Did Ualá just launch the coolest limited edition Credit Card ever?

Hey FinTech Fanatic!

Mastercard and Ualá are launching a new limited-edition credit card featuring Lionel Messi, the official ambassador of Mastercard.

This card provides access to an extensive program of exclusive promotions and benefits under the campaign concept "Viene de 10."

Issued by Uilo, it will be available in both physical and digital versions and can be used at over 100 million merchants worldwide where the Mastercard network operates.

The physical version of the card features Messi's image on the front and allows each user to choose their preferred identification or nickname.

It is "infoless," meaning the card number and security code are not displayed on the back but are accessible via the Ualá app, ensuring greater security for purchases.

When you follow me for a while, you know I love cool card design. I even dedicated a LinkedIn channel "Marcel van Oost - The Card Collection" to it🤣

What do you think about this design? Do you know about any other cool limited edition card designs out there? Let me know in the comments below👇

Cheers,

#FINTECHREPORT

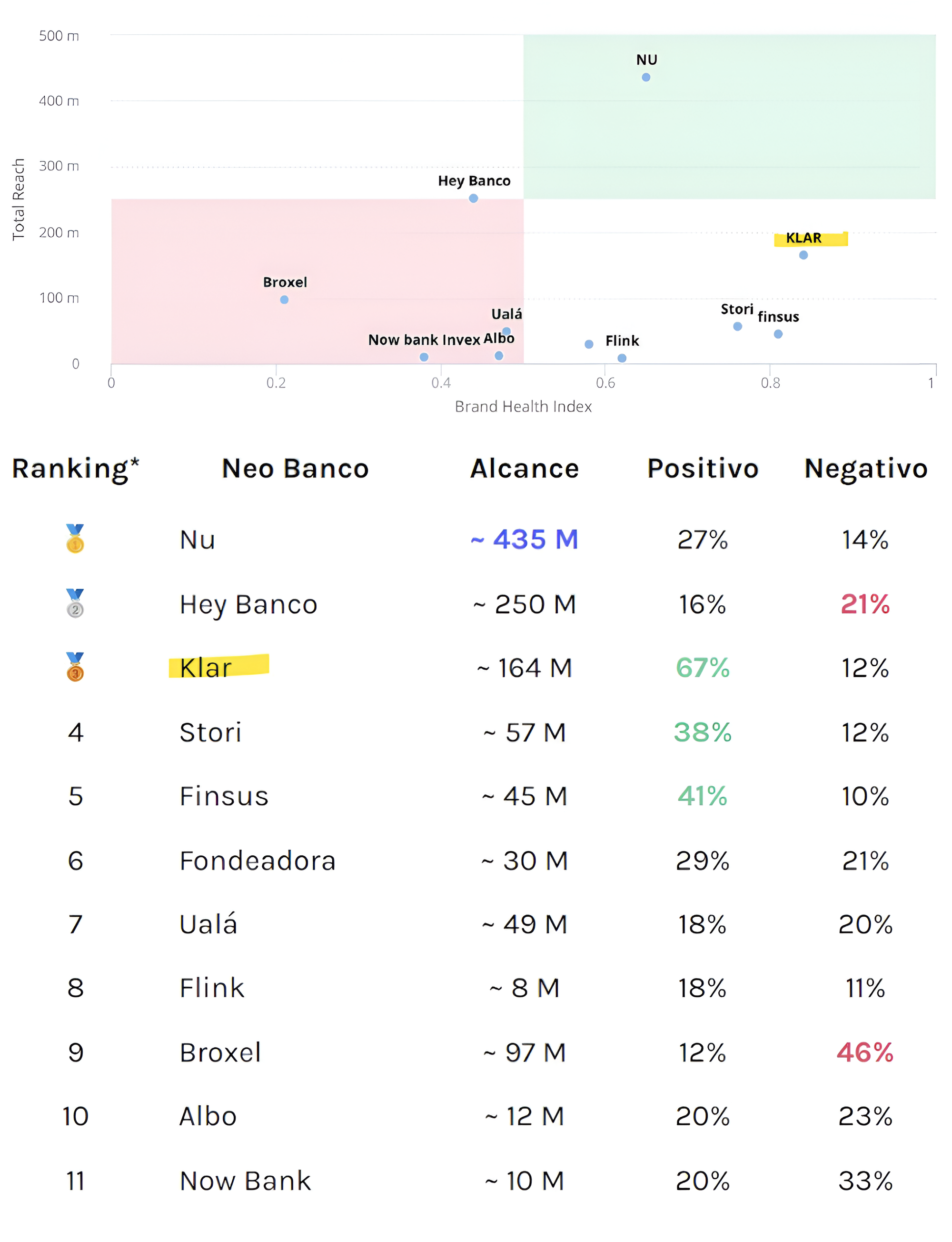

🇲🇽 Check out the results of a recent brand study on Neobanks in Mexico.

FINTECH NEWS

🇺🇸 Mastercard and Salesforce announce new integration to transform transaction disputes. The partnership will integrate Salesforce’s Financial Services Cloud (FSC) with Mastercard's dispute resolution services, providing a powerful one-stop-shop for intake, managing disputes, reporting and preventing chargebacks.

