Investor Increases Revolut Valuation by 20%

Hey FinTech Fanatic!

Last week, I invited you to participate in a poll following the announcement that Dutch neobank Bunq is aiming to secure a banking license from U.K. financial regulators later this year or early next year, as reported by CNBC. The big question on everyone's mind was:

Who will be the first to obtain a UK Banking License—Bunq or Revolut?

Here are the results:

It was a close call! Only time will tell who will prevail.

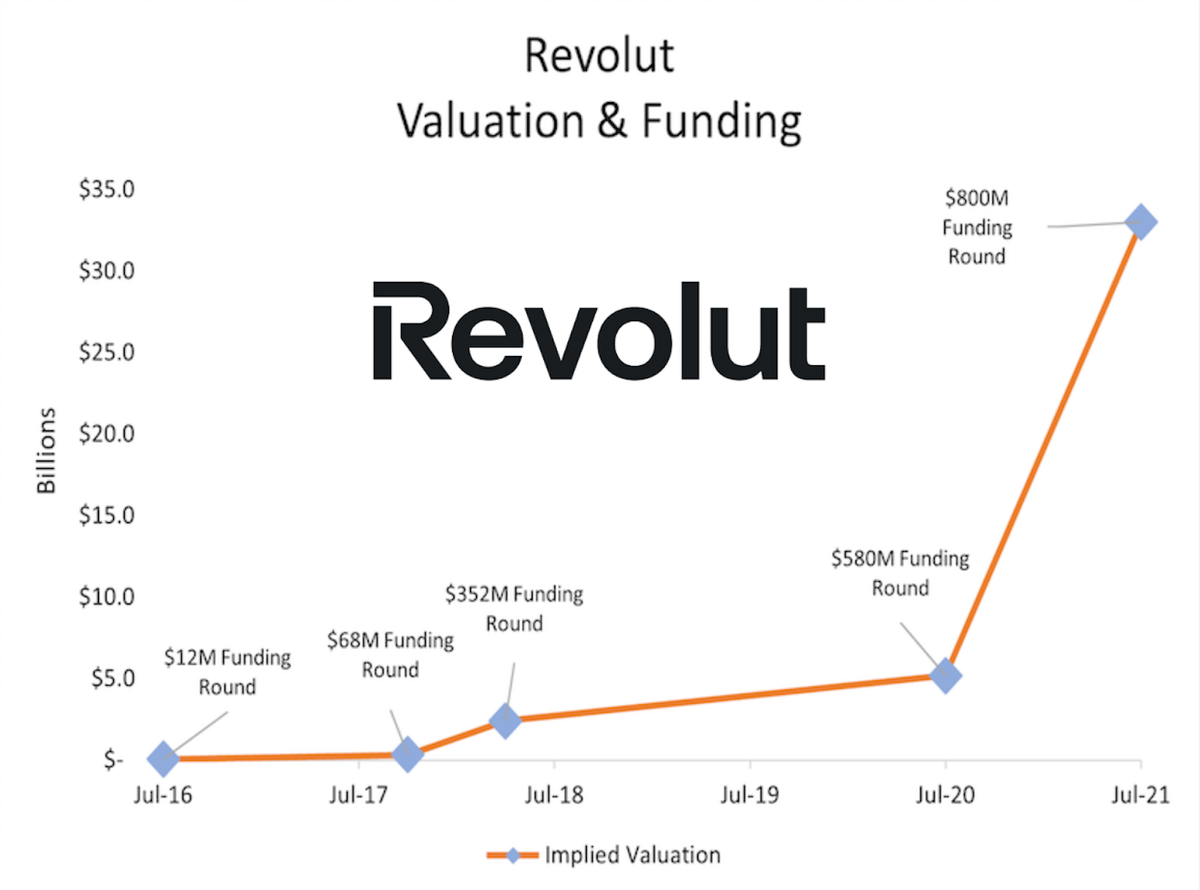

Meanwhile, Molten Ventures has increased the valuation of its investment in Revolut, as reflected in the firm's annual report, which indicates a total portfolio value growth to £1.38 billion.

According to Molten Ventures, the current valuation of its stake in Revolut stands at £65.1 million, marking a 20% increase year-over-year as of March 2024. This figure, however, remains lower than the £91.3 million valuation reported in 2022.

Additionally, during the latest reporting period, the venture capital firm invested an extra £4 million into Revolut.

Revolut’s last publicly shared valuation stood at $33bn in 2021.

This week, I also have a new poll question for you. Apple's recent announcement of their new feature, "Tap to Cash," has sparked mixed reactions.

Is Apple's "Tap to Cash" an industry game changer?

I'd love to hear your thoughts on this. Thanks in advance for your contributions, and I'll share the poll results with you soon!

Cheers,

Marcel

FINTECH NEWS

🇭🇰 Airwallex Hong Kong increases local customer base by nearly 80% amid growing adoption for cross-border money transfers. Reflecting the strong customer growth, Airwallex Hong Kong also recorded a 108% YoY revenue increase for the first quarter of 2024.

