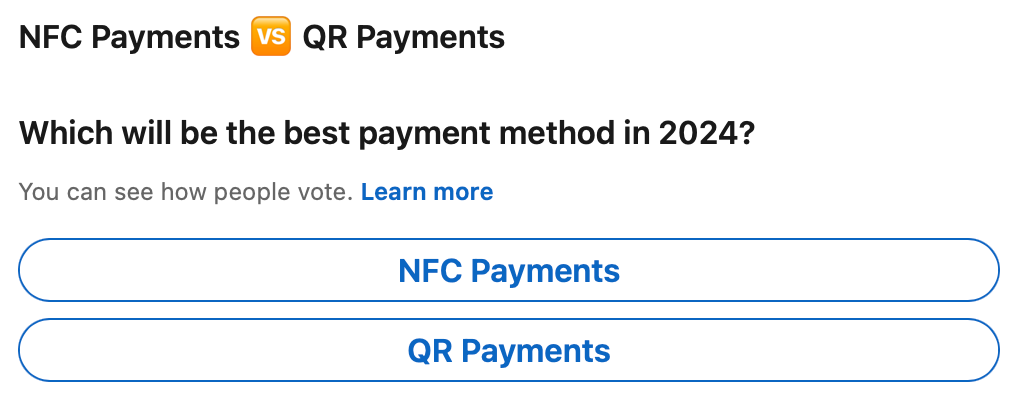

NFC payments 🆚 QR payments: Which will be the best payment method in 2024?

Hey FinTech Fanatic!

Google has entered into a Memorandum of Understanding with the National Payments Corporation of India, aiming to extend the reach of UPI (Unified Payments Interface) beyond India's borders.

This strategic move will allow Indian travelers to conveniently use Google Pay (also referred to as GPay) for transactions in foreign countries, thereby reducing the reliance on cash or international payment methods.

Furthermore, the agreement includes plans to create a digital payment system akin to UPI in various countries. The primary objective of this initiative is to ensure a smooth and hassle-free experience in conducting financial transactions globally.

I have to say, the UPI story in India is getting more impressive by the day!

Now over to you: NFC payments 🆚 QR payments: Which will be the best payment method in 2024?

The landscape of payment options has expanded substantially in the fast-paced world of digital commerce. Among the different solutions, two popular rivals have emerged: NFC Payments and QR payments.

Each method has its benefits and constraints, giving consumers the chore of determining the best payment option for their needs.

What do you think? Vote, and let me know why in the comments below👇

Cheers,

Marcel

FEATURED NEWS

PayPal CEO Alex Chriss: We will ‘shock’ the world. Paypal CEO Alex Chriss joins ‘Squawk on the Street’ to discuss what Chriss has to say about recent downgrades from Wall Street, how the new CEO plans to ‘shock the world’, and more.

FINTECH NEWS

🇬🇧 Payhawk secures UK e-money licence and expands top team. The UK licence joins Payhawk’s existing European EMI licence and was granted after the FCA conducted due diligence on the fintech’s compliance, financial, and operational processes. Hristo Borisov, Payhawk’s CEO and co-founder said “the new UK licence unlocks new possibilities for us”.

🇨🇱 Fintechs Tapi and Neat Pagos partner to transform payment experiences in the region. The Tapi integration with Neat Pagos offers users a more convenient solution for managing recurring payments, enhancing their overall experience with automatic bill payments.

Fintech R2 deepens its alliance with payments company TUU in a move to expand its credit business for SMEs in LatAm. This partnership aims to provide loans to merchants within TUU's network, which currently boasts over 15,000 clients receiving payments.

Fintech VCs’ predictions for 2024. Fintech underwent a tough period in the first half of 2023 followed by a tentative and budding recovery in the second half. Here's what investors are expecting this year.

PAYMENTS NEWS

🇮🇳 Google Pay partners with NPCI to expand UPI for international payments. The move will enable Indian travellers to make payments in other countries via Google Pay (also known as GPay), eliminating the need to carry cash or resort to international payment gateways.

Paymob secures Central Bank of Oman’s PSP license, making it the first international fintech company to be fully licensed in the Sultanate. The PSP license enables Paymob to accept and process online and in-store payments in Oman through its secure integration with CBO's payment infrastructure, OmanNet.

🇺🇸 Supreme Court rebuffs Apple's appeal on app payments, threatening billions in revenue. The Supreme Court has allowed a court order to take effect that could loosen Apple’s grip on its lucrative iPhone app store, and potentially affect billions of dollars in revenue a year.

🇬🇧 Virgin Atlantic implement Payment Orchestration with CellPoint Digital. By partnering with CellPoint Digital, Virgin Atlantic will cut transaction costs with intelligent routing, enhance control over payment processes and acquirer relationships, and centralize management of the entire payment ecosystem on a unified platform.

