Worldline Under Pressure Following “Dirty Payments” Allegations

Hey FinTech Fanatic!

Let's kick things off with some exciting news: my portfolio company, Confide Platform, has been nominated for the Asia FinTech Awards in not just one, but two categories: RegTech of the Year and Startup of the Year.

A huge congratulations to the entire team, and especially to the brilliant founders, Pav Gill and Ryan Dougherty. It's another strong signal that I'm not the only one who sees a bright future ahead for these guys.

The winners will be announced in late August. I'll keep you posted!

By the way, did you know Confide’s Co-founder & CEO, Pav Gill, was the whistleblower in the Wirecard case? Now, you might be wondering why I’m bringing this up.

Well, that’s because Worldline’s "Dirty Payments" investigation, reported yesterday, sounded a bit familiar to some of my followers (see comments). Hopefully, it’s not a Wirecard 2.0…

Based on confidential internal documents and data, Worldline is alleged to have accepted "questionable" clients across Europe, including pornography, gambling, and dating sites.

NRC reported that in some cases, transactions linked to suspicious activity were overlooked to preserve what insiders described as "good money."

In response, Worldline said it began a "thorough review" of its high-brand-risk portfolio back in 2023. That review now includes enhanced compliance controls, tighter documentation, and stricter oversight measures.

The company reiterated its "zero-tolerance" stance, emphasizing a full commitment to regulatory standards and risk prevention.

Its shares fell nearly 38% before trading was halted. Let's see what will come from this...

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

#FINTECHREPORT

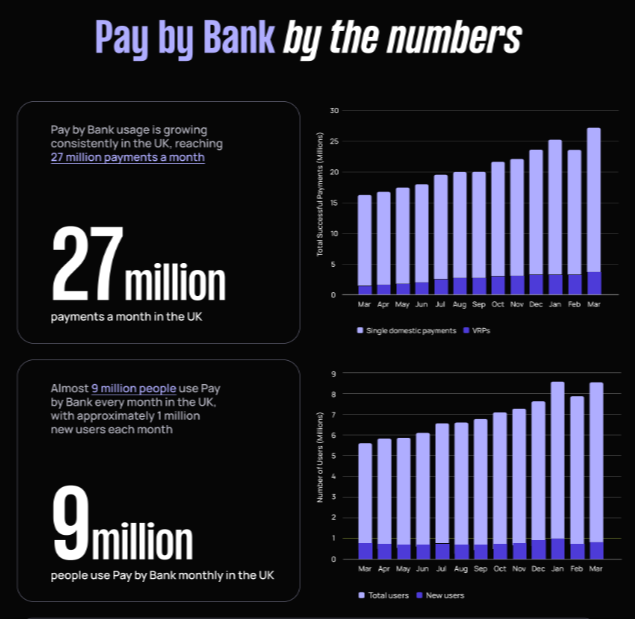

📊The Pay By Bank update 2025 report by TrueLayer.

INSIGHTS

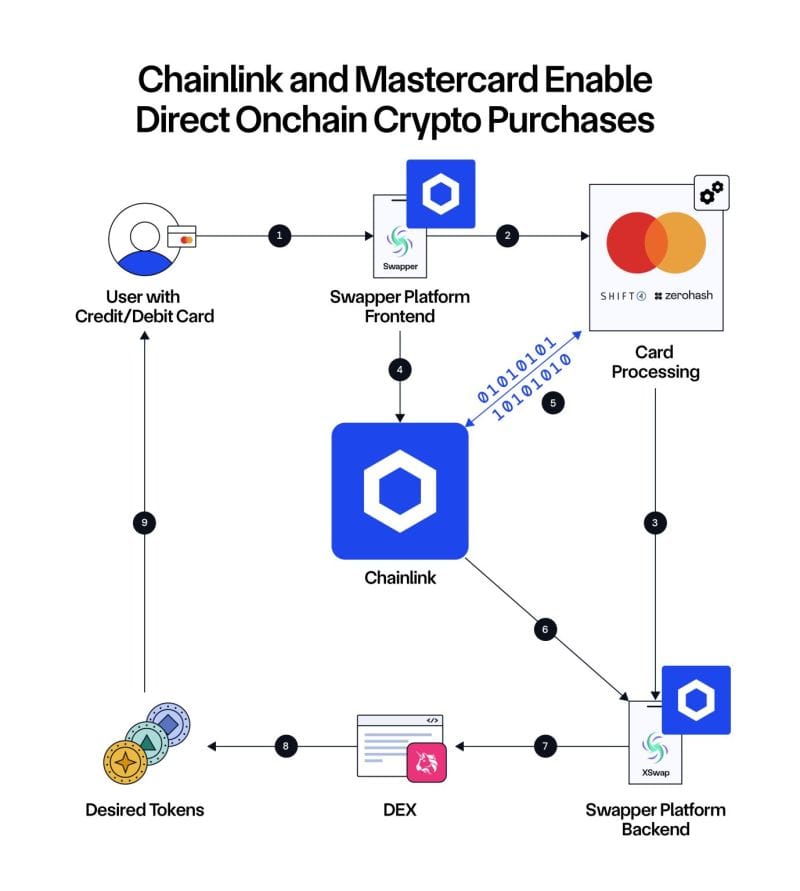

➡️ How Mastercard and Chainlink Labs enable on-chain crypto purchases using Mastercard's 3.5 billion cards.

