Monzo Bank is closing a £350M Mega Round that would value the British digital bank at £4bn

Hey FinTech Fanatic!

Monzo Bank is on the verge of securing a fresh funding round, expected to boost its valuation to approximately £4 billion, sources revealed to Financial Times.

This emerging FinTech powerhouse in the UK is reportedly close to finalizing an investment deal within the next couple of weeks. The anticipated funding could reach up to £350 million, drawing contributions from both new backers and current investors.

Before this influx of capital, Monzo's valuation stands at around £3.6 billion, which is projected to rise to about £4 billion once the new funds are incorporated.

Leading the investment charge is Alphabet's investment wing, CapitalG, with significant contributions expected from a roster of investors including Tencent from China and Ribbit Capital from the US. Additionally, HongShan, a leading venture capital firm in China that recently branched out from Sequoia Capital, is also expected to participate in this round along with other investors.

This isn't the first time Monzo has attracted substantial investment; the company's last funding round in 2021 valued it at around £3.5 billion, with financial backing from entities such as Tencent, the Abu Dhabi Growth Fund, Coatue, and Accel.

In a testament to its growing customer base, Monzo recently announced it had exceeded 9 million customers, with a significant uptick of 2 million new customers in 2023 alone, which includes over 380,000 business accounts.

In addition to this breaking news, I've compiled more updates from the global FinTech industry for your perusal below👇 (including a first glance of Revolut's new Crypto Exchange thats currently in Bèta).

Cheers,

POST OF THE DAY

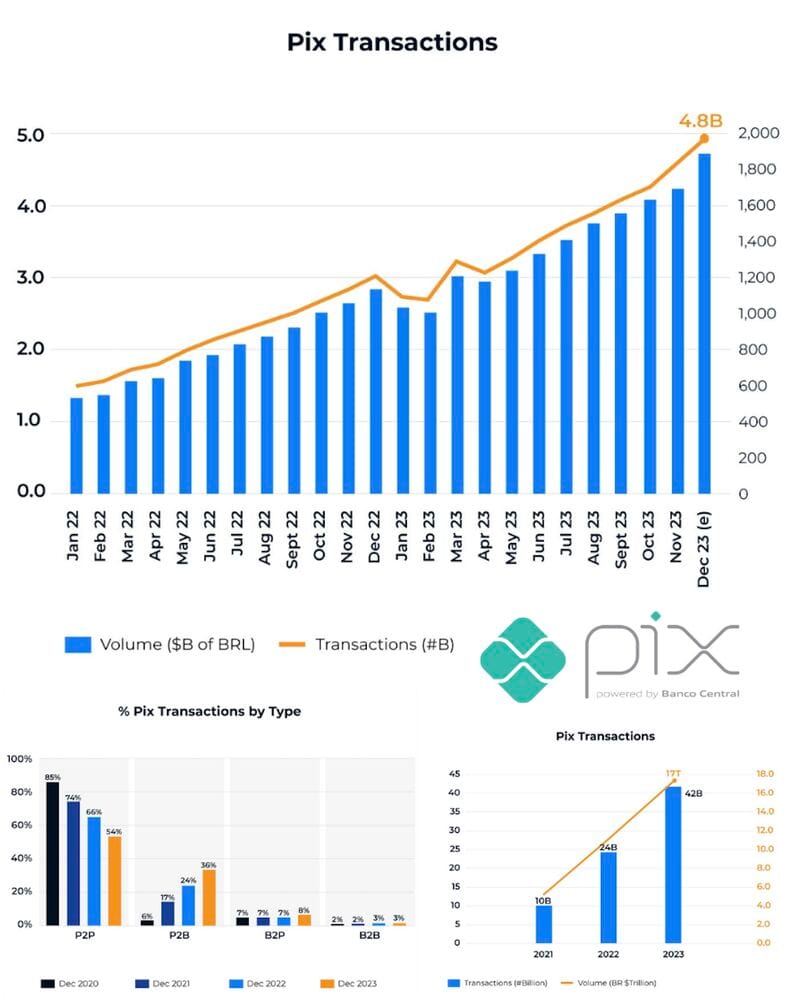

🇧🇷 Mind blowing numbers from Brazil: Over 42 Billion Pix transactions in 2023 - Approximately 4.8 Billion Pix transactions in December alone 🤯

Let's dive into more Key Stats:

#FINTECHREPORT

🇮🇳 The Indian real-time Payments market is defined by FinTechs linked to the national UPI system. Mobile wallet-based Payments are overwhelmingly funded through UPI, rather than cards (or other sources). Read this great FinTech report by ACI Worldwide for more interesting stats and insights.

