Zilch Targets Acquisitions in IPO Run-Up

Hey FinTech Fanatic!

Zilch has reportedly begun scouting acquisition targets overseas, collaborating with advisers to pinpoint smaller international peers.

As reported by Sky News, the initiative is part of a broader effort to scale ahead of a public listing, potentially in London or New York.

In parallel, the company has been weighing a private share sale to secure additional funding, appointing Citi to lead the process.

Led by Co-Founder Philip Belamant, Zilch is valued at £1.5 billion, serves more than 5 million users, and brings in annual revenues exceeding £150 million.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🇮🇳 FinTech sector sees 5% y-o-y drop in funding to $889 million in H1 2025. The highest-valued deal in January-June 2025 was Groww's acquisition of Fisdom for $150 million, followed by Stocko, acquired by InCred Money for $35 million. Companies in the country saw 16 acquisitions in H1 2025, compared to 11 acquisitions in the year-ago period.

📈 FinTech funding surges past $2.2bn this week. The standout deal was a massive $1.5bn raise by UK-based Propel Finance, aimed at boosting SME lending in the UK, one of the largest single funding rounds in European FinTech this year. Keep reading

FINTECH NEWS

🇸🇦 FinTechs look to join the Saudi listing boom amid growing demand. Two Saudi Arabian FinTechs, Emkan Finance Co. and Tamweel Al Oula Co., are preparing to list in Riyadh to tap into the growing demand for FinTech services in the kingdom. Continue reading

🇨🇳 China issues first long-term non-bank payment licenses. The People's Bank of China (PBOC) has ushered in a new era for China's non-bank payment sector, announcing the first wave of renewed “long-term” payment business licenses for 13 institutions.

🇨🇭 Swissquote secures full ownership of Yuh after four years, buying out PostFinance’s 50% stake. The company has acquired full ownership of the digital platform, which is valued at CHF 180 million. Yuh has grown to over 342K accounts and reported its first annual profit of CHF 1.7 million in 2024.

PAYMENTS NEWS

🌍 How Getnet is driving its evolution and staying at the forefront of the sector with Rubén Justel, CEO of Getnet Europe. He said, “Getnet is a global payments platform focused on offering complete, secure, and efficient solutions for both small businesses and large international clients. Our value proposition is based on facilitating digital business growth through technological solutions.”

🇧🇪 SurePay rolls out Verification of Payee in Belgium, enabling the country's banks to perform mutual VoP checks with counterparts in the Netherlands. VoP is a security measure that verifies the identity of payment recipients before transactions are completed.

🇺🇸 Ramp launches enhanced corporate cards that integrate with accounting platforms. The new cards feature spending controls that can be customized by employees or departments, instant issuance of virtual and physical cards, fraud detection tools, and the ability to assign dedicated virtual cards for vendor subscriptions.

🇬🇧 Bank of England considers stablecoins for wholesale markets and shifts regulatory stance. Sasha Mills, Executive Director of Financial Market Infrastructure at the Bank of England, indicated a more receptive attitude towards stablecoins in wholesale markets during her speech at the City Week conference.

🇳🇱 Dutch card payments hit a new record as online use soars. The number of card payments made by Dutch consumers rose to 6.7 billion in 2024, up from 5.9 billion in 2022, according to figures from the Dutch central bank. The total value of these payments increased 15% to €198 billion.

🇧🇷 BC suspends Pix participants Transfeera, Nuoro Pay, and Soffy. The decision was taken as a result of the hacker attack that began over the weekend, with the invasion of C&M Software, which affected six institutions. The suspension was based on Article 95-A of BCB Resolution No. 30 of October 29, 2020.

🇬🇧 British FinTech Zilch on the hunt for overseas bid targets. The payments company is working with advisers to identify smaller international peers to acquire as part of efforts to expand ahead of a bumper stock market listing, Sky News learns. Read more

REGTECH NEWS

🇦🇺 AusPayNet launches public consultation on account-to-account payments. The consultation aims to identify the current and future payment needs and expectations of users, AusPayNet said in a statement posted on its website on 2 July 2025.

🇮🇳 MobiKwik arm secures SEBI nod to operate as a stockbroker. The license enables the MobiKwik subsidiary to carry out activities including buying, selling, dealing, and the clearing and settlement of equity trades. Its payments unit received authorization from the Reserve Bank of India to operate as an online payment aggregator.

