The 2024 Bitcoin Halving Explained: How It Works & Why It Matters

Hey FinTech Fanatic!

In the midst of Bitcoin's surging valuation, all eyes are on the upcoming Bitcoin halving event, stirring up widespread anticipation and speculation. But what exactly does this event entail, and why is it so crucial in 2024?

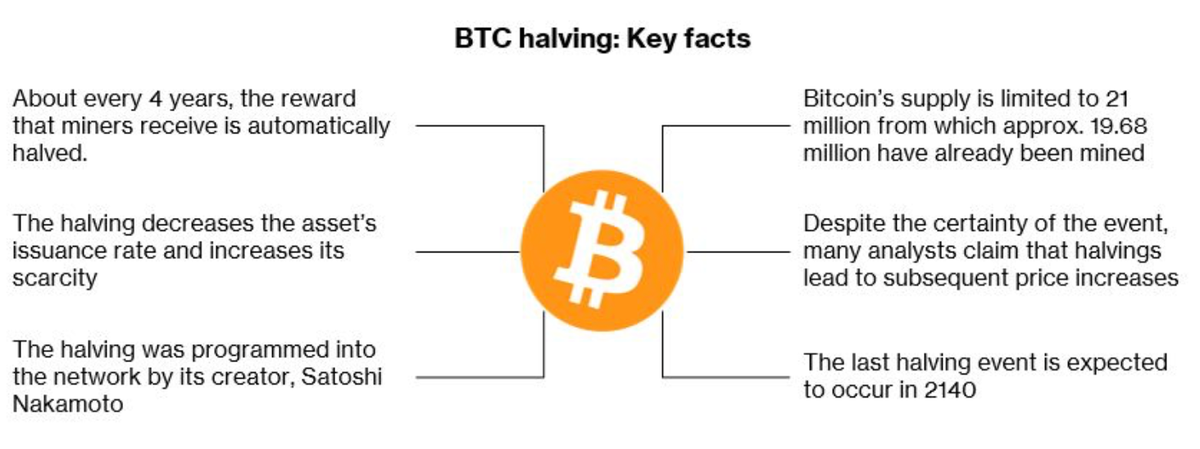

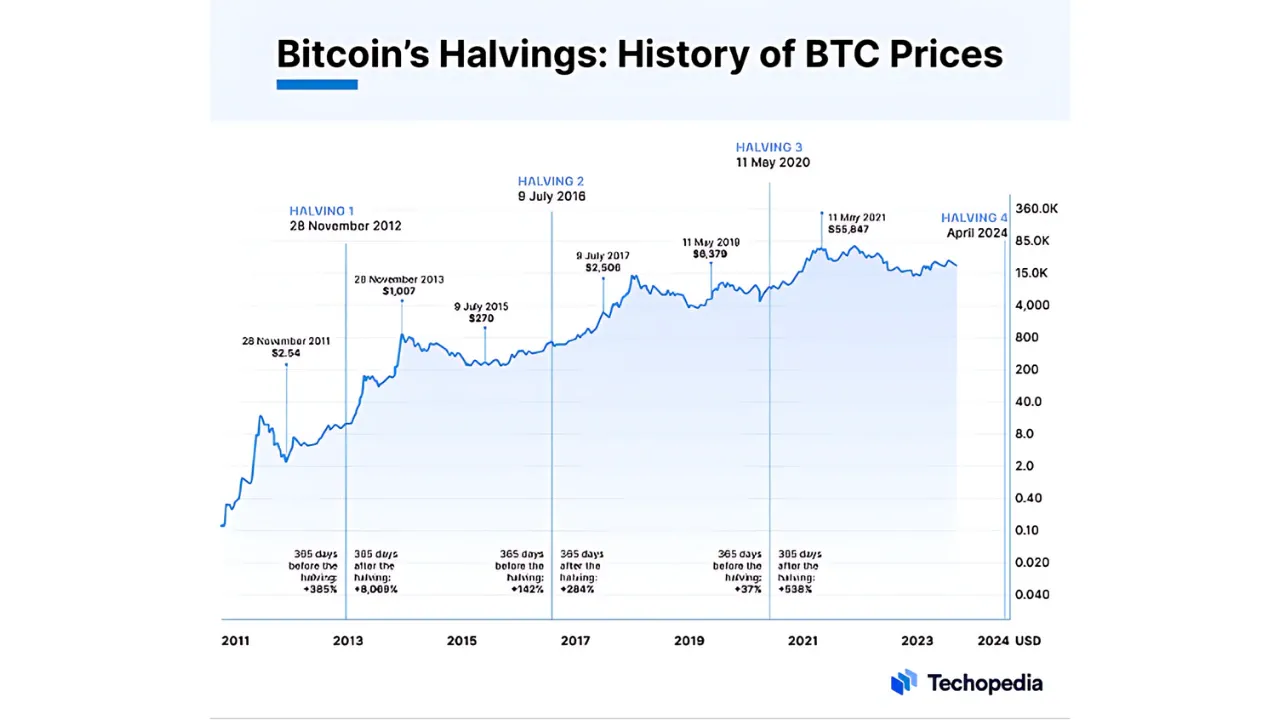

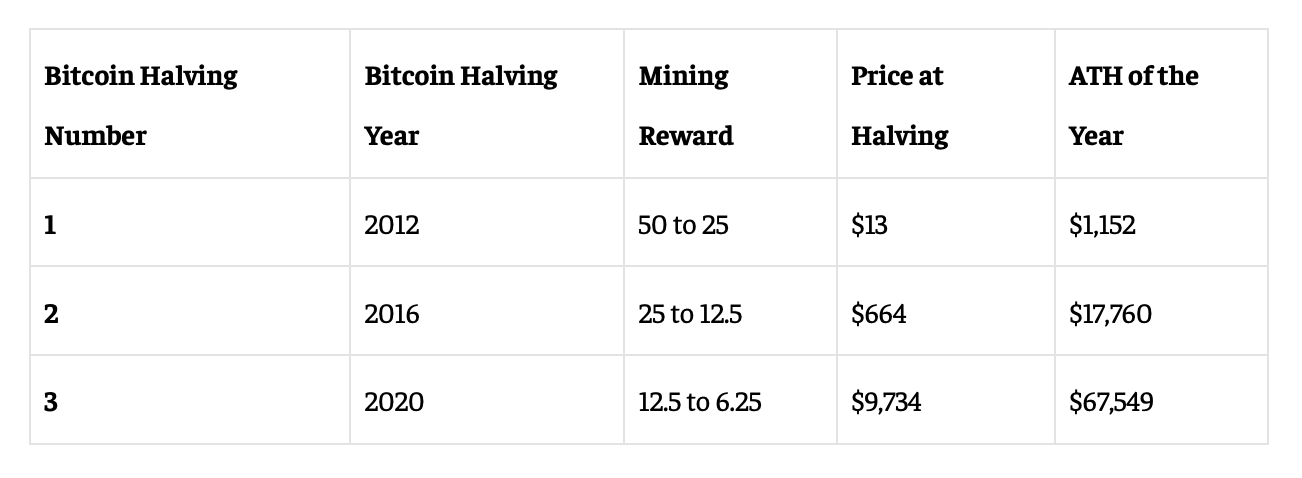

Bitcoin halving, occurring roughly every four years after the mining of every 210,000th block, slashes mining rewards by half. This reduction effectively slows down the introduction of new Bitcoins into circulation. The 2024 halving marks the fourth occurrence of this phenomenon, following its predecessors in 2012, 2016, and 2020.

Anticipation for the 2024 halving, slated for April 17, 2024, is palpable. Renowned figures like Robert Kiyosaki foresee Bitcoin soaring to $100,000 or even $200,000 by mid-2024, driven by factors such as potential SEC approval for a Bitcoin Spot ETF.

For miners, halving translates to a halved reward (this time from 6.25 to 3.125 BTC), prompting the need for enhanced efficiency and adaptation to fluctuating mining difficulty to maintain profitability. Yet, the halving's impact extends beyond miners, affecting investors and the broader crypto market.

The event is designed to be deflationary, curbing supply and heightening scarcity. As demand holds steady or rises, Bitcoin's value may surge over time. Already, we've witnessed significant price upticks preceding past halvings, indicating potential future gains.

To capitalize on this optimism, investors are advised to conduct thorough research, consider long-term investment strategies, and brace for potential market volatility surrounding the event.

Moreover, the 2024 halving is expected to fuel increased Bitcoin adoption globally, attracting new investors and potentially spurring regulatory scrutiny and mainstream acceptance.

In essence, the 2024 Bitcoin halving signifies a pivotal moment in the cryptocurrency realm, poised to reshape market dynamics, propel Bitcoin adoption, and catalyze regulatory developments with far-reaching implications for the global financial landscape.

