Nubank's Spectacular Growth: A Look at Q1 2024 Earnings Report

Hey FinTech Fanatic!

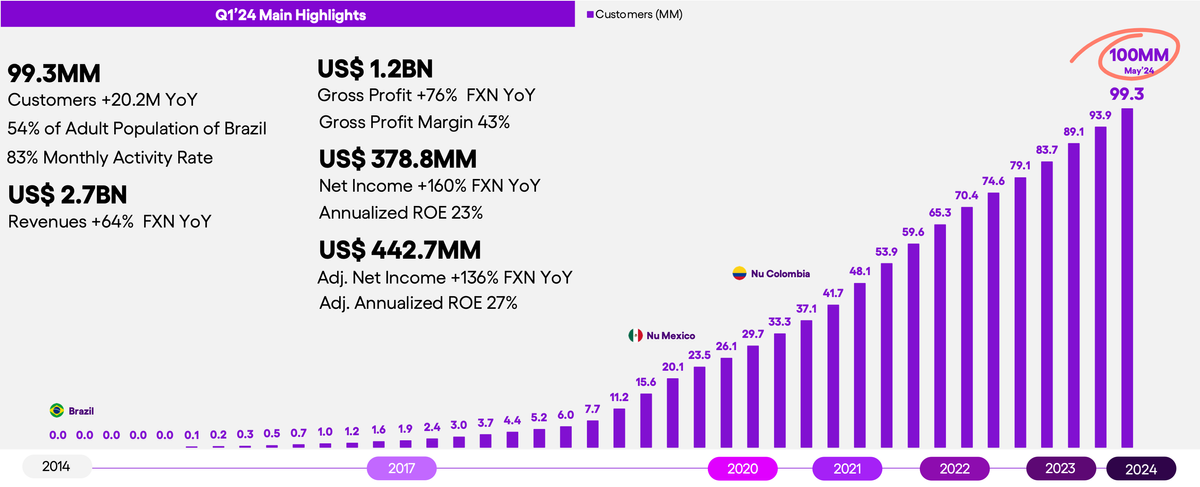

Last week, Nubank celebrated a significant milestone by crossing 100 million customers. Today, the neobank released its latest earnings report for Q1 2024, showcasing impressive growth and financial performance.

Key Q1 Metrics and Highlights:

- Customer Growth:

- Nubank now serves 99.3 million customers, marking an increase of 20.2 million year-over-year (YoY) and 5.4 million quarter-over-quarter (QoQ).

- The number of active customers stands at 82.6 million, up by 17.7 million YoY and 4.6 million QoQ.

- The activity rate is at 83.2%, showing a slight increase of 0.1 percentage points (pp) QoQ and 1.1 pp YoY.

- Revenue and Profit:

- Nubank's revenue reached $2.7 billion, a 64% YoY increase when adjusted for currency fluctuations (FXN).

- Gross profit surged to $1.2 billion, up 76% FXN YoY, with a gross profit margin of 43%.

- Net income skyrocketed to $378.8 million, a 160% FXN YoY increase, up from $141.8 million the previous year. The annualized return on equity (ROE) stands at 23%.

- Adjusted net income was $442.7 million, reflecting a 136% FXN YoY increase, with an adjusted annualized ROE of 27%.

Additionally, Nubank's efficiency ratio, which measures operating expenses as a percentage of net revenue, improved to 30% in Q1 2024.

Meanwhile, in Amsterdam, another neobank, bunq, presented its quarterly update with notable advancements. Bunq introduced its fully conversational GenAI Assistant, Finn, and expanded into the insurance market.

The neobank's user base has grown to over 12.5 million, with deposits exceeding €8 billion.

You can check the complete presentation by Founder, and CEO, Ali Niknam here:

Have a great day and I'll be back in your inbox with more FinTech industry news tomorrow!

Cheers,

SPONSORED CONTENT

#FINTECHREPORT

📊 Checkout.com's 4th annual MENA report finds cash on delivery usage halved, amongst maturing digital economy. Download the complete report for more interesting info and stats here

PODCAST

🎙️ In this FinTech Leaders episode, Miguel Armaza interviewed Rodger Desai, CEO & Founder of Prove, a billion-dollar company at the forefront of identity verification and fraud reduction. Listen to the full podcast here

FINTECH NEWS

🇦🇪 Symphony to open in Abu Dhabi. Markets technology platform latest to look to the Middle East for expansion. A host of financial services firms have told Financial News in recent months that they see bright prospects for the region.

🇺🇸 FinTech Sandbox, a nonprofit that provides early-stage FinTech startups around the world with free access to critical datasets and infrastructure through its Data Access Residency, announced the addition of Global Atlantic Financial Group to its group of sponsors and receipt of a generous grant of $150,000. Global Atlantic joins a prestigious group of organizations contributing to FinTech Sandbox's mission of providing a collaborative community and support system for entrepreneurs.

