Mercury's $30M Claim Against Synapse & Tabby's $700M Boost

Hey FinTech Fanatic!

In a notable legal twist in the FinTech world, business banking startup Mercury is asserting its financial interests against Synapse Financial Technologies, its former collaborator.

This conflict has escalated to a claim for a staggering $30 million against Synapse's assets. Mercury's aggressive stance stems from concerns about Synapse’s uncertain future and the necessity to secure potential arbitration awards.

This legal drama unfolded when Mercury, on December 11, initiated an arbitration demand against Synapse, a banking-as-a-service platform. Merely two days later, Mercury took its grievances to the California Superior Court in San Francisco County.

The request, although heavily redacted, was clear in its intent: to freeze at least $30 million of Synapse’s assets. This move, Mercury argues, is crucial to ensure that Synapse can fulfill any financial obligations arising from the arbitration process.

Mercury's legal filing bluntly states the risk: "Without provisional relief, Synapse may liquidate and transfer its assets—or third parties may seize them—long before Mercury can obtain an arbitration award."

This case was first brought to light by Jason Mikula, whose reporting continues to provide critical insights into this evolving situation. For those keen on following this high-stakes financial drama, subscribing to Jason's newsletter is a must.

In another significant development, Tabby, a trailblazer in the Middle East's FinTech scene and one of its first unicorns, has fortified its financial position ahead of a highly anticipated market debut.

The buy-now-pay-later giant has secured an impressive asset-backed credit line, potentially reaching up to $700 million. This strategic financial maneuver is a prelude to Tabby's planned listing in Saudi Arabia.

Further bolstering Tabby's financial prowess, the company expanded its recent funding round to an eye-catching $250 million. This increase comes on the heels of investment from prominent players like Saudi Arabia’s Hassana Investment Co., U.S.-based Soros Capital Management, and Saudi Venture Capital.

These investments have propelled Tabby's valuation beyond the $1.5 billion mark, attracting heavyweight investors including STV, Mubadala Investment Capital, and PayPal Ventures.

As we wrap up this edition, it's important to note that this will be my last newsletter for the holiday season. I'll be taking a brief hiatus to enjoy the festive period and recharge in Curacao for what promises to be an exciting year ahead in FinTech.

But don't worry, I'll be back at the end of next week with our final update for the year. Just to be sure you don't miss a beat 😉

I'd like to take this opportunity to extend my warmest wishes to you and your loved ones for a Merry Christmas. May this season bring you joy, peace, and prosperity.

I'm grateful for your continued interest and support and look forward to exploring more FinTech frontiers together in the coming year.

Happy Holidays, and see you soon for our year-end update!

