Five Key Metrics of Apple Card On Its Fifth Birthday

Hey FinTech Fanatics,

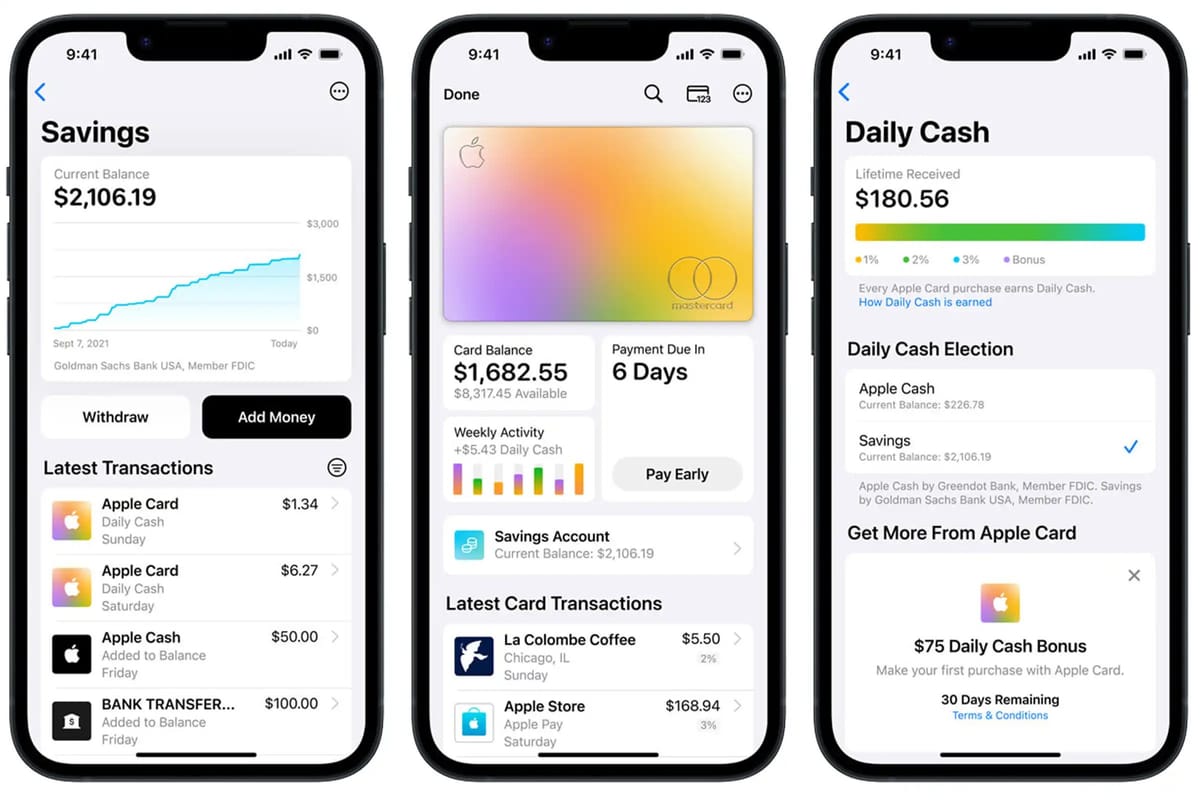

Since its introduction in 2019, Apple Card has significantly impacted over 12 million cardholders. Celebrating five years, Apple Card shared key metrics:

Key achievements of Apple Card include:

1️⃣ Users earned over $1 billion in Daily Cash rewards last year.

2️⃣ A Savings account feature, reaching over $10 billion in deposits, with most users auto-depositing their Daily Cash and adding extra funds from linked bank accounts. The account currently offers a 4.50% APY.

3️⃣ About 30% of customers make multiple payments monthly, aided by tools that estimate interest and simplify bill payments.

4️⃣ Apple Card Family has grown significantly, with over 1 million users sharing the card within their Family Sharing Group, and nearly 600,000 building credit with partners or trusted adults.

5️⃣ The Path to Apple Card program has led over 200,000 users to credit card approval by following personalized financial health steps.

