Goparity Secures €2.9M to Democratize Sustainable Investing Across Continents

Hey FinTech Fanatics!

Lisbon’s sustainable finance platform Goparity just wrapped a €2.9M raise, led by 3XP Global’s Impact Innovation Fund. Institutional heavyweights like Mustard Seed Maze and Schneider Electric backed over € 2.4 M. In addition, 800+ private investors chipped in €470K via Crowdcube, investing on the same terms as the big players.

Founded in 2017, Goparity lets anyone, starting at just €5, back projects tied to the UN Sustainable Development Goals. So far: 335+ impact projects, € 45 M+ mobilized, 86,000 people supported, 4,000+ jobs created, and 30,000+ tonnes CO₂ saved yearly across three continents.

Goparity's CEO, Nuno Brito Jorge, called this raise “the best validation we can have” and expects to break €50M invested by mid-2025. He also underscored the urgency, pointing to recent U.S. bank withdrawals from the UN’s Net Zero Banking Alliance.

Goparity will use the funds to expand its investor base (especially in Europe, Canada, and South America) and strengthen its ethical finance platform. As 3XP Global’s Impact Partner, Rita Branco, said, “We are excited to support a team transforming how we finance the future and making impact investing an easy and real choice for everyone.”

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

ARTICLE OF THE DAY

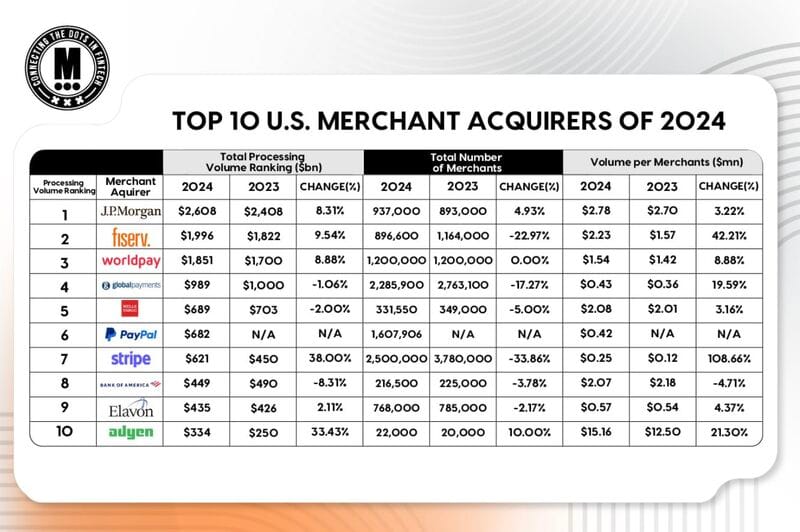

🇺🇸 The Top 10 U.S. Merchant Acquirers in 2024. The five largest players, J.P. Morgan, Fiserv, Worldpay, Global Payments, and Wells Fargo, accounted for about $8.1 trillion of that total.

FEATURED NEWS

🇩🇪 PayPal announces plans to revolutionize in-store payments in Germany. The new contactless feature will be accessible through the latest version of the popular PayPal App (both iOS and Android). Consumers will be able to choose PayPal to pay safely and easily with a simple tap of their phone at any location that accepts Mastercard contactless payments.

FINTECH NEWS

🇱🇹 PeerBerry reports €3B in total funded loans and over 100,000 users. At the end of March, its portfolio, the total amount invested, amounted to €117.45 million, the highest outstanding portfolio in PeerBerry's history. Since its inception, investors have funded just over €3 billion in loans.

🌍 The European Central Bank partners with the private sector through the digital euro innovation platform. The innovation platform simulates the envisaged digital euro ecosystem, in which the ECB provides the technical support and infrastructure for European intermediaries to develop innovative digital payment features and services at the European level.

🇨🇳 Ant Group in talks for international unit IPO in Hong Kong. It has received indications that there are currently no policy obstacles. Zhou Zhifeng, a senior Vice President and General Counsel of the group, is leading the discussions with regulators in Hong Kong and Singapore.