Before we dive in to more Global FinTech News updates, I have one more note to my esteemed network in legal, risk, internal audit, and compliance: My friends (and founders of my portfolio company Confide) Pav Gill and Ryan Dougherty are currently seeking to deepen their collective understanding of the challenges and inefficiencies encountered in their fields.

Your unique perspectives are crucial not only for influencing policy and refining best practices but also for shaping the innovations they are developing at Confide® .

If you could dedicate 4-5 minutes to complete this survey, it would be immensely helpful.

Cheers,

#FINTECHREPORT

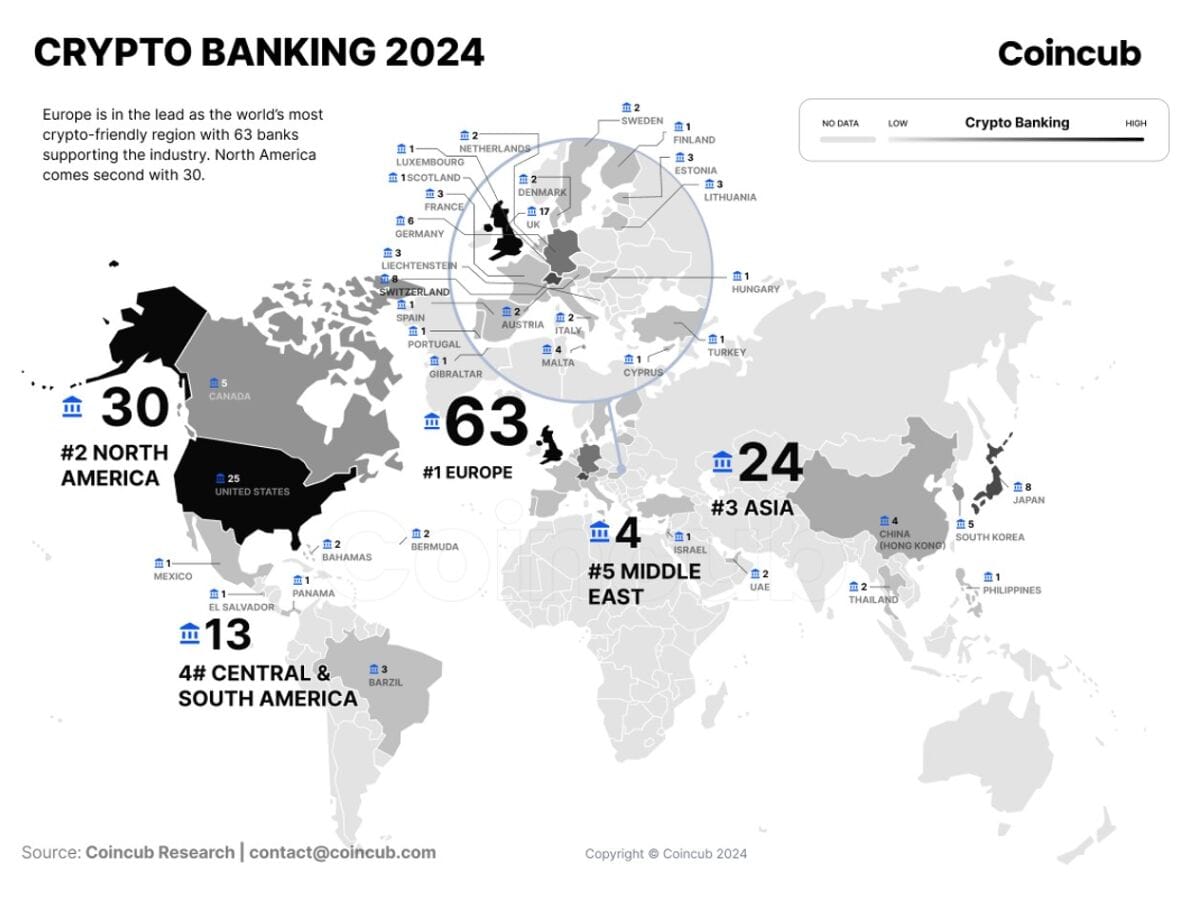

Crypto Banking Report 2024, by Coincub.

The map below shows the geography of crypto banking in 2024👇

FINTECH NEWS

🇨🇴 Colombian FinTech Finaktiva launches platform enabling companies to manage their treasury processes. The centralized financial management platform of Finaktiva allows businesses to monitor their invoices from a single place. Read on

🇿🇦 Mastercard has partnered with pan-African payments provider Onafriq to offer payment solutions to consumers and SMEs in Africa. In essence, the collaboration intends to enable Onafriq to use Mastercard technology for digital commerce purposes.

