Wise Faces Founders’ Tension Ahead of US Listing

Hey FinTech Fanatic!

What is going on with Wise? Taavet Hinrikus, one of the FinTech co-founders who stepped down in 2021 (but still holds a 5.1% stake), is urging shareholders to vote against shifting Wise’s primary listing out of London.

He’s raising concerns about transparency, as the vote includes a 10-year extension of Wise’s dual-class share structure, giving certain shareholders enhanced voting rights that were set to expire in 2026. Hinrikus says the change was “buried” in the proposal and bundled to force an “all-or-nothing” decision.

CEO Kristo Käärmann, who owns about 18% of Wise, responded, “Our plans are set out clearly and transparently.” He maintains that the structure is essential to supporting the company’s long-term performance.

Let's see how this turns out...

Scroll down to find more on Wise news and to get your daily FinTech dose 👇 I'll be back tomorrow!

Cheers,

P.S. Follow me on Threads for daily scoops!

INSIGHTS

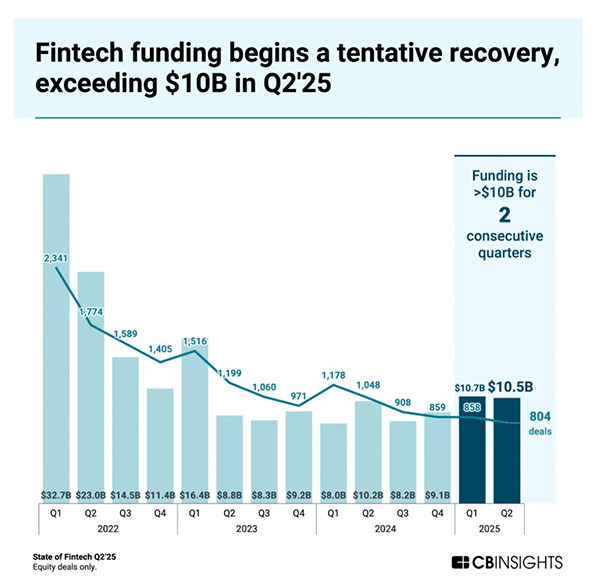

📈 FinTech funding begins a tentative recovery, exceeding $10 billion in Q2 2025.

FINTECH NEWS

🇺🇸 Bullish files registration statement for proposed initial public offering. Bullish has applied to list its ordinary shares on the New York Stock Exchange under the ticker symbol “BLSH”. The offering is subject to market conditions, and there can be no assurance as to whether or when the offering may be completed.

🇦🇪 eToro launches AI-driven smart portfolio to help UAE investors capitalise on US mid-cap stock growth. The new eToro portfolio features 30 AI-selected companies with up to $50 billion in market cap, identified for strong fundamentals and sector diversity.

🇺🇸 Block joins S&P 500 as crypto’s mainstreaming marches on. Block will replace Hess on the S&P beginning July 23 at the start of trading, the report said. In addition, the company is integrating bitcoin payment capabilities into its Square terminals.

🇺🇸 Wise Co-Founder slams FinTech’s plans to move listing to US. One of the main points of contention for Skaala Investments is that enhanced voting rights for certain shareholders, which were due to expire in July 2026, will be extended by an additional 10 years. The group’s letter said this was “buried in the proposal.”

🇺🇸 Crypto custody startup BitGo confidentially files for US IPO. The number of shares to be offered and the price range for the proposed initial public offering have not yet been determined, BitGo said. Keep reading

PAYMENTS NEWS

🇳🇱 What is Wero? By Mollie. Wero has ambitious plans to establish a new, uniform standard for online payments across the continent. In this guide, Mollie explains exactly what Wero is, how it works, and, most importantly, what it can do for your checkout process and your turnover.

🇳🇬 Update on Wabeh regarding recent articles on closure. The company stated in a LinkedIn post that it is not shutting down. It remains fully operational, continues to serve users and merchants, shows strong portfolio performance, and upholds regulatory compliance. Read the full post here

🇺🇸 PayPal has launched AI-powered scam alerts for friends and family payments. Designed to proactively alert customers to potential scams and prevent losses in real-time, the alerts intervene when it matters most, before any funds are sent.

🇫🇷 Worldline increases payment authorisation rates with AI-powered routing solution. Khalil Kammoun, Head of Shared Services, commented: “With AI-driven routing, we’re enhancing authorisation rates through smarter decision-making and unlocking new revenue for our customers. We aim to enable businesses to achieve new levels of efficiency, cost savings, and payment optimisation.”