🇺🇸 Kabbage Inc. agrees to resolve allegations that the company defrauded the Paycheck Protection Program. Kabbage is now winding down its operations as KServicing Wind Down Corp. after filing for Chapter 11 bankruptcy in the District of Delaware in October 2022. Find out more

🇺🇸 Here is why Klarna does 𝗡𝗢𝗧 report BNPL Payments to US credit bureaus, according to Sebastian Siemiatkowski. Click here to read the full story

🇸🇬 Audax teams with Paymentology on Cards-as-a-Service project. This collaboration transforms the payments landscape in Southeast Asia and the Middle East and allows financial institutions (FIs) to seamlessly launch and manage their own branded card program in a matter of months.

PAYMENTS NEWS

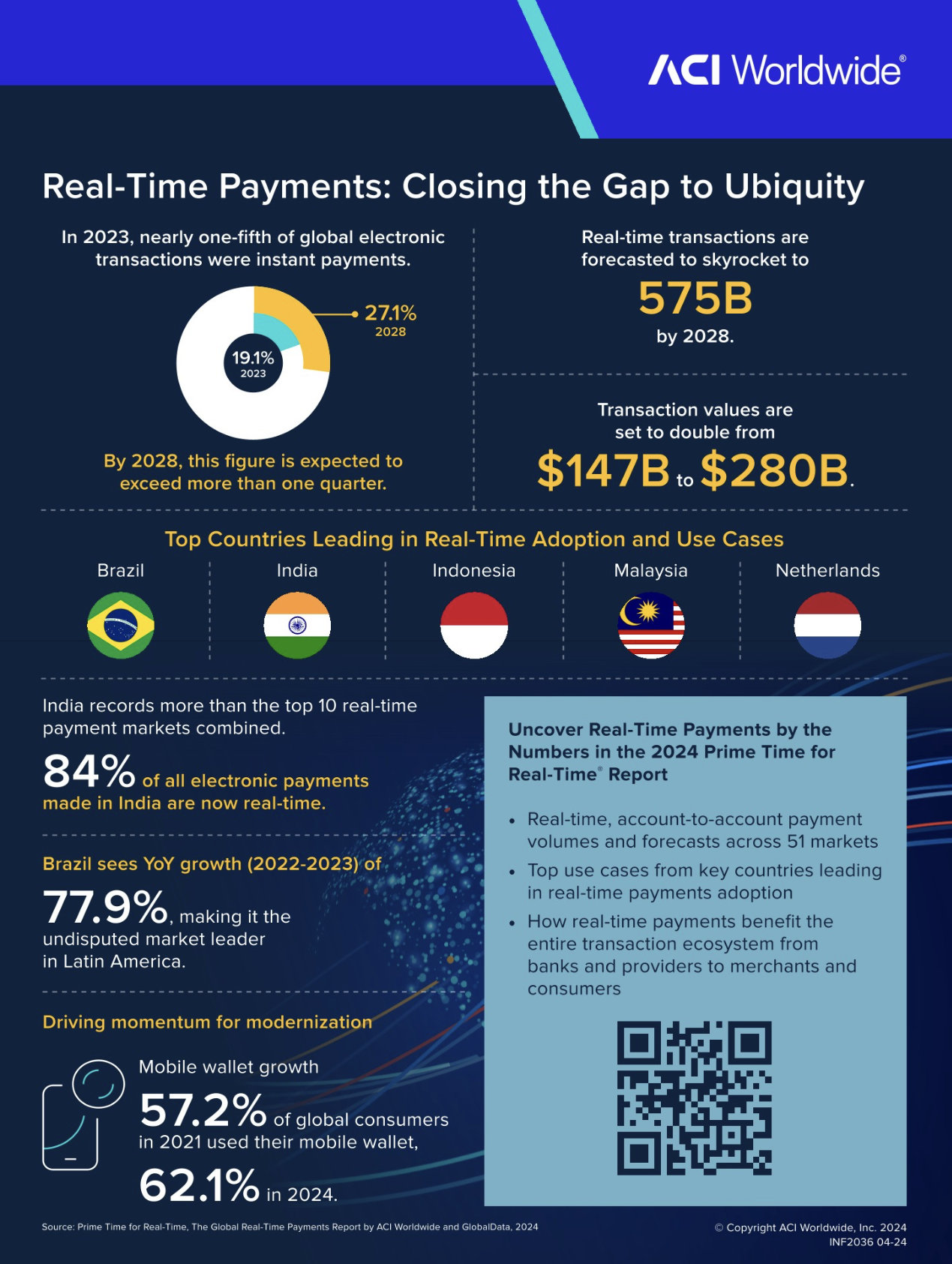

🇧🇷 With Pix, Brazil has become the second largest market for instant payments in the world 🤯

🇫🇷 Worldline and Visa partner for OTA payments. Worldline has partnered with Visa to introduce a new virtual card-issuing solution, expanding Worldline's scope from payment processing to direct card issuance.