🇺🇸 Pipe launches embedded Capital-as-a-Service for small business. The new development in embedded finance is going to have a dramatic impact on small businesses all over the country. Read the full piece here

🇬🇧 Justt, the chargeback mitigation company, has announced the opening of its European headquarters in the heart of Camden Market, London. To anchor its expansion across the UK and EMEA, Justt has relocated seasoned employees from its Israel headquarters and has embarked on an ambitious recruitment drive to bolster the London office.

🇧🇷 FinTech Brasil Cash receives authorization from Central Bank to become Payment Institution in Brazil. The FinTech specializes in payment solutions and is now also targeting small merchants and self-employed professionals. Read more

🇯🇲 In a bid to provide Jamaicans in the Diaspora with an alternate way to connect with loved ones back home, Jamaican-owned, global remittance brand, JN Money, and GiftMe, a Jamaican gift card digital marketplace have partnered to allow persons to send e-gift cards to their loved ones in Jamaica.

🇨🇦 Interac acquires the exclusive Canadian rights to use Toronto-based Vouchr platform, enabling the development of future multi-media Interac e-Transfer notifications that can be customized by Canadians.

🇺🇸 Klarna is launching its credit card in the United States, the Swedish FinTech giant told TechCrunch in an exclusive interview: “It was one of our most asked for products,” said David Fock, Klarna’s chief product and design officer, “and will allow people to pay in the Klarna way but with a card.”

Cogo and Personetics announce partnership to accelerate planet-friendly. Customers will receive easy guidance on reducing their impact with lending and sustainable solutions to help them complete their personally recommended climate actions.

PAYMENTS NEWS

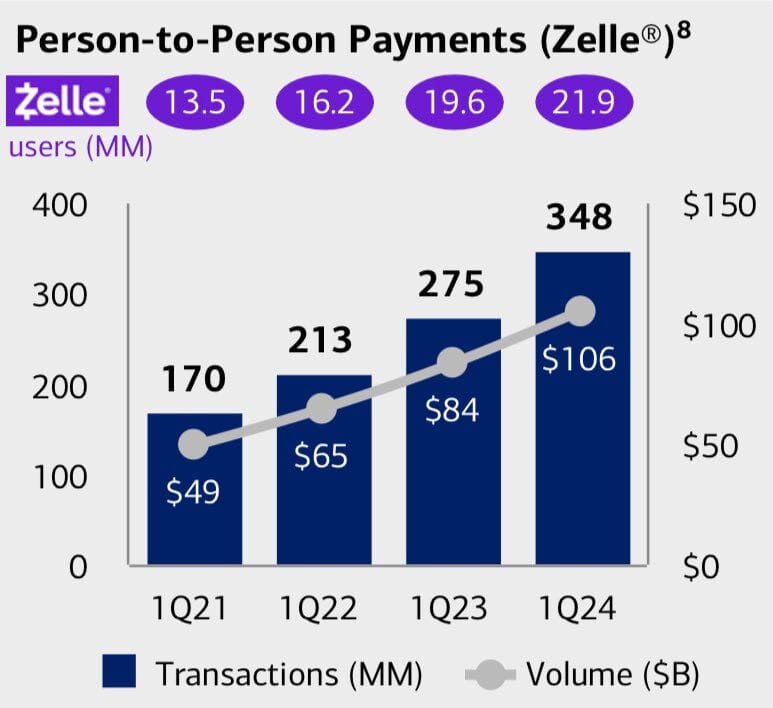

🇺🇸 Bank of America Q1 2024 results are in: Zelle P2P payment volume reaches $106 billion, up 26% YoY 🤯

🇱🇹 Kevin triumphs with first Account-to-Account NFC iPhone transaction. Pavel Sokolovas, co-founder of kevin, stated: “We’re immensely proud to be the first to provide account-to-account transactions using Apple’s NFC, giving consumers the power to choose how they pay.”

🇨🇦 The launch of Canada's oft-delayed Real-Time Rail (RTR) payments system will now not happen until at least 2026, with new tech partners IBM and CGI brought in to the process. Following the completion of a second review, the RTR programme will resume with "renewed momentum," says Payments Canada.

🇨🇳 Tencent further enhances digital payment services for visitors to China, with process streamlined and more overseas wallets linked. A series of measures are streamlining the process: It is now both more convenient and safe to register for a WeChat account, as well as quicker and easier to link international cards to Weixin Pay.