INSIGHTS

🇫🇷 Efficiency and Security in Financial Services: A Swan Case Study with Forest Admin. Swan, a rapidly expanding FinTech company, needed a robust admin panel to manage sensitive operations securely. They chose Forest Admin for its flexibility, ease of use, and strong security features. Read the case study here.

🇨🇭 Temenos to conduct independent review of Hindenberg allegations. Temenos shares last week plummeted by 33% after Hindenburg Research shorted the stock, alleging "accounting irregularities, failed products and an illusive turnaround". Temenos refuted the allegations backed by activist investor Petrus Advisers, which highlighted the Swiss FinTech's recent "substantial progress."

FINTECH NEWS

🇮🇳 FM Nirmala Sitharaman to meet FinTech heads amid Paytm Payments Bank crisis. The meeting has been arranged to reassure the FinTechs that the sector remains a key priority for the government. “The idea is to understand what their fears are and reassure them,” an official was quoted as saying by the publication.

Y Combinator, startup incubator behind Airbnb, Coinbase, and Stripe, looks to invest in stablecoin finance. YC also said that the numbers behind stablecoin finance reflect "the opportunity seems much more immense still.” The incubator has included stablecoin finance in its new request for startups (RFS) list.

🇨🇱 Chilean Paytech Global66 introduced a new feature in its "Global66 Smart Card" to make payments abroad. This is an evolution of the Global66 Card, allowing users to conduct transactions in up to eight different currencies. It allows direct purchases and ATM withdrawals from the relevant currency account.

