How Unified Platforms Can Power MENA’s FinTech Leap

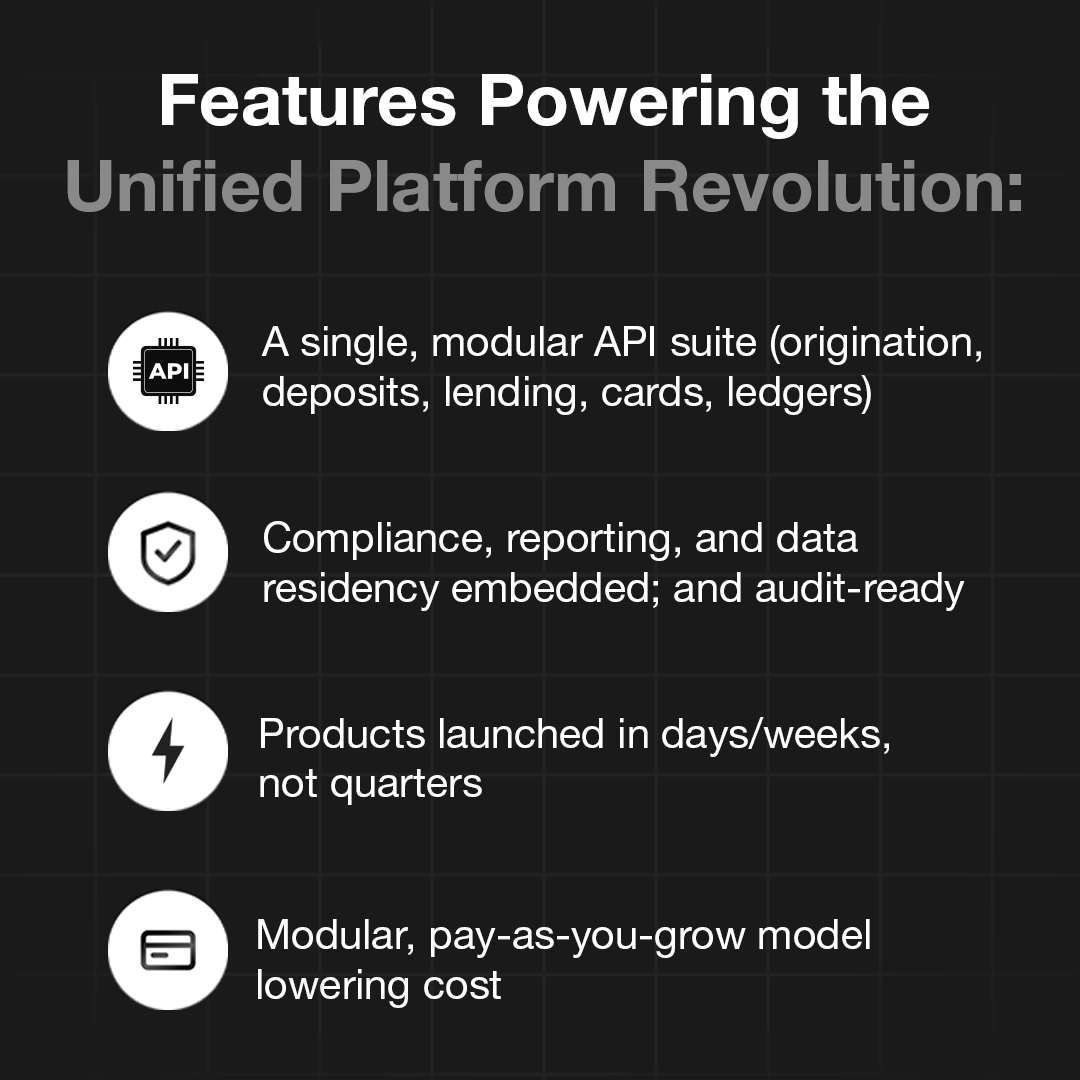

The unification ‘platform moment’ unlocks new ecosystem possibilities: banks, FinTechs, and even non-financial partners can launch new digital products in previously unthinkable timeframes. Financial infrastructure here is a set of pluggable components.

Why Unification Matters Now

The Middle East and North Africa (MENA) region is on the cusp of a new chapter in financial infrastructure focused on unification.

