Inside the Deals: Nuvei's Potential Buyout & Monzo's Extension Funding Round

Hey FinTech Fanatic!

Two notable FinTech deals are making headlines today. Firstly, Canadian payments processor Nuvei, known for its technology that enables online retailers, sports-betting apps, and crypto exchanges to accept various forms of payment, is on the verge of a major transaction.

The company, backed by celebrity entrepreneur Ryan Reynolds, is in advanced discussions with private-equity firm Advent International for a potential buyout. This move could mark one of the larger private-equity deals recently, especially at a time when such transactions have been rare due to high interest rates and other economic factors.

Nuvei, which has previously acquired payment platform Paya Holdings for $1.3 billion, has been under scrutiny from short seller Spruce Point Capital Management but remains a significant player in the market with a substantial investment from Reynolds.

Given Nuvei’s current market capitalization of about 4.1 billion Canadian dollars ($3 billion), it would qualify as one of the larger recent private-equity deals at a time when activity is muted as a result of higher interest rates and other factors.

On the other hand, UK-based digital bank Monzo is in talks with Singapore's sovereign wealth fund, Government Investment Corporation (GIC), to sell a stake worth around $50 million.

This discussion comes after Monzo secured a valuation exceeding £4bn, positioning itself as a significant entity in the UK's banking sector with over nine million customers. The investment from GIC is seen as a top-up to Monzo's recent funding round, which included a substantial investment from Capital G, Alphabet's independent growth fund.

This latest fundraising effort is anticipated to be the precursor to an initial public offering, setting the stage for Monzo's future growth and expansion.

I've compiled more updates from the global FinTech industry for your perusal below👇, and I'll be back in your inbox with more news!

Cheers,

POST OF THE DAY

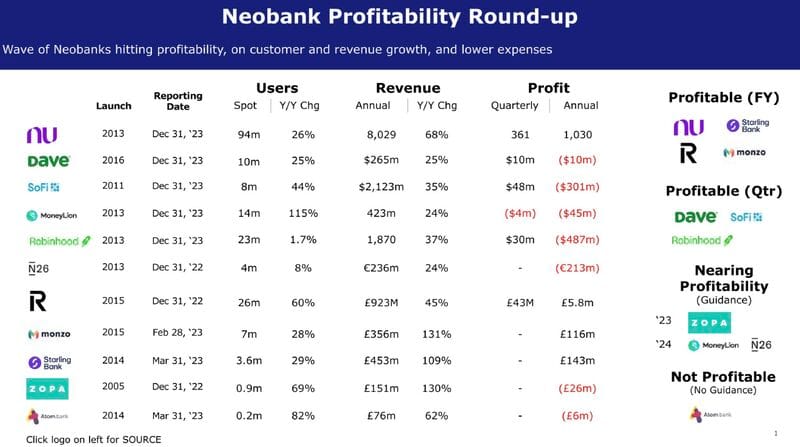

Most of the top 30 neobanks (by funding), despite being operational for a decade, have historically struggled to achieve profitability. However, the landscape is shifting.

#FINTECHREPORT

Modular payment infrastructure provider Mangopay has released a new eBook with insights into the different benefits of embedded finance and more specifically, how marketplaces can use it to help their businesses to grow and become more profitable.

The eBook, which can be downloaded here, covers:

► How embedded finance can support marketplaces with value creation to create more sustainable growth

► The role that wallet-based payment technology is playing in the rapidly expanding market for embedded finance

► The role of Payment Orchestration in unifying multiple payment systems

► How multi-currency wallet infrastructure can support international business growth

