Pix's Unstoppable Growth in Brazil

Hey FinTech Fanatic!

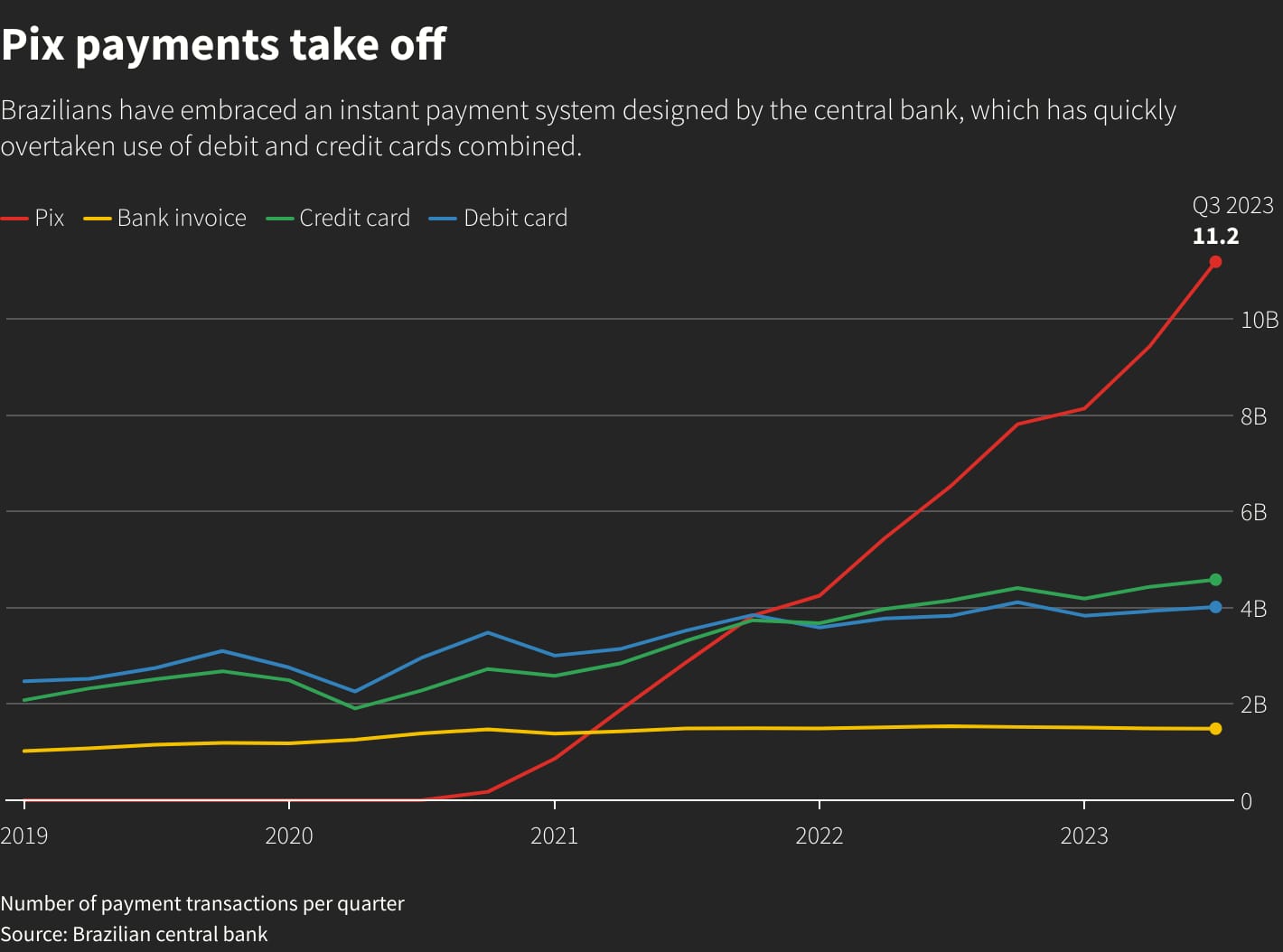

Brazil's Pix payment system, launched by the central bank three years ago, has quickly overtaken cash and wire transfers, posing a significant threat to credit cards, especially in e-commerce.

