Who Gave the Queen a Seat on the FinTech Board?

Hey FinTech Fanatic!

Well, here’s a royal plot twist no one saw coming: Queen Máxima just joined the International Advisory Board of the Global Finance & Technology Network. 👀

No joke, that actually happened last week!

Not every day a queen step into the FinTech arena and claims the throne while she’s at it.

The Queen of the Netherlands is a former banker, a fierce advocate for financial inclusion, and now... FinTech boardroom royalty.

Alongside Agustín Carstens and Sanjiv Bajaj, she’ll be shaping global conversations around financial health, inclusion, and innovation. And honestly? That’s a pretty epic trio.

Read on for the rest of today’s FinTech headlines 👇

Cheers,

PODCAST

🎤 Disruptions that will define the sector in 2025 by PagoNxt. The episode features insights from industry leaders, including Jose Luís Calderón (CEO of PagoNxt Payments), Beatriz Giménez (Country Manager of PayPal Spain), Paco Salcedo (Country General Manager and President of Microsoft Spain), and Arthur Bedel (Co-Founder of Connecting the Dots).

PayTalks Episode 1: Disruptions that will define the sector in 2025 by PagoNxt

FINTECH NEWS

🇸🇬 Queen Máxima of the Netherlands appointed Chair of Global Finance & Technology Network’s International Advisory Board. Agustín Carstens, Former General Manager of the Bank for International Settlements, and Sanjiv Bajaj, Chairman of Bajaj Finserv, Also Join the Board. Keep reading

🇬🇧 Profits soar at FinTech Abound as borrowers turn to AI loans. Abound, which uses artificial intelligence to provide borrowers with loans based on what they can afford to repay, generated a net profit of £7.5 million in the 12 months to February, up from £300,000 a year earlier, as revenues climbed 151 percent to £66.8 million.

🇺🇸 Instacart adds earned wage access to shoppers' rewards program. Instacart will roll out the card to its U.S. shoppers in two phases, first in October and again in April of next year. The card is part of Instacart's Cart Star program, which the company introduced in 2022.

🇮🇳 Fi Money rolls out an AI feature for users' queries on personal finance via ChatGPT and Gemini. The integration enables users to ask personalized questions about their money, from spending patterns to investment performance, and receive real-time, AI-generated insights based on actual financial data. The new feature, called Talk to AI, is powered by Fi’s implementation of the Model Context Protocol.

PAYMENTS NEWS

🇪🇸 Getnet joins the PCI Security Standards Council Board of Advisors. By joining this global forum, Getnet will actively contribute its expertise to the development of industry standards aimed at safeguarding the digital commerce ecosystem. The company remains committed to delivering secure, reliable solutions.

🇦🇷 Buenbit launches Stockback Card in partnership with Pomelo. Rolled out in Argentina, this is the first prepaid card in the market designed to transform everyday spending into an investment opportunity. With the Stockback Card, users receive rewards in the form of shares or cryptocurrency each time they purchase at select retailers.

🇮🇱 Nayax cuts 6% of the workforce in first major layoffs despite revenue surge. Israeli FinTech company Nayax will lay off 70 employees, 55 of them in Israel. This is the first major round of layoffs for Nayax, which is dual-listed in New York and Tel Aviv with a market value of around 6 billion shekels.

🇧🇷 Brazil becomes PayPal's laboratory for its Latin America bets. PayPal has transformed its Brazilian operations into a kind of experimental laboratory. After years of operating its digital wallet and checkout solution in online shopping carts, the American platform plans to expand among small businesses, advance as an acquirer, and launch products connected to Pix.

🇪🇸 Redpin opens a property payments platform in Spain. Redpin Payments gives Spanish real estate professionals complete control over all transactions through one online dashboard while protecting client funds with bank-level security. Keep reading

🇲🇦 Morocco joins the Pan-African Payment and Settlement System. By welcoming Bank Al-Maghrib, PAPSS advances its mission of connecting African central banks and facilitating seamless cross-border trade, payment flows, and investment across the continent.

🇮🇳 Airpay targets to onboard 20 million users for a financial wellness platform. Airpay has launched Airpay Money, which is a free financial wellness platform, designed specifically for the underserved middle-class earning between Rs 20,000-75,000 monthly, the company's founder and CEO, Kunal Jhunjhunwala, said.

🇮🇳 Cred processes 75% more in bill payment value than PhonePe and its nearest competitor. In May, Cred facilitated Rs 52,000 crore worth of bill payments. In contrast, PhonePe processed Rs 30,000 crore worth of utility bills such as credit cards, electricity, Fastags, loan repayments, and telephone bills, among others.

🇨🇴 The Bank of the Republic confirmed that the new Bre-B instant payment system will begin operating in Colombia in the second half of September 2025. This platform will allow users to send and receive money in real-time, regardless of their bank or financial institution.