INSIGHTS

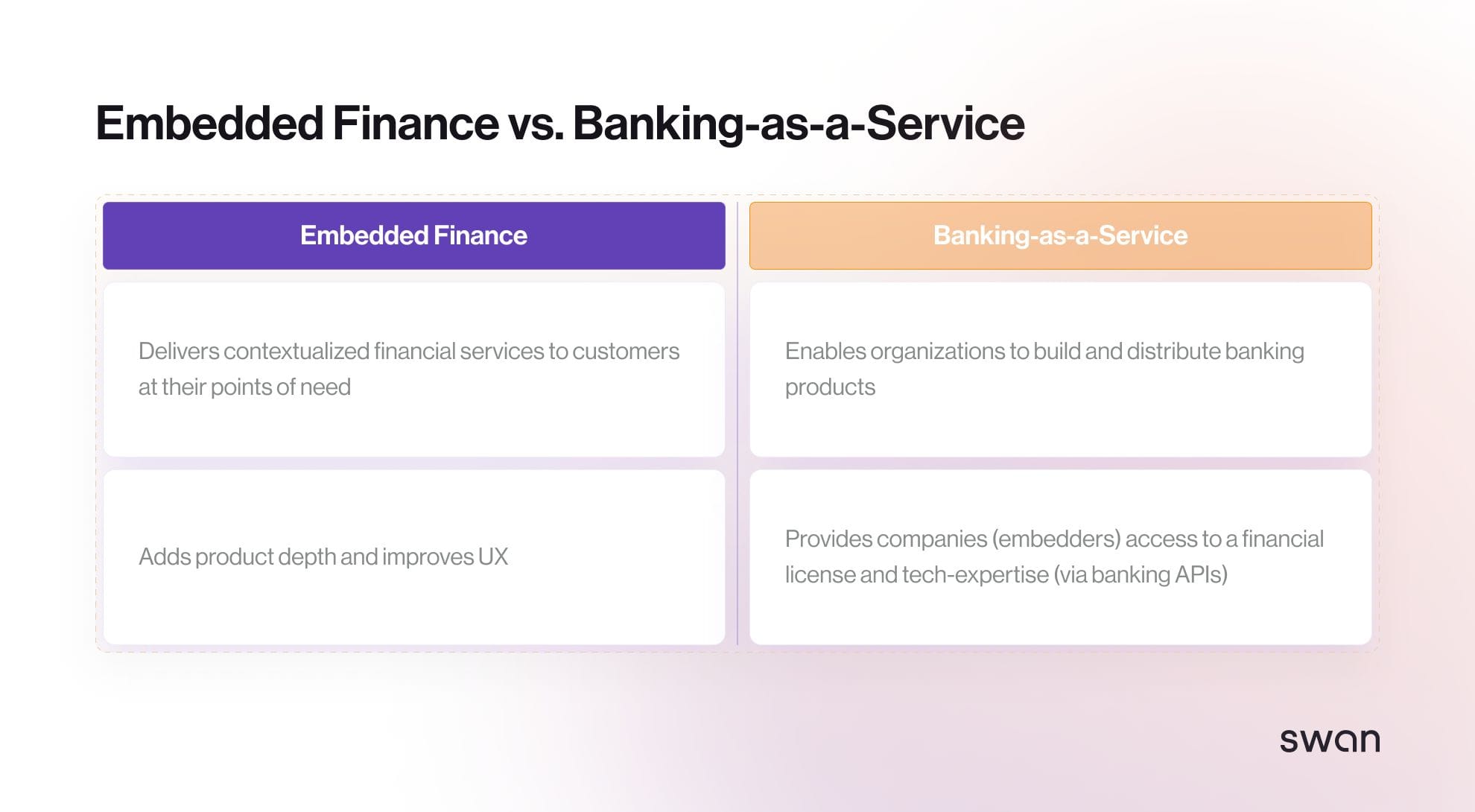

Banking-as-a-Service (BaaS) 🆚 Embedded Finance

What's the difference? Let's dive in:

🇺🇸 On March 13, the US House of Representatives passed a measure that would force TikTok to spin off from its parent company, ByteDance, or else face a nationwide ban in the United States. President Biden has indicated that he would sign the bill if it also passes in the Senate, doing so in the name of safeguarding US consumer data from Chinese government influence. But questions remain—many of which directly impact the future of FinTech. READ MORE

FINTECH NEWS

🇺🇸 FIS offers greater card Fraud Detection through new Artificial Intelligence collaboration. The company has announced that its SecurLOCK™ card fraud management solution is poised to deliver an increase in accurately identified and prevented fraudulent card transactions utilizing a new collaboration with FIS FinTech Accelerator alumnus Stratyfy.

🇧🇷 Five months after their launch, Nubank's first index funds (ETFs), Nu Renda Ibov Smart Dividendos (NDIV11) and Nu Ibov Smart Dividendos (NSDV11), have attracted R$57 million in investments, with R$23 million in NSDV11 and R$34 million in NDIV11. During this period, the funds gained 13,000 investors and achieved the highest accumulated return among all Brazilian company share ETFs listed on the local stock exchange.

🇯🇵 Wise receives Type 1 Funds Transfer License in Japan. The acquisition of the license will enable Wise to completely remove the limit of 1 million Yen per transaction for overseas remittances, which had been imposed as a Type II Money Transfer Operator since 2016. This will bring further competition to the market for individual and businesses considering international remittances of up to 150 M Yen.

🇬🇧 Rewards app Cheddar re-launches with instant consumer savings during the cost of living crisis. Cheddar 2.0 is packed with various tools for consumers to regain control of their finances, and make their money go further. Features include instant cashback immediately landing into the user’s bank account, along with personalized spending recommendations.

PAYMENTS NEWS

🇧🇭 EazyPay to provide Tabby's buy now, pay later on POS terminals network. This partnership marks a significant milestone as EazyPay becomes the premier provider of BNPL services over Eazypay POS terminals network in the Kingdom. Merchants using EazyPay’s POS systems will be delighted to know that they can now extend Tabby's interest and fee-free Pay in 4 solution to their customers.

OPEN BANKING NEWS

🇬🇧 Millions more in cash needed to fund UK’s open-banking watchdog: £10m needed for regulator charged with developing tools to thwart financial crime and protect consumers. New open-banking rules mean customers can share their personal financial information with firms other than their bank, opening up chances for better deals on mortgages, overdrafts plus insurance and broadband deals.

