Monzo co-founder wanted challengerbank sold in 2020

Hey FinTech Fanatic!

In a heartfelt letter to his colleagues, Monzo co-founder Jonas Templestein revealed his past desire to sell the challenger bank amidst tumultuous times in 2020.

Detailing both the struggles and highlights during his nine-year tenure, Templestein paid homage to CEO TS Anil and COO Sujata Bhatia.

Their "unwavering belief" and efforts were pivotal in overcoming the myriad challenges Monzo faced, including regulatory concerns and financial losses amplified by the pandemic.

Templestein's acknowledgment of their resilience and leadership shines a light on the importance of steadfast visionaries in times of uncertainty. As he steps away from Monzo, with Matej Pfajfar taking over as CTO, this marks the end of an era and the beginning of a new chapter for the bank.

Turning our attention to bunq, the second-largest neobank in the EU is making a strategic re-entry into the UK market.

CEO Ali Niknam cited the UK's significance as a hub for digital nomads and Brits living the same lifestyle as a key driver for this decision. After halting new UK accounts post-Brexit, bunq's return signals not just resilience but a strategic repositioning in the evolving European banking landscape.

This expansion to the UK comes a few months after bunq had filed an application for a US banking license with the FDIC in the state of New York. By applying for a bank charter, bunq brings its proven and user-centered approach to banking to location-independent people and businesses in the US.

To be continued!

A Unique Opportunity for Your Brand

Now, for an exclusive opportunity for B2B FinTech companies: In this dynamic industry, standing out is paramount. That's why I'm offering a rare chance for one B2B FinTech company to partner with me and my community.

This partnership is more than advertising; it's about creating a narrative that elevates your brand, ensuring you're not just seen but remembered.

With limited availability for 2024, this is a bespoke opportunity for a company that aligns with my ethos and ambition. If you're ready to transform your brand's visibility and impact, sign up for more details.

Let's make your brand unforgettable in the FinTech industry.

Now enjoy more FinTech industry news updates I listed below👇 and I'll be back for more tomorrow!

Cheers,

Stay informed, stay ahead. Join my Telegram channel for real-time updates, and remember, in the world of FinTech, knowledge isn't just power - it's profit.

P.s. Remember that the most valuable currency in our rapidly changing financial world is information. Don't miss out on the latest trends, analysis, and insider tips – join my Telegram community now, where the future of finance unfolds in real-time.

Subscribe today and be the first to know, the first to grow!

