Revolut Founder to Sell Part of Multibillion-Dollar Stake in $500M Share Sale

Hey FinTech Fanatic,

Nik Storonsky, the founder and CEO of Revolut, is preparing to sell a portion of his multibillion-dollar stake in the company as part of a $500 million (£391 million) share sale. This information, obtained by Sky News, indicates that Storonsky plans to offload stock valued at tens or even hundreds of millions of dollars in an upcoming secondary deal.

The final amount of Storonsky's disposal will hinge on the valuation Revolut secures from new investors, as well as the allocation decisions made by the company and its advisers, Morgan Stanley, according to sources within the financial sector.

While the exact size of Storonsky's stake remains unclear, it is estimated to be worth several billion dollars if Revolut achieves its target valuation of $40 billion (£31 billion).

Have a great start to the week and I'll be back in your inbox tomorrow!

Cheers,

INSIGHTS

🇺🇸 Nazuk Jain, VP of Product and Innovation at PayQuicker chats with HRtech Series about the various ways in which business payout models have evolved over the years: Read on for the full interview

FINTECH NEWS

🇺🇸 FinTech is likely to face increased scrutiny after Evolve hack. A recent data breach at Evolve Bank & Trust has disrupted the FinTech sector, highlighting its interconnectedness. This comes at a challenging time, as FinTech struggles to attract venture capital with investors shifting focus to AI. The breach underscores the importance of trust and the responsibility FinTech companies have in safeguarding customer information.

🇺🇸 Google Wallet to support digital passports in the US. With the rising adoption of Google's mobile payment service in the US, and the recent addition of numerous banks, Google Wallet is not just about storing your financial information. Read more

🇦🇪 Compound, a new “save now, buy later” start-up is preparing to launch in the Middle East and North Africa (MENA) region. Compound is touted as “a new way of getting paid to save”, according to its website, enabling users to earn rewards for saving with their favourite brands.

🇸🇱 Africell, FinTech PYYPL launch Visa card in Sierra Leone. Africell says the card works smoothly with its Afrimoney mobile service, giving customers a virtual or personalised real card for local and international transactions between their Afrimoney Wallet and the PYYPL card.

🇸🇬 Singapore-based Software-as-a-Service (SaaS) firm Summit is launching a smart expense management solution built specifically for finance managers of small to medium-sized enterprises (SMEs). The start-up aims to “modernise and automate” traditionally manual processes for employee expense claim and accounts payable functions.

🇲🇽 Mexican FinTech Yuhu is taking steps to become a Sociedad Financiera Popular (Sofipo). According to CEO Ricardo Flores, the company has begun the authorization process with the National Banking and Securities Commission (CNBV). Read on

🇦🇪 Mastercard inks deal with UAE-based LuLu Group. The partnership will introduce revamped features and benefits, such as digital in-store transactions and more cashless experiences, as well as personalized rewards and generous cashback offers on spends at LuLu stores.

PAYMENTS NEWS

🇳🇬 Accelerex launches Pay with Fingerprint in Nigeria. This solution allows bank account holders to make secure and convenient payments at merchant locations using their fingerprints on biometric-enabled PoS devices, using advanced biometric technology for a seamless payment experience, enhancing security for consumers and merchants.

📱 Global Real-Time Payments to top $58T by 2028. Real-time payments continue to advance globally. Banks, FinTechs, corporates and governments are all pursuing initiatives to accelerate payments for their citizens and customers. Read the full piece

🇺🇸 One form of payment will no longer be accepted at Targets across the United States. The giant retailer announced it will cease accepting personal checks starting this month, a spokesperson told NBC Chicago. The company made the decision due to “extremely low volumes,” according to the media outlet.

🇪🇺 Visa, Mastercard to extend non-EU card fee caps to 2029, EU says. The fee caps are due to end in November this year. The move followed a long-running investigation by the EU competition enforcer triggered by a 1997 complaint by business lobby EuroCommerce.

DIGITAL BANKING NEWS

🇦🇺 Revolut named Australia its fastest-growing international market, where local users doubled over the past 12 months as it recruits Millennial and Gen Z spenders away from the major banks with crypto and Wall Street functionality. Revolut has more than 600,000 users of its app in Australia, and 45 million globally.

🇮🇳 RBI (Reserve Bank of India) is the latest bank to join the global Project Nexus initiative, designed to enable cross-border instant payments. According to the Bank of International Settlements, who oversees Project Nexus, the goal of the initiative is to standardise the way that IPS connect to each other.

🇦🇺 CommBank launches in app Travel Booking. The new CommBank digital experience is powered by global online travel agency Hopper, already used by customers worldwide, and focuses on providing a range of innovative travel features.

BLOCKCHAIN/CRYPTO NEWS

📉 Crypto stolen by hackers doubles to $1.38 Billion in first half of this year. Five major attacks accounted for 70% of all stolen crypto this year, continuing the trend of a few large-scale thefts making up the majority of losses. However, the total stolen is still below the nearly $2 billion taken in the first half of 2022, the record year for crypto thievery.

🇸🇬 Justin Sun says gas-free transfers of stablecoins coming to Tron this year. He said the innovation would be implemented on the Tron blockchain first, then later expanded to Ethereum and Ethereum Virtual Machine-compatible blockchains. More here

🇨🇭 Tangem plans crypto Visa payment card with hardware wallet. The two companies plan to introduce a Visa payment card combined with a hardware wallet, which will enable Tangem users to make payments using their crypto or stablecoin balance at Visa-accepting merchant locations.