🇦🇺 Zip Co Q3 FY24 results are in. Take a look at the key highlights. Link here

DIGITAL BANKING NEWS

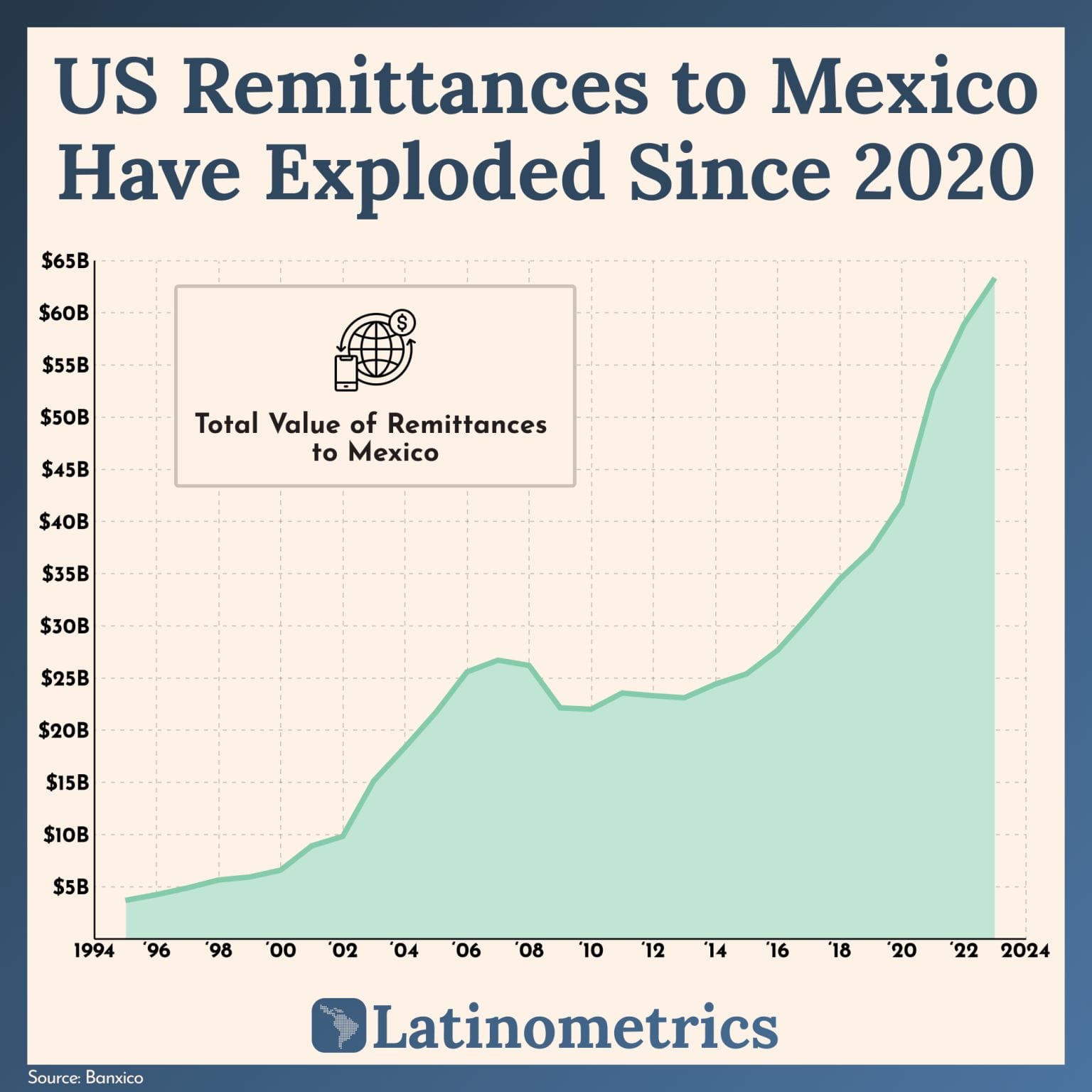

🇲🇽 46 months in a row remittance volume in Mexico has grown. The $63B that Mexicans abroad sent home last year is 70% more than pre-pandemic levels and almost 3x the amount they were sending ten years ago 🤯

🇺🇸 Bankjoy + Pinwheel partnership gives banks and credit unions easy access to the industry's most advanced digital deposit switching solution, Pinwheel Prime. Bankjoy customers can achieve account primacy by eliminating the friction that causes 90% of users to drop off. More here

🇬🇧 HSBC’s Zing clocked up 36k downloads in the UK after its launch in January, while Revolut and Wise attracted 𝟭.𝟭𝗺 (!) and 𝟮𝟬𝟯𝗸 (!) respectively. Zing CEO James Allan still claims it’s been a “fantastic start to the year”🤯

🇺🇸 Mercury, the FinTech over 100,000 startups use for banking, announced its expansion into consumer banking with the launch of Mercury Personal, a powerful personal banking experience designed with the best of today’s technology to help builders in tech optimize their money.

