Mastercard and Visa under fire from Payment Systems Regulator

Hey FinTech Fanatic!

The Payment Systems Regulator (PSR) in the UK has released an interim report on card scheme and processing fees, focusing on Mastercard and Visa. The PSR is now seeking feedback on its provisional findings to inform its final report.

The PSR's interim report reveals that Mastercard and Visa dominate the market, lacking effective competition in both core scheme and processing services, as well as some optional services. Alternative providers struggle to match the comprehensive offerings of these giants.

Over the past five years, Mastercard and Visa have increased their fees by over 30% in real terms, without a corresponding improvement in service quality. With these two companies handling 95% of UK-issued card transactions, businesses have little choice but to absorb these rising costs. Non-card payment methods are not viable competitive alternatives.

Key issues identified by the PSR include:

- Complicated and unclear pricing statements from Mastercard and Visa.

- Acquirers face difficulties in accessing fee information and negotiating fees.

- Frequent delays and insufficient notice for fee changes.

The PSR proposes several remedies to enhance transparency and competition:

- Better transparency to help businesses and acquirers make informed decisions.

- Obligations for Mastercard and Visa to explain and document price changes.

- Increased reporting of financial information to improve oversight.

Chris Hemsley, Managing Director of the PSR, emphasized the need for transparency and effective competition to protect businesses. The PSR is consulting on these findings and potential remedies, with feedback open until 30 July 2024.

Also, Mark your calendars for Wednesday, June 5th for the upcoming webinar where Ingo Payments CRO, Lydia Inboden, along with industry experts from TBK Bank, SSB, Fundbox, and Pipe, will delve into the world of real-time payments.

Have a great weekend and I'll be back on Monday!

Cheers,

#FINTECHREPORT

📊 The rapid evolution of Payments in Latin America: Cash is no longer the preferred way to pay, as debit cards, credit cards, and mobile payments have gained fans, presenting opportunities for financial-services companies. Full report here

INSIGHTS

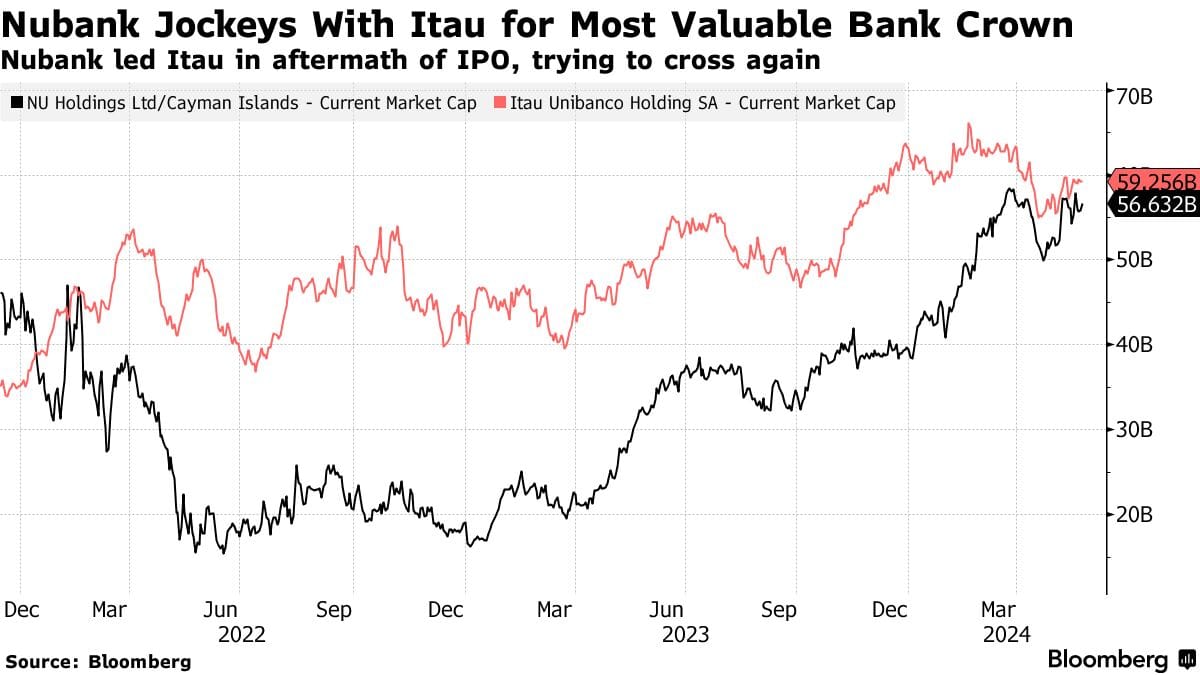

📈 Now one of the world’s largest digital banks, Nubank has crossed 100 million customers and for a brief moment last week — while Velez spoke at a company event about another record quarter — passed Itau as the most valuable financial institution in Latin America. Link here