Enjoy more FinTech industry updates I listed for you below and I'll be back in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

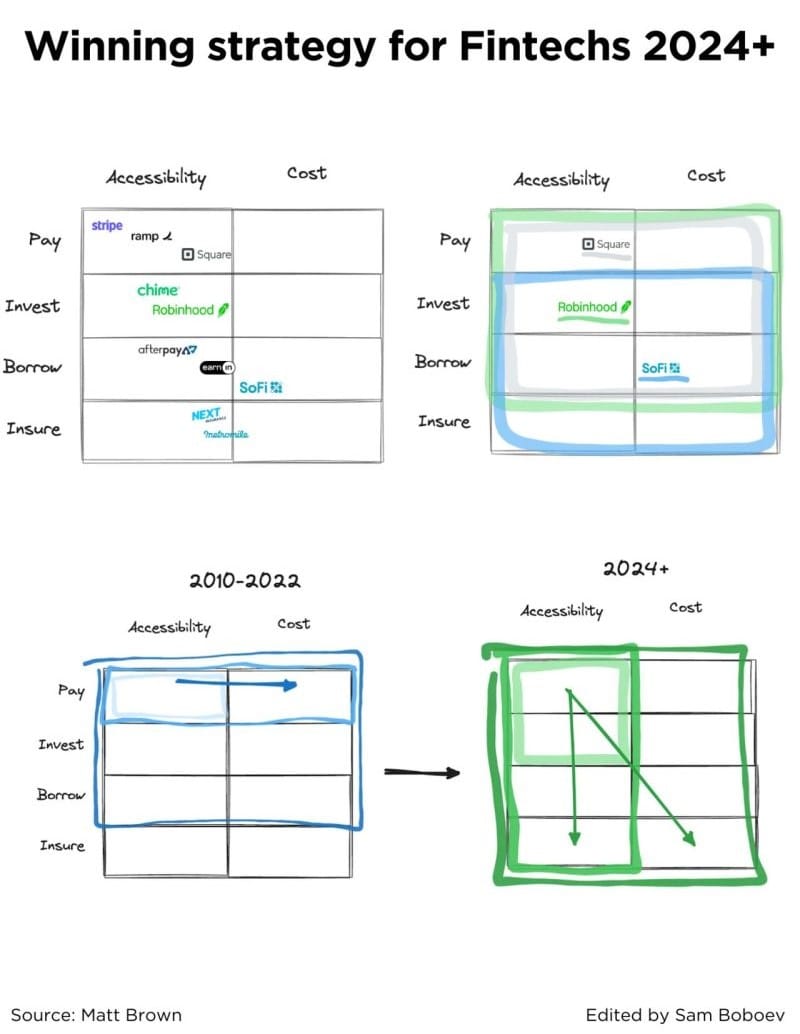

POST OF THE DAY

What has the winning strategy for FinTechs been over the last decade?

FEATURED NEWS

Robert Vis, founder of Amsterdam’s unicorn MessageBird, announced that he is seeking $0- $5M revenue companies with Electronic Money Institution (EMI) and/or Payment Institution (PI) licenses to be acquired. The founder calls this a “once in a lifetime” opportunity. Read on

#FINTECHREPORT

Are financial institutions prepared for a revolution of a $7 trillion magnitude? It is imperative that banks commence the transformation towards a more future-oriented strategy for both their own survival and the planet's well-being. Read the details of this excellent Fintech report here.

INSIGHTS

SoFi CEO Anthony Noto on Q4 earnings.

FINTECH NEWS

LHV Bank has launched into the specialist buy-to-let market and appointed Conor McDermott as its new director of SME lending. McDermott will also sit on the bank’s executive committee, as it boosts its lending range.

🇮🇹 Opyn, leading Italian Lending-as-a-Service platform, scales up in the European Union, Switzerland, and the UK with its proprietary BNPL solution for B2B, Opyn Pay Later, and targets M&A opportunities. Access point to the service is the new opyn.eu website, developed in Italian, English, German, French and Spanish.

🇦🇹 Austrian fintech unicorn Bitpanda launches Bitpanda Wealth, a new service tailored to the needs of HNWIs, Family Officers, External Asset Managers and Corporate Treasuries. The service will provide the opportunity for these users to diversify their portfolios through one of the most regulated brokers in Europe.