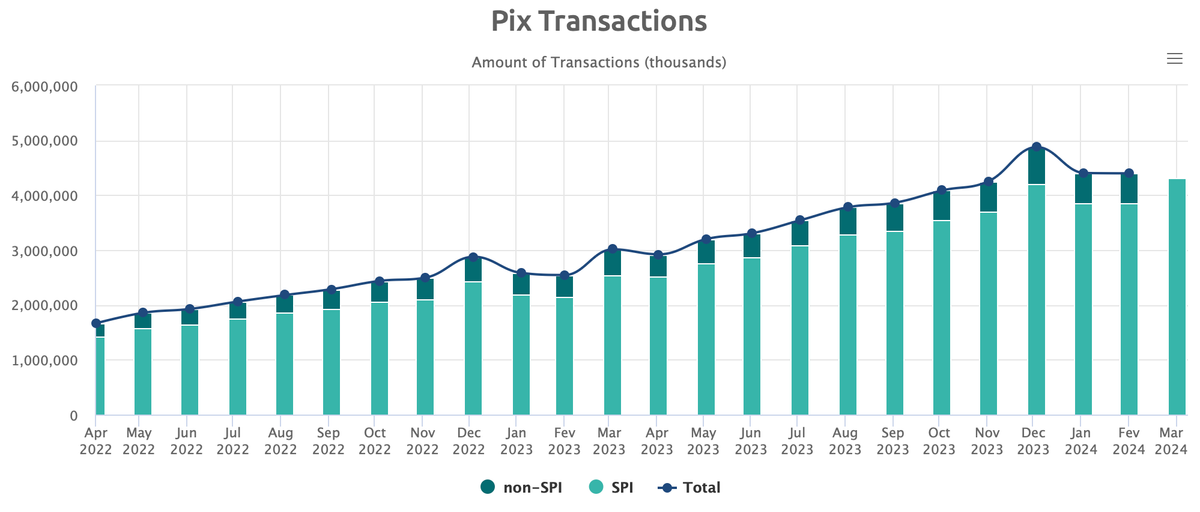

Pix's instant payment feature has become a favorite, with usage soaring 74% last year, outperforming credit and debit card transactions by about 23%.

This shift is largely beneficial for buyers and online retailers, offering lower transaction costs and improved cash flow.

The system allows seamless transactions by scanning a QR code, reducing the reliance on traditional card payments which involve higher fees shared among networks and processors.

Pix's average transaction cost is significantly lower than those of debit and credit cards, prompting predictions of diminishing credit card relevance.

With new features like recurring payments and installment purchases on the horizon, Pix's dominance in the retail sector is expected to grow, further challenging the credit card industry.

More industry news is listed for you below, including a few very interesting crypto updates that I think are worth checking out.

Enjoy!

PODCAST

🎤 In this FinTech Leaders episode, Miguel Armaza sits down with Alberto Dalmasso, CEO & Co-Founder of Satispay, the largest FinTech in Italy and one of the largest in Europe. Listen to the full podcast episode here