ARTICLE OF THE DAY

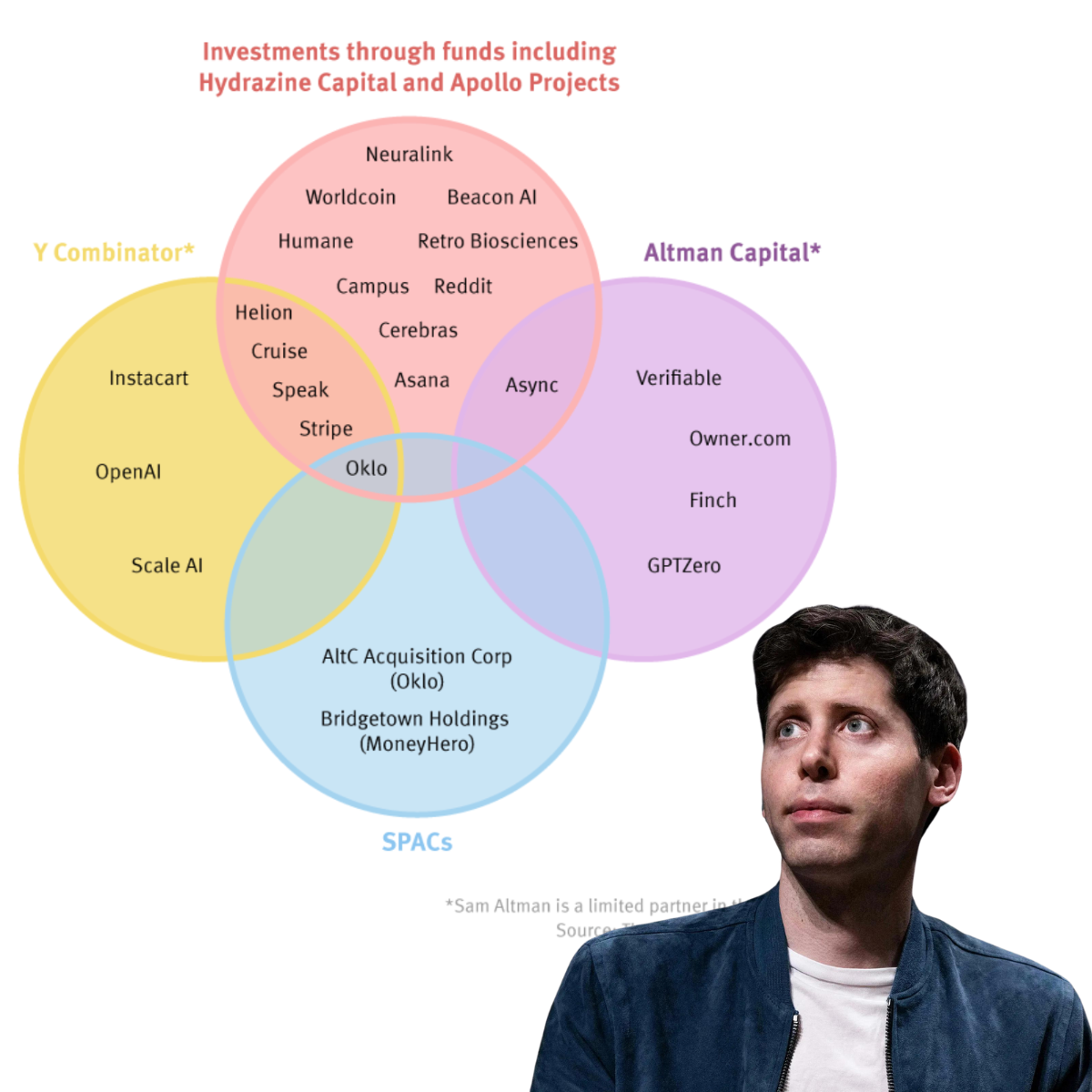

Sam Altman's FinTech Investments. Sam Altman has spent the last decade making some interesting investments.

Let’s dive into his (FinTech) portfolio by reading my complete article here:

INSIGHTS

How to choose an AML solution for your business: 5 considerations. Choosing the right AML screening solution requires going beyond product features and functionalities. Discover the 5 essential factors to consider in this insightful article from Fourthline. Click here to learn more.

FINTECH NEWS

BharatPe forms new entity to separate lending vertical from core business. BharatPe Money, a new lending division, emerges as part of BharatPe's effort to enhance internal corporate governance for merchants and consumers.

🇺🇸 Pluto announces strategic partnership with Mastercard to transform corporate spend management solutions. The agreement will see Pluto well-positioned to support businesses of varying sizes, ranging from mid-sized enterprises to large multi-group holdings, in better managing their finances.

🇦🇪 J. Crew has launched a multi-year credit card program with Synchrony and Mastercard. According to a news release, the partnership with Mastercard is the first time a new J.Crew Group co-branded card will be available for making purchases to earn rewards, powered by Mastercard’s network.

PAYMENTS NEWS

🇪🇹 Safaricom M-PESA and Chapa forge partnership for streamlined payment solutions in Ethiopia. The partnership aims to boost the ease of transactions for both merchants and M-PESA customers in the Ethiopian market. Read on

🇲🇽 Mexipay signs with ACI Worldwide to boost payment innovation in México. Mexipay, a new fintech in the Mexican ecosystem, will use ACI Enterprise Payments Platform for ISO 20022 real-time payments and other innovative services.

🇦🇷 Wibond has recently partnered with Libertad to offer a novel shopping solution. This collaboration allows customers to buy from Libertad's hypermarket chain without a credit card, opting for a fixed installment plan. It reflects Wibond's rapid national growth and its ambition to expand across Latin America.

