Mollie Returns to Profit, Stripe's Major Updates, and Adyen's Results

Hey FinTech Fanatic!

This week, Stripe made waves with its annual "Stripe Session," unveiling a whopping 50 updates to its stack.

Perhaps the most significant revelation was its decision to decouple payments—the cornerstone of its services—from the rest of its financial offerings.

On the home front, Amsterdam is abuzz with financial/Payments news.

Renowned Dutch financial journalist Rutger Betlem sat down with Mollie CEO Koen Köppen, shedding light on the company's recent milestone: its first profitable period in four years.

Despite profitability not being their primary goal, Mollie's impressive 2023 financials, including a 36% increase in net revenue and a 50% reduction in losses, demonstrate a strategic shift and robust growth trajectory.

Meanwhile, Adyen, Amsterdam's payment giant, shared its Q1 2024 update, boasting solid growth numbers but facing investor scrutiny for maintaining its financial objectives without upward revisions.

This earnings season, failing to exceed expectations seems to spell trouble for stock performance, as evidenced by Adyen's recent stock downturn.

Stay tuned for more global FinTech industry insights below, and I'll be back in your inbox on Monday with further updates.

Wishing you a fantastic weekend ahead!

Cheers,

POST OF THE DAY

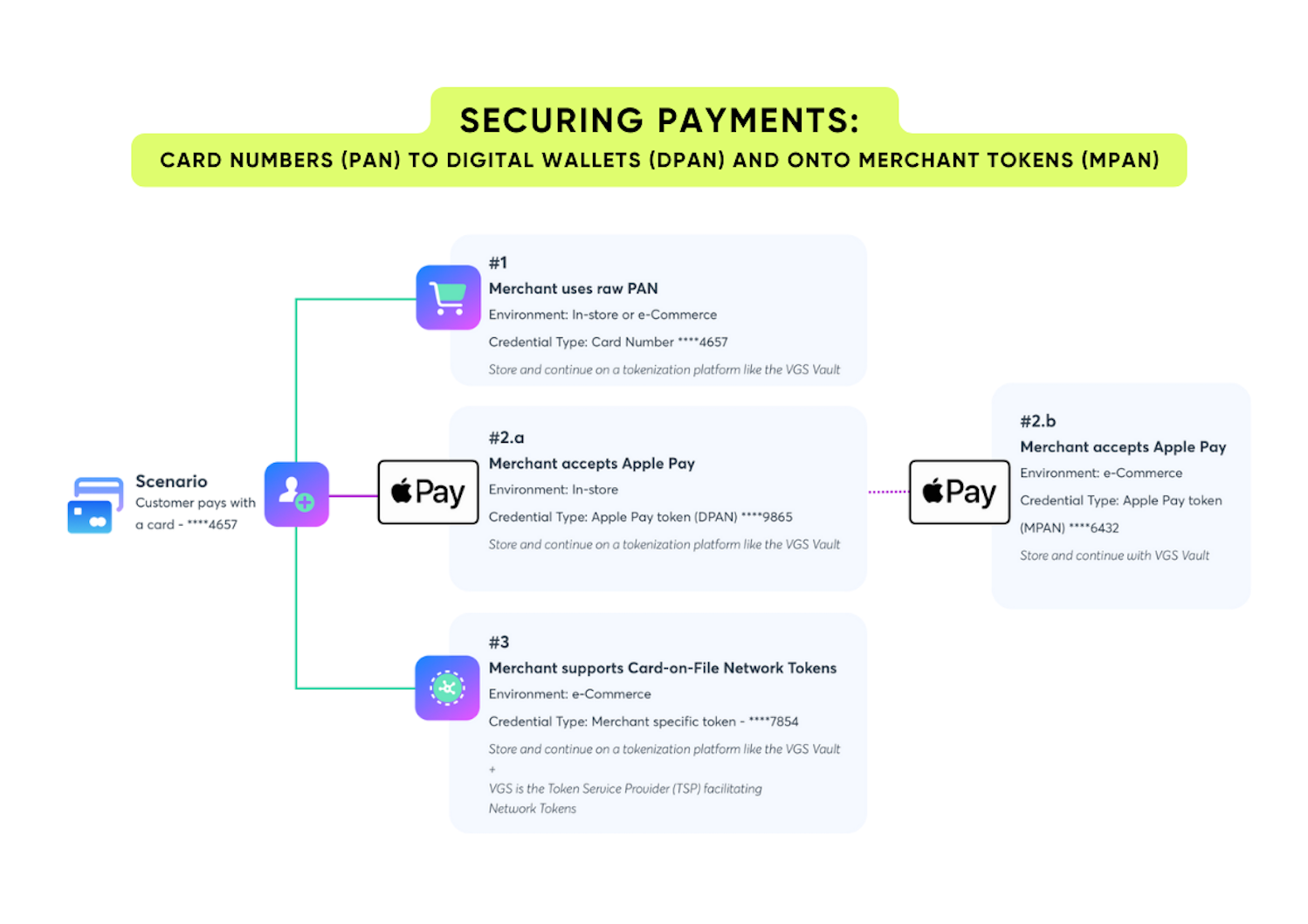

🔐 Ever wonder how your ApplePay transactions happen smoothly without your card number ever leaving your phone? It's all thanks to 𝗧𝗼𝗸𝗲𝗻𝗶𝘇𝗮𝘁𝗶𝗼𝗻.

#FINTECHREPORT

📊 Visa just released an interesting report on GenAI in Payments. Link here

📈 Check out “Q1 2024 Report: Global FinTech M&A Poised for Rebound in 2024,” by Flagship Advisory Partners. Access full report here

INSIGHTS

🇺🇸 Nasdaq's revenue beats on strong demand for FinTech products. Nasdaq beat estimates for first-quarter revenue on Thursday, driven by strong demand for its financial technology products used by traders and investors to navigate the capital markets.

FINTECH NEWS

🇹🇭 T2P integrates with Wise Platform for faster, cheaper and more transparent transfers for customers in Thailand. This integration also makes T2P the first FinTech in Thailand to provide international money transfers to their customers with no exchange rate mark-ups or hidden fees within their DeepPocket app.

🇺🇸 Payhawk joins American Express SyncTM to offer U.S. Business and Corporate Card Members the ability to issue virtual cards with built-in spend controls and manage business spend globally. According to Hristo Borisov, CEO of Payhawk. “The integration helps us provide an elevated user experience and more value to our customers.”

