Nubank is Launching a Travel Booking Platform

Hey FinTech Fanatic!

Another day, another big announcement from Nubank:

The Brazilian neobank is launching a travel booking platform for its high-income Nubank Ultravioleta customers.

“𝗡𝘂𝗩𝗶𝗮𝗴𝗲𝗻𝘀” will be available to the customers over the next few months offering air and hotel bookings.

NuViagens guarantees the best price. If the customer finds a more attractive offer for the purchased flight or hotel within 24 hours, Nubank Ultravioleta will refund the price difference.

Additionally, in the flight purchasing experience, the platform offers price monitoring and indicates the best purchase time. By following the app’s recommendations, when the ticket reaches the lowest price relative to the flight history, Ultravioleta customers receive free protection that automatically reimburses up to BRL 500 if the flight price drops within 30 days after purchase.

NuViagens also allows purchases in up to 8 interest-free installments via NuPay, an exclusive payment method for Nubank customers, for all air tickets and accommodations, as well as 1% cashback that grows at 200% of the CDI.

Dedicated 24-hour travel-related support via the app’s chat or phone is also available, providing even more peace of mind from start to finish of the trip.

Another step in becoming a super app. What do you think about this feature?

Cheers,

SPONSORED CONTENT

#FINTECHREPORT

🇧🇷 Brazil: a booming country for e-commerce. Download the complete FinTech report by Payretailers to learn all about it.

FINTECH NEWS

🇬🇧 Modulr unveils payment service built for online travel agents. The embedded payments platform launched a new travel payments solution for online travel agents and intermediaries, enhancing efficiency, streamlining reconciliation and cash flow, and improving margins.

🇺🇸 Klarna ditches investor veto on share trades as $20b float looms. The buy now pay later (BNPL) FinTech giant, has removed the right of large shareholders to block smaller investors' share trades ahead of a prospective $20bn (£15.7bn) US float. Read more

🇭🇰 FinTech Aspire enters Hong Kong with ‘Money Service Operator’ license. Aspire’s integrated solution is built to help Hong Kong’s fast-growing SME segment across industries facilitate multi-currency cash management and domestic and cross-border money transfers.

PAYMENTS NEWS

🇲🇽 Viva.com, Nexi, and MyPos to Offer Tap to Pay on iPhone for Merchants in Italy. Tap to Pay on iPhone allows merchants to accept contactless payments, including credit and debit cards, Apple Pay, and other digital wallets, using just an iPhone and the Viva.com app, Nexi SoftPOS app and the myPOS Glass app, respectively, with no extra hardware needed.

🇱🇺 Worldline signs deal with Banque Raiffeisen for cloud based instant payments. Worldline will enable Banque Raiffeisen to send and receive instant payments as mandated by the EU's Instant Payments Regulation. Using Worldline’s modern cloud infrastructure, the bank will benefit from smarter and quicker onboarding processes.

🇨🇳 Pyvio selects Currencycloud to deliver cross-border payments for Chinese merchants. The partnership will allow Pyvio to leverage Currencycloud’s technology to collect and pay funds in over 180 countries and more than 30 currencies, including CNH and CNY.

🇬🇧 Currencycloud selects Form3 for Confirmation of Payee. The Form3 Confirmation of Payee Requester Service enables Currencycloud’s customers to verify account holder and payee details to provide fast and secure account verification.

🇲🇿 Flutterwave Mozambique receives payment aggregator license approval in principle. This license enables Flutterwave to offer its comprehensive payment services within Mozambique and strengthen its operations in southern African markets.

🇺🇾 Totalnet Uruguay has officially launched its new mobile app. This app turns Android phones with NFC capabilities into point-of-sale (POS) terminals, allowing merchants to accept card payments easily, quickly, and securely. Designed especially for small businesses and entrepreneurs, this tool promises to revolutionize the payment market in the country.

🇺🇸 Buy now, pay later plans are the second-most used form of credit payment among U.S. consumers, according to a NerdWallet report. Credit cards are the most commonly used form of credit, with 66% of respondents using them in the past 12 months.

OPEN BANKING NEWS

Open banking in the US 🇺🇸 in 2024. How did we get here?

Here is a timeline:

DIGITAL BANKING NEWS

🇳🇱 The Netherlands has a new "bank" that promises to distribute its excess profits among customers, the environment, and shareholders. Named GoDutch, the bank hopes to attract ten thousand startup entrepreneurs this year. The company, which uses the license of the French firm Swan, targets payment services for small entrepreneurs.

🇸🇬 Fintech app Revolut has announced Flexible Accounts, its first interest-bearing product in Singapore, offering customers up to 5.21% in annual percentage yield (APY) with no minimum sum. This interest is paid daily and available for withdrawal anytime, said Revolut on May 29.

🇧🇷 Nubank is launching a travel booking platform for its high-income Nubank Ultravioleta customers. “𝗡𝘂𝗩𝗶𝗮𝗴𝗲𝗻𝘀” will be available to the customers over the next few months offering air and hotel bookings, and guaranteeing the best price. Read more