🇨🇳 Ant Group, an affiliate of e-commerce giant Alibaba Group Holding, is boosting its operations throughout Asia, as the Chinese fintech major seeks to capitalise on the country’s visa-free policy and an anticipated Lunar New Year travel boom. Read more

Klarna is reviving a feature that enables customers to look back on their personal spending history over the past year and get nudges to better money management tools in the app: With Money Story, consumers can identify their peak spending months, top purchases of 2023, and categories they purchased the most in.

🇬🇧 Fintechs battle for UK traders amid rising competition. Trading platforms have two battles to win: with institutions and their own peers. Some fintech leaders said that UK investors also have more of an appetite for international and sophisticated financial products than some other countries’ retail investors do.

PAYMENTS NEWS

Thunes has expanded an ambitious tree-planting initiative with its partner, Handprint. Thunes pledges to plant one tree for every 5,000 transactions on its platform over the next two years with Handprint. This will enable Thunes’ customers and partners to make positive environmental changes through payment processing.

🇺🇸 Alto Global Processing signs with WLPayments: This collaboration is set to leverage the white-label payment orchestration platform technology of WLPayments to empower Alto Global Processing to deliver advanced and seamless solutions to their clients.

🇫🇷 Viva.com partners with Conecs. The partnership allows French restaurants to accept meal voucher cards as payment through tap-to-pay on any device technology, available with the Viva.com Terminal app. Read more

OPEN BANKING NEWS

🇬🇧 Two open banking providers announce a strategic partnership: Clowd9 and Ozone API will now work together globally, merging CLOWD9's cutting-edge payment processing platform with Ozone API's top-notch open banking services. Both companies are based in the UK where open banking services are mandated.

REGTECH NEWS

🇬🇧 AccessPay, the leading provider of bank integration, announced the addition of Confirmation of Payee (CoP) and Sanctions Screening capabilities to its Fraud & Error Prevention Suite, launched in 2023. This will enable finance teams to avoid fraudulent and non-authorised payments, as well as accidental misdirection of funds.

DIGITAL BANKING NEWS

🇰🇼 Boubyan Bank has sealed a partnership with Snowdrop Solutions to enhance the Bank app users' ability to access a comprehensive and seamless overview of their financial transactions, aiming to improve digital banking by facilitating effortless financial management and understanding.

🇺🇸 BNY Mellon has announced the launch of Virtual Account Based Solutions, a new cash management solution providing clients with enhanced access to and control of cash administration activities and reporting capabilities.

🇬🇧 GoHenry urges Government to prioritise financial education from primary school age. As GoHenry continues its push for financial education to be made compulsory in all primary schools, CEO and co-founder, Louise Hill, gave oral evidence to the Education Select Committee’s inquiry into strengthening financial education in England this morning.

🇺🇸 Apple now has 12 million Apple Cardholders. From easy-to-navigate spending tools, to Apple Card Family, and the recently added Savings account, Apple Card continues to reinvent the credit card experience and provide features designed to help users lead healthier financial lives. More on that here

DONEDEAL FUNDING NEWS

🇺🇸 Ramp acquires Venue and enhances procurement product: The strategic move expands Ramp’s procurement capabilities and marks an expansion for the company as it aims to tackle inefficiencies across the entire financial tech stack, the company said in a press release.

🇺🇸 Neobank Dave repurchases convertible note owned by FTX Ventures. In a public statement Dave noted the original principle amount was $100 million with a purchase price discount of $71 million. The note was repurchased at a $35 million discount compared to the $105.5 million total liability.

MOVERS & SHAKERS

🇺🇸 PayPal began company-wide layoff on Tuesday, the latest tech company to cut jobs, as a newly appointed CEO looks to cut costs and improve profits. The layoffs affected people across multiple teams, according to LinkedIn posts from employees who were laid off.

🇬🇧 Tandem hires senior leaders for digital and marketing divisions. The UK’s greener digital bank, has announced the appointment of Maria Khan, as Director of Product and Digital, and Chris Parker, as Head of Marketing. Read full article

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()