X to Launch Trading, Credit Cards, and X Money in Super App Push

Hey FinTech Fanatics!

X CEO Linda Yaccarino says users will soon be able to invest, trade, and manage their financial lives directly on the platform, marking the boldest step yet in Elon Musk’s plan to build an “everything app” modeled after China’s WeChat.

“Whether I can pay you for pizza or make an investment, that’s the future,” Yaccarino told the Financial Times.

Key Moves:

- X Money, a digital wallet with Visa as its launch partner, will roll out in the U.S. later this year.

- Users will be able to tip creators, buy merchandise, and store funds on-platform.

- A potential X credit or debit card is also in the works for release this year.

Yaccarino hinted that X Money is just the foundation for a broader fintech ecosystem on the platform, one that could eventually support investments, trading, and credit/debit cards. She confirmed the company is exploring launching its X-branded cards as early as this year.

“A whole commerce ecosystem and a financial ecosystem are going to emerge on the platform that do not exist today,” she said.

This financial layer would transform X into a real-time financial hub, connecting content, payments, and commerce, all within a single interface.

However, such a move will likely trigger regulatory scrutiny, as X will need to comply with money transmitter laws, KYC/AML obligations, and potentially obtain multiple state licenses.

Still, the ambitions are clear: X wants to own the rails of social and financial life, making it possible to post a meme, pay for lunch, invest in stocks, and tip your favorite creator, all without leaving the app.

Read more global FinTech industry updates below 👇 and I'll be back with more on Monday!