PAYMENTS NEWS

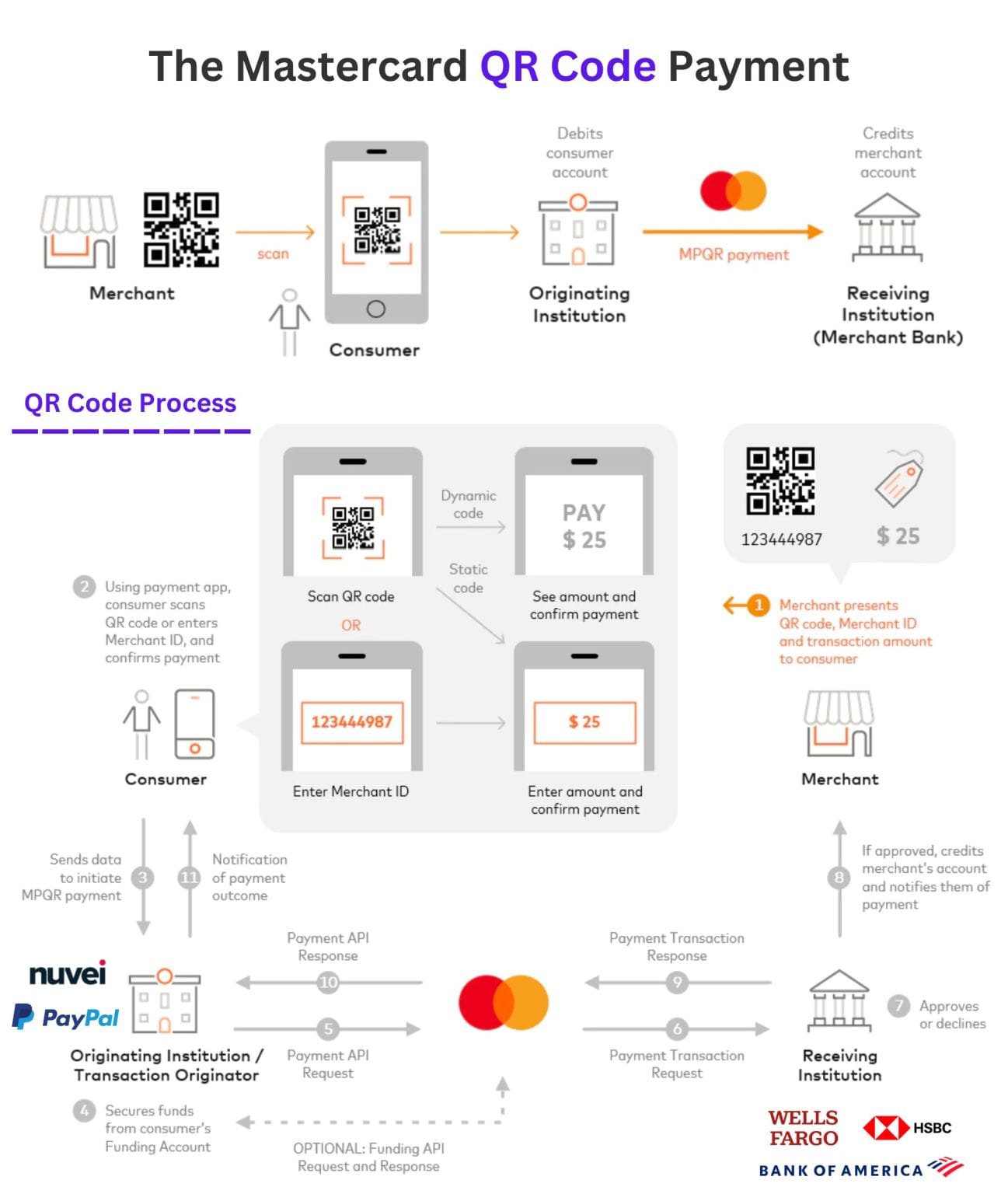

The QR Code Payment by Mastercard in 11 Steps👇

🇫🇷 Payplug and Mangopay partner to strengthen payments offering for marketplaces and platforms. The partnership will allow clients to benefit from a complete, seamless payment solution with Mangopay’s marketplace capabilities, including payout solutions, to complete Payplug’s pay-in expertise.

🇳🇱 Adyen and Billie partner up to bring BNPL to businesses across Europe. By partnering up with Billie, Adyen helps merchants and their business customers tackle everyday hurdles in B2B commerce. This includes managing cash flow for buyers and sellers, eliminating payment defaults and fraud risks.

🇧🇷 Stark Bank, one of the few Latin America startups to receive funding from Jeff Bezos’ family office, is generating profits from its business of helping companies handle payments, while leaving cash raised from its funding rounds nearly untouched. The startup is focused on gaining domestic market share from larger corporate banks.

🇺🇸 Network tokenization, essential to Apple Pay, is undergoing significant changes. Apple introduced Merchant Tokens (MPAN), not device-bound but linked to the user’s iCloud, facilitating device changes without affecting the token. Click here to learn more.

OPEN BANKING NEWS

🇹🇷 Turkish financial technology company United Payment received an Open Banking license. United Payment is among the first FinTech firms licensed for Open Banking in Turkiye, poised to introduce its services in this area to users. It remains a key player for its business partners with its Open Banking infrastructure.

🇬🇧 OpenPayd partners with TrueLayer to bolster instant A2A payments. This will enable OpenPayd’s clients to offer pay-by-bank functionality that is fully embedded into their payment infrastructure and delivered through API integration. Read on

DIGITAL BANKING NEWS

🇬🇧 Revolut targets CFOs with new AI-driven product ‘Billpay’. The digital bank is planning to roll out Billpay to companies during the second half of 2024. Revolut is building a new product targeted at finance bosses to streamline accounts functions with the help of AI.