🇺🇸 eToro announces launch of IPO. The IPO is expected to price between $46.00 and $50.00 per share. It has applied to list its Class A common shares on the Nasdaq Global Select Market under the ticker symbol “ETOR.” Read on

🇧🇷 Why is Brazil So Important for Global FinTech Jeeves? The firm sees Brazil as a key market for expansion, citing its strategic importance and potential for innovation. At the Web Summit in Rio, Jeeves’ CEO emphasized plans to scale locally and export Brazilian-born solutions to other global markets.

PAYMENTS NEWS

🌎 How is ACI Worldwide Transforming the Real-Time Payments Landscape? Alberto Olivares, Director for Latin America at ACI Worldwide, shares his vision and experience on the Global IT Media technology program. Watch the full interview here

🇨🇴 Women leading financial inclusion with real-time payments. More than 740 million women remain excluded from banking services, especially in developing regions where they face social and structural barriers. However, according to ACI Worldwide’s 2024 report, real-time payments are transforming this reality, with women leaders driving decisive progress toward financial inclusion.

🇺🇸 JPMorgan uses a new feature to limit Zelle payments originating from social media. CNBC’s Leslie Picker breaks down the latest details on JPMorgan’s new restrictions to Zelle payments. Watch the full video

🇺🇸 X Money's new updates are revealed ahead of the official launch. X Money, an X payment platform, will reportedly offer users cashbacks on their payments, with Elon Musk’s X set to partner with Persona for ID checks. X Money is expected to launch soon, allowing international users to exchange money.

🇮🇳 PhonePe unveils made-in-India smart speaker to power offline payments. The device offers real-time audio payment confirmations in 21 languages, including a celebrity voice option with prominent Indian actors, which allows shopkeepers to focus on customers instead of checking their phones for payment alerts.

🇨🇦 Dream Payments enables Interac e-Transfer payouts in Canada. This feature enables the transfer of funds using only an email address or mobile number, eliminating the need for banking information. Keep reading

🇩🇪 The undiscovered 400-million exit of Sevdesk. Sevdesk, a cloud-based accounting software startup from Offenburg, Germany, was acquired by French company Cegid for nearly €400 million. The acquisition strengthens Cegid's position in the SME market, especially ahead of the upcoming e-invoicing mandate in 2025.

🇧🇷 Crypto broker Kraken debuts with Pix in Brazil and promises low fees. This integration allows faster and more efficient transactions, aligning with its commitment to providing low fees and Portuguese-language support. Kraken does not yet accept Brazilian Real deposits. However, the addition of Pix facilitates smoother fiat-to-crypto conversions for Brazilian traders.

DIGITAL BANKING NEWS

🌍 Revolut Business announced the launch of a high-yield savings account offering up to 2% interest in four countries: France, the Netherlands, Ireland, and Lithuania. According to James Gibson, CEO of Revolut Business, credit products, term deposits, and investment options like bonds and ETFs are also on the way later this year.

🇦🇺 ANZ to support password-free web banking from mid-2025. Users will authenticate their identity through two methods, including a passkey, which may include biometric options such as fingerprints or facial recognition, or by entering their mobile number and approving a login request via the ANZ Plus app.

BLOCKCHAIN/CRYPTO NEWS

🇦🇪 US-Based Ripple secures license for blockchain-powered payments in UAE. The approval grants Ripple access to the UAE’s $400 billion international trade corridor and its $40 billion annual remittance flow, where businesses can now leverage faster, cost-efficient blockchain transactions under full regulatory oversight.

🇺🇸 SEC closes PayPal PYUSD probe as rollback of Gensler-Era crypto enforcement barrage continues. The decision offers another insight into the current SEC’s stance on stablecoins. PayPal is looking to make strides in the cryptocurrency industry with PYUSD as the focus.

🇲🇻 Maldives plans to build a $9 billion crypto hub to attract investment. The agreement was done in the hopes of moving the Maldives away from reliance on tourism and fisheries by attracting foreign direct investment into blockchain and Web3 technologies.