🇺🇸 PingPong, the global cross-border payments platform and business network, announced the launch of its embedded lending solution. The innovation enables US enterprises of all sizes to facilitate global, cross-border growth. Read more

PAYMENTS NEWS

🇺🇸 Cash use persists in US beyond pandemic. Consumers remained committed to cash use last year, even as the share of card payments rose and online payments increased, according to an annual Federal Reserve study.

🇬🇧 UK restricts FinTech AstroPay, owned by Uruguay’s first-ever billionaires. UK regulators imposed a series of restrictions on the financial-technology company as part of a widening crackdown on payments firms that process hundreds of millions of dollars worth of transactions every day.

🇦🇪 The Central Bank of the UAE (CBUAE) is preparing to launch a domestic card scheme – dubbed Jaywan – through its subsidiary, Al Etihad Payments, later this month. Jaywan intends to increase the availability of payment options with a specific focus on e-commerce, digital transactions and financial inclusion.

🇪🇺 MoonPay and PayPal partnership expands to the UK and EU, following a successful launch in the United States last month. MoonPay users in 24 EU member states and the UK can now buy cryptocurrency using their PayPal account.

DIGITAL BANKING NEWS

🇬🇧 ‘Consider yourselves challenged’: Monzo CEO takes aim at legacy banks. “I do absolutely believe that when we describe the ‘challenger bank’, it does mean and it should mean that the incumbents should consider themselves challenged,” TS Anil said at London Tech Week. Read on

🇧🇷 Nu : Nubank reaches 2 million active insurance policies in Brazil. Nubank and its insurance partner Chubb announced this significant milestone. Contributing to the success is Nubank Vida, their first co-created product launched in 2020, which has over 1 million active policies.

🇬🇧 Starling Bank announced its third full year of profitability, driven by strong growth in revenue, deposits, and active customers. Click here to learn more

🇺🇸 BNY Mellon rebrands as BNY. The company said: “To improve familiarity with who we are and what we do, we are updating our logo and simplifying our company umbrella brand to BNY. Changes to the logo include a modern font, a refined arrow and a distinctive teal color.”

🇮🇹 Italy's competition watchdog said on Wednesday it had closed a probe into Intesa Sanpaolo and its digital bank unit Isybank because they had taken the required action to avoid unfair commercial practices. The antitrust authority (AGCM) opened the investigation in November into the transfer of thousands of Intesa Sanpaolo customers to the lender's mobile-only service Isybank.

🇧🇷 Itaú Unibanco has opened Bitcoin and crypto trading to over 60 million customers, as per reports. The bank's investment app, Ion, now allows users to buy and sell Bitcoin and Ethereum after initially offering crypto trading to only select clients in December 2023.

BLOCKCHAIN/CRYPTO NEWS

🇷🇺 Russia to start using CBDC for cross border payments in 2025. Russia intends to perform its first cross border payments using the digital ruble in the second half of 2025. Central bank digital currency (CBDC) transactions with China or Belarus are on the cards.

