Wise’s U.S. Switch Lands Blow to London’s Stock Exchange

Hey FinTech Fanatic!

The UK took another hit this week as Wise, one of its standout FinTech names, announced plans to shift its primary listing from London to New York. While the move includes a dual listing, keeping London as a secondary venue, it highlights deeper concerns surrounding the London Stock Exchange.

Wise’s decision reflects growing pressure on London’s capital markets, where limited liquidity and lower valuations have led several firms to reconsider their future.

According to Wise, the shift is mainly about access to more capital and to a wider investor base. “We believe the addition of a primary US listing would help us accelerate our mission and bring substantial strategic and capital market benefits to Wise and our owners,” said co-founder and CEO Kristo Käärmann.

It’s not a full departure, but symbolically, it matters. London, once the undisputed financial center of Europe, no longer offers the depth some companies need. The U.S. remains the go-to destination for firms seeking scale, visibility, and investor engagement. Wise pointed out that many American retail and institutional investors currently lack access to its stock, a gap the new structure aims to close.

Wise went public in London in 2021, choosing a direct listing route that, at the time, was hailed as a win for the UK’s ambitions to become a magnet for global tech IPOs. Now, only 3 years later, the company is valued at £11.07 billion and is making a decisive move across the Atlantic.

This isn’t just a story about one FinTech’s listing strategy. Revolut, Monzo, OakNorth, and others may also be looking across the Atlantic... why else would the UK Treasury meet with them just last month?

Read more global FinTech industry updates below 👇 and I'll be back with more on Monday!

Cheers,

FEATURED NEWS

🇺🇸 Wise is planning to list its shares in the US, the latest blow to London’s stock market. Wise said the move will allow institutional and retail investors in the US to purchase its shares, noting that many of them are currently unable to do so. The move should increase liquidity in the firm’s stock, allowing current shareholders greater flexibility and opportunity to buy and hold our shares.

FINTECH NEWS

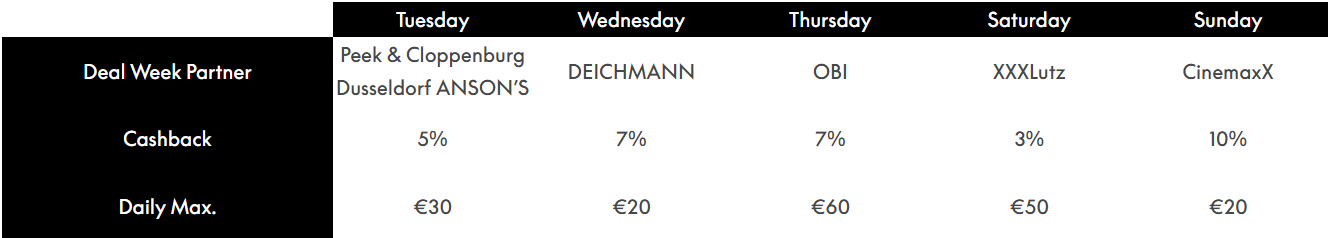

🇩🇪 PayPal launches ‘Deal Week’ in-store rewards at 2,000 locations. On different days of the week, customers can earn up to 10% cashback when they pay contactless in-store with the PayPal app. The offers recur every week, allowing consumers to earn hundreds of euros in cashback each month.

🇪🇸 Trade Republic reaches 1 million customers in Spain. It rolls out its Spanish banking offering, challenging local banks with Spanish IBANs, 2.25% interest uncapped on all cash deposits, mutual funds, and automated tax withholding. Continue reading

🇬🇧 UK Rap Icon JME teams up with new FinTech platform Strade Base to launch a new era in music investment. At its core, Strade Base is about empowerment, giving artists greater control over their earnings while inviting fans and supporters to participate directly in their success.

🇩🇪 Germany’s N26 weighs new funding round that allows partial exit. The bank is considering a new funding round at a reduced valuation that could allow some of its existing investors, including Coatue Management, Third Point, and Dragoneer Investment, to recoup part of their investment.

PAYMENTS NEWS

🌎 ProntoPaga Launches SMARTPIX and Expands Payment Innovation Across Latin America. It allows operators to process high-volume transactions directly from their bank accounts. This eliminates exposure to third-party handling, reduces latency, enhances availability, and ensures total control and security for merchants.

🇸🇪 Klarna saved $2 million after cutting ties with Salesforce. The company is consolidating data from multiple platforms into one place and using AI to make sense of it, having closed down 1,200 small software services. Meanwhile, Sebastian Siemiatkowski, CEO, says the company will use humans to offer VIP customer service. He spoke about how the company plans to balance employees and AI workers.

🇺🇸 Square AI, now in open beta, unlocks business insights. With Square AI, sellers can visit their dashboard and ask questions about their business using natural language. The AI interprets the query and delivers direct, instant answers, eliminating the need for sellers to locate specific reports, apply the right filters.

🇧🇷 EQT's top payment company receives prestigious permit. Zimpler is now officially a certified Payment Institution (PI) in Brazil, approved by the Central Bank of Brazil. This means businesses can now offer instant bank payments via Pix with fewer clicks, less friction, and no detours.

OPEN BANKING NEWS

🇺🇸 Experian and Plaid team up to unlock smarter credit decisions with real-time cash flow insights. Banks, credit unions, and consumer lenders can leverage Experian and Plaid’s combined expertise in real-time cashflow data and credit analytics to accelerate decisions, sharpen risk assessment, and improve borrower outcomes.