🇳🇬 Flutterwave, Africa’s leading payments technology company, has partnered with payment processing specialist, Acquired.com, to help users process domestic card payments on Send App, Flutterwave’s flagship remittance product.

Additionally, the Nigeria-based digital payments company, and Africa’s most valuable startup, has made changes to its corporate team as part of moves aimed at preparing for an initial public offering, Flutterwave's chief executive told Semafor Africa.

🇺🇸 Sanlo, a FinTech startup that helps gaming companies manage finances, announced Wednesday the closed beta launchof its webshop tool, giving select game developers and studios a plug-and-play solution that works alongside their existing tech stacks. Gaming companies can now sign up for a demo.

🇪🇸 Ouro becomes new official Real Madrid sponsor. The collaboration agreement will see the technology and financial services company become the exclusive, official sponsor of the men's and women's football first teams in the prepaid, credit and debit card sector.

🇮🇳 UK FinTech Tide, a financial platform focused on small and medium enterprises (SMEs), seeks to make India its second core market after the UK within five to ten years, its Global CEO Oliver Prill said. The firm is open to investing more in the country to reach the targeted ₹1,000-crore mark and headcount of 1,000 by 2026, he added.

🇪🇬 Mashreq & Visa introduce Mashreq NEO Visa card in Egypt. The Mashreq NEO Visa Card represents a fusion of technology, seamless banking services, and exclusive benefits tailored to meet the evolving needs of consumers. Read more

PAYMENTS NEWS

📝 Who are the 100 most important companies in cross-border payments globally?

FXC Intelligence published their sixth annual listing👇

🇺🇸 Stripe announced that it will be de-coupling payments — the jewel in its crown — from the rest of its financial services stack. The updates were unveiled at Sessions, Stripe’s big developer event in San Francisco, where the company announced over 50 new features on its platform, part of a total of more than 250 announced so far this year.

🇦🇷 Veritran has announced its partnership with Swift in order to optimise the user experience and increase the overall transparency in cross-border payments. The firms will focus on enabling financial institutions and companies to provide optimised and secure cross-border payments to their customers and collaborators.