🇮🇳 FinTech firm PayU India to invest $120 mn by end of FY26. The credit business is expected to get an investment of $50-$60 million. PayU is considering another $60-$70 million infusion in payments infrastructure firm Mindgate Solutions, in which it acquired a 43.5% stake in March.

🇮🇳 WhatsApp Pay growth stalls in India as Meta shifts focus on stablecoins. Meta Platforms’ attempt to position WhatsApp as a major player in India’s massive FinTech sector has largely failed, primarily due to regulatory restrictions but also because of the company’s lack of significant product improvements.

🇪🇬 Lime Consumer Finance enters Egypt’s FinTech market with education-focused app. It aims to address a vital need for families seeking affordable and flexible payment options. Through the app, families can access installment plans ranging from 6 to 12 months, for amounts up to EGP 1m.

🇮🇳 NPCI International expands UPI-PayNow linkage to drive cross-border remittances. This update for real-time cross-border payments makes it easier for people, especially migrant workers and students, to send and receive money between the two countries safely and easily.

🇺🇸 Block Inc. settles $12.5 million cash app referral lawsuit. The settlement is specifically relevant to Washington state residents who received the disputed spam messages, with eligibility dependent on having received such texts during the settlement period, which began on November 14, 2019, and will conclude at a date yet to be determined.

DIGITAL BANKING NEWS

🇱🇺 Revolut focuses on “product localization” to attract SMEs. The FinTech company is focusing on instant access to savings to win Luxembourg business customers, while exploring lending options and the potential benefits of a deeper regulatory footprint. Additionally, Revolut plans to create 400 new jobs as the Paris HQ leads hopes towards a French banking licence. The new roles will be created across France, Spain, Ireland, Germany, and Portugal, and will encompass risk management, compliance, and other key functions.

🇵🇹 FinTech Rauva to hire 500 people in Europe by 2026. The company claims the team expansion is due to the need to double the size of its operations, product, and support departments. The roles in this recruitment process include engineering, design, data, customer experience, operations, financial services, and growth.

🇧🇷 Nubank surprises by creating a new loyalty program, NuCoin. Nubank reported that the new nucoins will be registered on the blockchain like the old ones, but with the character of a utility token exclusively for the NuCoin program. Furthermore, Nubank introduces a subscription manager and launches the Colombo card for customers. With it, the digital bank aims to help users maintain control over the services contracted with their credit card.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase CLO, Paul Grewal, slams state agencies over crypto staking crackdown despite CLARITY Act. Despite the CLARITY Act’s clear stance on staking-as-a-service as a non-security, several state agencies continue to pursue claims against crypto firms. This discrepancy has prompted Grewal to advocate for a more unified regulatory approach.

🇺🇸 Crypto payments are the 'next big category' for Coinbase, says CEO Brian Armstrong. Coinbase CEO joins 'Closing Bell Overtime' and CNBC's Emily Wilkins to talk about the recent passage of new crypto legislation and what that will mean for the sector as a whole. Watch the interview here

🇺🇸 Coinbase IPO investors are finally in profit after 4 years. After waiting more than four years, the long-suffering Coinbase IPO investors are finally back in the green. On July 18, COIN price ascended to an all-time high of $444.65, before a quick correction.

🇮🇳 CoinDCX suffers $44 million hack, and user funds reportedly safe. In a public statement, CoinDCX assured customers that the attack was contained to a non-custodial internal account and that user funds held in cold wallets or primary customer accounts were not affected.

🇺🇸 US bank lobby challenges crypto firms’ bids for bank licences. US banking groups have urged the country’s banking watchdog to postpone its decision on crypto companies’ bank licenses until more details about their plans are public, claiming that allowing the bids would be “a fundamental departure” from current policy.

PARTNERSHIPS

🇬🇧 Solidgate expands partnership with Shopify: Bring payment orchestration to your storefront. With the new Solidgate Payments App, merchants on Shopify can connect to Solidgate’s powerful payment infrastructure, bringing smarter routing, access to local payment methods, advanced payment acceleration technologies, real-time analytics, and billing flexibility.

🇬🇧 GoCardless powers Cashflow Payouts, a solution promising to eliminate delays in sending payments. Cashflows Payouts aims to enhance how businesses handle disbursements by enabling instant, branded, and secure payouts through an intuitive self-service portal.

🇲🇽 User demand drives integration of tax payments in Mercado Pago. This initiative is part of a broader strategy focused on promoting financial inclusion and strengthening the digital payment network. Continue reading

🇪🇸 Spain's Unicaja signs 10-year partnership with DXC Technology to modernise its banking operations. Unicaja will leverage DXC's artificial intelligence solutions to drive automation, improve operational efficiency, and strengthen customer interactions.