BLOCKCHAIN/CRYPTO NEWS

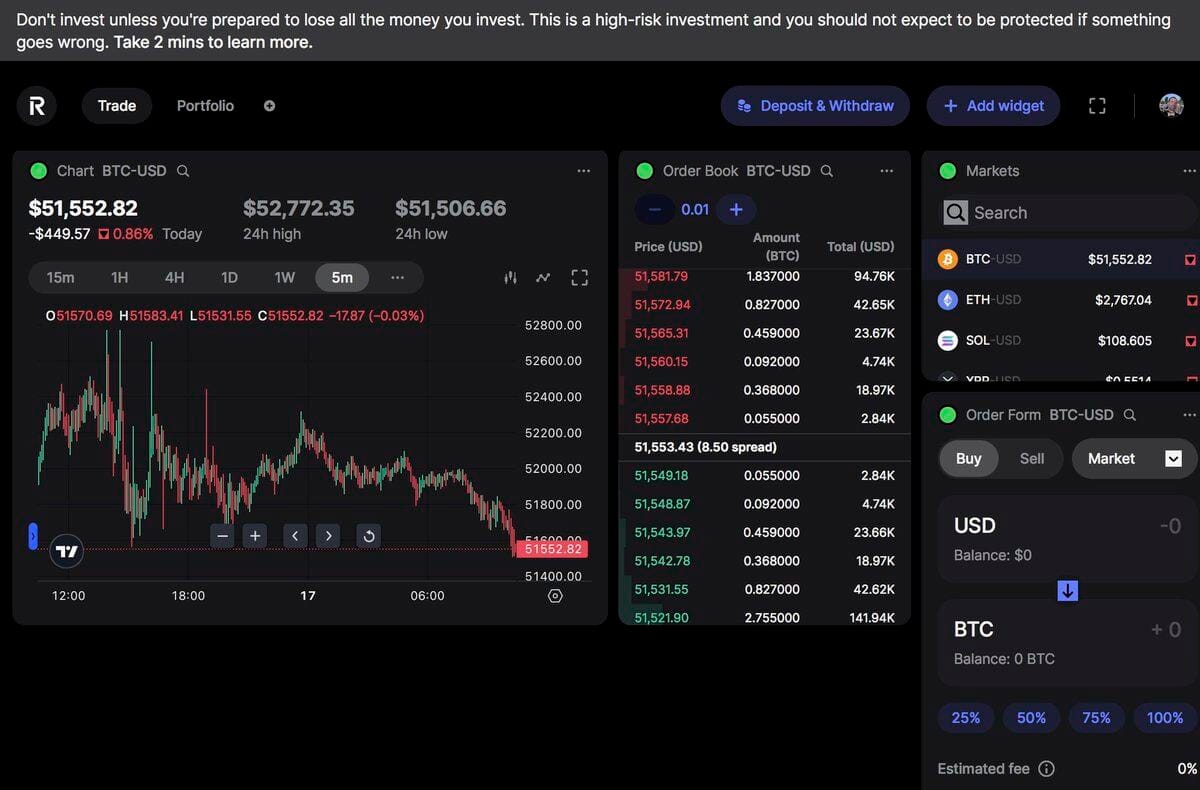

First look at the New (invite-only Bèta) Revolut Crypto Exchange👇

🇺🇸 MetaMask monthly active users nears all-time high — over 30 million. MetaMask reported the number of monthly active users has climbed 55% in four months — jumping from 19 million in September to more than 30 million in January.

DONEDEAL FUNDING NEWS

🇬🇧 Monzo targets £4bn valuation in fresh funding round. Monzo is nearing a new round of funding that would value the British digital bank at about £4bn, according to people familiar with the matter. The UK FinTech could finalise a deal as soon as the next two weeks to raise as much as £350mn from a mix of new and existing investors, the people said to FT.

🇩🇪 Peter Thiel-backed Valar Ventures invests in $6M funding round of German FinTech Monite, US expansion on cards. Monite, an API-first FinTech based in Berlin plans to double down on product development and expand its suite of embeddable financial services for US B2B platforms and their customers.

🇮🇳 Mobility FinTech firm, Moove, has successfully raised $10m in a debt round from Stride Ventures. The newly acquired funds will be instrumental in Moove’s strategic plan to broaden its reach within India, according to a report from Entrackr. It also intends to use the investment to expand into new cities, including Delhi, Pune, and Kolkata.

🇺🇸 Pulsate, a mobile-first customer engagement platform for community financial institutions, has raised $7.7 million in funding. Pulsate works with over 270 credit unions and community banks reaching 20 million consumers. The firm says it will use the funds to grow its staffing and further refine its product offering.

🇵🇭 UNO Digital bank secures $32.1 M in funding to fuel expansion. The funding and support from various partners reflect a collective confidence in the UNO Digital Bank approach to future proofing banking services in the Philippines through digital innovation.

M&A

🇳🇬 FairMoney, a digital bank based in Lagos and headquartered in Paris, is in discussions to acquire Umba, a credit-led digital bank providing payroll and financial services to customers in Nigeria and Kenya, in a $20 million all-stock deal, sources tell TechCrunch. Read full article

🇸🇬 Xalts has announced its acquisition of Contour Network and its plan to launch an application ecosystem for embedded trade financial solutions for global banks. The acquisition of Contour Network will enable Xalts in the process of accelerating digitalisation in trade and supply chain finance.

MOVERS & SHAKERS

🇦🇺 Judo co-founder Healy to resign. Judo Capital has announced the co-founder and CEO of Judo Bank, Joseph Healy, will step aside on 18 March to make way for another co-founder - deputy CEO and chief relationship officer Chris Bayliss - to lead the company.

🇬🇧 Metro Bank has appointed Andy Veares as its new Managing Director for Corporate and Commercial subject to regulatory approval. Andy has been at the bank since 2012 most recently as Director of Large Trading Businesses. Read on

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()