🇧🇪 Belgian banks join the European Payments Initiative to expand Wero wallet across Europe. "By integrating Wero into our offering from 2026, we will empower our clients, entrepreneurs, and liberal professions with a fast, secure, and intuitive way to manage their payments, which is fully aligned with their daily needs," said Bank Van Breda CEO Dirk Wouters.

REGTECH NEWS

🇸🇬 MAS fines CS, UOB, UBS, Citi, JB, and LGT for AML failings. Singapore’s regulator, the Monetary Authority of Singapore, has fined nine financial institutions, including leading banks in the region, a total of S$27.45m ($21.54m), and penalized several relationship managers over the money laundering scandal that rocked the country.

DIGITAL BANKING NEWS

🇪🇸 Monzo Expands to Barcelona. This move marks an exciting step in Monzo’s international growth and commitment to building a world-class team across borders. Meanwhile, Monzo invests a further €2m in the Irish arm. TS Anil, the Chief Executive of Monzo, said last year that its new Irish office would act as a gateway to Europe after it raised £340 million (€394 million) to bring its valuation to £4 billion.

🇬🇧 Revolut is yet to receive a key credit license from UK regulators. The group is still awaiting authorization from the Bank of England’s Prudential Regulation Authority and the FCA after applying for a consumer credit license last year, which would enable it to offer credit cards and other services in the UK.

🇬🇧 Starling strengthens the marketing team as it prepares a major brand relaunch with a new ‘good with money’ platform. The platform is supported by the bank’s central mission that one day, everyone in the UK will have a healthy relationship with their money. This mission is a response to the challenging financial landscape for people in the UK.

BLOCKCHAIN/CRYPTO NEWS

🇹🇷 Turkish authorities block PancakeSwap in a crackdown on crypto websites. The Capital Markets Board said it had taken legal action against 46 websites, including decentralized exchange PancakeSwap and Cryptoradar, in a crackdown on crypto services offered to residents of Turkey.

🇭🇺 Revolut suspends certain services immediately in Hungary. The announcement, sent to users via email on Friday evening, cites recent changes in Hungarian legislation as the reason for the decision. According to Revolut’s statement, several key crypto features are no longer available in the country.

🇨🇳 FTX may exclude users in 49 countries from compensation. FTX is seeking court approval for a new claims process that could affect creditors from 49 jurisdictions where crypto is banned or restricted. Continue reading

PARTNERSHIPS

🇹🇷 Mastercard and Octet Türkiye join forces to meet business demands for greater B2B payment services. This collaboration will enable companies to use their preferred bank’s credit cards for payments while seamlessly managing their collections. Additionally, Mastercard and Pay4You partner to enhance tail spend management for corporations. They can reduce costs, increase process efficiencies, and ensure compliance while offering employees a better user experience.

🇪🇬 ContactNow and Kashier partner to launch flexible BNPL payment solutions in Egypt. The collaboration will see the integration of ContactNow’s Buy Now, Pay Later (BNPL) service into Kashier’s platform, expanding the availability of flexible digital financing options for consumers across the country.

🇦🇺 Monoova, SuperAPI, and Payroo partner to launch one-click payroll and super solution. The new solution combines Monoova’s payments infrastructure, SuperAPI’s onboarding and compliance tools, and Payroo’s cloud-based payroll software to streamline the process and reduce risk. The offering replaces error-prone legacy systems and is already live for Payroo customers.

🇦🇺 Zap taps TrueLayer and DNA Payments for new payment offerings. With Zap Cashier, end-users will enjoy a fully integrated pay-in and pay-out journey, eliminating the need for manual bank transfers. The service will also deliver enhanced customer support for Zap’s clients and their users.

🇬🇧 Wirex Pay partners with Schuman Financial to boost the accessibility and liquidity of EURØP stablecoin. This integration delivers several key benefits to both users and institutional partners: streamlined issuance and redemption of the stablecoin, simplified access across multiple blockchains and platforms, and enhanced liquidity.

🌍 Pan-African Payment and Settlement System and Interstellar unveil the African currency marketplace. This next-generation Financial Market Infrastructure represents a bold evolution of the PAPSS mission, addressing Africa’s longstanding challenge of currency inconvertibility and enabling seamless, sovereign currency exchange for intra-African trade.