#FINTECHREPORT

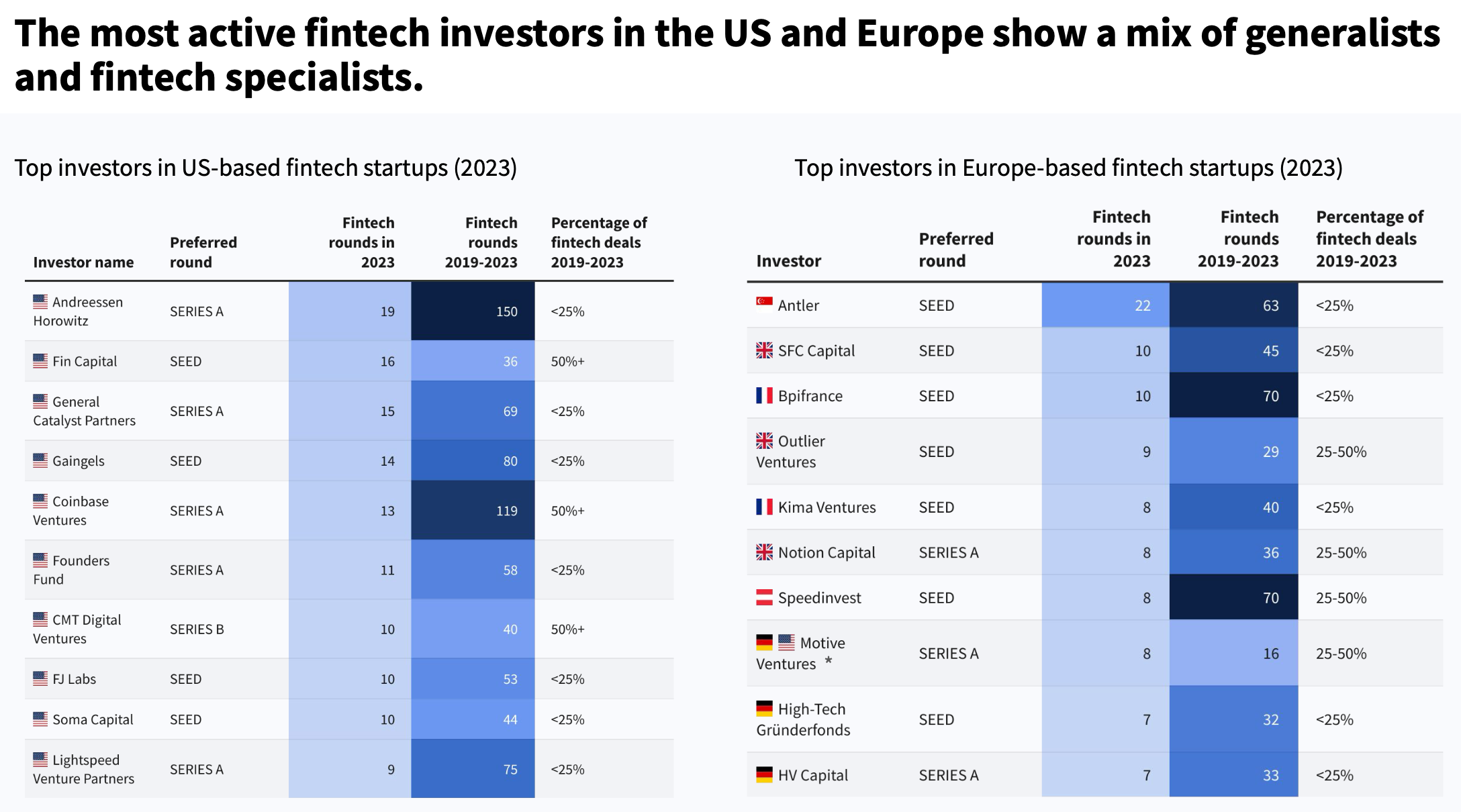

📊 The State of FinTech 2024 – Europe & US. VC investment in FinTech startups fell to $42B in 2023, marking a 63% decrease from the previous year, with Europe experiencing a sharper decline than the US. Click here to learn more

INSIGHTS

🪙 The most active FinTech investors in the US 🇺🇸 and Europe 🇪🇺 show a mix of generalists and FinTech specialists:

FINTECH NEWS

🇵🇭 BillEase doubles revenue to $57m in 2023, hits full-year profitability. The Philippines-based BNPL, said it doubled its revenue in 2023 to US$57 million compared to the year before. It also stayed profitable with US$7 million in net income for the full year – a relatively steep rise from last August.

🇬🇧 AIM-listed FinTech and consultancy firm Alpha Group International has confirmed its intention to move to the premium list of the London Stock Exchange’s main market as it looks to expand. Alpha Group’s admission to the main market is not expected to be subject to shareholder approval but will require authorisation from the FCA.

🇳🇬 Nigerian FinTech, Thepeer shuts down. The startup has shuttered its business and will return its remaining capital to investors after failing to scale, the company said in a statement on Monday. The three-year-old startup said it closed shop after realising its exceptional technology alone wasn’t sufficient.