OPEN BANKING NEWS

🇧🇷 Palenca launches income verification product via digital work card. Palenca is a data verification fintech with a focus on app-based delivery and private transport workers. Using an API, the company validates job and income information for these professionals, serving clients like banks and fintechs.

🇷🇴 Finqware launches FinqPayments. With this launch, Finqware, a Romanian company passported as a European Payment Institution, becomes the first company in Central and Eastern Europe (CEE) to launch payment services based on Open Banking APIs for corporations within an integrated treasury automation platform (TMA).

DIGITAL BANKING NEWS

🇺🇸 Apple announced a series of groundbreaking entertainment experiences that will be available on Apple Vision Pro. How could AI-powered spatial banking of the future on the visionOS platform look like?. Click here to learn more.

🇵🇭 Tonik enters SME lending. The Philippines' first digital-only neobank, leveled up its Big Loan to address a broader spectrum of financial needs for small businesses. Offering up to P5 million, it provides flexible repayment options, competitive interest rates, and a streamlined application process, enhancing the lending experience for SMEs.

🇺🇸 Tower Community Bank taps FintechOS to offer lending solutions at the Point-of-Sale. This strategic move preserves Tower's traditional values, enhances customer service with a seamless digital lending experience, and produces a resilient solution adaptable to market changes, integrated with Tower’s core infrastructure.

🇩🇪 N26 launches stock and ETF trading to complement its banking offering. N26 is rolling out a new stock and ETF trading feature starting with Austria as the first market. N26 is partnering with Upvest for this feature. Users will be able to drag and drop money from their main N26 account to this new trading space.

🇺🇸 JPMorgan says hacker attempts have increased this year. JPMorgan Chase & Co. is now seeing hackers attempt to infiltrate its systems 45 billion times a day as the Wall Street giant and its rivals continue to deal with a surge in global cybercrime. Read more

TymeBank South Africa sees Unicorn Status in next fundraising. Tyme Group could raise as much as US$100-million (R1.9-billion) in funding this year, propelling it into unicorn status. The Group is also preparing to launch a third digital bank in Vietnam, Southeast Asia, as it looks to increase its market share in the continent’s banking sector.

🇺🇸 High Circle, Treasury Prime and FirstBank combine on BaaS initiative. In the coming months, High Circle will unveil additional initiatives in partnership with Treasury Prime and FirstBank, including personal banking products, allowing customers to secure their cash reserves within a unified platform.

The number of Irish Revolut users who used the platform to trade securities last year surged 22 per cent with Tesla and Heineken among the top traded stocks in 2023. Meanwhile, in London, the son-in-law of a late Russian oligarch is mounting legal action against Revolut for “unlawfully” closing his account, the High Court in London heard on Wednesday.

🇨🇴 Nu Colombia, a subsidiary of Nubank in the country, has announced the opening of the waiting list for Cuenta Nu, its latest product which is a free digital account without hidden fees or annual charges, designed to offer Colombians an unparalleled experience in saving money.

🇺🇸 Overdraft fees could drop to as low as $3 under new Biden proposal. The proposed change by the CFPB would potentially eliminate billions of dollars in fee revenue for the nation’s biggest banks, which were gearing up for a battle even before Wednesday’s announcement.

DONEDEAL FUNDING NEWS

🇺🇸 Thomvest Ventures closes $250M fund to invest across fintech, cybersecurity, AI. The capital firm is popping into 2024 with a new $250 million fund and the promotion of Umesh Padval and Nima Wedlake to the role of managing directors. Read more

🇺🇸 Specialist neobank Panacea Financial bags $24.5m series B funding. The company says it will use the capital to further develop its suite of loan, banking and insurance services, and to build out its team with a focus on technology, financial services and healthcare.

🇮🇩 Ayoconnect, an open finance service provider startup, has reportedly secured funding of US$2.5 million (Rp38.8 billion) from Mandiri Capital Indonesia. More on that here

🇦🇷 Pomelo stacks $40M to scale its payments infra business in LatAm. The latest financing brings the startup’s total raised since inception to $103 million. CEO and co-founder Gastón Irigoyen declined to reveal valuation, saying only that it was “a positive round, not a down round.”

M&As

Encompass Corporation has acquired two compliance startups - CoorpID and Blacksmith - developed by Dutch bank ING. “The combination of the technology and market expertise brought by these two businesses is the perfect match for Encompass," said Wayne Johnson, co-founder and CEO of Encompass Corporation.

MOVERS & SHAKERS

🇬🇧 Ex Revolut/ActivTrades exec Lana Sinelnikova named UK Chief Compliance Officer at Kraken. She will also serve as Kraken UK’s SMF 16 officer. Sinelnikova initially joined Kraken in late 2022 as Head of Compliance and Risk, after serving in a similar role for a year and a half at Revolut.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()