DONEDEAL FUNDING NEWS

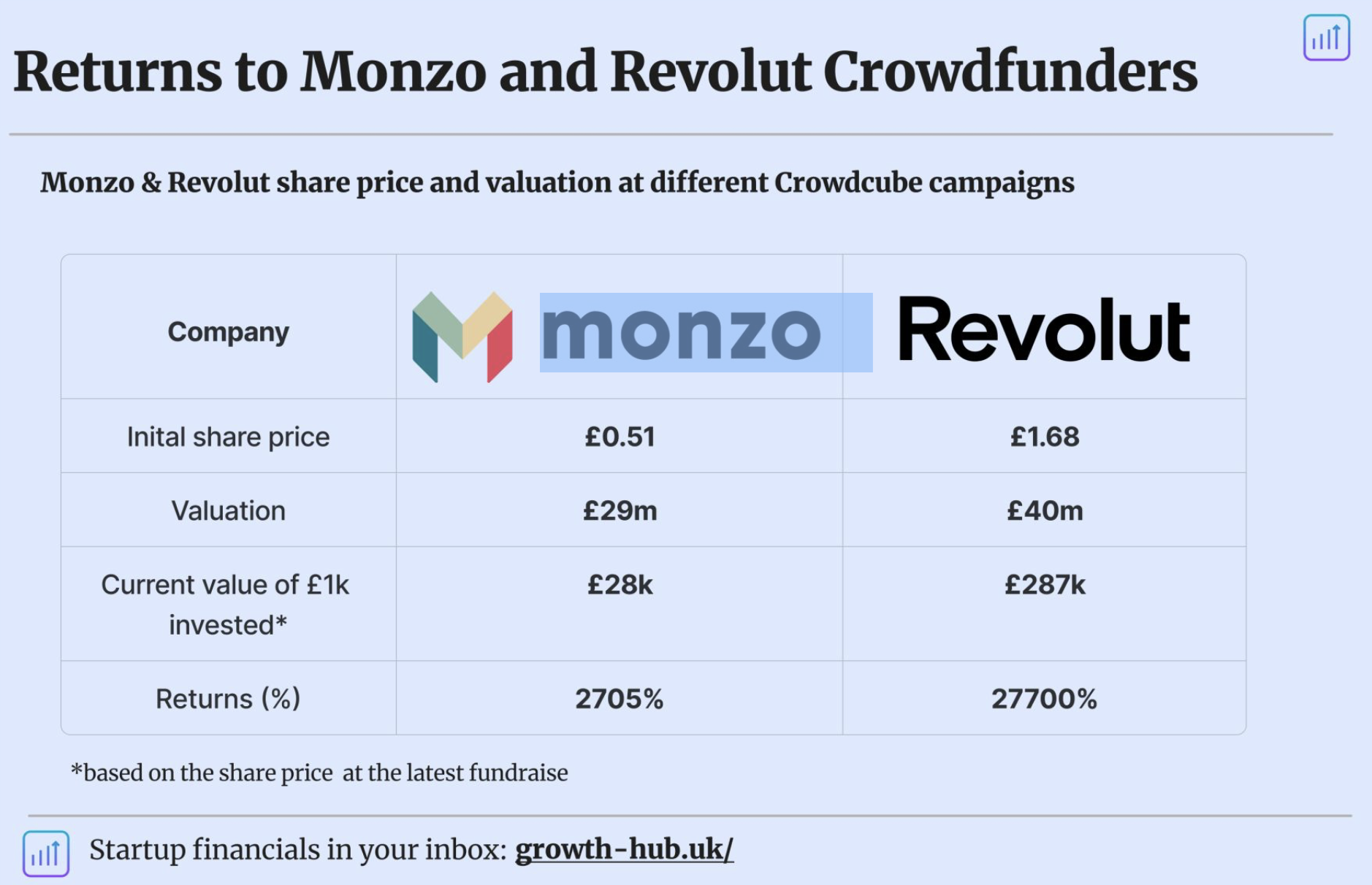

🇬🇧 Monzo Bank 🆚 Revolut. Crowdfunding investors in these FinTechs are sitting on Millions.

Learn more👇

🇪🇸 AI stock picking platform Danelfin raises €2 million. The funding will support Danelfin's plans for growth, product development, international localization, and operations. More on that here

🇦🇪 NOW Money secures $4 million investment. The leading inclusive banking and payroll FinTech, dedicated to providing safe and secured digital banking solutions for low-income workers in the GCC region, will use the funds to scale its operations and enhance its technology product offerings.

🇺🇸 Pipe aims $100 Million at embedding working capital solutions into business software. FinTechs like Pipe connect small businesses with innovative capital by embedding financing solutions into their POS systems and software platforms, making previously unattainable lending products accessible, has said its CEO.

🇵🇱 Wealthon, a Polish FinTech company that provides financial support to SMEs and offers innovative tools for entrepreneurs, secured debt financing of USD12.3M from funds managed by CVI Dom Maklerski. The funds will be used to scale up the business, develop financial products and expand in the e-commerce sector.

🇺🇸 Lightspeed Venture Partners leads $4.3M seed in automated financial reporting FinTech InScope. Along with the cash flow statements, the company will release a feature later this year that helps customers draft annual and quarterly financial reports, co-founder Mary Antony said.

M&A

🇩🇰 Danish FinTech Ageras eyes acquisitions. After posting a profit for 2023, the Danish accounting software FinTech has set its sights on securing one or two "major acquisitions" ahead of a potential IPO in 2026. Keep reading

🇬🇧 The London Stock Exchange is in talks about a deal to boost its offering to retail investors by taking over parts of PrimaryBid, one of the hottest British FinTech start-ups of recent years. Alongside its discussions with the LSE, City sources said that Sir Donald Brydon is to step down as chairman of PrimaryBid.

MOVERS & SHAKERS

🇬🇧 Checkout.com announces the promotion of Jenny Hadlow to Chief Operating Officer. Since joining the firm in 2021, Jenny has led the Global Revenue Operations team, driving commercial excellence and scaling the company’s operations globally. She will now also oversee the Risk Operations and Merchant Care teams.

🇩🇪 N26 appoints Peter Kleinschmidt to supervisory board. Peter, an avid investor in startups with a focus on new and emerging technology, brings decades of experience in the financial services, banking and insurance industries.

🇬🇧 S64 appoints Marcus Glover as CTO. Glover brings to S64 his extensive experience in software engineering and a deep understanding of wealth management technology. In his role as CTO, Glover is responsible for shaping the future direction of S64's enterprise private markets technology platform.

🇬🇧 Hannah Dobson appointed as KPMG's UK head of FinTech. Hannah was previously Co-Head of FinTech alongside John Hallsworth, who is retiring from the firm in July 2024. She joined the firm in 2015 and in addition to leading its FinTech team she is a Partner in KPMG’s indirect tax team.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()