DONEDEAL FUNDING NEWS

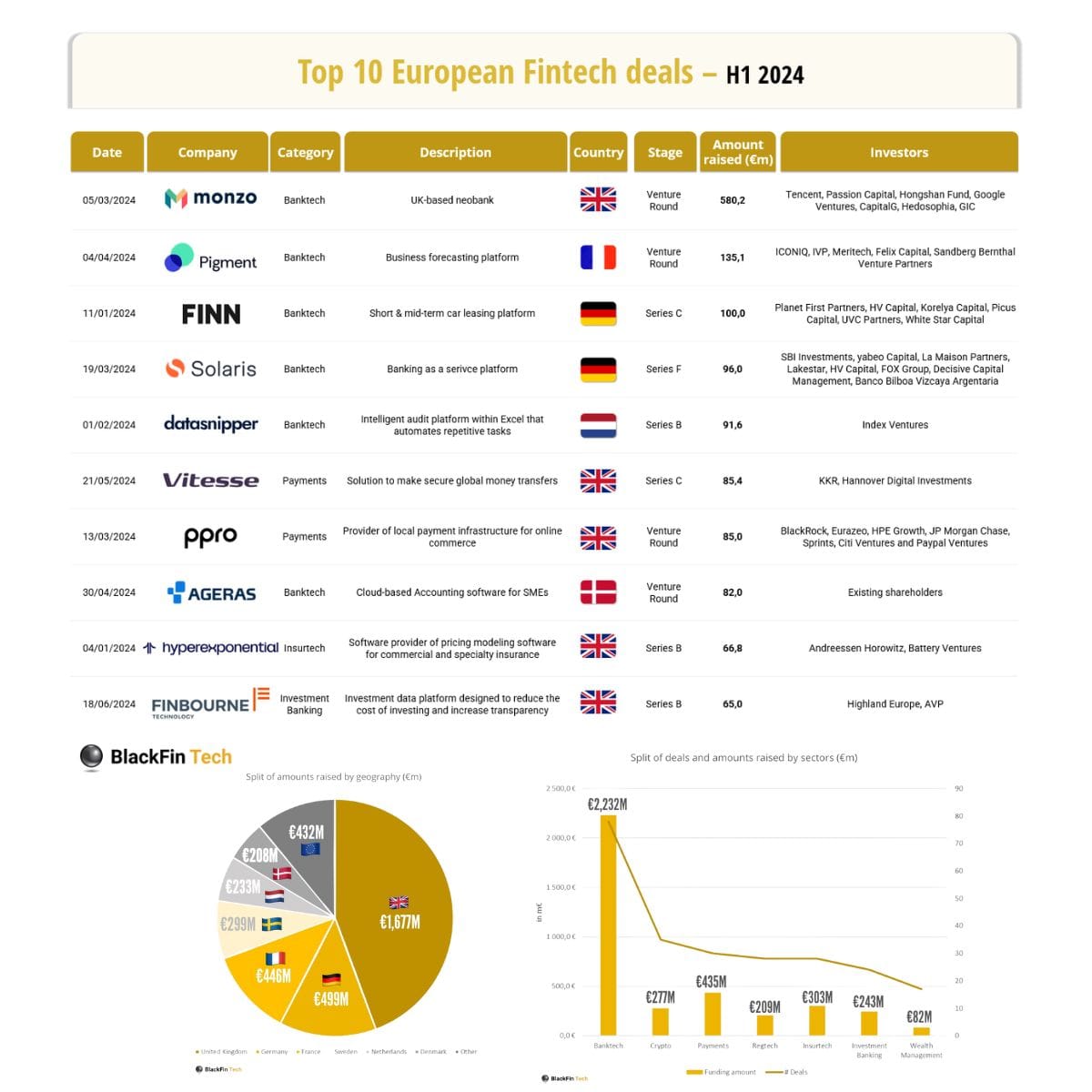

💰 In H1 2024, European FinTechs raised €𝟯.𝟴𝗕𝗻 (+14% compared to H1 2023)

Let's dive into Funding Stats from H1 2024 in 🇪🇺 FinTech:

🇬🇧 The founder of Revolut is to cash in part of his multibillion dollar stake in the company as part of a $500m (£391m) share sale. Sky News has learnt that Nik Storonsky, who is the FinTech’s CEO, plans to offload stock worth tens or even hundreds of millions of dollars in the secondary deal in the coming weeks.

🇩🇪 Mitgo Group has made the first tranche of investment in its recently launched FinTech business, Capy. This is the initial step in a $20 million investment package planned for the next three years. The first tranche will be used to develop the initial version of the platform, focusing on early and accelerated payment solutions.

🇮🇳 Dice raises $5m in Series A round led by Dallas Venture Capital India Fund. The funding will fuel the company’s various go-to-market initiatives, which aim to enhance deeper market penetration, expand customer outreach, optimize sales and marketing strategies, and boost AI capabilities to enrich the user experience.

🇺🇸 US-based FinTech Netevia has raised USD 120 million in committed and uncommitted capital from WhiteHorse to support its growth efforts. The funding comprises various debt facilities aimed at facilitating acquisitions, launching new products, and advancing strategic initiatives.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()