REGTECH NEWS

🇬🇧 Allpay becomes the first signatory of Enfuce’s Fortitude Pledge, leading the way in responsible finance. By integrating Enfuce’s cloud-based technology, allpay is modernising public sector payments across the UK, making them more secure, efficient, and less vulnerable to fraud.

🇵🇱 Cinkciarz.pl Chief Accountant arrested in an alleged $25m FinTech fraud case. Prosecutors allege Monika J. participated in a fraud scheme that misled customers about the actual use of their funds deposited through the Cinkciarz.pl mobile application.

🇺🇸 California advances bill on unclaimed crypto and merchant payments. California’s lower house has passed a sweeping crypto payments-regulating bill that would also allow the state to take idle crypto holdings from exchanges if an owner hasn’t accessed their account in three years.

🇬🇧 BIS and BoE test ‘modern AI techniques’ to spot criminality in retail payments data. Transaction analytics could be a valuable supplementary tool to help banks and payment service providers identify financial crime patterns in real-time retail payment systems, an 18-month collaboration between the banks has concluded.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 MoonPay bags BitLicense from New York. This BitLicense and money transmitter licenses ensure the firm has legal backing to provide its services in the region. It's a business license for virtual currency activities issued by the NYDFS under special regulations designed for companies.

🇨🇳 Hong Kong set to allow crypto derivatives trading. The Securities and Futures Commission, Hong Kong’s securities regulator, is planning to allow professional investors to trade crypto derivatives, marking a significant expansion of the territory’s virtual asset market offerings.

PARTNERSHIPS

🇬🇧 FundApps integrates with BlackRock's Aladdin platform to integrate FundApps' cutting-edge compliance service with the Aladdin platform. The integration delivers to common clients a streamlined shareholding disclosure, monitoring, and reporting offering that fits effortlessly into their daily investment workflows.

🇺🇸 Worldpay enables Paze℠, bringing new levels of convenience and speed to online checkout. The convenient Paze checkout experience enables consumers to pay online with their preferred credit and debit cards via added security through tokenization and seamless digital authentication.

🇨🇳 LianLian and UnionPay forge a strategic partnership. The alliance aims to facilitate seamless, secure, transparent, and efficient international transfers, particularly for clients remitting funds to China's mainland. Keep reading

🇺🇸 Keeta and SOLO create the first-ever blockchain credit bureau, fueling traditional finance's adoption of blockchain technology. Features will include a lending marketplace with verified reputations, stablecoin-based loan origination offering real-world APR relief to crypto-native borrowers, and bank integrations.

DONEDEAL FUNDING NEWS

🌏 Syfe raises US$ 80 million Series C to power regional expansion. The capital will be used to scale the company’s reach and strengthen its leadership position across Singapore, Hong Kong, and Australia. The company will continue investing in innovation, enhancing the customer experience, and expanding its product.

🇳🇬 Profitable African FinTech PalmPay is in talks to raise as much as $100 M. The new capital, expected to include both equity and debt, will fuel PalmPay’s expansion: deepening its footprint in Nigeria, scaling its newer business-focused offering, and rolling out both products in new markets across Africa and Asia.

🇺🇸 Aibidia raises $28m series B to expand AI-powered financial tax technology in the US. Aibidia has established itself as a critical component of the tax tech stack for multinational companies. The round was led by Activant alongside participation from existing investors, DN Capital, FPV, and Icebreaker.vc.

🇮🇳 Groww to raise $202 Mn from GIC and ICONIQ ahead of IPO. The startup said that the purpose of the offer is to raise funds for the growth of its existing business and the business of its subsidiaries. The Series F fundraise would be separate from Groww's pre-IPO fundraise.

M&A

🇦🇪 TOPPAN Security to acquire dzcard for Asia and Africa Expansion. TOPPAN Security will now offer localized banking card services to clients in high-growth markets, including Thailand, the Philippines, Malaysia, India, Morocco, and East Africa.

MOVERS AND SHAKERS

🇺🇸 Shift4 Payments announces CEO Isaacman’s resignation. The announcement also indicated that Isaacman will assume the role of Executive Chairman of Shift4 Payments. As Executive Chairman, he will continue to serve as an executive officer and Class I member of the board of directors.

🇬🇧 UK regtech Napier AI names Noel King as new CTO. In his new position, King will concentrate on building AI-enabled solutions that remain online for when financial institutions need them most, according to Napier AI, while also directing the development of financial crime compliance software.

🇦🇺 Kelly Bayer Rosmarin joins Airwallex banking board as FinTech eyes licence. Rosmarin will also act as a strategic adviser to Airwallex. She is one of five directors appointed to the board of Airwallex SVF Pty Ltd, which is in the advanced stages of applying for an Authorised Deposit-taking Institution (ADI) licence.

🇨🇳 Citigroup to cut 3,500 jobs at China tech centres amid global revamp. The reduction of staff at the China Citi Solution Centres in Shanghai and Dalian is expected to be completed by the start of the fourth quarter this year. This is to simplify and shrink global tech operations to improve risk and data management.

🇺🇸 Bill taps PayPal veteran Rohini Jain as CFO. The incoming finance chief will join Bill’s executive team on July 7, replacing John Rettig, who will stay on as president while also taking on the new role of chief operating officer, the company said. Read more

🇮🇳 Phone Pe appoints Ex-Standard Chartered CEO Zarin Daruwala as Board Member ahead of IPO. The FinTech appointment comes after PhonePe has established itself as a key player in India's digital payment ecosystem by capitalising on the launch of Unified Payments Interface (UPI) approximately eight years ago.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()