🇸🇪 Scayl emerges from stealth and raises €100 million to grow the loan books of European FinTech lenders. Dubbed a “FinTech for FinTech Lenders”, Scayl provides FinTechs building credit products with access to transparent funding structures, allowing them to fund their loan books with more flexibility, and 10 times faster than negotiating directly with banks and credit funds.

XTB, a global FinTech offering an online investing platform and a mobile app, announced a new milestone as it now serves one million customers worldwide. This achievement comes in little over three years after XTB expanded its CFD offer with the addition of stocks and ETFs.

PAYMENTS NEWS

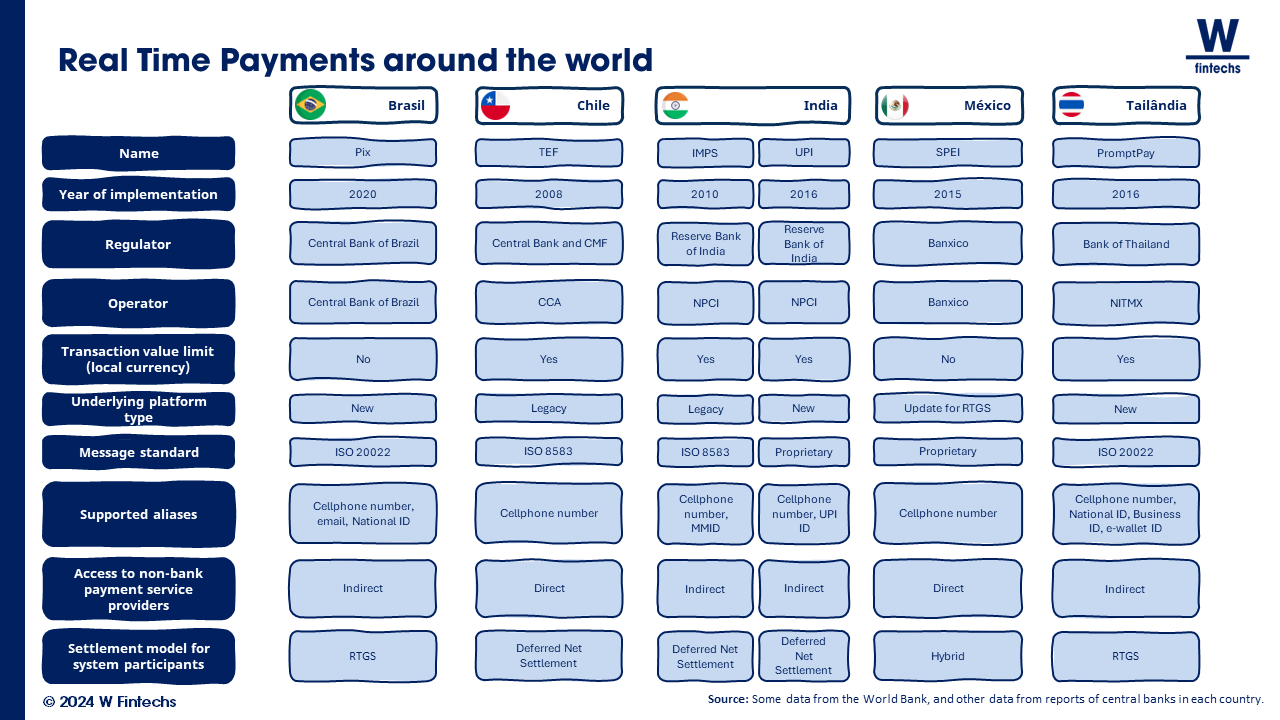

➡️ The revolution of instant payment systems in Asia and Latin America.

In the table below, it is possible to notice that Asian and Latin American economies have differentiated in terms of approach👇

🇬🇧 Zilch, the ad-subsidised payments network (ASPN), announced it has selected Checkout.com as its primary acquiring partner globally, with a particular focus on the UK and USA. Checkout.com will help Zilch continue to offer the fast and reliable high-performance payments that its expanding customer base has come to expect from its regulated payment network.

