Nubank allows withdrawals for Bitcoin, Ethereum and Solana

Hey FinTech Fanatic!

Nubank has informed its customers of a new capability within its app: the ability to withdraw their cryptocurrency assets.

The digital bank has recently integrated support for deposits and withdrawals of three prominent cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). Additionally, Nubank intends to broaden this functionality, allowing customers to transact with other coins directly through their Nubank app.

This expansion plan was revealed in details shared on Tuesday.

Meanwhile, following its granted Banking License in Mexico, neobank Revolut has to undergo an operational audit, which can take up to 12 months.

This Monday, April 22, it was published in the Official Gazette of the Federation (DOF) the document by which the British-origin firm Revolut is granted the authorization to establish itself as a bank in Mexico, after a process of more than two years.

According to what was published in the DOF, the firm with a presence in more than 40 countries and serving more than 40 million customers worldwide, has received authorization to establish itself as a subsidiary multiple banking institution, the registered office of the new bank will be Mexico City and the amount of its social capital amounts to 1.431 million pesos.

Now, the firm headed in Mexico by Juan Miguel Guerra Dávila will have to undergo an operational audit so that the bank can start operations with its flagship product: international transfers, and subsequently, deploy its entire range of services that the bank has planned for the country.

It's a jam-packed newsletter full of interesting FinTech News updates today, so you better get to it👇