🇲🇽 Paytech Kueski Pay and BBVA Partner to Promote "Buy Now, Pay Later" in Mexico. This alliance aims primarily to facilitate access to electronic payments for millions of Mexicans, without the need for credit cards or cash, thereby stimulating online economic activity.

🇺🇸 Pagos, a leading provider of payments optimization solutions, announced the launch of Pagos Copilot, an AI-powered tool for instant payment intelligence. Commerce businesses of all sizes can benefit from the industry knowledge and streamlined payments analysis available via a simple conversation with Pagos Copilot.

🇩🇰 Nets to offer Klarna payments to Nordic merchant customers. Klarna’s flexible payment options will be integrated into the Nets checkout for e-commerce merchants in Sweden, Norway, and Denmark. Read more

🇺🇸 Payments-Company Waystar plans to restart IPO pitch. The private equity-backed company is eyeing a June stock-market debut. Waystar is likely to target a valuation around $5 billion or $6 billion, one person familiar with the matter said.

OPEN BANKING NEWS

🇦🇪 New UAE-based open banking start-up Thimsa launches in beta. The firm, on a mission to “simplify and accelerate payment processes” by embracing open banking, has announced the beta launch of its payment management platform in the UAE and Bahrain.

DIGITAL BANKING NEWS

🇧🇷 Nubank released it’s Q1 2024 earnings. Some Metrics are just out of this world. Click here for further insights

🇳🇱 bunq makes its GenAI Assistant Finn fully conversational and enters the Insurance market, as the neobank’s total user base surges past 12.5 million, and its deposits climb to over €8 billion. “At bunq, we use the latest tech to make our users’ lives easy”, says Ali Niknam, founder and CEO of bunq.

🇪🇹 Cooperative Bank of Oromia and Mastercard have unveiled a groundbreaking collaboration with the launch of the Coopbank Prepaid Mastercard and the introduction of the Community Pass technology in Ethiopia. These initiatives are set to significantly enhance digital and financial inclusion across the country, particularly Ethiopia’s smallholder farmers.

🇫🇷 Lydia invests €100 Million to become a bank. The company, known for its money transfer app, is re-launching its banking account offers under a new name, Sumeria, and is introducing remunerated current account solutions. It aims to reach 5 million customers within three years.

🇧🇷 Brazilian neobank PicPay has announced the launch of an account for minors, connected to their parents' accounts. This new feature introduces the family hub, designed to facilitate family management and promote financial education.

BLOCKCHAIN/CRYPTO NEWS

🚀 Robinhood Crypto launches Staking in Europe. The US neobroker has announced that its Robinhood Crypto unit has launched a series of new features specifically designed for its customers in Europe. Read on

DONEDEAL FUNDING NEWS

🇧🇷 Brazilian FinTech Grupo Bloxs raised an undisclosed amount from neobank BS2. Bloxs will use the funds to further develop its Capital Market As a Service (CMaaS) platform. The funding seals a partnership to serve BS2’s clients with Bloxs’s credit products, making capital markets accessible to SMBs in Brazil.

🇨🇭 Alpian secures CHF 76M Series C Funding to drive expansion and innovation in digital banking. The new capital will drive further advancements in Alpian's financial solutions. The company was ranked among the TOP 100 Swiss Startups from 2022 to 2024.

MOVERS & SHAKERS

🇱🇺 Mangopay appoints Ariel Shoham as Vice President of Risk Product. Ariel joins to lead the product vision, strategy and roadmap for Identity and Fraud Protection at Mangopay, including its award-winning cybersecurity solution.

🇺🇸 Green Check named a best place to work in Financial Technology by American Banker for third consecutive year. The leading FinTech provider of financial services solutions and industry insights in the cannabis market has been recognized for its collaborative remote culture and competitive benefits.

🇬🇧 Tandem, the UK’s greener digital bank, has announced the appointment of Suavek Zajac, as Chief Technology Officer. Suavek will lead the development of Tandem’s digital offering, spearheading a team of high calibre engineers towards building scalable systems to support Tandem’s green mission.

🇬🇧 GoCardless hires Jolawn Victor as chief growth officer. In her new role at GoCardless Victor will lead the global ‘Growth Group’, managing a team primarily responsible for SME customer acquisition, incremental revenue growth and brand, marketing and communications.

🇨🇦 Trulioo, an identity platform with proven global coverage for person and business verification, announced the appointment of David Liu as senior vice president of fraud & risk. He will lead the team with “the charge of cementing the company’s position as a fraud-prevention innovator for organizations across industries and around the world.”

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()