DIGITAL BANKING NEWS

🇨🇭 Kaspar& is evolving into a Banking-as-a-Service (BaaS) provider for banks, leveraging its finance technology to offer embedded finance solutions for third-party partners. This marks a strategic shift towards collaboration with banks, aiming to utilize BaaS to facilitate embedded finance solutions.

🇬🇧 LHV Bank to offer ChatGPT to all employees. Adopting the ChatGPT Enterprise edition offers significant advantages and unique features beyond the standard ChatGPT version. Under the deal, LHV Bank employees will benefit from improved interaction quality, greater customisation options and advanced data handling.

🇨🇭 Swiss banking giant UBS will look for merger and acquisitions opportunities in the United States in the years to come, its chairman told the NZZ newspaper on Sunday. UBS, which took over former rival Credit Suisse last June, wants to expand its U.S. wealth-management business through potential M&A in three or four years, Colm Kelleher said.

🇺🇸 The pay of Goldman Sachs’ top three executives jumped by an average of nearly 24% in 2023, the Wall Street investment banking company disclosed in a filing on Friday, even as its profit fell last year. The compensation committee determined the pay based on factors such as decisive leadership that recognized the need to simplify the firm’s strategy and a series of actions that narrowed the focus of the firm.

🇦🇺 GCI Consulting and Moroku unveil Bank-as-a-Service platform in Australia. This groundbreaking solution leverages the robust foundation of the Temenos Australian Community Banking Solution, seamlessly integrating it with Moroku Money’s award-winning digital channels solution. The platform is designed to empower financial institutions.

🇳🇬 Nigerian neobank Kuda has secured payment licenses in Tanzania and Canada for its expansion across Africa and globally. These licenses will enable Kuda to offer remittance and multi-currency wallet services to Africans in Canada and similar services to Tanzanian customers. Read on

BLOCKCHAIN/CRYPTO NEWS

🇸🇻 El Salvador creates first Bitcoin “Piggy Bank” for long-term storage. El Salvador President Nayib Bukele says the country has sent a huge chunk of its Bitcoin (BTC) stash to a cold wallet reserved in its territory. Sending Bitcoin to a cold wallet is symbolic of plans to explore tighter security storage means and, in most cases, for longer-term storage.

DONEDEAL FUNDING NEWS

🇮🇳 Perfios turns unicorn with $80 Mn funding from Teachers’ Venture Growth. With the new funding, the company aims to expand globally and explore growth opportunities, according to a press release. It will also continue to invest in its tech stack to power the end-to-end customer journeys across banking, insurance, and embedded commerce.

🇬🇧 Digital bank Monzo in talks to sell stake to Singaporean state fund GIC. Monzo Bank which last month secured a valuation in excess of £4bn, is in talks to sell an additional stake to one of Singapore's sovereign wealth funds. Sky News has learnt Monzo is in advanced negotiations to raise in the region of $50m by issuing new shares to the Asian city-state's Government Investment Corporation (GIC).

🇳🇬 Blockchain payment network Zone raises $8.5 million. The Nigerian company is Africa's first regulated blockchain network for payments and has already signed up over 15 of Africa's largest banks and FinTech companies. The new funding will be used to further expand the coverage of its network domestically and connect more banks and financial services companies.

🇺🇸 Tandem unveils goals feature set, announces $3.7M in seed funding led by Corazon Capital. As Tandem continues to redefine the landscape of shared finances, the new Goals experience in the app promises to bring couples closer to their financial goals while fostering a sense of collaboration and shared aspirations.

🇲🇦 Morocco-based super-app ORA Technologies raised USD 1.5 M in seed funding from undisclosed Moroccan entrepreneurs. The funding comes one year after the startup raised USD 1 M from local private investors. The new cash influx will help propel ORA’s plans to activate its e-wallet, which allows users to transfer money instantly.

M&A

🇨🇦 Canadian payments processor Nuvei, backed by celebrity entrepreneur Ryan Reynolds, is nearing a buyout deal. Private-equity firm Advent International is in advanced talks with Nuvei for a transaction that could be announced soon, according to people familiar with the matter. The talks could still fall apart before a deal is reached.

🇪🇬 MNT and Egyptian startup Halan acquire Advans Pakistan Microfinance Bank. This strategic move follows a meticulously planned acquisition process initiated with a share purchase agreement signed in August 2023, culminating in the recent green light from the CCP after meeting all regulatory requirements.

🇺🇸 NCino to acquire DocFox. DocFox’s technology helps simplify and automate the onboarding and account opening process for commercial and business banking, enabling remarkable client experiences. The acquisition is expected to close in March 2024.

🇺🇸 Shift4 Payments' CEO Jared Isaacman is said to be distinctly unimpressed by the valuations placed on the firm from potential acquirers. According to an internal memo seen by Bloomberg, Isaacman said that the firm had received multiple offers from potential suitors but that none properly valued the business of its potential.

MOVERS & SHAKERS

🇦🇺 FinTech Australia to bolster its support for the industry with new leadership appointments. The firm appoints three-time founder and DAS executive Sarah Gorman as Chair with previous Chair, Simone Joyce to move to an advisory role and General Manager, Rehan D’Almeida as its new CEO. Keep reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()