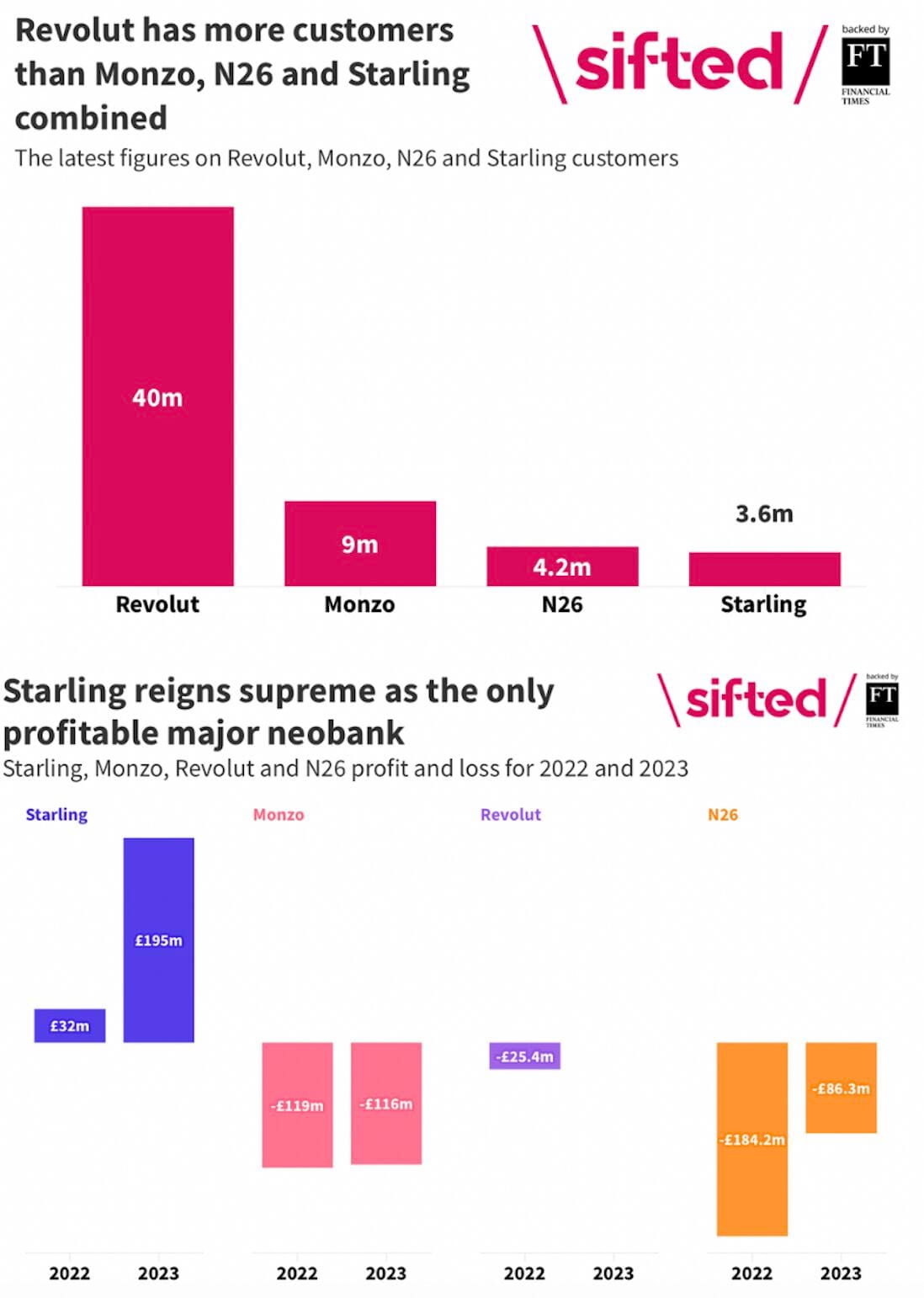

📊 Revolut 🆚 N26 🆚 Monzo Bank 🆚 Starling Bank

Let's dive in:

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Circle launches in Brazil to catalyze digital dollar access. Circle is partnering with leading regional businesses, including BTG Pactual and Nubank, to launch digital asset products, providing their users with near-instant, low-cost, 24/7 access to USDC.

🇫🇷 Binance France drops CZ and names two new shareholders to preserve European foothold. The move aims to safeguard the top crypto exchange's operation in the EU's second-largest economy. French regulations stipulate that a company's majority shareholder cannot have a criminal record.

💳 Mastercard just launched Crypto Credential, which allows you to send Bitcoin to any customer at an exchange with a simple username, instead of a wallet address. Read the full release

DONEDEAL FUNDING NEWS

🇬🇧 British bill payment outfit PayPoint has made a £1 million investment in consumer and business credit reporting and open banking platform Aperidata. The deal builds on an existing commercial partnership between the two companies delivering open banking-based income screening tools for clients across multiple sectors.

🇨🇦 Relay raises $32.2 million to help smaller businesses manage their cashflow. Relay users can send and receive ACH transfers, wires and check payments like they would with traditional banks. And they can capture and store receipts, allowing people in their employ access through role-based accounts.

🇪🇸 Spain's Banktrack secures €2M Seed round. The capital raised in this funding round will be used to enhance the functionalities of the treasury monitoring software, as well as to expand the customer service and sales teams, with the goal of accelerating growth in Spain before expanding to other international Markets.

🇺🇸 The web3 payments firm Coinflow Labs raised $2.25 million in seed funding. Coinflow develops a payment system that instantly accepts payments and settles transactions with stablecoins. The platform also allows businesses to send funds from stablecoins to a user's bank account immediately.

M&A

🇬🇧 UK wealth management firm Intelligent Money has entered administration after agreeing a deal to sell off its business and assets to fellow provider Quai. Intelligent Money administers over £1 billion of client assets covering self-invested personal pensions (Sipps), Individual Saving Accounts (Isas) and General Investment Accounts (Gias).

🇮🇳 Y-Combinator-backed fintech BharatX acquires Zenifi to expand into the medical lending sector. This acquisition enables the BNPL services startup to break into the medical lending sector, utilising Zenifi's established presence in healthcare lending services.

MOVERS & SHAKERS

🇦🇷 Ualá Lays Off 9% of staff amid regional reorganization. The layoffs, impacting 140 employees, aim to enhance efficiency and product development, according to a company statement. Ualá, which offers financial solutions across Latin America, stated that severance packages exceed legal requirements.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()