Nu México launches functionality for customers to receive money from the US through WhatsApp

Hey FinTech Fanatic!

Before we dive into today's exciting FinTech developments, I like to ask you for a favor. I would like to invite you to become a member of my Connecting the dots in FinTech Community. Sign up here and get this daily newsletter a few hours before it hits LinkedIn.

Your early access not only keeps you in the loop but also supports me and my team in delivering the latest and greatest in the FinTech industry.

Your membership means the world to me and motivates me to tirelessly provide the freshest FinTech news every day in 2024.

Now on to todays news:

Nu México & Felix Pago: Revolutionizing Cross-Border Transfers

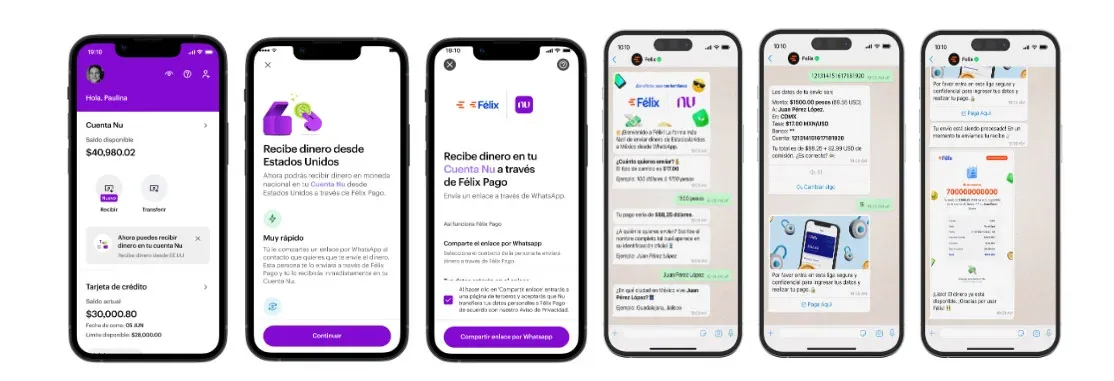

- Innovative Functionality: In a groundbreaking move, Nu México 🇲🇽 has launched a new feature allowing customers to receive money from the U.S. through WhatsApp, in partnership with Felix Pago. This strategic alliance is reshaping the way cross-border money transfers are handled, leveraging technology for a seamless and secure experience.

- Empowering Financial Freedom: Ivan Canales, the General Manager of Nu México, highlights this step as a significant stride towards their goal of financially empowering people in Mexico. With Mexico being the second-largest recipient of money from abroad globally, this feature is a game-changer. Nu México's presence in 9 out of 10 municipalities showcases their commitment to expanding their services and promoting saving habits among their customers.

- Simplifying Transactions: Here's how it works in the Nubank app:

- Generate a Request: Customers initiate a money transfer by creating a request link in the app, pre-loaded with essential details about their Cuenta Nu.

- Share via WhatsApp: They then share this link with the sender in the U.S. through WhatsApp.

- Easy Interaction: The sender uses the Felix chatbot directly within WhatsApp, bypassing the need for any additional apps.

- Efficient Transfer: Felix Pago oversees the transfer from the U.S. to Mexico.

- Instant Receipt: Funds are instantly received in Mexican pesos through SPEI in the Cuenta Nu.

- Attractive Returns: Users can also earn annual returns of 15% by saving in “Cajitas” (money boxes).

Enjoy more FinTech industry news below👇 and I'll be back in your inbox tomorrow.

Cheers,

Marcel

P.s. A big shoutout to Linkedin for naming me a "Top Voice" on the platform. I'll wear the badge with pride 😉

POST OF THE DAY

Here is a snapshot of Payments in The Middle East and Africa (MEA)🌍

Are there any Payment Companies missing in this overview?

BREAKING NEWS

🇺🇸 SEC approves 11 spot bitcoin ETFs, with trading likely set to start today. The SEC said it has approved proposals for 11 spot bitcoin ETFs on an accelerated basis, in a document that was uploaded to the SEC website. The document lists 11 spot bitcoin ETFs by Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, BZX, Invesco, VanEck, WisdomTree, Fidelity and Franklin.

FINTECH NEWS

🇩🇪 German neobroker Trade Republic reached profitability in 2023, a "solid double-digit million euro amount” according to CEO and co-founder Christian Hecker. This marks a notable reversal from the €145m net loss reported in the prior fiscal year, aligning with Hecker's announcement that the company now manages €35bn in assets.

🇺🇸 Digital Business Networks Alliance launches to operate US e-invoicing exchange network. DBNAlliance's mission is to make the exchange of business-to-business documents smooth and frictionless, eliminating all the obstacles and inefficiencies that businesses are experiencing with traditional invoicing methods.

🇦🇪 Qashio and CredibleX launch 'Qashio Financing.' This new initiative marks a significant step forward in providing flexible and accessible financing to businesses of all sizes. The service delivers quick access to funds, competitive rates, and a user-friendly process for Qashio’s SME customers, powered by CredibleX.

🇨🇴 RappiPay exceeds 230K clients in 2023, aiming for US$257M in balances by 2024 in Colombia. Ignacio Giraldo, CEO of RappiPay, stated that this year the company will focus on strengthening its savings account, "RappiCuenta," and addressed the impact of high rates on the RappiCard.

PAYMENTS NEWS

🇺🇸 JPMorgan’s WePay abruptly dumps business customer. JPMorgan Chase has stopped providing payments services for many long-standing clients of WePay, suggesting a retreat in the bank’s efforts to compete with Stripe. Access the full article here

Optty to offer customers Link Money's Pay by Bank tech. The partnership enables Optty's U.S. merchants to utilize Link Money's Pay by Bank solution. Amid increasing credit card fees and fraud incidents, merchants are exploring alternatives for a more cost-effective and streamlined payment acceptance.