🇩🇪 Hawk launches Fraud Day One Defense Models. The models are expected to safeguard an institution’s customers from the beginning with the use of the Hawk fraud platform, aiming to defend them against typologies ranging from authorized push payment fraud and merchant fraud to money mule behavior and account takeover.

DIGITAL BANKING NEWS

🇬🇧 Digital lender Zopa expands to Manchester in British banking push. Zopa will launch its Manchester office in August with an initial capacity of 50 staff, it said, as it seeks to increase its current 1.5 million customers and 5.5 billion pounds in deposits.

🇬🇧 Guaranty Trust plans a secondary listing in the UK. GTCO mentioned that led by Citigroup, would meet a central bank target for all banks to raise capital by March 2026. Lagos-listed is valued at USD 1.8 billion, and it aims to be the first Nigerian financial services firm to secure a secondary listing in London.

🇪🇸 BBVA launches Bitcoin and Ether trading and custody service for all retail customers in Spain. Customers can now use this service to trade in bitcoin and ether directly through the BBVA app, all within a fully integrated environment that also includes the bank’s other financial services.

BLOCKCHAIN/CRYPTO NEWS

🇪🇺 Gemini releases a new batch of Blue Chip, TradFi, and other tokenized stocks for EU customers. Tokenized stocks are blockchain-based digital tokens that represent a single share of an underlying company. These tokenized instruments aim to mirror the economic value of the underlying securities and, where permitted, may include rights such as dividends.

🇧🇷 Hackers behind $140M Brazil banking heist turn to crypto to launder their loot. A group of hackers that gained unauthorized access to the Central Bank of Brazil's service provider has started laundering a portion of its $140 million haul using cryptocurrencies.

PARTNERSHIPS

🌍 FinSei Ltd partners with FinHub.cloud to accelerate next-generation payment solutions across the UK and Europe. This collaboration will boost FinSei's scalability, security, and operational efficiency across the UK and Europe. Read more

🇩🇪 Lynck Solution GmbH and Mastercard jointly bring Open Banking payments "Pay by Bank" secured by Mastercard live for merchants. This collaboration marks a crucial milestone in redefining e-commerce payments for merchants and end customers. By integrating Mastercard Open Banking technology, Lynck is expanding its payment portfolio with a secure, flexible, and efficient digital payment method.

🌍 Ecobank and Google Cloud partner to boost African FinTech. The collaboration will harness the power of scalable cloud infrastructure, artificial intelligence (AI), and data analytics to expand access to financial services and develop new digital banking solutions.

🇺🇸 SBI Credit Guarantee goes live on nCino following rapid implementation. To launch this new business swiftly and efficiently, it was essential to adopt a business platform with built-in functionalities tailored to its operations. The SBI launch demonstrates a focus on operational agility and customer service in modern banking.

DONEDEAL FUNDING NEWS

🇺🇸 Telegram blockchain startup TOP raises $28.5 million as messaging platform expands crypto footprint. The Open Platform co-founder and CEO, Andrew Rogozov, plans to use the new injection of capital to expand the wallet into the U.S. and Europe.