DONEDEAL FUNDING NEWS

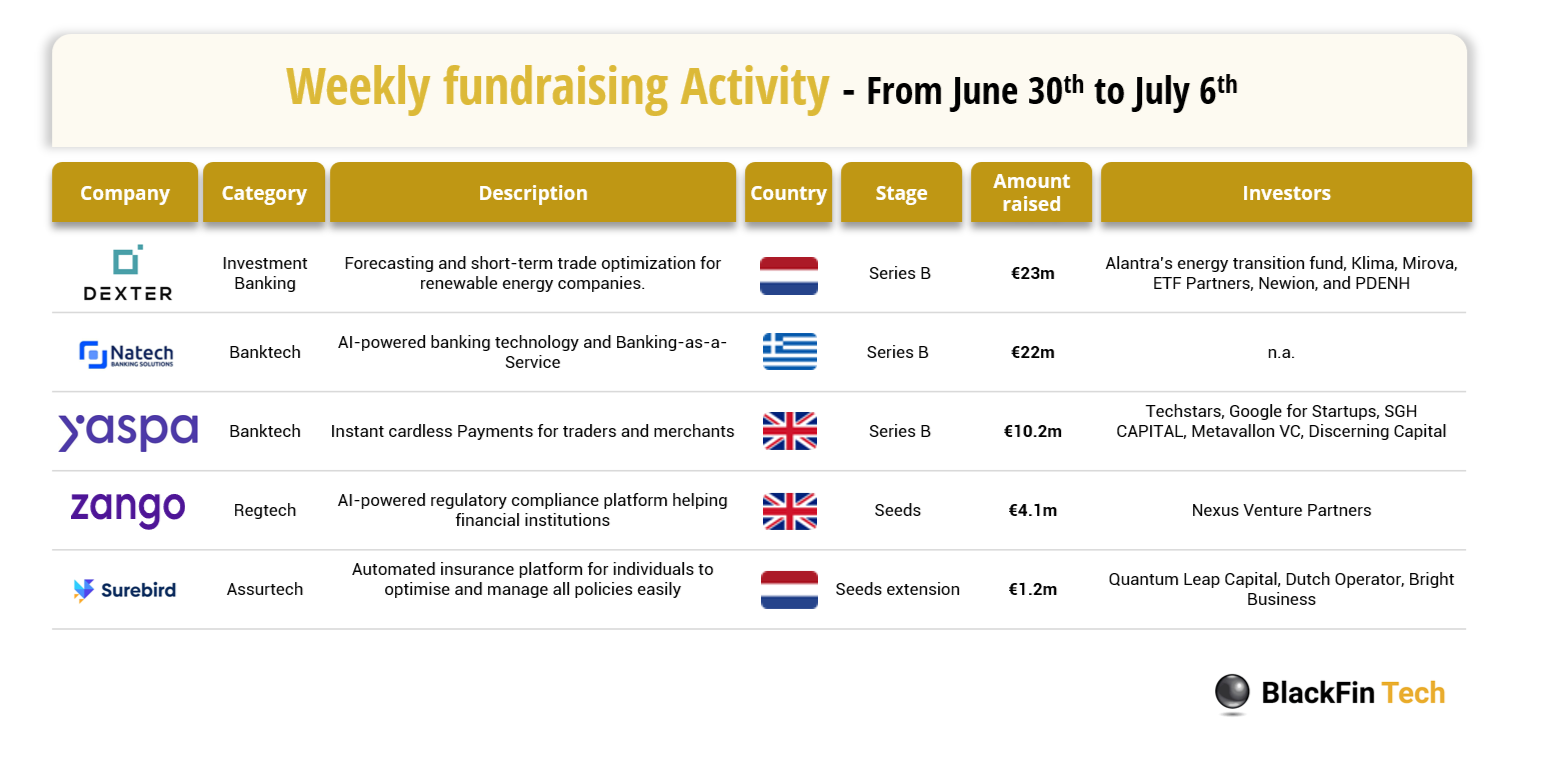

💰 Over the last week, there were 9 FinTech deals in Europe, raising a total of €60.5 million, two deals each in the Netherlands and UK, and one deal in Greece.

🇸🇦 Saudi FinTech Tarmeez secures funding led by stc’s Tali. The funding will enable Tarmeez Capital to scale its platform, expand its offerings, and deliver advanced financial solutions across the Saudi market. Read more

🇺🇸 Newly public Webull obtains a $1bn capital access agreement. Group president Anthony Denier says the funds will help Webull "pursue new growth opportunities, such as product expansion, new asset classes, and geographic expansion". Read more

🇺🇸 FinTech Netcapital bags $9.9M direct offering round. The funds raised in this round will be used by Netcapital to repay certain outstanding promissory notes and for general working capital. Continue reading

🇮🇪 Irish FinTech Nomupay lands $40M at a $290M valuation from SoftBank. The startup will use the new capital for the next phase, which involves expanding its reach in key regions as well as acquisitions. In addition, it will double down on scaling its sales and operations to reach existing and new locations.

MOVERS AND SHAKERS

🇺🇸 Currency.com announces the appointment of Enrico Serafini and Dave Ackerman to lead US expansion. Serafini will spearhead Currency.com’s expansion, leveraging his deep expertise in regulatory strategy, digital asset infrastructure, and customer experience. Ackerman will oversee the execution of strategy for the American market, ensuring the delivery of frictionless, secure, and compliant financial services.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()