FINTECH NEWS

🇺🇸 Crypto firm BitGo’s assets in custody surpass $100 billion. Its assets under custody have increased from $60 billion to $100 billion in the first half of 2025, driven by rising crypto adoption and regulatory clarity. It is considering an IPO as soon as the second half of this year and plans to go live in Dubai in 2025.

🇬🇧 eToro’s aggressive debit card deal, UK customers can get 4% back in stocks. According to the eToro Money website, the platform will allow debit card holders to earn up to £1,500 in stocks as monthly cashback rewards. They can either sell the awarded stocks or keep them as investments.

🇺🇸 New Zealand's Xero to buy US FinTech Melio for $2.5 billion. The deal enables a step change in Xero’s North America scale and the potential to help millions of US (small-to-medium businesses) and their accountants better manage their cash flow and accounting on one platform.

🇺🇸 SoFi reintroduces crypto investing and launches global remittances. It plans to offer crypto spot trading, allowing customers to buy, sell, and hold cryptocurrencies such as Bitcoin and Ethereum in their accounts. Additionally, it will introduce global remittances on its app, enabling international money transfers via a blockchain-based process.

PAYMENTS NEWS

🇦🇺 Tyro Payments removes Senior Leader from website amid speculation. Tyro's CEO & Managing Director, announced his departure earlier this month to a leadership role outside of the financial sector. But he stated that he will remain in his current position for up to 6 months as the company searches for a successor.

🇳🇱 Payment processor Worldline knowingly protected fraudulent webshops for years. It offers similar services to Adyen or Klarna, mainly enabling payments for online shops, as well as in physical stores. The law requires these payment companies to prevent fraudulent customers from using their systems for criminal money flows.

🇰🇷 South Korea’s central bank wants a gradual stablecoin rollout. Bank of Korea Governor Ryoo Sangdai wants banks to be the primary issuers of stablecoins in the country before gradually expanding to other sectors. “The aim is to establish a safety net, considering the potential for market disruption or consumer harm”, he said.

🇵🇱 Polish FinTech Blik bets on Erste entry to speed up foreign expansion. Blik's founders plan to invite major banking groups to invest in a planned capital increase, which may lead to these banks adding Blik to their platforms and provide a fresh valuation for the FinTech.

🌍 Mastercard unveils AI-powered card reissuance fraud prevention service in EEMEA. Dubbed ‘Account Intelligence Reissuance,’ the new Mastercard product will leverage its AI technology and network purview to crack down on card fraud that costs card issuers and merchants billions of dollars each year.

🇨🇦 Airwallex gains momentum in Canada as demand for global payments grows. The company has significantly grown its Canadian operations with the launch of services in Quebec in May 2025, making it one of the few FinTechs operating in the province, and a rapidly expanding Toronto team that continues to scale.

DIGITAL BANKING NEWS

🇧🇷 Nubank prepares the arrival of a physical chip at NuCel. Analysts point out that NuCel users can now order a physical SIM directly through the Nubank platform, with home delivery at no additional cost. With the physical chip, it will be possible to increase the addressable base of the offer.

🇰🇷 KakaoBank targets stablecoin market with 12 trademark filings. It has filed multiple trademark applications related to its stablecoin business in a bid to secure first-mover advantage in the fast-growing market. The applications cover three categories: cryptocurrency-related software, cryptocurrency financial-transaction services, and cryptocurrency mining.

🇲🇽 Nu, Revolut, and other neobanks will take time to become profitable. The new digital banks in Mexico will face pressures on profitability and asset quality "for a considerable time" as they go through the process of entering the market and establishing themselves, according to Fitch Ratings.

🇺🇸 DXC and Thought Machine partner to accelerate banking modernisation. By leveraging DCX’s full-service management and Thought Machine’s core banking technology, the solution aims to enable banks to accelerate time to market for new digital products.

PARTNERSHIPS

🇬🇧 Ecommpay embraces Visa instalments. Visa Instalments enables merchants to offer consumers the facility to split their purchase amounts into convenient, fixed payments over time using their existing eligible Visa credit cards, which have already been subject to affordability checks.

🇺🇸 FalconX joins Crypto.com as a partner for Lynq institutional settlement network. FalconX, which says it has access to over 400 tokens, will act as both a participant and a liquidity provider on the Lynq network. Lynq aims to provide a solution that deals with evolving regulatory frameworks and counterparty risk.