Cheers🍻

#FINTECHREPORT

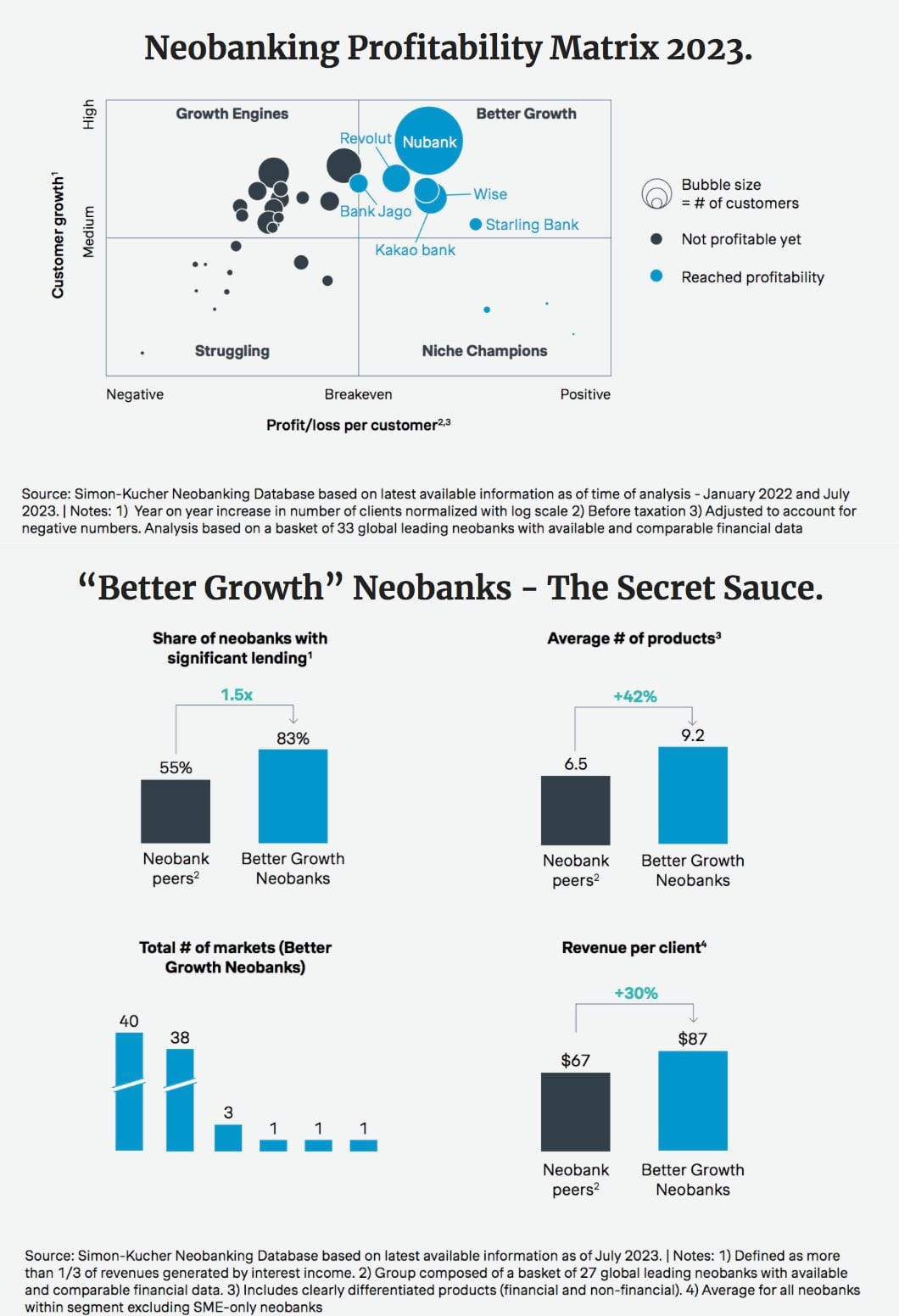

The number of non-profitable neobanks still by far exceeds the number of profitable banks. The good news is that there is evidence of a growing number of neobanks who appear to have cracked the code or are getting very close to doing so. Simon-Kucher released an investing report on this topic, and here are the Key Takeaways:

INSIGHTS

🇺🇸 Wells Fargo becomes the first big US Bank with a unionized branch. Albuquerque, N.M. employees voted to unionize, with Alaska up next. This vote comes as Wells Fargo faces a growing union campaign in its branches and call centers.

