What A Week It Was For Block 🤯

Hey FinTech Fanatic!

What a week it was for Block. Let's dive into a short list of the biggest updates of the week:

► Block (SQ) has begun a dollar cost averaging (DCA) program to add to its already sizable bitcoin stack.

Led by CEO Jack Dorsey, the company in April began using 10% of its monthly bitcoin-related gross profit to buy additional bitcoin, with plans to do this each month for the remainder of 2024.

For perspective, Block had $80 million in bitcoin gross profit in the first quarter, according to its earnings results. Were that level of profit to continue through the rest of the year, the company under this program would add another $24 million worth of bitcoin to its balance sheet.

► Block integrates Afterpay with Cash App card:

The test offering provides buy now, pay later financing to a limited number of users of Block’s Cash App debit card for “a small fee.”

► Square unveils Kiosk for restaurants:

Square unveiled Square Kiosk, a fully integrated software, hardware, and payments solution that enables self-serve ordering for quick-service restaurants.

► Block to raise $2.0 Billion Offering of Senior Notes:

Fitch Ratings notes that Block has used convertible debt for external funding since its IPO and is well-positioned to exploit the growth in payments and consumer financial services.

The company said in a statement that the terms of the notes, including interest rates and maturity dates, are subject to negotiation with the initial purchasers. Investors permitted to join the round include pension funds, banks, mutual funds and high-net-worth individuals.

► Federal prosecutors are examining financial transactions at Block, owner of Cash App and Square:

Internal documents indicate Block processed crypto transactions for terrorist groups and Square processed transactions involving nations subject to economic sanctions.

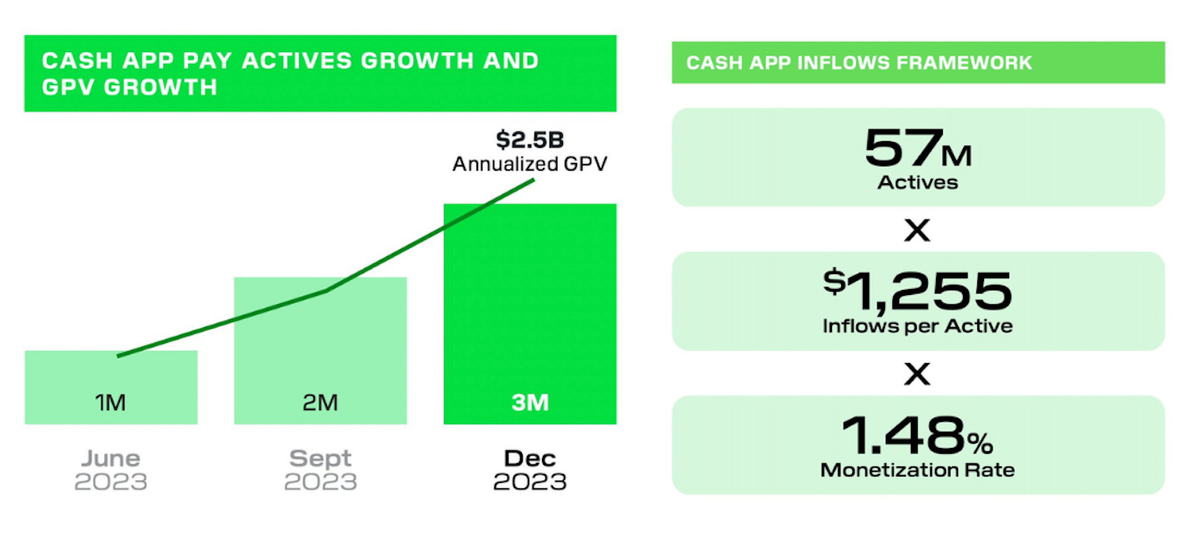

► Cash App shows growth:

Cash App Pay was used by 4 million people in March 2024. Cash App Pay also continued to grow, with volume up more than 40% on a quarter-over-quarter basis. That is $3.5 billion in Annualized GPV.

From Block Shareholder Letter:

"In March, Cash App had 57 million monthly transacting actives, up 6% year over year. In the first quarter of 2024, overall inflows were $71 billion, up 17% year over year. Inflows per transacting active were $1,255, up 11% year over year from strength in financial services products."

"We continued to see strong usage of Cash App Card as the number of Cash App Card monthly actives increased to 24 million in March and spend per monthly active also grew on a year-overyear basis. During the quarter, Cash App Card transaction fees surpassed Instant Deposit as Cash App’s largest contributor to gross profit."

Finally, I highly recommend reading the latest Q1 2024 Shareholder Letter for the latest Block stats.

Have a great start to the week, and I'll be back in your inbox tomorrow!