Cheers,

#FINTECHREPORT

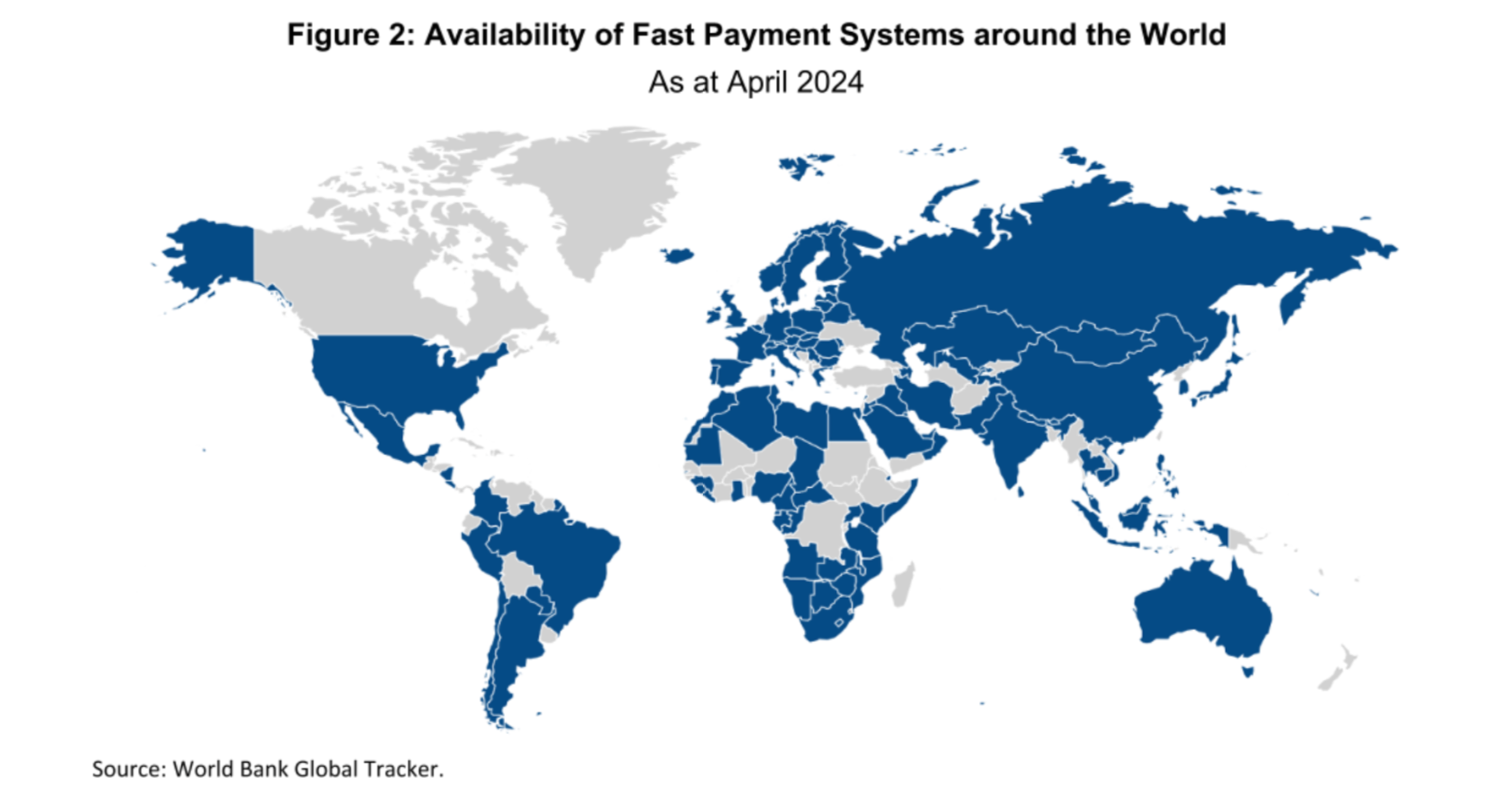

📊 Reserve Bank of Australia's FinTech report: Benefits and Challenges of Interlinking Fast Payment Systems for Cross-border Payments.

FINTECH NEWS

🇺🇸 Episode Six and DCS Card Centre launch Cards-as-a-Service platform for FinTechs. The partnership will enable FinTech companies to issue their own branded credit cards through their own customer interface. This move will pave the way for the service to be rolled out to other markets in the Asia Pacific region.

🇮🇹 UniCredit rolls out accessible cards for visually impaired. UniCredit is upgrading all its debit, credit and pre-paid cards with features designed by Mastercard for blind and partially sighted people.

🇮🇳 Google Wallet will finally launch in India — nearly two years after its relaunch as a digital wallet platform in the U.S. — according to a preview of the app that the company accidentally posted on the Google Play store in the country. More here

🇬🇧 Monzo’s latest $430m funding round saw the UK-based digital bank valued at $5bn and confirmed at a share price of £14.41. Meet the Monzo millionaires.

🇪🇸 Ouro and Bnext announced a strategic partnership designating Bnext as Ouro’s strategic issuer in Europe for Ouro’s portfolio of consumer financial brands and products. Ouro's platform, in collaboration with Bnext, will offer prepaid cards, debit cards, digital wallets, and other innovative products, focusing mainly on Spain.

🇺🇸 FinTech Fundid was shut down over interest rates and a strained cap table. But the founder is already back with a better idea. Read on

🇧🇷 Clara, a FinTech firm based in Brazil, is working to raise new equity and debt financing to support its growth as the company’s chief executive officer sees the venture capital market coming back.

PAYMENTS NEWS

🇮🇳 PayU gets RBI approval to operate as payment aggregator. The RBI’s in-principle approval underpins the company’s mission to build a world-leading digital payment infrastructure that originates from India, for India and the world, accelerating its next growth phase in India.

🇩🇪 Brite launches instant payments in Germany to further boost European coverage. This marks the company’s most significant market expansion to date, building upon its strong presence in the Nordics, Baltics and Benelux as it continues to expand across Europe.

🇬🇧 Zilch selects Amazon Web Services to accelerate the roll out of AI innovation across the Zilch proposition. Zilch will continue to use AWS AI and ML services to transform how the company serves its customers and works with merchants in the future.

🇺🇸 Square brings offline payments to all devices. Now, offline payments are available across the entire Square hardware lineup, expanding to Square Stand and Square Reader for contactless and chip, enabling nearly 90% of hardware sellers to take offline payments.

🇺🇸 Airwallex, a leading global payments and financial platform for modern businesses, announced the U.S. launch of its payment acceptance solution. U.S.-based merchants can use the service to accept payments from domestic and international customers.

🇦🇺Volt launches one-click PayTo payments in Australia. In addition to simplifying the payments experience for customers and eliminating credit card surcharges, this next-generation online digital payment solution allows retailers to receive payments instantly.

🇩🇪 PayPal was the most used online payment method among German online shoppers in 2023, like the year before. However, the American company saw its share of the local payment market decrease. Buy now, pay later services are on the rise.

🇸🇪 Klarna scores major payment deal with Uber ahead of hotly anticipated IPO. You can now use Klarna to pay for your Uber and Uber Eats in the US, Germany and Sweden, where Klarna will roll out its “Pay Now” option, which lets customers pay off an order instantly in one click, in the Uber and Uber Eats apps.

💳 Nium and Thredd expand partnership to power B2B travel payments in APAC. Nium's virtual card solution is used by travel intermediaries to effectively pay hotels, airlines, and other global travel suppliers with enhanced security, efficiency, and reduced costs.

OPEN BANKING NEWS

🇦🇪 Al Etihad Payments (AEP), a subsidiary of the Central Bank of the UAE (CBUAE), has signed a partnership with Core42, a G42 company and full-spectrum AI enablement solutions provider to mark the commencement of the implementation of Open Finance within the UAE, one of the nine initiatives within the CBUAE’s Financial Infrastructure Transformation (FIT) Programme.