M&A

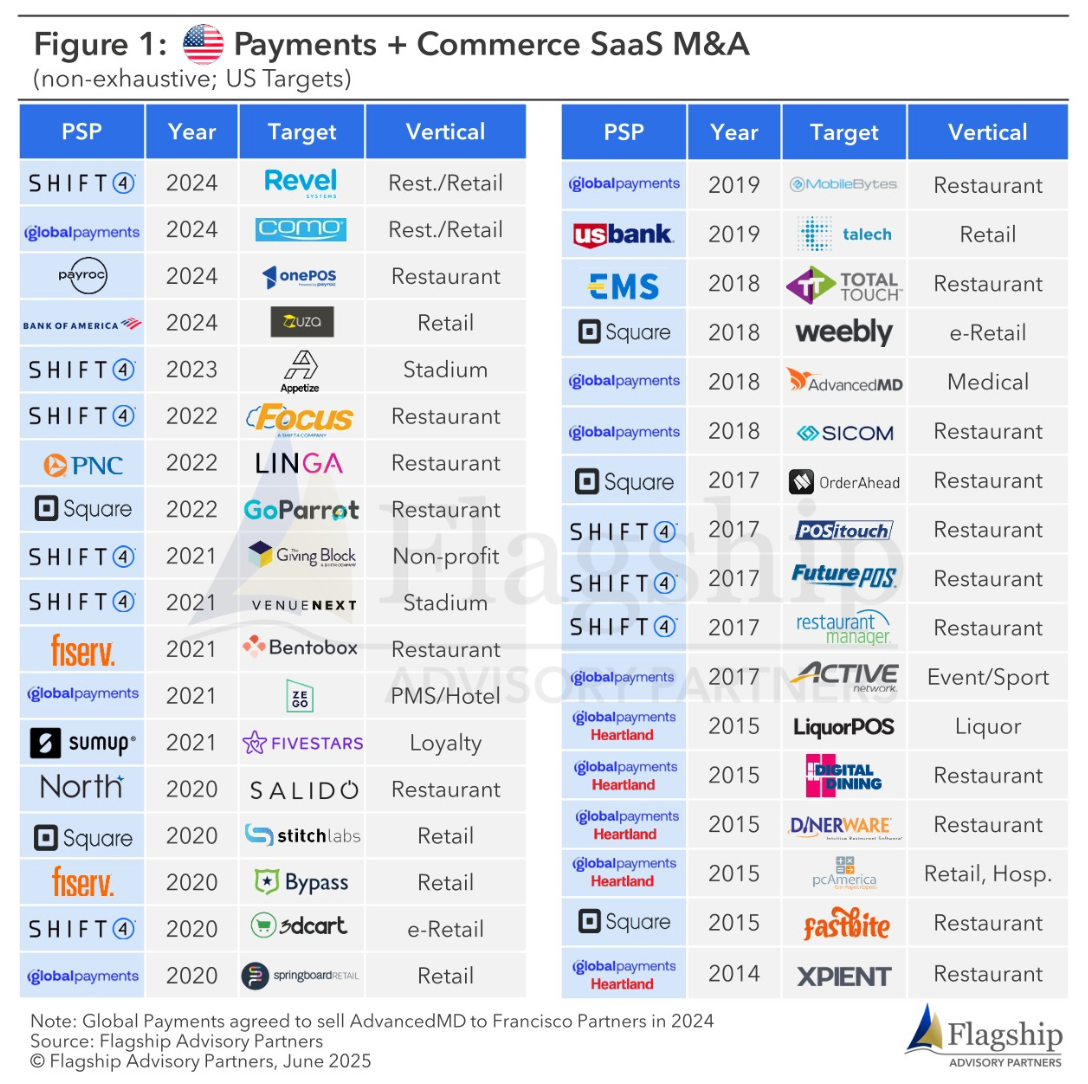

🌍 PSPs Buying Commerce Software is Accelerating in Europe.

🇨🇭 Shift4 Payments completes acquisition of Global Blue for $2.5bn. The transaction involved a tender offer by GT Holding 1, an indirect wholly owned subsidiary of Shift4, allowing the latter to purchase outstanding shares of Global Blue at $7.5 per share in cash.

MOVERS AND SHAKERS

🇨🇦 Interac appoints David Bruyea as Group Head and Financial Crimes. Bruyea will oversee the development and delivery of fraud prevention and detection services at Interac. His leadership will be instrumental in further strengthening the company’s core fraud capabilities and deepening collaboration with ecosystem partners.

🇵🇭 Tonik appoints digital lending veteran Mike Singh as President of Tendo. In his new role, Singh will lead Tendo as President, with full P&L ownership. Serve as Chief Strategy & Ecosystem Officer of Tonik Group, focused on scaling strategic partnerships and embedded finance.

🌍 Binance names Gillian Lynch as Head of Europe and the UK to lead strategic expansion. At Binance, Lynch will oversee the company’s strategy, day-to-day operations, and regulatory engagement efforts across the European and UK markets. Her role will involve driving regional growth and deepening relationships with policymakers and regulators.

🇬🇧 Apex Group names Helen Wang Chief AI and Data Science Officer. In her new role, Wang will lead Apex Group’s global AI and data science strategy, embedding intelligence across operations to deliver smarter, faster, and more secure services to clients.

🇧🇷 Nubank hires former Central Bank official Otávio Damaso as a consultant. Damaso will act as a permanent observer of the Audit and Risk Committee of Nu Holdings and the Risk Committee of Nu Brasil, in addition to advising the group as a consultant "on any issue related to business or risk environments."

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()