🇦🇪 Network International partners with Wio Bank to expand digital SME lending in the UAE. The collaboration integrates Wio Bank’s lending products directly into Network’s merchant lending marketplace, streamlining access to business financing for SME merchants.

🇮🇪 Codec and Yavrio announce strategic partnership. The partnership enables seamless integration of Yavrio’s open banking platform into Business Central, allowing users to access real-time banking data, initiate payments, and automate reconciliation, all within their ERP system.

🇬🇧 Monzo migrates investment accounts to Seccl. As part of the migration, Monzo is introducing a range of new features, starting with a fully digital accumulation SIPP (to which customers can make new contributions, as well as consolidate existing pensions) and the ability to trade ETFs.

🇺🇸 PublicSquare adds Apple Pay and Google Pay to payment platform. The integration comes as mobile payment adoption continues to grow in the United States. According to data cited in the company’s statement, over 50% of U.S. smartphone users currently use mobile wallets at checkout.

DONEDEAL FUNDING NEWS

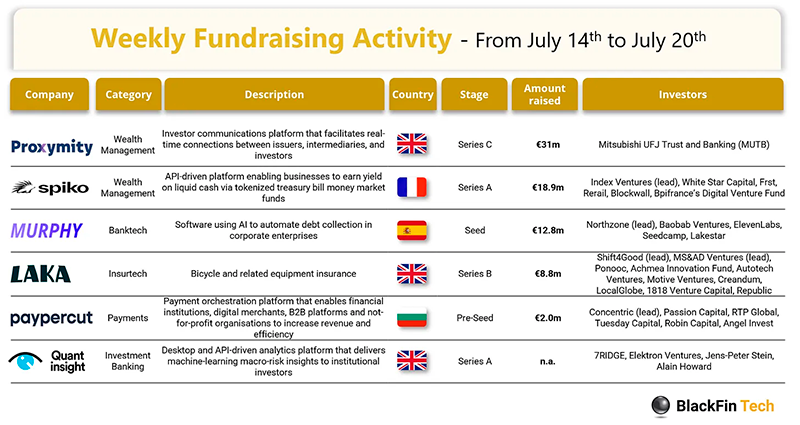

💰 Over the last week, there were six FinTech deals in Europe, raising a total of €73.5 million, three deals in the UK, and one deal each in France, Spain, and Bulgaria.

🇬🇧 SpacePay raises $1.1M to bring crypto payments to everyday card machines. This London-based startup enables merchants to accept cryptocurrency payments through their existing Android card machines with just a software update. The platform supports over 325 wallets, charges a transaction fee of only 0.5%.

🇺🇸 Folio raises $14M series A to transform financial operations at hotels. The capital will help Folio continue to power profitability at hotels and deliver even faster implementations. Folio’s modern procure-to-pay platform delivers increased profitability to hotels through its managed marketplace.

🌍 Zvilo secures expanded credit facility of up to €75 million from Fasanara Capital to power MSME growth. The additional headroom within the facility will enable Zvilo to meet growing demand and accelerate its strategic expansion, particularly across Africa, Turkey, and the broader Middle East.

🇮🇹 Italian FinTech platform Toduba raises €3.5 million to digitise the employee welfare sector. The new funding will be used to expand its product portfolio, strengthen its merchant network, accelerate both organic growth and M&A activity, introduce complementary services in the flexible benefits space, and kick off its international expansion.

M&A

🇬🇧 IFX Payments may terminate the £3M Argentex acquisition on insolvency grounds. The company is considering withdrawing its takeover offer for the troubled FX broker after the target firm entered administration. The original deal involved escape clauses, and IFX is now consulting regulators about invoking them.

MOVERS AND SHAKERS

🇺🇸 Finzly has appointed Adam Carson as its first Chief Financial Officer, while Robert Coakley has been named as the new Head of Partnerships. Carson brings over two decades of financial expertise to the company. Coakley will focus on expanding Finzly's client portfolio.

🌎 Breno Queiroz is Facilitapay's new Chief Technology Officer. Breno joins FacilitaPay to take its products and services to the next level, strengthen the infrastructure that connects global businesses to the most dynamic markets in Latin America, and accelerate our innovation journey.

🇧🇷 PicPay announced the hiring of André Tonelini as the new Head of the Company's Card Division. The Executive's mission will be to drive growth and consolidate PicPay Card's value proposition. Tonelini spent the last nine years at Banco Carrefour, where he held different positions.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()