🇺🇸 Splitit enables banks to offer in-checkout instalment payments. The new service unlocks Splitit's merchant network to financial institutions that want to offer instalment plans to existing customers, directly at the merchant checkout. Find out more

🇮🇳 Unlimit secures online payment aggregator license in India and launches operations in the Region. This development allows Unlimit to operate as a payment service provider in the region, offering a variety of payment services and methods to help local businesses expand their audience reach.

🇳🇱 It looks like this earnings season, failing to outperform and revise upward leads to a considerable downturn in your stock's performance… Check out the 𝗞𝗲𝘆 𝗧𝗮𝗸𝗲𝗮𝘄𝗮𝘆𝘀 𝗳𝗿𝗼𝗺 Adyen'𝘀 𝗿𝗲𝗹𝗲𝗮𝘀𝗲𝗱 𝗤𝟭 𝟮𝟬𝟮𝟰 𝗨𝗽𝗱𝗮𝘁𝗲 here.

REGTECH NEWS

💳 Mastercard harnesses AI to take on scammers. To combat the growing threat of scams, Mastercard has launched Scam Protect, a suite of specialised tools powered by AI, biometrics and open banking, which help identify and prevent scams whether they are card-based, account-to-account, or fraudulent account openings.

DIGITAL BANKING NEWS

🇬🇧 Standard Chartered has announced its partnership with Visa in order to optimise cross-border payments, as it joined the Visa B2B Connect network. Both financial institutions will prioritize meeting customer needs in a changing market and remaining compliant with industry regulations and laws.

🇺🇸 Visa joins AWS Partner Network (APN). Visa’s presence in the APN will help enable its partners and clients, including cloud-native FinTechs, to access and integrate select Visa services more efficiently. More on that here

🇺🇸 JPMorgan Chase is preparing a broad rollout of a biometric authentication system at U.S. retailers in 2025, following experiments it has run over the past year. JPMorgan will offer biometric payments as part of its omnichannel payments platform, which also supports Tap to Pay, which allows mobile phones to accept contactless payments without add-on hardware.

🇸🇦 The highly popular Saudi digital wallet stc pay has launched a new digital banking platform in beta, available to join for selected customers, as the first step of transitioning into the first fully digital bank in the Kingdom.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Stripe announced that it would let customers accept cryptocurrency payments in the next few months, starting with just one currency in particular, USDC stablecoins, initially only on Solana, Ethereum and Polygon.

🇳🇬 Binance exec Tigran Gambaryan is a ‘state-sanctioned hostage’ in Nigeria, says lawyer. Gambaryan, a US-based financial compliance executive, has found himself ensnared in a legal nightmare from shortly after he landed in Abuja in late February. More details here

🇺🇸 Keonne Rodriguez and William Lonergan Hill are charged with operating Samourai Wallet, an unlicensed money transmitting business that executed over $2 billion in unlawful transactions and laundered over $100 million in criminal proceeds.

DONEDEAL FUNDING NEWS

🇺🇸 UserHub heads the bill with $3.2M in pre-seed funding to revolutionise SaaS monetisation. The funding will be allocated towards expanding the engineering team, accelerating product development, and expanding the customer base. Learn more

🇫🇷 RockFi raises €3 million to become the “new wealth management.” With this fundraising, the FinTech, which already has 15 employees, aims to triple its workforce by the end of the year by expanding its network of private bankers and wealth management experts to cover the entire French territory.

🇺🇸 Dripos, a comprehensive software platform built specifically for coffee shops, is thrilled to announce its $11 million Series A funding round. This investment will fuel Dripos' continued mission to transform the way coffee shops operate. Read full article here

🇨🇱 Chilean instant payments API startup Fintoc raises $7 million to turn Mexico into its main market. Fintoc’s product is an API that lets online businesses accept instant payments coming directly from the customer’s bank account.

MOVERS & SHAKERS

🇺🇸 Melio names Boaz BenDavid as its first Chief Financial Officer. In his new role, BenDavid will oversee initiatives to optimize financial performance, strengthen internal controls, and fuel innovation.

🇨🇦 Zafin announces strategic CEO transition to propel future growth. Al Karim Somji, with over two decades of leadership, will step down as Zafin's CEO. He'll remain on the Board, while Charbel Safadi, currently Group President, takes over as CEO.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()