🇪🇺 Viva.com and Bluecode team on QR payments in Europe. The partnership will enable merchants, including marketplace operators, to accept Bluecode payments in all 15 Eurozone markets in which Viva.com operates, optimizing customer experience and loyalty.

🇬🇧 Paymentology and Rain unveil industry first payment solution for Web 3.0, digital asset businesses. The collaboration is a first for the FinTech industry with the launch of a new payment solution for digital asset businesses throughout the Caribbean and Latin America.

🇮🇪 Strengthening its payment ecosystem, CatalystPay partners with Paynetics, Europe’s leading regulated FinTech. The collaboration represents a significant step in expanding CatalystPay’s European ecosystem of acquiring bank partners, emphasizing the company’s dedication to providing versatile and robust payment services tailored for the evolving needs of digital businesses.

OPEN BANKING NEWS

🇳🇬 Mono Technologies Nigeria Ltd, an open banking infrastructure provider for African businesses, announces a strategic collaboration with Mastercard. This partnership combines Mono’s open banking expertise with Mastercard Gateway’s advanced payment tech to offer a secure and efficient account-to-account (A2A) payment solution for regional businesses.

REGTECH NEWS

🇨🇴 FinTech Palenca and Experian Ventures have formed a partnership to provide income verification services in Brazil and Colombia. This investment will drive Palenca's growth in other markets where Experian has a presence, integrating Palenca's income verification services to make them available to its extensive customer base.

🇸🇬 Singapore launches platform to tackle money laundering. The Cosmic platform was built by MAS with the six major banks that will be its first users - DBS, OCBC, UOB, Citibank, HSBC and Standard Chartered. Participants can only share customer information with each other if the customer profile or behaviour display "objectively defined" red flags.

Chekk, a leader in digital identity and KYC, is releasing ‘Express KYB Company Report bot’ on Symphony, the leading markets infrastructure and technology platform. This new bot will enable the quick generation of exhaustive real time reports for 450 million entities across 220 countries and territories.

DIGITAL BANKING NEWS

🇩🇪 N26 launched Stocks and ETF Trading in Germany. The company also announced an increased interest rate of 4% on Instant Savings for N26 Metal customers. With its new Stocks and ETFs trading product, N26 allows its customers in Germany to invest in fractional shares of hundreds of the most popular European and US assets on global equity markets with as little as 1 EUR.

🇺🇸 Treasury Prime and Narmi partner to offer banking customers FedNow. This collaboration enables Treasury Prime’s banking customers to send and receive money instantly through the FedNow Service and integrate the FedNow experience into their products.

🇩🇪 Commerzbank revamps platform for cross-border payments. The bank is updating its existing payment platform in Germany to process cross-border payments via the Swift network and to process high-value and urgent payments via the TARGET 2 or EURO 1 payment systems.

🇺🇸 Apple Card Savings account interest rate set to dip slightly starting this week. Apple and Goldman Sachs have been tweaking the interest rate on the Apple Card Savings account recently. The Savings account was introduced about a year ago, and it's now set for its first-ever interest rate decrease.

🇺🇸 Chase launches Chase Media Solutions, its new Digital Media Business, providing brands with the ability to connect directly with the financial institution’s 80 million customers. It combines the scale and audience of a retail media network with the exclusive advantages of Chase’s first-party financial data, institutional credibility and precise targeting capabilities.

BLOCKCHAIN/CRYPTO NEWS

🇳🇬 Nigeria’s government charged Binance with money laundering to the tune of $35.4 million on Thursday in the latest salvo between Africa’s most populous nation and the crypto exchange. More here

Binance released an Official Statement regarding Tigran Gambaryan. Binance respectfully requests that Tigran Gambaryan, who has no decision-making power in the company, is not held responsible while current discussions are ongoing between Binance and Nigerian government officials. Read the full statement here

🇹🇷 Turkish crypto chief starts 11,196-year prison sentence. Faruk Fatih Ozer, the former boss of failed Turkish cryptocurrency exchange Thodex, has started a lengthy jail sentence after he was found guilty of defrauding investors in a multimillion dollar fraud.