🇬🇧 American Express bags first utilities client for A2A bill payments. Pay with Bank transfer is an online debit product which allows consumers to pay for products and services directly from their bank account, without the need for using a debit or credit card, whether or not they are an American Express Cardmember.

🇸🇬 BitGo receives in-principle approval from MAS for Major Payment Institution licence. This enables clients to trade digital assets securely using BitGo's insured cold storage custody solution housed in a class III vault, providing access to robust liquidity and top-tier security and custody measures.

🇧🇷 Paytech Stone authorized by Central Bank to operate as a Financial Institution in Brazil. In practice, the company now shares the same "status" as other prominent fintechs like Nubank and Mercado Pago. The list of credit, financing, and investment companies (SCFI) currently surpasses 60 names, according to Central Bank data.

🇺🇸 Weave adds ACH Direct Debit to payments suite. With ACH Direct Debit, healthcare patients experience enhanced transaction security and healthcare providers can benefit from lower transaction costs. ACH Direct Debit is available for Text to Pay and Online Bill Pay workflows.

OPEN BANKING NEWS

🇺🇸 PortX connects with Plaid. This collaboration combines the power of PortX’s digital core banking integration experience with Plaid’s industry-leading capabilities for connecting data between applications and bank accounts significantly expanding API capabilities in financial services.

REGTECH NEWS

🇰🇼 Kuwait International Bank unveils KYC updates on mobile app. The bank launched its “Update your KYC” service that enables all customer segments to update their information and personal data wherever they are, whether inside Kuwait or while traveling abroad, at any time around the clock.

VoPay unveils instant micro-transaction service for bank account verification. Its innovative solution empowers enterprises to rapidly authenticate and confirm any US or Canadian bank account, eliminating the protracted waiting times of up to 24 hours or more for micro-transactions to finalize.

DIGITAL BANKING NEWS

🇹🇷 Garanti BBVA goes full digital with car loan approvals. Utilizing the Instant Loan from Dealer (BAK) feature, customers can swiftly complete transactions with digital document approval through Garanti BBVA Mobile app, ensuring an efficient and seamless experience.

🇵🇱 Revolut is now used by over 35 million clients worldwide and more than 3 million in Poland. The number of Polish Revolut clients using the app for investment purposes increased by 97% in 2023. The largest investment accounts in Revolut were held by Poles in the 55-64 age group. Read on

🇲🇽 Nu México launches functionality for customers to receive money from the US through WhatsApp, in alliance with Felix Pago: This strategic alliance simplifies the process of sending money and revolutionizes the landscape of cross-border money transfers, leveraging technology for a seamless, fast, secure, and efficient customer experience.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 SEC should be held accountable for X account compromise: US Senator Bill Hagerty said in a post on X, an hour after the SEC’s official X account posted that bitcoin ETFs had been approved. That announcement ultimately proved false, the result of the account being “compromised,” according to an SEC spokesperson.

Bitcoin ETF war enters end game: BlackRock, Ark cut planned fees. The intended price slash comes after Bitwise lowered its planned fee from 0.24% to 0.20% on Tuesday — positioning it, for now, as the cheapest spot bitcoin ETF, should such funds be approved.

🇺🇸 Bitcoin ETFs could see up to $100B in inflows if SEC approves: Standard Chartered. Analysts are predicting that bitcoin ETFs may see well over $1 billion in inflows over the next three months, and potentially more than $100B by the end of the year.

How much bitcoin might BlackRock buy for its spot ETF? Rumor has it that BlackRock, for one, has $2 billion earmarked to cover day-one interest in its spot ETF, should the SEC allow it. Read more

DONEDEAL FUNDING NEWS

🤑The Top 10 European FinTech Funding Deals of 2023.

Let’s dive in👇

NoahArk Tech Group secures $2.4 Million investment from EOS Network Ventures to propel EOS DeFi Ecosystem forward. This investment transcends mere financial support, symbolizing a profound commitment to nurturing innovation and collaborative growth within the DeFi sector. Read on

🇧🇷 Brazilian Paytech Lina secures US$1.6M investment for developing New Open Insurance products. Lina does not disclose financial figures for its operation. The company aims to expand its customer base to 36 companies next year. To support this growth, an additional 25 employees will be hired, supplementing the current team of 50 professionals.

MOVERS & SHAKERS

🚀Are you a Sales Director looking for your next opportunity? If so, Mangopay has two exciting opportunities for you.

🇺🇸 PayPal hires Barclays digital MD Simon Bladon as new UK CEO. With over 20 years at Barclays, Bladon ascended the ranks, starting as the head of legal in its EMEA team in 2004. The move, which is subject to regulatory approval, also includes Bladon becoming VP of PayPal’s global entity management.

🇺🇸 BankProv announces leadership shake-up. The firm has welcomed Curt Murray into the role of Assistant Vice President (AVP), Business Banking Officer. In his new position, he will be tasked with spearheading the organisation’s business development initiatives while collaborating closely with commercial loan portfolio clients.

🇺🇸 Treasure Financial lays off staff just months after reporting ‘explosive growth’. The Fintech laid off 14 employees in December. The move affected some 60% to 70% of the company, according to multiple sources familiar with internal operations. Read more

🇺🇸 SoFi layoffs – Reports indicate that Fintech is cutting staff. The first reports appear to be coming from an X account that reports multiple SoFi employees posting on LinkedIn they are now looking for a new job. The number of employees being whacked is estimated at around 7% of the total headcount or around 300 employees.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()