Rather than relying on outdated or fragmented systems, financial institutions are increasingly seeking solutions that simplify integrations and reduce operational headaches.

Financial systems remain fragmented:

► Juggling multiple vendors

► Slow and costly integrations

► Ongoing regulatory friction

The shift underway? A move toward unified financial infrastructure that is modular, secure, and API-first. That is what unification in financial infrastructure means, and it’s gaining traction.

Imagine a ‘Shopify transformation moment’ where financial infrastructure finally becomes as modular, scalable, and easy as adding apps to a smartphone. For finance in this region, that moment is approaching fast.

The fastest growing region for FinTech, being MENA, is projected to be the fastest because its runway is long for innovation in MENA’s financial services.

The High Cost of Fragmentation

Without unified platforms, banks and FinTechs often manage a patchwork of solutions. This can mean lengthy timelines that mean months to add origination, ledgers, or loan modules, each requiring its own integration and compliance process. As a result, slow rollout times (often 6–12 months) and recurring risk are common.Challenges Include:

► Multiple vendors for basic features (origination, lending, payments, cards, ledgers)

► Delayed product launches due to integration backlog

► Higher cost, more risk, and slow innovation cycles that hurt both incumbents and startups

The “Shopify Moment” for financial products

Unified financial infrastructure platforms offer modular APIs for essential features like origination, ledgers, deposits, card issuing, lending, and compliance. In MENA, a financial infrastructure software provider such as Stitch is helping regulated institutions as well as FinTechs plug into this shift. Globally, purpose-built players like Mambu (for loan orchestration) and Paymentology (for card issuing and processing) showcase how beautified backends are replacing legacy stacks.

Just as platforms like Shopify simplified retail infrastructure, Twilio enabled programmable communications, and Wiz modernized cloud security operations, unified financial infrastructure providers are transforming financial institutions. These platforms offer flexible, API-driven components or cloud-native cores that allow financial institutions to build, launch, and scale financial products faster while meeting regional compliance needs.

► Teams can roll out new financial products in weeks, not months.

► The impact is immediate: product managers can mix and match features they need, rapidly iterate, and respond to changing market or regulatory needs.

The benefit is not simply speed, but also greater flexibility for managing evolving customer and regulatory needs across various regions.

Case in Point - Stitch: A Real-World Example of Unification in Action in MENA

Financial infrastructure softwares like Stitch are sitting at the cusp of this shift. Rather than just another software provider, Stitch’s platform is an inflection point technology for regulated institutions.

► Tanmeya Capital transformed its lending business and launched a live product in under a month… An 80% faster rollout compared to typical legacy cycles. All ledgers, loan origination, core functionality, and reporting were unified in a single deployment, not stitched together from a dozen different vendors.

► This is about cloud-native, API-first, and regulatory-ready financial infrastructure from day one.

The ROI of Unification

Fragmented stacks are known to stifle innovation and inflate costs. Unified infrastructure empowers both massive incumbents and micro-banks to compete, experiment, and serve new segments. This eliminates the need for massive tech teams and compliance delays.

Key Benefits:

► Lower technical debt and integration headaches.

► Rapid, compliant launches for everything from retail lending to payroll.

► Faster feature updates; easier to meet evolving regulatory needs.

► A lower bar for innovation/market entry means increased competition and financial inclusion.

Regulation-Ready by Design

MENA’s regulators (Saudi Arabia, UAE) require strict onboarding processes, data sovereignty, and robust digital frameworks. Unified platforms are built to comply from day one with in-country data centers, regulatory reporting tools, and automated compliance checks. Even global players wanting to avoid the hassle of navigating the foreign regulatory landscape benefit from using unified platforms.

Industry Impact and the Road Forward

This unification ‘platform moment’ unlocks new ecosystem possibilities: banks, FinTechs, and even non-financial partners can launch new digital products in previously unthinkable timeframes. Financial infrastructure here is a set of pluggable components.

The platform model democratizes the market allowing even niche players to innovate and scale, and letting regulators/agency programs roll out inclusion, SME, or green lending solutions in months, not years.

In short, it levels the playing field.

Just as AWS turned server racks into code and Shopify turned retail infra into a service, unified platforms are turning financial infrastructure into building blocks.

That’s the quiet revolution. And it’s already underway.

Comments ()