🤷🏼♂️ What are the differences between BNPL (Buy Now Pay Later) and SNBL (Save Now Buy Later)?

Zalando recently partnered with savrr , a relatively unknown start-up until recently. Together, they offer German Zalando customers a new service: ‘save now buy later’, the counterpart of ‘buy now pay later’.

Founders Lukas Schmitt and Nico Tobias Gemkow recently presented Savrr at the K5 Future Retail Conference in Berlin.

Their promise: ‘Loyal customers before the first purchase.’

The product was actually not even fully developed when the start-up presented itself in the German capital, as reported by Internet World.

Nevertheless, shortly thereafter, they signed a deal with Zalando. The service is already live for German Zalando customers.

𝗪𝗵𝗮𝘁 𝗮𝗿𝗲 𝘁𝗵𝗲 𝗱𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝗰𝗲𝘀 𝗯𝗲𝘁𝘄𝗲𝗲𝗻 𝗕𝗡𝗣𝗟 (𝗕𝘂𝘆 𝗡𝗼𝘄 𝗣𝗮𝘆 𝗟𝗮𝘁𝗲𝗿) 𝗮𝗻𝗱 𝗦𝗡𝗕𝗟 (𝗦𝗮𝘃𝗲 𝗡𝗼𝘄 𝗕𝘂𝘆 𝗟𝗮𝘁𝗲𝗿)?

Buy now pay later (BNPL), where customers receive a product first and pay later, has become highly popular among online shoppers in recent years.

Save now buy later (SNBL) works the other way around: customers set a savings goal and put money aside monthly to achieve that goal. When the goal is reached, they receive not only their savings but also a ‘bonus’ to be spent (in this case on Zalando).

If they no longer wish to make a purchase, they can withdraw their money without the bonus.

