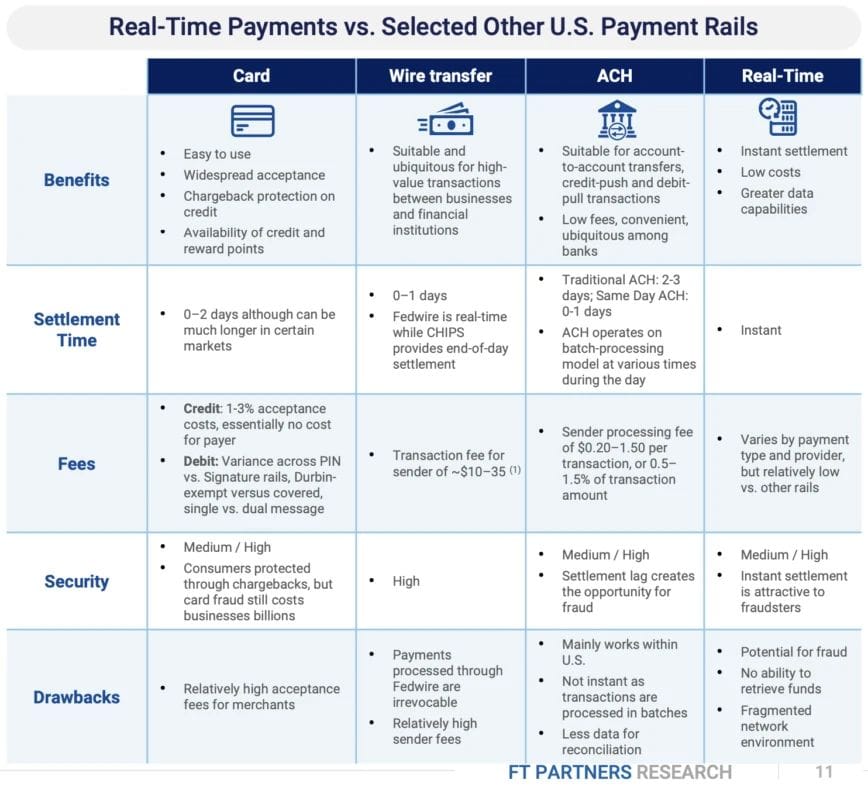

Can A2A Payments replace Card Payments?

Here are 3️⃣ major benefits of A2A Payments:

🇮🇳 Paytm likely to partner with Axis Bank, HDFC Bank, State Bank of India (SBI), and Yes Bank for enabling UPI transactions: Paytm is the third-largest app for UPI payments in the country, processing 1.6 billion monthly transactions, according to data available on the NPCI website. PhonePe and Google Pay are the two largest.

🇬🇧 American Express adds BNPL twist to credit card bills: American Express has launched ‘Plan It’ – a new offering for the UK market that allows credit card holders to pay off purchases on their statement, or a portion of their monthly bill, in instalments. Instalment plans can be set up from the American Express App, or via the user's online account.

OPEN BANKING NEWS

🇬🇧 Ozone API's Dame Jayne-Anne Gadhia hits out at Starling Bank founder Anne Boden's criticism of Open Banking. In 2021, Boden said Open Banking’s implementation had been “clunky” and the technology had been unable to break big banks’ stranglehold on the market, one of its key aims. Read Dame Gadhia's viewpoint on Boden's statement here.