🇧🇭 stc pay, a mobile wallet for digital financial transactions in Bahrain, has partnered with Mastercard to launch the first Mastercard World prepaid card in the Kingdom: The stc pay Mastercard Elite card.

🇨🇴 A new alliance in the FinTech sector, between Minka and Refácil, aims to support over 700,000 small and medium-sized businesses in the country to reduce their use of cash, improve their financial management, and better administer their resources.

🇬🇧 Revolut opens job recruitment tools to companies on LinkedIn, enabling companies to use the toolkit to manage their application and hiring processes directly from the business and employment-focused social media platform.

🇬🇧 TRIVER and Experian join forces to boost lending to small and medium sized businesses. Leveraging Experian data solutions, TRIVER now offers an end-to-end automated application and approval process in as little as six minutes. Read on

🇳🇬 Visa has announced the 20 startups that will make up the second cohort of its Africa FinTech Accelerator. Nigeria has the most presence among the 20 startups, with six FinTechs selected for the second cohort.

🇮🇳 Pine Labs, a merchant commerce startup, has received approval from a Singapore court to merge its local entity with its Indian unit, and transfer all its assets and properties, effectively permitting the firm to shift its operations to India.

🇭🇰 US-based paytech company InComm Payments has announced it is offering gift cards for Roblox, an online game platform, at online and physical retailers in Hong Kong. InComm Payments first entered Hong Kong in 2012, offering point-of-sale activation (POSA) technology.

🇺🇸 Stash goes B2B with StashWorks: Stash has taken its popular investing and savings app to the workplace with a new employee benefit offering, StashWorks, which turns Stash's savings and investing offering into workplace benefit that rewards employees for saving money.

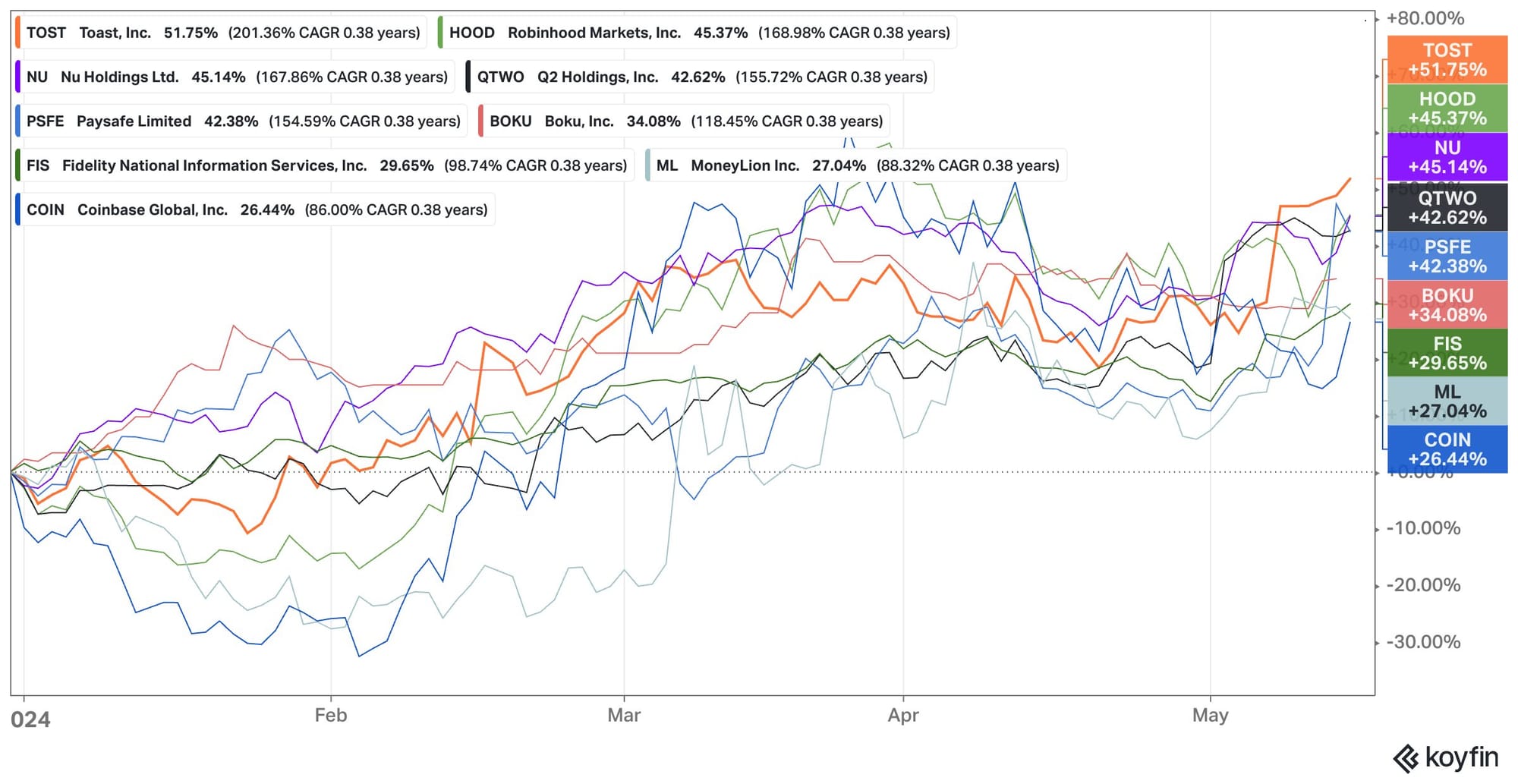

▶️ Health check after Q1 2024 earnings.

