A New Fintech Unicorn, Revolut Ditches Crypto For Business, And Another Lawsuit For Apple, Mastercard, and Visa

Greetings FinTech Fanatic!

A class action lawsuit has been filed in East St. Louis, Illinois, targeting tech giant Apple and payment moguls Visa and Mastercard. The allegation? A conspiracy to monopolize the point-of-sale payment network services.

This lawsuit, spearheaded by beverage retailer Mirage Wine & Spirits, claims these companies colluded to suppress competition, resulting in inflated fees for credit and debit transactions at merchant locations. The crux of the matter lies in Apple's alleged agreements with Visa and Mastercard, which reportedly included a substantial exchange of transaction fees for purchases made via Apple’s Mobile Wallet. The suit goes as far as to describe these payments as a “very large and ongoing cash bribe,” amounting to hundreds of millions annually.

In contrast to Apple's restrictive ecosystem, Google's Android platform allows for more diverse mobile wallet options, further highlighting the competitive concerns raised in the lawsuit.

Apple is currently facing multiple legal battles across the United States and Europe, making this a pivotal moment for the industry.

Meanwhile, Goldman Sachs is navigating a challenging exit from its four-year credit card partnership with Apple.

The deal, initially seen as a lucrative venture, has turned risky and unprofitable, prompting Goldman to seek a buyer for its stake. However, the sale faces hurdles, with potential buyers expected to demand a lower valuation, reflecting the partnership's underperformance.

This potential writedown adds to Goldman's losses in consumer banking.

New bidders might also press Apple for access to its proprietary credit card data, though Apple maintains a strict policy against selling cardholder data.

Apple has proposed a plan allowing Goldman to withdraw from the contract within the next year, but details remain under wraps as both parties stay tight-lipped about the negotiations.

Shifting gears to the dynamic FinTech landscape in the Middle East, Tamara, a pioneering 'buy now pay later' platform in Saudi Arabia and the wider GCC region, has achieved a landmark feat.

The company recently secured a whopping $340 million in a funding round, catapulting its valuation to a staggering $1 billion - giving it unicorn 🦄 status.

This news arrives just ten months after Tamara received a substantial debt financing boost from giants like Goldman Sachs and Shorooq Partners, expanding its warehouse facility to $400 million.

Finally, breaking Revolut news. Check it out below👇

Stay tuned for more updates in the world of FinTech!

Cheers,

SPONSORED CONTENT

BREAKING NEWS

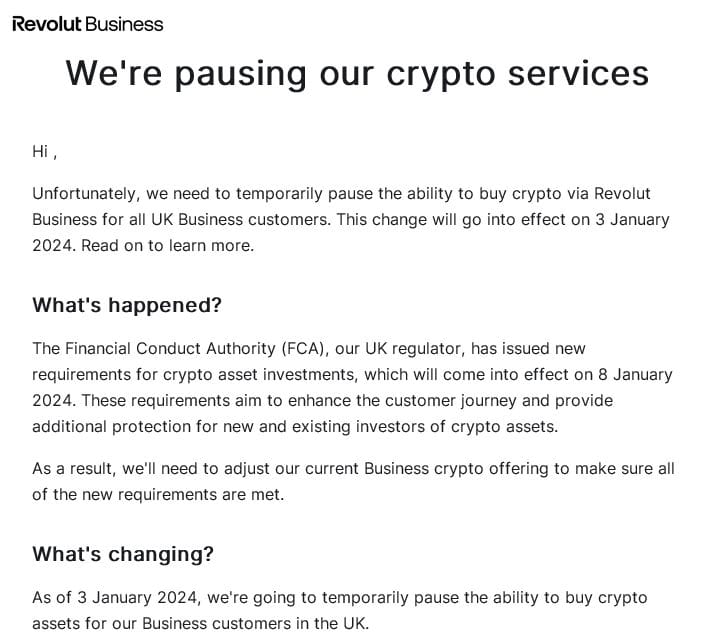

🇬🇧 Revolut Business suspends crypto services. Looks like Revolut is the latest to 'suspend' crypto services in the UK due to FCA's latest regulations. Jason Deane was the first to share this news on Twitter (X) earlier today (see the email he received from Revolut in the picture below👇

FEATURED NEWS

🇺🇸 Sale of Silicon Valley Bank’s old venture capital arm hits a snag. A process to sell the venture capital arm of bankrupt SVB Financial, the former parent of Silicon Valley Bank, has fallen flat and creditors are now gearing up for a potential takeover of the business.