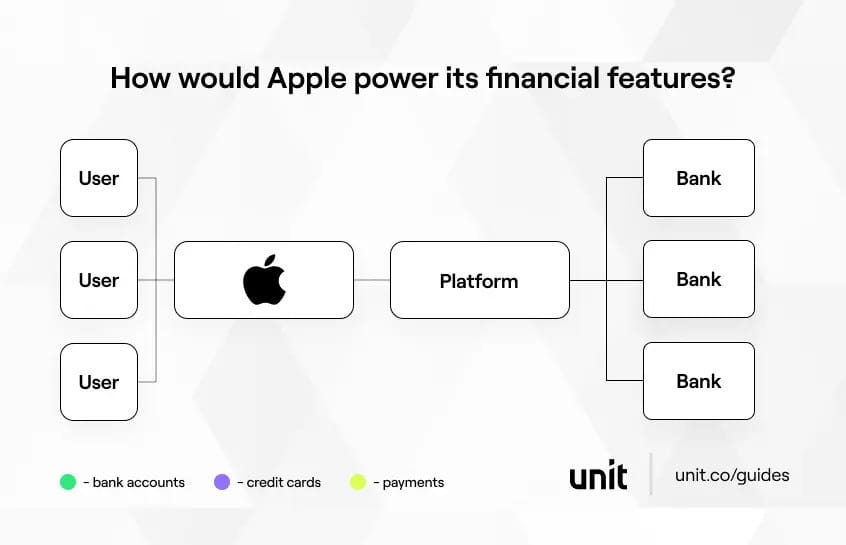

🇺🇸 By banking its users, Apple could drive engagement, retention, and revenue. What would it look like if Apple built banking? According to Unit CEO Itai Damti there are many ways Apple could launch financial services. They vary widely in terms of inputs required, time to market, and economics.

FINTECH NEWS

Uber for Business modernizes expense management through integrations with Brex and Ramp. The integrations will automate receipt matching for Uber rides and meals, which rank among the most-expensed items for employees. This will help companies of all sizes simplify expenses and save time on and off the road.

PAYMENTS NEWS

🇱🇺 Mangopay introduced the new Mangopay Checkout SDK, offering hassle-free online payments. It features an easy-to-integrate design, a seamless payment experience, and faster time to market with its simple integration.

🇺🇸 PayPal to amend terms and conditions under EU customer rules. The company has announced its commitment to modify its terms and conditions in order to fully comply with the European Union’s consumer laws to make them more transparent and easier to understand for its clients and users.

🇺🇸 Stripe swings to a profit as business rebounds. Stripe kept a lid on spending for engineers and salespeople this year after business slowed in 2022. Now it’s reaping the benefits: as revenue growth has re-accelerated, it’s making money again. Read complete article

🇺🇸 Fiat-to-crypto payment gateway Alchemy Pay joins forces with Worldpay to amplify its payment channels and elevate its payment capabilities. This partnership grants access to Worldpay’s Visa and Mastercard payment rails on Alchemy Pay’s On & Off-Ramp.

🇺🇸 Why It’s Taking So Long for Americans to Get Payments Instantly:

Hundreds of banks use Fed’s new instant-payment service, but universal availability could remain a long way off. Read full article here

OPEN BANKING NEWS

🇺🇾 The Single Taxi Union of Montevideo and Uruguayan fintech Prometeo have joined forces to integrate open banking technology into the city's 3,000 taxis and accept payments "from account to account" through a QR code. More here

BLOCKCHAIN/CRYPTO NEWS

🇳🇿 Revolut launches crypto trading in New Zealand. The fintech firm has integrated a third-party crypto tax reporting solution on its platform. The company has supplemented its service in the country with the ‘Learn and Earn’ program, offering free courses for crypto traders.

🇺🇸 BlackRock’s bitcoin ETF team has met 5 times with the SEC. Pooling BlackRock’s meetings with the rest of the ETF hopefuls, the agency has met 24 times with applicants. Read more

DONEDEAL FUNDING NEWS

🇧🇷 Credmei, Fintech specialising in advance receivables for SMEs, raised US$8.1M to expand its credit portfolio in Brazil. This deal was made in Credix, a marketplace lending through DeFi, who provided the credit line. According to the Fintech, the recent influx of capital will be used to speed up the granting of credit.

🇧🇷 Bankme, Brazilian Fintech in credit infrastructure for "mini-banks", raised US$1.5M for the development of a new product. The investment was raised from venture capital manager DOMO.VC, and the funding for the product will be split on the Redesconto and Contribution fronts.

🇸🇦 Saudi’s Tabby gets $700 Million credit line from JPMorgan. The buy-now-pay-later firm also increased a recent funding round to $250 million after adding Saudi Arabia’s Hassana Investment Co. as an investor.

🇰🇷 Toss launches procedures for IPO. Viva Republica, the operator of financial super app Toss, has kicked off procedures for its initial public offering (IPO), as the firm aims to select lead underwriters for the listing process.

🇺🇸 Claim, a platform that is both a rewards app and a social network, has raised $4 million in a seed funding round led by Sequoia Capital. The startup is on a mission to make shopping fun, rewarding and social allowing users and their friends to earn cash back, exchange rewards and even redeem them together.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()