FINTECH NEWS

🇳🇬 One month after a ban on onboarding new customers in Nigeria, FinTechs are still at the negotiating table with regulators. Five Nigerian neobanks—Moniepoint, OPay, Palmpay, Kuda, and Paga—remain unable to onboard new customers one month after a TechCabal report revealed the restriction was connected to a directive from the National Security Adviser (NSA).

🇬🇧 Visa and EBRD sign Memorandum of Understanding to boost digital payments, SMEs and female empowerment. The partnership aims to promote sustainable and inclusive economic growth and other countries in the EBRD’s region by supporting digitalization and financial inclusion.

🇬🇧 Zilch reached 4 Million customers in 44 Months, and generated these customers over $500 million in savings along the way. Link here

🇵🇭 Philippines’ top FinTech GCash eyes 2025 IPO. Globe Telecom Inc., the Philippines’ second-biggest telco, is looking at other investment opportunities like healthcare to capitalize on its thriving FinTech arm as its core business matures, according to its CEO Ernest Cu.

🇬🇧 TotallyMoney launches TotallySure for car finance — putting customers in the driver’s seat with pre-approval, and three guarantees. TotallySure enhances transparency and ensures customers get exactly what they apply for, avoiding rejection.

PAYMENTS NEWS

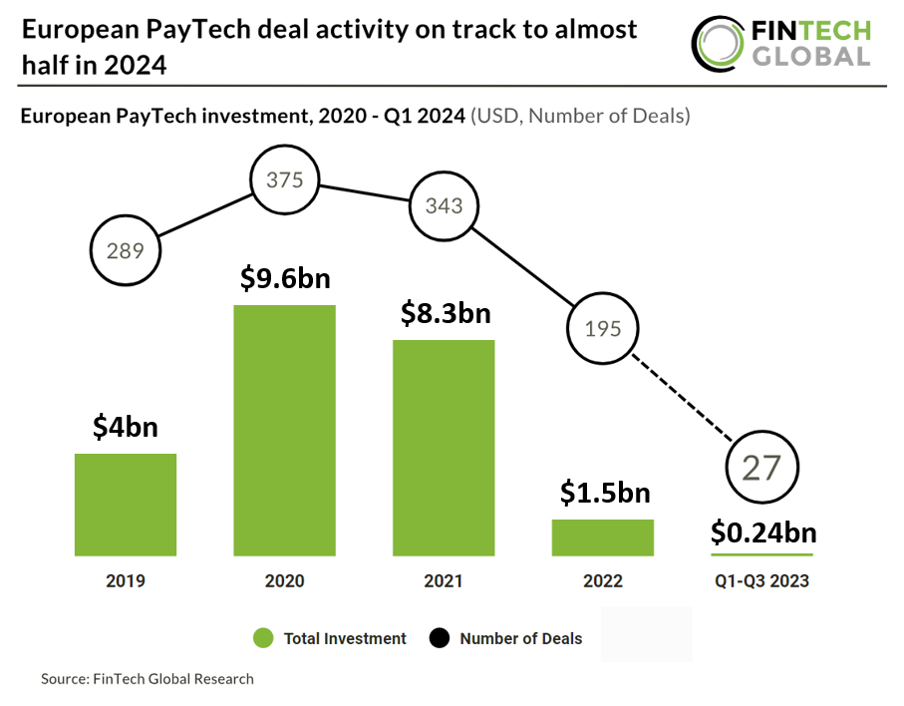

🇪🇺 European PayTech deal activity on track to almost half in 2024.

The Key European PayTech stats in Q1 2024:

🇺🇸 Sabre and Uplift partner to enable hotels to offer BNPL. This collaboration underscores Sabre’s commitment to revolutionizing the guest experience by harnessing innovative solutions that enhance payment options and drive customer satisfaction.

🇳🇬 Jumia, the leading e-commerce platform in Africa has announced two new Buy Now, Pay Later (BNPL) partnerships in Nigeria with Nigerian companies Newedge (Easybuy), and CredPal. These partnerships will expand Nigerian consumers’ access to Jumia’s marketplace.