REGTECH NEWS

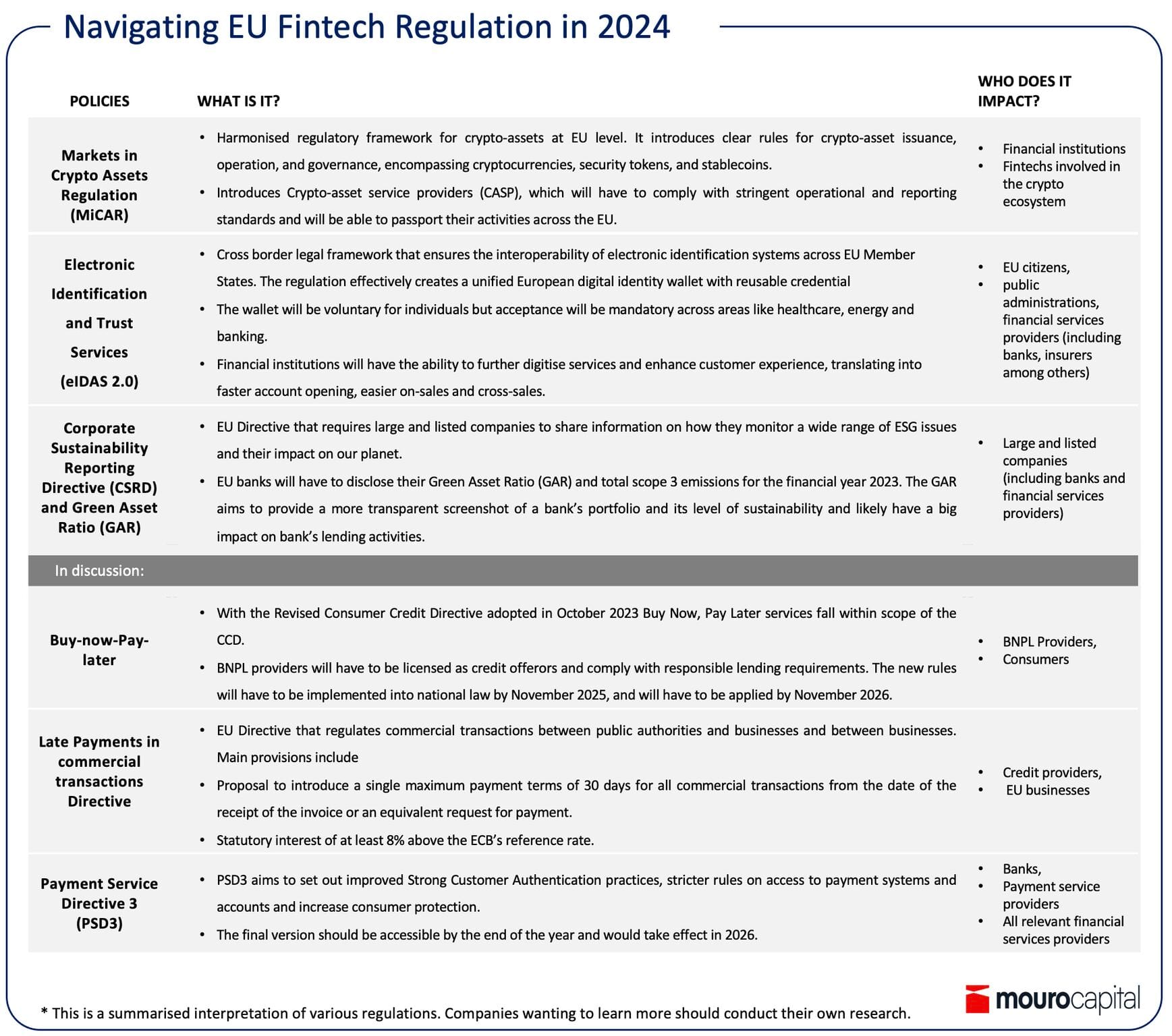

Navigating European 🇪🇺 FinTech Regulation in 2024.

🇬🇧 Volume introduces one-click age verification for KYC. This unparalleled solution addresses the critical need for merchants, such as iGaming, Money Remittance, Crypto, FinTechs and other businesses, to streamline age verification and ensure the authenticity of user data in compliance with regulatory standards.

DIGITAL BANKING NEWS

🇳🇬 Nigerian FinTech company OjirehPrime has changed its name to Pryme to expand to Europe, Central Asia, and the United Kingdom. The company said it has started applications to secure a European banking licence allowing it to reach the 12 million Africans (5.8 million are Nigerians) who live in Europe.

🇧🇷 Brazil's Central Bank in "meltdown," chairman says. CB employees canceled a two-day strike planned for Tuesday and Wednesday, but the dispute with the government continues. Consequently, Central Bank chairman, Roberto Campos Neto, said last week that the bank is in ‘meltdown,’ losing an average of seven employees a day -as more qualified workers are lured away by private banking.

Vermiculus to build central core for clearing houses in Chile, Colombia and Peru. uam exchange, the entity resulting from the integration of the Lima, Santiago and Colombia stock exchanges, announced a partnership with Vermiculus Financial Technology to implement a modern, flexible technological core for the Central Counterparty Clearing Houses (CCP) in Chile, Colombia and Peru.

🇨🇭 Klarpay announces the launch of its new Entrepreneur Accounts, a tailored financial solution designed exclusively for Business Founders, UBOs, and Senior Management members who already hold accounts with Klarpay. This service allows entrepreneurs to set up multiple accounts customised to their business needs.

BLOCKCHAIN/CRYPTO NEWS

🇿🇦 South Africa regulators to unveil document categorizing stablecoins as a 'Particular Type of Crypto Asset'. In 2024, the Intergovernmental FinTech Working Group, a consortium of South African regulators that unveiled a position paper on crypto assets in 2021, is expected to “publish additions to include stablecoins as a particular type of crypto asset.”

DONEDEAL FUNDING NEWS

🇪🇸 Spanish FinTech Embat secures $16M to expand in the UK and become the corporate bank of the future. The round comes after Embat has already achieved significant success, quadrupling its turnover, and will be used to support its global expansion, especially into the UK and German markets.

BNP Paribas and Citi invest in United FinTech. BNP Paribas and Citi have become the first institutional investors in United FinTech, an umbrella outfit dedicated to scooping up a stable of capital markets, wealth management and wholesale banking vendors. Read more about this deal here

MoneyHash raises $4.5 Million to fix payment failures & fuel revenue growth in Middle East & Africa. The new funds will primarily be used to expand the business team and growth capabilities across the region while maintaining technological progress. Click here to learn more

M&A

🇦🇪 UAE FinTech startup Dunes to acquire significant assets of Be Mobile Africa paving the way to digital banking innovation. The acquisition, slated for completion by the end of the second quarter of 2024, marks a significant milestone for Dunes, positioning the company as a trailblazer in the latest generation of FinTech companies.

MOVERS & SHAKERS

🇮🇳 Vijay Shekhar Sharma Quits Paytm Payments Bank’s Board. In a filing with the bourses, the FinTech startup said that Sharma has resigned as the part-time non-executive chairman and board member of the payments bank. It added that a newly-reconstituted board will now helm the affairs at the company.

🇬🇧 Enfuce strengthens its leadership team. Enfuce has appointed former Tide’s UK CEO and Revolut’s COO Laurence Krieger as the Chairman of the Enfuce UK Board of Directors. More on that here

🇳🇱 Payter appoints new CPO and CFO. Payter, a global pioneer in payment technology, has appointed two new senior executives, Jack Driessen as Chief Financial Officer and Ryan Philo as Chief Product Officer.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()