OPEN BANKING NEWS

🇨🇱 Floid has joined forces with Mastercard to enhance digital transaction security and transparency across the region. This collaboration stems from Floid being the first LatAm fintech to join Mastercard's Start Path Open Banking program, resulting in an advanced fraud prevention solution.

REGTECH NEWS

🇺🇸 Cable launches its industry-first solution, Transaction Assurance, pioneering a new wave of financial crime compliance and transaction testing. This marks a significant leap in the standard for monitoring, testing, and enhancing the efficacy of front-line financial crime controls.

DIGITAL BANKING NEWS

🇮🇹 Italian watchdog hits Intesa Sanpaolo over customer migration to app-only unit. The AGCM says it has received 5000 complaints about the switch. According to the regulator, messages about the move were sent to customers in the archive section of the Intesa Sanpaolo App without push notifications or pop-ups.

🇬🇧 bunq plots return to UK 🇬🇧 after leaving post-Brexit. Bunq’s move to regain market share in a crowded fintech sector comes amid a turbulent time for Britain’s biggest banks, with both Barclays and Lloyds recently unveiling thousands of job cuts and dozens of branch closures.

🇺🇸 Greenwood adds retail investing, eyes profitable 2024. The neobank that provides banking services to Black and Latinx communities, announced the launch of Greenwood Invest, an app that allows customers to invest in stocks and exchange-traded funds.

🇬🇧 Lloyds Bank teams up with PrimaryBid to allow customers to invest in IPOs, following the launch of its 'ready-made investments' service for Lloyds Bank, Halifax and Bank of Scotland customers. Shares brought through PrimaryBid can be settled directly into customers' Lloyds share dealing account.

BLOCKCHAIN/CRYPTO NEWS

Binance pilots Banking Triparty agreement to help Institutional investors to manage counterparty exposure. This solution lets institutional investors trade collateral off-exchange with a third-party banking partner, marking the first in a series of Binance's pilot projects and making it the sole cryptocurrency exchange providing this solution.

🇦🇪 Copper Securities to launch in the UAE. Copper will aid the transition of financial market infrastructure to blockchain, aligning with Abu Dhabi’s Economic Vision. The seamless integration of blockchain services with financial infrastructure will establish a robust foundation for expanding local capital markets and attracting international investors.

DONEDEAL FUNDING NEWS

🇦🇺 Westpac and nCino lead $28 million round in Rich Data Co. Founded in 2016, RDC uses explainable AI to provide banks with deeper insight into borrower behaviour, enabling more accurate and efficient lending decisions to businesses, with Westpac as a marquee client.

🇬🇷 Plum has secured a €10 million minority equity investment from Greece's Eurobank as part of a strategic partnership in the region. Having doubled its revenue in the past year, Plum says the partnership and fundraise aims to bring the firm to profitability by early 2025.

🇨🇱 Colaboramed, a Chilean fintech company, has achieved a significant milestone by securing a $1 million investment for a 12% stake, valuing the company at $8.8 million. This investment was driven by the development of a specialized prepaid health card by AMOL, designed to simplify health co-payments.

Quantopay secures €150 million funding and unveils future plans at COP28 sustainable Tech Global Summit. The groundbreaking announcement highlighted QuantoPay's commitment to sustainability, global accessibility, and new technologies. Read more

🇺🇸 Tacora, a Peter Thiel-backed venture-focused debt fund founded by a Third Point alumna, will put up to $30 million into Exectras, an SMB-focused fintech. The new funding will be used to boost Exectras' existing business model and to buy up merchant card portfolios.

M&A

🇿🇦 South African cryptocurrency platforms Revix and BitFund are joining forces and together with Austria’s Coinpanion, have formed a new alternative investment platform called Altify, which aims to empower individuals to grow wealth beyond the stock market through diverse alternative investments.

🇺🇸 Yieldstreet to acquire real estate tech startup Cadre, a real estate investment platform with a mission to democratize access to investing, particularly in commercial real estate, Fortune reports. More here

MOVERS & SHAKERS

Zepz, a $5 billion fintech unicorn, is laying off more staff. “Zepz has entered a redundancy consultation which could affect less than 2% of its global headcount,” a Zepz company spokesperson said in an exclusive statement to CNBC.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()