Cheers,

#FINTECHREPORT

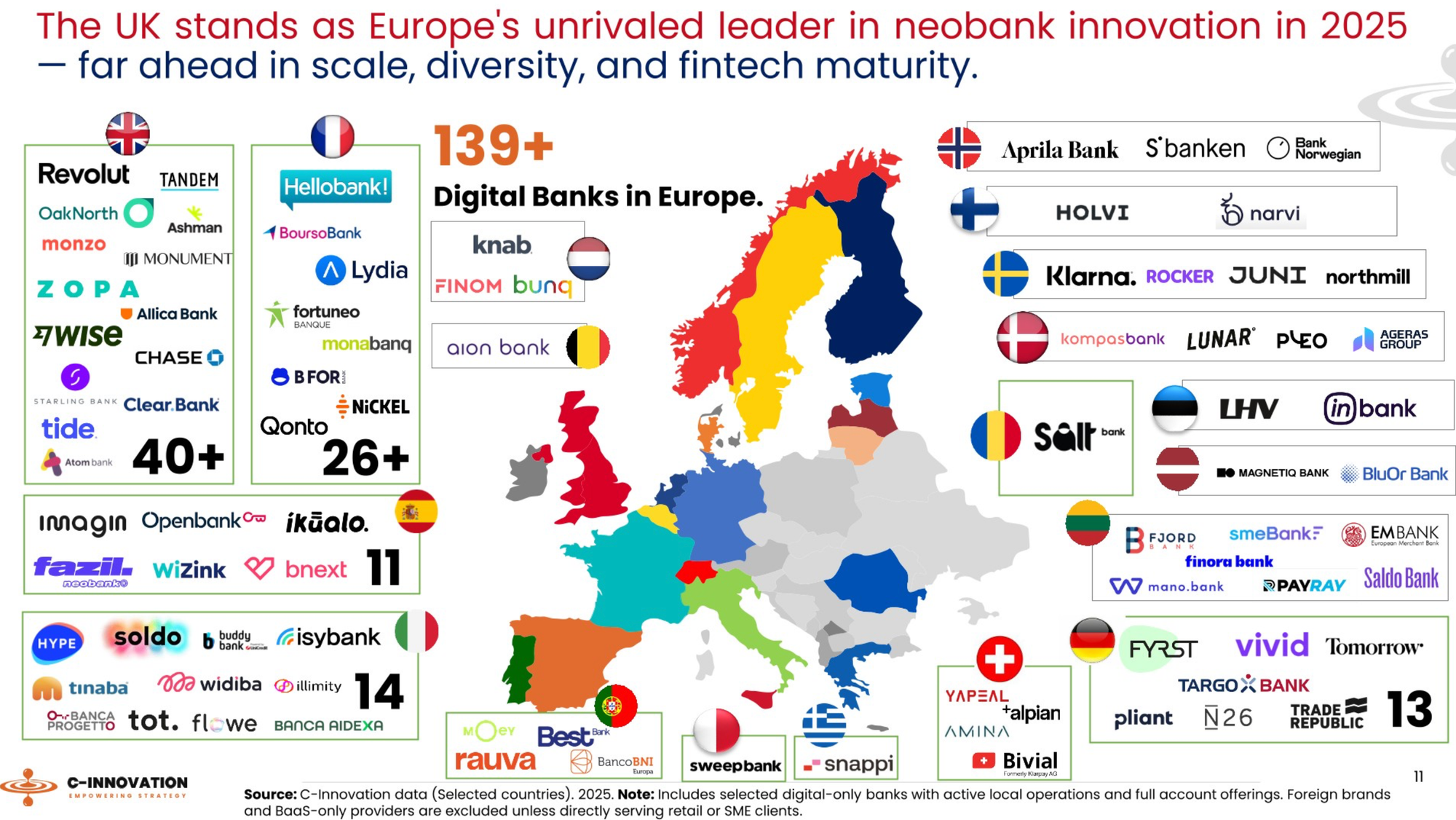

📊 The UK stands as Europe's unrivaled leader in neobank innovation in 2025.

Check this out👇 Any neobanks missing on this market map?

FINTECH NEWS

🇺🇸 FalconX considers IPO amid crypto sector surge. This move comes as the firm seeks to capitalize on the growing institutional interest in cryptocurrencies. The company has held early-stage discussions and informal talks with bankers and advisers to explore the IPO process.

🇰🇷 K-Bank launches third attempt at IPO, targeting $3.6 billion valuation. This is similar to the valuation it aimed for during its previous IPO attempt, based on the upper end of the indicative price range, and the company is once again seeking investors at that level.

🇺🇸 Coinbase launches Coinbase Payments to bring stablecoin commerce to the mainstream. The new system enables businesses to accept and settle USDC payments globally, instantly, and around the clock. This move aims to position Coinbase as a key player in the emerging digital payments sector.

🇺🇸 Elon Musk’s X to offer investment and trading in ‘super app’ push. X Chief Executive Linda Yaccarino has said that users will “soon” be able to make investments or trades on the social media platform, as she outlined a push into financial services in owner Elon Musk’s quest to build an “everything app”.

PAYMENTS NEWS

🇨🇱 KLog.co has introduced Kredit, developed in partnership with Getnet Chile by Santander, a new feature that allows customers to pay invoices directly on the platform using a credit card. Kredit simplifies the payment process. Clients receive a weekly email with pending invoices and can pay them online with just one click, receiving an instant receipt

🇨🇳 UOB Becomes Direct Participant in China’s Cross-Border Payment System. UOB will offer RMB clearing, settlement, and payment services to businesses and financial institutions in and outside China. The bank said this enables real-time gross settlement and reduces intermediary steps, helping clients lower payment and clearing costs.

🇧🇩 Google Pay is coming to Bangladesh. City Bank has announced that, in partnership with Mastercard and Visa, it is set to launch Google Wallet. Customers will be able to use Google Pay to enjoy seamless payment services, ensuring secure, tap-and-go purchases using their smartphones at any contactless terminal.

REGTECH NEWS

🇺🇸 Jumio rolls out Advanced Liveness Detection to combat deepfakes. The new solution builds on the recently launched in-house Jumio Liveness and is designed to enhance protection against sophisticated identity fraud tactics, including deepfakes and injection attacks.

🇬🇪 Bitget secures digital asset license in Georgia. The new licensing development is a strategic expansion aligned with Bitget’s plans of growing its licensing portfolio in Eastern Europe, a region increasingly dictating the growth of crypto through open regulatory frameworks and progressive economic outlooks.

DIGITAL BANKING NEWS

🇧🇷 Nubank is the main bank for 21.7% of Brazilians. Okiar Consultancy surveyed more than a thousand Brazilians to analyze users' relationships with financial institutions. The survey revealed that each Brazilian has, on average, four bank accounts, highlighting the multiplicity of options available on the market.

🇹🇭 Kakao Bank wins approval for Thailand's first virtual bank. Thailand's central bank said the digital lenders are expected to enhance customer experience, increase efficiency, and drive healthy competition through innovation and better pricing.

BLOCKCHAIN/CRYPTO NEWS

🇳🇷 Pacific nation Nauru passes law to establish a crypto regulator. The tiny Pacific nation of Nauru has passed legislation to establish a dedicated virtual asset regulatory authority covering crypto, digital banking, and Web3 innovation, aiming to become a crypto hub.