🇪🇨 Kushki expands as acquirer across four Latin American countries. Kushki aims to expand “card-present” transactions, allowing users to utilize physical cards at POS terminals. Read more

🇺🇸 One of the most compelling features Google Pay is rolling out is the ability to see each of the cards’ benefits and rewards before making a selection at the checkout. Google notes that consumers who have multiple credit cards with different perks may not always remember which is the best card to use when.

🇺🇸 PPRO offers overseas merchants access to Afertpay BNPL in the US. With the popularity of BNPL in the US expected to increase, offering it at checkout is a no-brainer for merchants looking to sell to US consumers.

🇨🇦 Apple launches Tap to Pay on iPhone in Canada. Businesses can now seamlessly and securely accept payments from contactless credit and debit cards, Apple Pay, and other digital wallets using only an iPhone and a partner-enabled iOS app.

OPEN BANKING NEWS

🇺🇾 LatAm open finance platform Prometeo OpenBanking plans expansion to Mexico, the US and Brazil. The Uruguayan company, specialized in Open Banking in Latin America, will also increase its team by 50% this year, consolidating its presence in the region.

DIGITAL BANKING NEWS

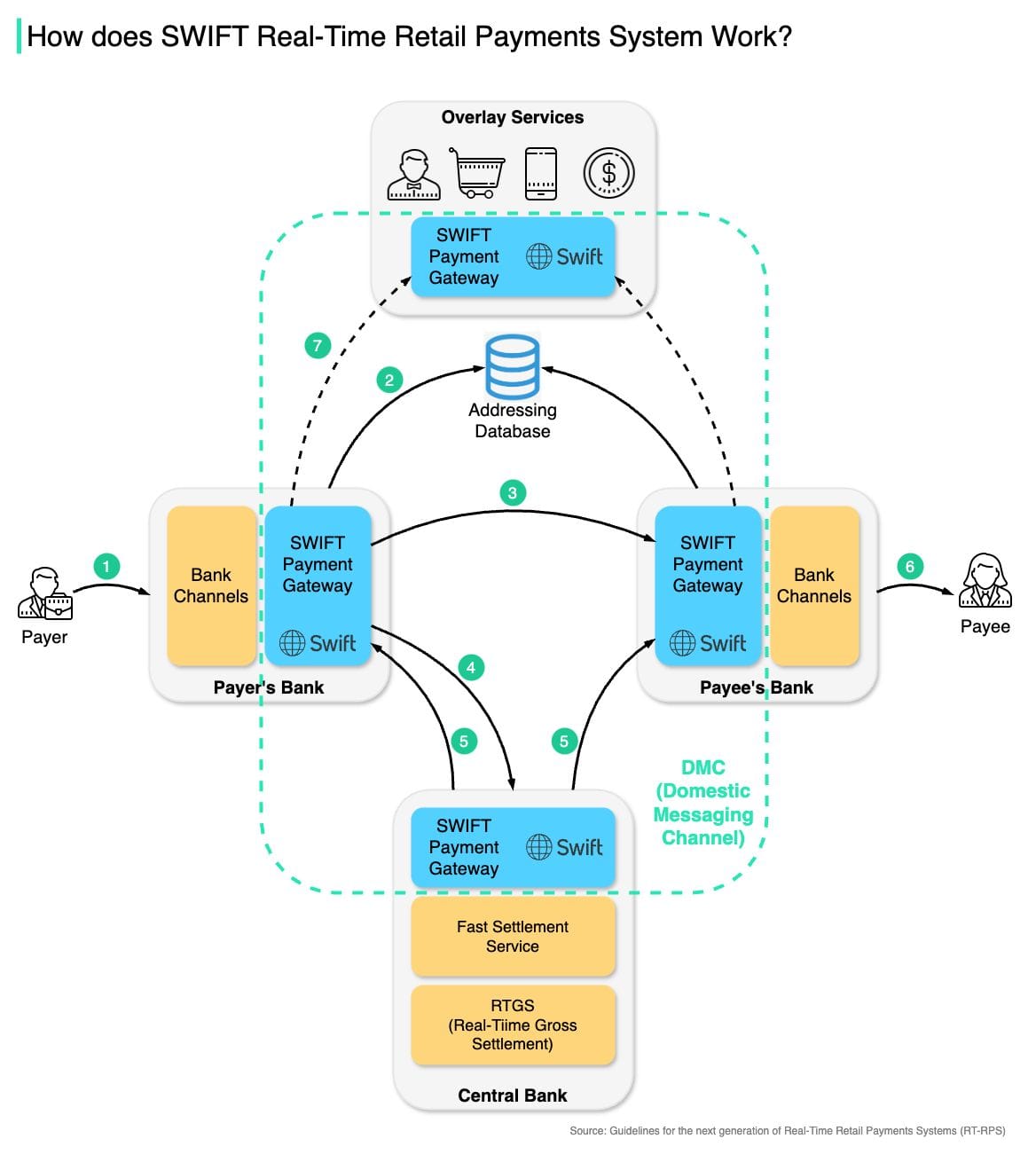

🏦 How does 𝐒𝐖𝐈𝐅𝐓 𝐫𝐞𝐚𝐥-𝐭𝐢𝐦𝐞 system work?