🇺🇸 Two years after the acquisition of Tink by Visa, Tink’s services have now launched in the US as Visa Open Banking Solutions. Find out more

DIGITAL BANKING NEWS

🇬🇧 Marqeta announced a partnership with OakNorth to offer a commercial card for OakNorth’s Business Banking customers. By partnering with Marqeta, OakNorth will provide its small and medium-sized business customers the services typically only available to commercial banking customers. Learn more

🇬🇧 LHV Bank moves into profit. The bank has reported a profit after tax of £6.4 million in its first year of operation as a licensed bank. By year end LHV Bank’s SME loans business in the UK had built a £69 million lending portfolio.

🇵🇪 Prex will be the first non-banked digital wallet to achieve interoperability in Peru, allowing its users to send and receive immediate transfers to anyone, regardless of the financial institution they belong to. Continue reading

🇲🇽 UPDATE on Revolut's announced Banking License in Mexico last week: The firm has to undergo an operational audit, which can take up to 12 months. This Monday, April 22, it was published in the Official Gazette of the Federation (DOF) the document by which Revolut is granted the authorization to establish itself as a bank in Mexico, after a process of more than two years.

🇺🇸 Atomic announced its collaboration with San Antonio-based Frost Bank, a top 50 financial institution with 185 branch locations across Texas. Incorporating Atomic into its operations will help Frost achieve its goals of improving customer satisfaction and making banking more accessible for all.

🇺🇸 Former Tesla FinTech head spins off Aspiration’s green consumer financial services brand. In response to the growing demand for climate-friendly financial services, FinTech and sustainability industry veteran Tim Newell has reached an agreement with climate finance company Aspiration Partners, Inc., to spin off Aspiration’s green consumer financial services brand into a new standalone company.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 US Call for 3 years jail for Binance founder Changpeng Zhao. U.S. prosecutors want Zhao, the founder and former chief executive of Binance who is expected to be sentenced on April 30, to serve three years in prison after he pleaded guilty to violating laws against money laundering.

🇺🇸 Simplex partners with Zero Hash to provide seamless fiat-crypto ramps for US Market. The partnership with Zero Hash enables Simplex to offer a seamless and compliant method for US customers to on and off ramp cryptocurrencies and stablecoins.

🇺🇸 Jack Dorsey’s Block announces development of ‘full Bitcoin mining system.’ The Block — then Square — CEO initially suggested the idea of a collaborative approach to decentralize Bitcoin mining in October 2021.

Block is linking together two of its biggest platforms, Square ➕ Cash App, to give retail stores the ability to automatically convert a portion of their daily sales into Bitcoin (BTC). The feature, rolling out in the U.S. starting today, will transfer 1-10% of Square sellers’ daily sales to their personal Cash App account.

DONEDEAL FUNDING NEWS

🇺🇸 PPRO secured an additional £73 million in funding. They recently completed a dual-tranche funding round to pursue growth in key markets for its local payments platform, starting in the US. Get more details

M&A

🇺🇸 ComplyAdvantage buys Golden to boost financial crime intelligence. San Francisco-based Golden is a startup "automating the construction of one of the world’s largest knowledge graphs, which shows interconnected data points and their relationships for the purpose of analysing complex information".

🇲🇽 Sulpayments Switzerland and GameCash Mexico, have announced their consolidation under a unified holding structure. This strategic move aims to leverage synergies between the two companies, combining Sulpayments' expertise in secure and efficient payment solutions with GameCash's stronghold in the gaming industry.

MOVERS & SHAKERS

🇨🇭 Temenos says allegations of mismanagement made by short seller Hindenburg Research led to a temporary "lengthening of sales cycles" in the first quarter. Meanwhile, the core banking vendor has appointed former VMWare executive Jean-Pierre Brulard as CEO.

🇬🇧 Revolut to boost staff by 40 per cent this year amid rapid expansion. It reached 10,000 employees worldwide earlier this month, adding some 2,000 staff since the start of 2024. It plans to boost this number to 11,500 by the end of the year,and is currently advertising more than 70 roles in the UK.

🇬🇧 MyPOS welcomes Mario Shiliashki as CEO. Shiliashki will join the strong executive leadership team, which will continue to be supported by the Board of Directors and Advent International, one of the largest and most experienced global private equity investors.

🇺🇸 Figure Technology Solutions has named Michael Tannenbaum as CEO and a member of the board of directors, effective immediately. He joins Figure at “a pivotal period of growth for the company,” the firm’s previous CEO, co-founder Mike Cagney said in a release.

🇸🇬 B2B micropayments platform DT One names Claudio Di Zanni as new CEO. The FinTech cites Di Zanni’s “solid track record of leadership and success” at numerous multinational digital enterprises as the driving force behind his recruitment.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()