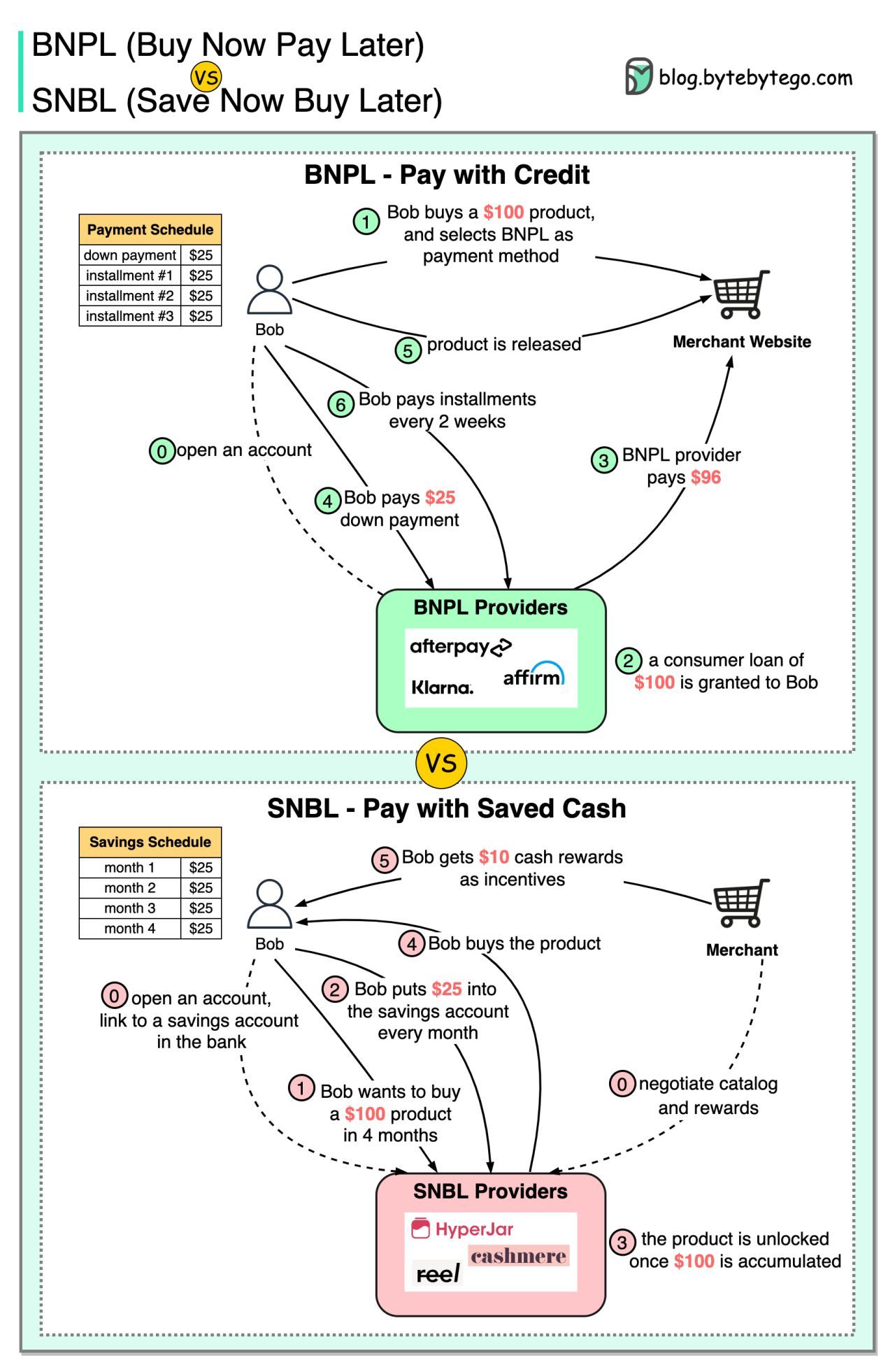

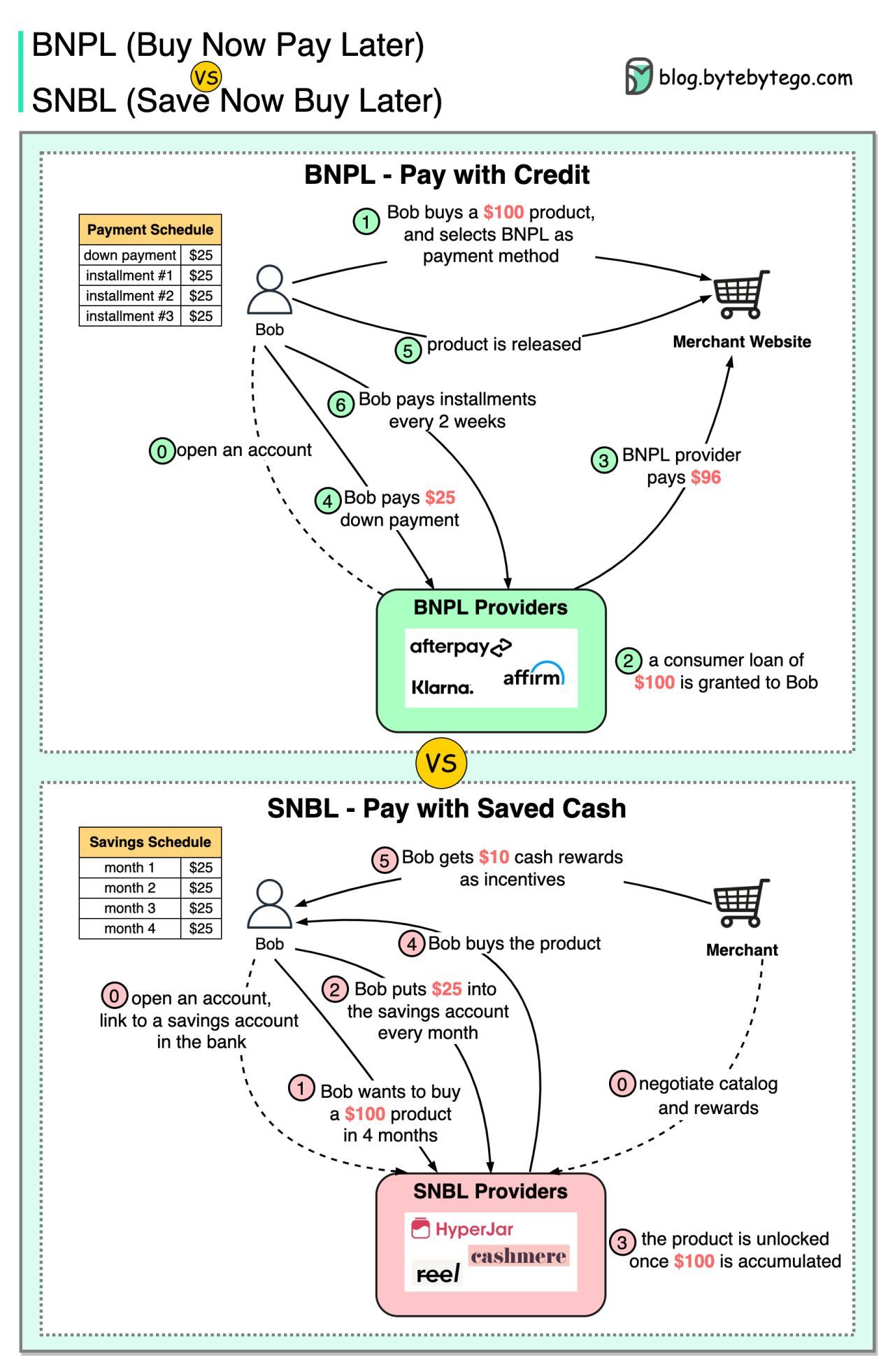

The diagram below by Hua Li shows how both BNPL and SNBL work👇

‣ With BNPL, Bob pays with credit, and BNPL providers help fund Bob’s purchase. The merchant immediately gets the money from BNPL providers, but with a discount. Examples: Klarna, Affirm, and Afterpay.

‣ With SNBL, Bob first saves cash in a virtual savings account. Once enough money is saved, the product is unlocked, and Bob can purchase it. Bob will get cash rewards from the merchant for saving up. Examples: HyperJar, Cashmere App, and Savrr.

Both models target reducing shopping cart abandonment. However, BNPL increases the customer’s debt and has late fees as a penalty. The encouragement of overspending has had some bad reviews during the recession.

SNBL, on the other hand, focuses on 𝐦𝐨𝐧𝐞𝐲 𝐩𝐥𝐚𝐧𝐧𝐢𝐧𝐠 𝐚𝐧𝐝 𝐦𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭, where multiple virtual savings accounts can be opened for different purposes. Also, the customers get rewards from the merchants, which means the return on the savings is much higher than keeping it in the bank.

Interestingly, SNBL vendors are functioning like a 𝐦𝐚𝐫𝐤𝐞𝐭𝐩𝐥𝐚𝐜𝐞. They work with many merchants to offer specific products to customers and negotiate cash rewards.

Now over to you: Do you think 𝗦𝗮𝘃𝗲 𝗡𝗼𝘄 𝗕𝘂𝘆 𝗟𝗮𝘁𝗲𝗿 will be the new big thing?

Source picture: Bytebytego

Comments ()