Top 10 performing FinTech companies year-to-date:

PAYMENTS NEWS

🇺🇸 NCR Voyix unveils Aloha Pay-At-Table. Given its seamless integration with Aloha POS by NCR Voyix, Aloha Pay-At-Table decreases time spent waiting and paying for the check while increasing efficiencies for guests, staff and restaurant owners.

🇺🇸 Payarc partners with AWS to develop payments Artificial Intelligence Platform. Leveraging AWS machine learning, generative artificial intelligence (gen AI), analytics, security, and business intelligence technologies, Payarc aims to redefine financial data analysis in the payment industry.

🇸🇬 Singapore tightens grip on digital payment token providers: What you need to know. The MAS of Singapore has recently announced stringent AML and CFT controls on digital payment token (DPT) service providers. Keep reading

🇺🇸 Restaurant technology provider Olo has expanded its partnership with TRAY to integrate Olo Pay card-present payment processing with TRAY’s point of sale (POS) system. This move is part of a larger integration with the Olo Engage product suite, designed to offer restaurants digitally personalised experiences for their guests.

DIGITAL BANKING NEWS

🇺🇸 Jamie Dimon hints he is preparing to retire as CEO of JPMorgan Chase. Dimon acknowledged that he will likely be leaving his role as chief executive officer of JPMorgan Chase in fewer than five years. Continue reading

🇬🇧 JPMorgan Chase to allocate £40 million into funding underserved communities in the UK to help connect young people and underserved communities to economic opportunities – bringing the firm’s total commitment since 2019 to £90 million.

🇩🇪 Deutsche Bank to offer discounted mortgages for climate-friendly houses. Deutsche Bank and the European Investment Bank Group have signed an agreement to promote climate-friendly new builds and energy-efficient home modernisation in Germany.

🇲🇾 Malysia's Bank Muamalat signs long-term deal with Backbase. This collaboration, together with Mambu for its core banking transformation, marks a significant milestone in Bank Muamalat’s journey to revolutionize its digital Islamic Banking offerings.

🇯🇲 Western Union adds Jamaica's two largest digital wallets to remitttance portfolio. Jamaicans can now access Western Union money transfer services through GraceKennedy’s GKOne mobile wallet app and Lynk’s mobile wallet app, giving customers the option to receive money digitally.

🇹🇭 The Bank of Thailand is working towards digital payments expansion. Thailand's PromptPay is a mobile banking and payment system that allows users to transfer money using their mobile phone number or National ID number. It was launched in 2017 and has since gained popularity in Thailand and beyond.

BLOCKCHAIN/CRYPTO NEWS

📈 Ethereum ETF approval raised to 75% chance by Bloomberg analysts. Ethereum just pumped 11%

DONEDEAL FUNDING NEWS

🇬🇧 GB Bank, which specialises in funding property projects for SME property developers and investors, has secured £85m of additional capital. Since becoming a fully licensed bank in August 2022, GB Bank has approved more than £80m in loans to support over 100 property projects in locations from Northumberland to the south coast. It has also attracted over £300m in deposits from savers for its competitive fixed term and instant access accounts.

🇬🇧 Revolut is lining up a $500m (£394m) secondary share sale. The sale may permit some of Revolut's employee-shareholders. However, early indications are that this privilege may be limited to members of Revolut's board.

🇲🇽 Mattilda, a Mexican startup specializing in Software as a Service (SaaS) solutions for payment management and financing for private schools, has secured a $14 million credit line extension from Addem Capital, a Mexican private equity firm.

🇮🇳 Niro, a Bengaluru-based FinTech startup, has raised $4.3m in a pre-Series B funding round, with contributions from the notable Japanese retailer, the Marui Group, among other existing backers. Notably, the investment amount might increase should more investors join.

MOVERS & SHAKERS

🇸🇦 Geidea, a payment service provider based in Riyadh, Saudi Arabia, has appointed former STC Pay head Abdulrahman Almutairi as its new group CTO. Almutairi brings over 20 years of experience across technology and financial services to his new role at Geidea.

🇿🇦 FinTech expert Bradwin Roper heads to Jumo. Seasoned financial services professional Roper has been appointed as chief: payments partnerships and member of the executive committee at Jumo. More on that here

🇺🇸 PayGround promotes Andy Rellihan to Chief Commercial Officer to lead strategic growth. Under Rellihan's leadership, PayGround is set to continue to redefine the healthcare payment experience, focusing on commercial growth and specifically targeting the acute market.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()