Telegram introduces Toncoin as new payment option for advertisers. This move allows advertisers to purchase in-platform ads using Toncoin. It is a key part of the growing strategy by the platform to create a user-friendly environment while also compensating content creators for their work.

DONEDEAL FUNDING NEWS

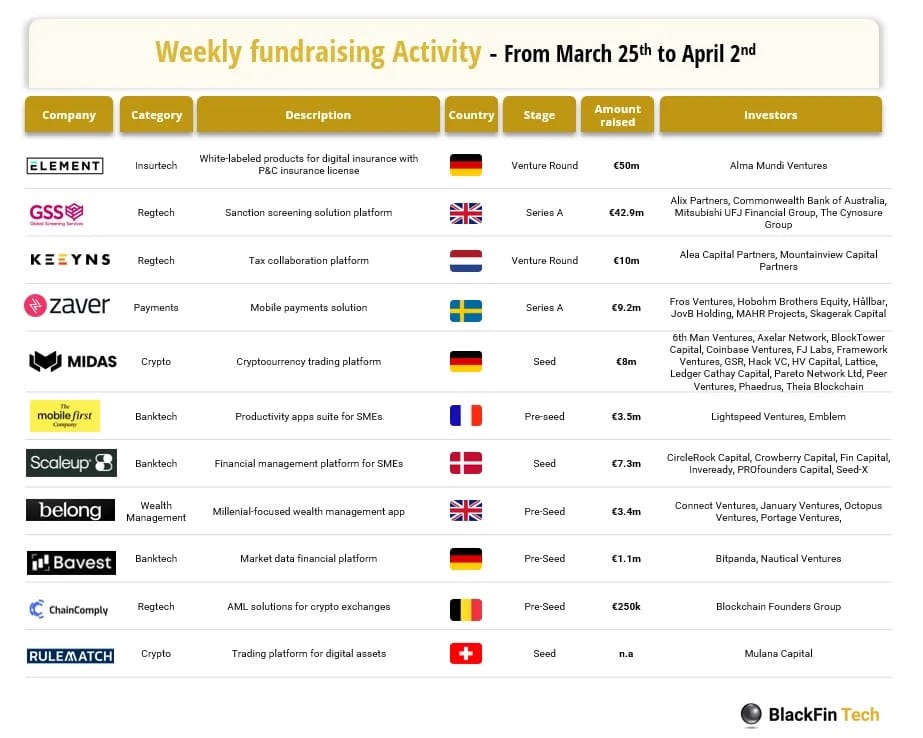

Last week we saw 12 official FinTech deals all over Europe for a total amount of 136m€ raised with 3 deals in Germany, 2 in the UK, 2 in France, 1 in the Netherlands, 1 in Sweden, 1 in Denmark, 1 in Belgium and 1 in Switzerland. Read the complete Blackfin Tech article here

🇲🇽 Mexican taxtech Taxo raised $1.2M in a pre-seed round. Seedstars, 500 Latam, BuenTrip, Newlin Ventures, and other investors participated. With the funds, Taxo will consolidate its presence in Mexico, and also plans to add new services like tax payment assistance and expand to Peru and Colombia.

MOVERS & SHAKERS

🇱🇺 Mangopay appoints Bertrand Dezard as Head of Sales for Fraud. Bertrand joins to drive the growth of Mangopay’s international fraud prevention business worldwide with a focus on Europe and Latin America as the company expands the client base of its award-winning cybersecurity solution.

🇺🇸 TaxBit announces European expansion and welcomes Dr. Max Bernt as Managing Director of Europe to steward the company's efforts in the region. Leveraging his regulatory insights and deep ecosystem network, Dr. Bernt will be pivotal in helping companies and governments navigate the complexities of the European digital asset market as MiCA and DAC8 regulations come into effect.

🇺🇸 ConnexPay names Ben Peters CEO. Peters brings more than two decades of experience leading and scaling global payments and vertical software companies. A seasoned payments executive, Peters’ vast experience spans the utility, fleet and insurance sectors.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()