🇮🇪 Online bank Revolut has launched new instant access savings accounts in Ireland with rates of up to 3.49% AER variable. The company said that customers will be able to earn daily interest while also having access to their funds on-demand. Read on

🇦🇺 Revolut expands services to Australian sole traders. Revolut Australia has announced it will extend its Revolut Business product to include an offering for specifically for sole traders with over 4,000 sole traders already registered on the platform.

🇺🇸 Synctera launches Bring-you-own-Bank. This model enables customers to leverage the Synctera Platform while maintaining the flexibility to work with whichever bank best fits their needs.

🇬🇧 Startup lender SilverRock achieves banking authorisation. New challenger SilverRock Bank has been granted banking authorisation with restrictions by the Prudential Regulation Authority following the completion of a £50m funding round.

🇺🇸 Big banks face intensifying political pressure over Zelle fraud. Executives from JPMorgan Chase, Bank of America and Wells Fargo are expected to testify this summer before a U.S. Senate panel that has spent much of the last year examining fraud on the Zelle payments network.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Solana dev says new crypto phone ‘feels like madness’ — but it already has $65m in pre-orders. Solana’s second mobile phone is called Chapter 2 and is slated to come out in early 2025. The Chapter 2 is Solana’s bid to liberate crypto from the desktop and the domination of the app platforms at Apple and Google.

DONEDEAL FUNDING NEWS

🇸🇦 Saudi FinTech’s $224 Million IPO draws orders worth $29 billion. Like some of its Gulf peers, Saudi Arabia is trying to diversify its stock exchange beyond banks and industrial companies that have typically dominated it.

🇬🇧 Islamic car finance platform Ayan Capital raises £2/3 million debt and equity seed round. Ayan Capital gives UK drivers access to professional and business car financing of up to £50,000 that is fully compliant with Islamic finance principles, capturing the demand for such products among PHV drivers, the majority of whom are Muslim.

🇨🇦 Beacon raises C$5.25m for super-app targeting Canada's immigrants. The investment will accelerate the development of Beacon’s Super App—a comprehensive, purpose-built solution tailored to the needs of Canadian immigrants.

🇭🇰 Just over a year after HSBC Holdings acquired the UK unit of Silicon Valley Bank (SVB) for £1 (US$1.27), wealthy customers from Hong Kong and the rest of Asia are keenly exploring investment opportunities in tech start-ups, according to a senior HSBC executive.

🇳🇱 Dutch open banking platform EnableNow raises further €650,000. With this capital injection, EnableNow wants to further develop the platform and scale it commercially. The company focuses on broadening its portfolio and European expansion.

🇨🇴 Loopay, a FinTech focused on implementing technological solutions to achieve financial efficiencies among companies, has raised $10 million in a debt round. The Colombian startup, which began operations in 2021, announced that these funds will be used to bolster its operations in Colombia and Ecuador.

M&A

🇧🇷 PayRetailers acquires payment company Transfeera in a strategic move to expand its business in Brazil. Operating in more than 20 countries in Latin America and Africa, PayRetailers aims to double its number of employees in Brazil by 2025 and expand its services to Brazilian companies.

MOVERS & SHAKERS

🇬🇧 Mangopay has strengthened its team in the UK and Ireland with the appointment of Jonathan Greenland as a new Sales Director. Jonathan joins to increase Mangopay’s market share through establishing relationships with key clients while maximising business opportunities.

🇨🇦 Nuvei names Gang Wang CTO. Wang will lead Nuvei’s global technology team together with former CTO Max Attias, who has been appointed to the new role of Chief Information Officer. Continue reading

🇺🇸 Bakkt appoints Ray Kamrath chief commercial officer, crypto business. Kamrath joined Bakkt in December 2023 and brings 30 years of experience in capital markets. He will lead the company’s sales across Bakkt’s crypto business including trade, custody and institutional offerings.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()