🇰🇬 Binance partners with the Kyrgyz National Agency for Investments. Binance and the National Agency for Investments aim to revolutionize cross-border payments, not just within Kyrgyzstan but across Central Asia and the EAEU. The goal is to facilitate faster, simpler, and more inclusive financial flows across borders.

🇺🇸 Tether AI platform to support Bitcoin and USDT payments. According to Tether CEO Paolo Adroino, Tether’s AI platform will be integrated with USDt and Bitcoin payments, allowing users to make transactions directly through a peer-to-peer (P2P) network.

PARTNERSHIPS

🇬🇷 KPMG in Greece selects Confide Platform as a strategic partner to support clients. This collaboration signifies a shift from traditional compliance systems to integrated, intelligent platforms that offer substantial value to organizations. Confide Platform brings essential Governance, Risk & Compliance functions together in one intuitive interface.

🇩🇪 European Regtech Fourthline selected by Riverty to provide KYC Tech. The partnership gives Riverty access to technological components for compliant onboarding through a single API, including identity document verification, biometric data analysis, and the application of Fourthline’s verification models.

🇫🇷 BNP Paribas renews IBM partnership, unveils new cloud infrastructure for 2028. The expansion will further bolster BNP Paribas’ ability to manage risks associated with cloud service providers, a priority area under DORA. Continue reading

🇦🇺 Adyen selects Fiskil as its partner in Australia. Through this collaboration, both firms intend to simplify how businesses connect their financial data, minimising complexities and ensuring an optimal and secure process. By utilising Fiskil’s banking API, Adyen is set to offer merchants a more efficient onboarding process, mitigating delays and augmenting the customer experience.

🇩🇪 Lemon.markets expands brokerage-as-a-service platform with Optio to support equity compensation. This partnership aims to help big German companies, including one listed on the major stock index DAX, manage their employee stock compensation more efficiently.

🇺🇸 authID partners with TechDemocracy. As part of their collaboration, authID and TechDemocracy will work to create a series of white papers, co-host webinars, and conduct roadshows aimed at assisting organisations in transitioning from passwords to modern, biometric-first authentication.

🇮🇳 Zillion partners with FinTech major PayU. The company said that the integration expands its ecosystem, offering customers opportunities to accumulate and utilise their Zillion Coins across a more extensive portfolio of brands. Read more

🇬🇧 Moneyhub extends its partnership with Experian to optimise debt payments. The partnership will provide practical and personalised financial services for clients who face debt issues, and complements Experian’s recent integration with ReFi to offer users affordable debt consolidation options.

DONEDEAL FUNDING NEWS

🇪🇬 MoneyFellows raises $13M to take its group savings model outside Egypt. The Cairo-based FinTech says it’s ready to shift from steady growth to regional expansion, adding that it has reached profitability in Egypt, placing it among a small group of African FinTech startups operating in the black.

🇸🇦 Saudi FinTech firm Nqoodlet raises $3m in seed funding. The company plans to use the investment to expand its banking infrastructure, introduce new product features, and strengthen partnerships with banks and other ecosystem players. Continue reading

🇵🇹 Portuguese sustainable finance platform Goparity raises €2.9 million to help invest in projects with an impact. With this new funding round, it plans to solidify its position as an ethical finance platform, as well as to increase its community of investors.

M&A

🇵🇱 Santander raises €7bn from Poland sale. The Spanish bank’s move comes amid questions about whether its sprawling global presence, in which it has described Poland as one of its 10 “core markets”, still makes sense. Keep reading

MOVERS AND SHAKERS

🇧🇷 Magalu has appointed Jorg Friedemann as the new CEO of MagaluBank, its financial services division. This strategic move aims to accelerate the growth of Magalu's financial services, particularly in digital channels, where the company sees significant untapped potential.

🇬🇧 Former Sucden COO Gavin Parker joins Marex Abu Dhabi. Parker worked at execution, clearing, and liquidity provider Sucden Financial for 17 years in London, before leaving the company last year. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()