FINTECH NEWS

🇧🇷 Vórtx, a key player in financial and capital market infrastructures, has recently been granted a Direct Credit Company (SCD) license by Brazil's Central Bank. In practice, the approval broadens the spectrum of activities for the infratech. That is to say, it completes the so-called "credit cycle.”

PAYMENTS NEWS

EPI successfully executes first instant payment transactions in Europe with wero between customers from Banque Populaire and Caisse d’Epargne (Groupe BPCE) in France and Sparkasse Elbe-Elster Bank in Germany. This successful demonstration shows the progress done by EPI in building its account-to-account (A2A) payment means based on SCT Inst and its digital wallet. Read more

🇺🇸 Buy now, pay later company Affirm pushes further into retail gift cards. The company said it is teaming up with a major provider of retail-branded gift cards to let shoppers purchase digital gift cards for the holiday season and pay for them with installment payments spread over as many as 12 months.

🇺🇸 Fraud emerges as concern for FedNow users. The Federal Reserve is weighing additional fraud-fighting tools as it takes feedback from users of the new instant payments system. Read more

Spain's Bizum in mobile payments deal with Italy's Bancomat, Portugal's SIBS: The three leading payments companies in Spain, Italy and Portugal said they would team up to allow users in the three countries to make instant mobile payments, in a push to help to develop a unified European payments market.

OPEN BANKING NEWS

🇧🇷 Belvo receives approval to operate payment initiation. The FinTech has recently received authorization to operate as a Payment Transaction Initiator (PTI) in Brazil. With Belvo, the number of institutions authorized to operate with the Pix modality in Open Finance reaches 27.4

Xero is partnering with Flinks to give access to more than 20 high-quality bank feeds in Xero. As Flinks expands its bank connections through direct APIs, users gain access to new bank feeds promptly. This reduces manual data entry and reconciliation time, ensuring an up-to-date financial overview.

DIGITAL BANKING NEWS.

🇦🇪 AstroLabs announces strategic collaboration with Wio Bank PJSC to facilitate business expansion in the Gulf through simplified banking processes. This partnership marks the beginning of a collaborative effort aimed at streamlining banking operations and enhancing the level of service provided to small and medium-sized enterprises (SMEs).

🇦🇺 ANZ first major bank to launch PayTo service for Billers. The first successful transaction on the service was completed with the Australian Bond Exchange (ABE) on 13 December, 2023. ANZ’s PayTo initiation service will allow businesses to send a payment agreement (a request to debit) to their customers via digital banking platforms.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase says it will challenge SEC crypto rulemaking rejection. In a post on X, Coinbase Chief Legal Officer Paul Grewal said that the exchange company will challenge the US SEC in a court filing. The decision to once again engage the SEC in the courts came after the SEC denied the crypto exchange’s rulemaking petition.

Circle and Fuze sign strategic partnership to expand the use of USDC across the Middle East and Africa. The firms have signed a MoU to explore digital assets initiatives. Circle will work alongside Fuze to expand the adoption of USDC amongst new customers in the region, such as banks, fintechs, traditional enterprises and Web3 firms.

DONEDEAL FUNDING NEWS

Here are Europe’s biggest fintech funding rounds of 2023. A few familiar faces are back again this year, but there were some new kids on the block showing up with big Series A rounds as well, putting the industry in a good place as we head into 2024.

🇺🇸 SupportPay lands $3.1M to deliver a unique employee benefit for parents, family members, and caregivers while expanding its consumer offering. New purpose-built employee benefit targets the single and divorced parents and caregivers who make up 73% of the total workforce. More on that here

MOVERS & SHAKERS

Udaan fires 120 employees within a week of raising $340 Mn. The downsizing has majorly affected staff across marketing, finance and operations. An Udaan spokesperson said that the company is working towards providing all requisite support to the impacted employees, which includes medical insurance and compensation package.

🇬🇧 Pockit appoints Garreth Griffith As Chief Operating Officer. Griffith will oversee Pockit’s day-to-day operations and assist in developing and delivering the next phase of Pockit’s growth strategy. He brings a wealth of fintech and payments experience to Pockit’s senior leadership team.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()