🇺🇸 Revolut changes partner bank in the US and began informing its customers about changing its card issuer and bank partner from Metropolitan Commercial Bank (MCB) to Community Federal Savings Bank (CFSB). Previously, Revolut was forced by its US banking partner (MCB) to trim down crypto offerings in the US.

Meanwhile in Brazil, 🇧🇷 The President of Banco do Brasil and Revolut emphasized the importance of addressing consumer issues in the most pleasant manner possible for them - whether they are in the remote areas or in the Brazilian metropolises. The Future of Banking was the main topic on the first day of Web Summit Rio.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 MetaMask taps rising embedded finance startup Mesh to aggregate crypto exchange accounts for wallet users. For the first time, users can seamlessly aggregate and track their crypto assets on exchanges from the MetaMask Portfolio.

Introducing Kraken Wallet, a self-custodial wallet by Kraken Digital Asset Exchange, the first major-exchange Wallet to be open-source at launch. Whether you’re a Kraken client or not, you can use multichain Kraken Wallet as your bridge to the decentralized financial system.

DONEDEAL FUNDING NEWS

🇿🇦 Telecommunications group, MTN, has announced plans to invest an additional R35 to R39 billion (approximately $1.8 billion) to boost its data and FinTech services offerings across Africa this year. This comes as the group’s active FinTech users rose to 72.5 million at the end of 2023.

🇮🇱 Data analytics provider Bridgewise raises $21M. The funding will further accelerate the expansion of Bridgewise's global presence and support the development of its ML-enabled recommendations. Read more

🇩🇰 Danish FinTech startup Flatpay raises €45M to simplify payment solutions for smaller merchants. Flatpay plans to use this funding to advance its goal of enhancing small businesses' operations by innovating new products, entering new markets, and prioritizing customer satisfaction.

🇲🇽 Nubank announced that it will increase Nu Mexico’s equity capitalization by US$100 million, raising its investment in the country to over US$1.4 billion dollars. This move solidifies the company position as one of the most significant foreign investors in the financial sector in the country.

🇨🇱 Chilean FinTech Toku announced the raising of US$9.3 million to solidify its presence in Chile, accelerate its development in Mexico, and expand into Brazil. This investment was led by Gradient Ventures, Google's investment fund. The FinTech expects to reach more than 600 corporate clients this year.

🇪🇨 Kamina, an Ecuadorian FinTech developing a financial prevention app, concluded a pre-seed round of US$3.2 million, becoming a record investment in Ecuador. This financial backing will enable the firm to solidify the launch of its financial prevention platform with Artificial Intelligence (AI).

🇩🇪 Pliant announces an €18+ million Series A extension financing led by PayPal Ventures, bringing its total Series A financing to more than €50 million. The company will use the funding to fuel expansion into the UK and other markets outside the EU.

M&A

🇳🇿 Buy-now pay-later (BNPL) firm Laybuy has put itself up for sale and is hunting for potential buyers following a turbulent few years on the public markets, City AM revealed. The Kiwi FinTech firm is looking to delist from the New Zealand’s junior stock exchange Catalist and move into private ownership.

🇺🇸 Cloud tokenisation provider TokenEx has announced its strategy to merge with IXOPAY to enable merchants to optimise the overall use of multiple payment processors. The merger is set to also deliver a complete unified payments platform, including omnichannel tokenisation, payment orchestration, and card lifecycle management.

🇺🇸 Huma Finance, a leading tokenization platform with a focus on real-world impact, and Arf, a global transaction services platform offering scalable liquidity for financial institutions, have merged to expand global blockchain-powered financial services. The new company aims to exceed $3 billion in on-chain liquidity volume by the end of 2024.

MOVERS & SHAKERS

🇺🇸 Ingo Payments welcomes Anita Hayrapetian as their new VP of Sales. With over a decade of FinTech experience, specializing in open banking and embedded finance, Anita brings invaluable expertise to the company.

🇸🇬 Crypto.com makes major hiring push. After significant layoffs in 2022 and 2023, crypto exchange Crypto.com is embarking on a hiring spree that could add 1400 staffers to its headcount.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()