🇲🇦 VPS and Mastercard team up to advance digital payments in Morocco. The collaboration will seek to improve financial inclusion metrics while offering a raft of upsides to both parties. The partnership will see Mastercard grow its market share in Morocco via the addition of Mastercard-branded cards across several verticals.

🇲🇾 PayNet partners Alipay+ and Weixin Pay to boost tourist spending in Malaysia. The collaboration involves three summer campaigns linked to the DuitNow QR payment system, which allows users to transact using their existing mobile wallets across a network of more than 2.5 million merchants.

🇬🇧 10x Banking goes for growth in APAC with Constantinople tie-up. The collaboration sees two major technology companies coming together to provide banks, mutuals, and financial institutions around the world with access to best-in-class banking technology architecture and solutions.

DONEDEAL FUNDING NEWS

🇫🇷 Financial marketplace for retirees Skarlett raises €8 million. With this new funding, it aims to launch its tailor-made financial products, improve the customer experience, leverage AI to enhance satisfaction, and deliver truly personalized recommendations.

🇦🇪 UAE’s Related raises USD 8M to scale loyalty and rewards solutions from Saudi’s investment firm Equivator. The investment will fuel Related’s tech development in AI and blockchain while supporting Saudi Arabia’s FinTech and customer engagement goals.

🌎 US wealthtech Waltz preps LatAm launch with new $25M credit line. Waltz says it plans to use part of its capital allocation to finance up to $1 billion in loan volume, also to support an official launch in Latin America, with a focus on establishing operations in Mexico, Brazil, Colombia, and Argentina.

🇺🇸 Polymarket set for $200M raise at $1B valuation. The latest funding round comes after the prediction platform announced a partnership with Elon Musk’s social media platform X in early June. The two companies aim to combine Polymarket’s prediction markets with analysis from the artificial intelligence chatbot Grok.

🇺🇸 DeFi company Blueprint Finance raises $9.5 million from Polychain Capital. Blueprint Finance will spend the money raised in this round on hiring new employees, engineering, and marketing. Keep reading

🇮🇳 Business-payments platform Pazy raises pre-seed funding round. The proceeds will be used to expand product capabilities, integrate deeper into the ecosystem, and scale the platform to Rs 10,000 crore in annual spend under management over the next year, Pazy said in a press release.

🇺🇸 Zama raises $57M in Series B to bring end-to-end encryption to public blockchains. The new funding will support Zama’s mainnet launch, ecosystem adoption, and research efforts to make financial applications built with FHE scale to thousands of transactions per second.

M&A

🇺🇸 Capchase acquires Vartana to redefine the future of vendor financing. This strategic milestone positions Capchase as the clear category leader in modern vendor financing, uniquely equipped to increase access to working capital and accelerate sales in a heavily manual and outdated industry.

🇺🇸 Acorns accelerates family strategy with acquisition of Zeta. With this acquisition, Acorns welcomes Zeta cofounders Kevin Hopkins and Aditi Shekar to the team. They bring deep experience in the couples and family space, which is especially meaningful as Acorns accelerates its family product strategy.

🇦🇺 Humm Group shares soar after chair makes $286M acquisition bid. TAG, which already owns 26.6% of Humm, proposes to buy the remaining shares at $0.58 each, a 17.2% premium, valuing the company at around $285.6 million. An independent board committee has granted TAG a four-week due diligence period to potentially formalize the offer.

💰 Monaco Bank with ties to Prince Andrew nears sale to FinTech investors. The buyers are seeking regulatory approval to finalize the acquisition and plan to transform the business into a wealth-focused financial technology company under a new name.

MOVERS AND SHAKERS

🇺🇸 Deirdre Stanley to join PayPal’s Board of Directors. Stanley brings nearly three decades of experience as a senior executive for global organizations spanning the consumer, media, and information technology sectors. She most recently served as Executive Vice President and General Counsel of The Estée Lauder Companies.

🇮🇳 PhonePe hires JPMorgan Chase, Citigroup, Morgan Stanley, and Kotak as IPO bankers. The UPI payments giant is targeting a $1.5 billion raise in the IPO, potentially pushing its valuation to $15 billion. The company is expected to file its draft red herring prospectus by August, with the listing anticipated later this year.

🌏 Tim Poskitt has joined Ethoca, a Mastercard company, as Director of Asia Pacific Sales. With over 20 years of experience in banking and FinTech, his background aligns well with Ethoca’s focus on digital transparency, fraud mitigation, and customer experience.

🇺🇸 Ovanti appoints ZIP leader Peter Maher to drive US expansion. He is set to start his new role on July 14, subject to serving the remainder of his notice period. He is known for building and scaling high-performance teams, driving technology-led growth, and operationalising new market entry in regulated financial environments.

🇩🇪 Qonto names Malte Dous Managing Director for Central Europe. In this role, he will oversee the company’s operations in Germany and lead expansion efforts in neighbouring markets such as Austria. He will also focus on product enhancements and local partnerships aimed at meeting the specific needs of German businesses.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()