🇺🇸 Kraken launches Bitcoin staking through the Babylon Bitcoin staking protocol. The integration enables Kraken clients to earn passive rewards on their BTC without bridging, wrapping, or lending it out. Kraken clients can choose to stake their Bitcoin directly from Kraken through an integration with the Babylon Bitcoin staking protocol.

PARTNERSHIPS

🇬🇧 OnePay adopts Flagright’s AI-Powered AML and transaction monitoring platform. OnePay will gain real-time oversight of all customer transactions, including domestic transfers, card activity, and international payments. This partnership supports OnePay’s efforts to strengthen its compliance operations as it scales its services and navigates evolving regulatory expectations across the UK and EU.

🇰🇪 Chpter’s Flutterwave deal opens 11 new markets for WhatsApp-based selling. The deal allows Chpter customers to accept payments using mobile money, cards, and bank transfers. Merchants in the new countries can collect payments in local currencies or USD.

🇬🇧 Toqio and Adyen partner to accelerate embedded finance globally. Through this partnership, Adyen’s global acquiring infrastructure becomes available via the Toqio Marketplace, enhancing Toqio’s embedded finance proposition while enabling joint clients to rapidly deploy scalable, multi-market payment solutions.

🇨🇦 Zūm Rails partners with Western Union, facilitating real-time transactions from Canada to the world. The partnership will, in turn, enable the company to drive real-time movement of funds for Western Union customers using Interac eTransfer. With Interac eTransfer, customers can instantly fund their money transfers in Canada, then send the money anywhere in the world.

🇬🇧 D•One delivers open banking connectivity to JaJa Finance. The partnership will enable Jaja to enhance financial inclusion by using data beyond traditional credit decision-making methods, offering a comprehensive view of a customer’s financial health. This approach will ensure better outcomes for its customers.

🇬🇧 Salt Edge, Tuum, and LHV Bank partner to accelerate growth through secure open banking. The partnership between Tuum and Salt Edge aims to help financial institutions across Europe access the full spectrum of open banking features quickly and securely while enabling integration with an API-first and modular core banking platform. LHV Bank is one of the beneficiaries of this collaboration.

🇨🇭 Light Frame and Mambu launch strategic partnership to provide cloud-native core banking for the wealth industry. The collaboration offers a distinct advantage to banks as they shape and execute their strategy. Continue reading

🇸🇬 OKX and Consensys announce strategic partnership, integrating DEX API for MetaMask and MEV Protection for OKX Wallet. The partnership will enhance the on-chain trading experience for millions globally through expanded trading capabilities and advanced user safety features.

DONEDEAL FUNDING NEWS

🇮🇳 Venture Catalysts leads pre-Series A round in payment ring startup Seven. The proceeds will be used to scale production of the flagship 7 Ring, launch a more affordable variant called 7 Ring Air by Q2 FY26, and expand distribution through metro stations and e-commerce platforms like Amazon and Flipkart.

🇲🇾 Instapay Technologies raises RM13 million to expand remittance and B2B services. The funds will be used to expand its product offerings, enhance its cross-border payment capabilities, and support new market growth.

🇮🇳 Mahaveer Finance bags Rs 200 Cr. The latest capital injection is aimed at deepening the company’s presence across South India, expanding its technology infrastructure, and improving access to formal credit for small entrepreneurs currently reliant on informal moneylenders.

🇳🇱 Dutch FinTech startup Delfio raises €1.5 million for automation platform. Delfio is a data-driven procurement platform that organises collective purchasing for professional buyers across Europe. By aggregating demand from multiple buyers, it creates joint purchasing power, resulting in more competitive offers.

🇬🇧 FX FinTech Glyde raises £450k to reshape global transfers. The new capital will be used to expand Glyde’s engineering team, speed up product development, and grow the company’s presence in the UK and international markets. Continue reading

M&A

🇮🇳 Jio Financial Services takes full control of Jio Payments Bank with Rs 104.5 crore SBI stake buy. This follows RBI approval and coincides with Jio BlackRock's launch of mutual fund schemes, aiming to offer innovative investment products. The company reported a slight increase in net profit and revenue for Q4 FY25.

🇮🇹 Fabrick completes acquisition of finAPI. The acquisition, authorized by regulatory authorities, expands the international perspective of Fabrick and enables the development of synergies for innovation in digital payments across Europe. Read more

MOVERS AND SHAKERS

🇷🇴 Revolut announces changes in Romanian branch management team. Gabriela Simion has recently stepped into a new role at the group level, leading the Global Credit Insurance business. Gianmaria Scocca will oversee the operations of the RBUAB Vilnius Bucharest Branch. It has appointed Tamer Nurla as the Deputy Branch Manager.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()