Cheers,

#FINTECHREPORT

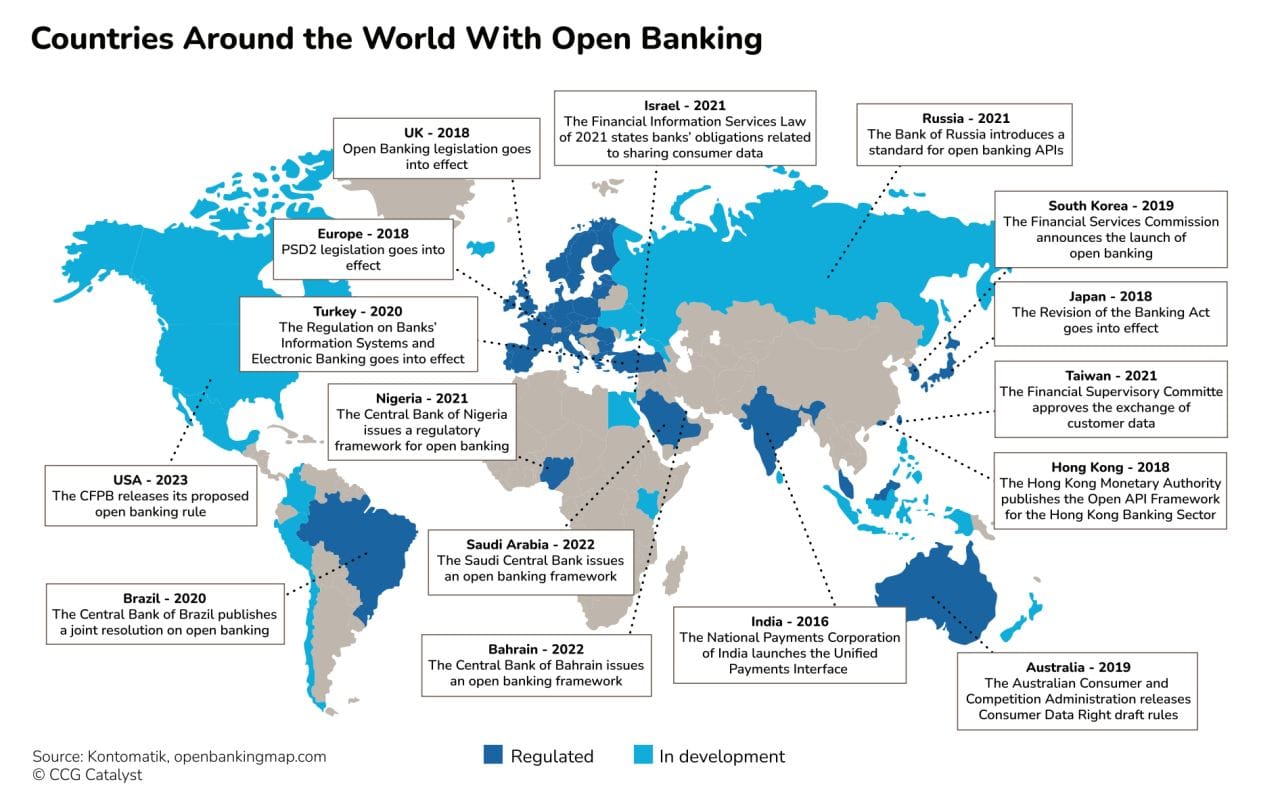

📊 US Open Banking 2024. CCG Catalyst ’s research report on Open Banking 2024 is out with a Global Open Banking Map👇

PODCAST

🎙️ BaaS in the USA with Arcady Lapiro of Agora. In this latest episode of the Demystify Podcast, Dave and Dharm are joined by Arcady Lapiro, founder and CEO of Agora Financial Technologies, a US-based banking technology company. Listen to the full podcast episode here

FINTECH NEWS

🇧🇷 FacilitaPay secures historic partnership with Webull to enhance cross-border payments in Brazil. The partnership with Webull not only enhances FacilitaPay's service offerings but also solidifies its reputation as a formidable player in the FinTech sector capable of handling large-scale international transactions.

🇦🇺 Gift card disruptor Karta partners with Visa. The relationship with Visa marks an incredible milestone for Karta, which has developed a mobile-first solution that lets shoppers scan, select and buy Gift Cards in seconds from any participating retailer digitally and physically.

🇱🇧 Wink Pay launches in Lebanon in cooperation with Codebase Technologies and Visa International for digital onboarding and instant card issuance. This revolutionary service provides over 5 million Lebanese citizens with the ability to manage their payments securely and transparently for local and international purchases without needing a bank account.

🇱🇻 Abillio rolls out global API for payments and DAC7 compliance for gig economy marketplaces. Abillio’s API automates the freelancer and vendor payment distribution process and tax reporting, allowing platforms to focus on their core business operations. Learn more

🇺🇸 Investing platform Robinhood added more than $3.4 billion through its automated customer account transfer service in Q1, up 100% QoQ. The Menlo Park, Calif.-based company reported net deposits of $11 billion for Q1, more than double last year’s quarterly average.

🇳🇬 American Express introduces business card for Nigerian users. The card offers business owners a spending limit of $10,000 and a repayment period of up to 45 days for international transactions, and comes as a result of a partnership with local neobank O3 Capital.

🇮🇳 Groww joins the first wave of Indian startups moving domiciles back home from US. The Indian investment app has become one of the first startups from the country to shift its domicile back to India from the U.S., signaling a broader trend among the local startup community.

🇨🇴 RapiCredit, a Colombian FinTech, announced that it will soon finalize a partnership agreement to enter the Peruvian market and expand its operations there. They stated that this initiative represents a strategic step for the company's growth.

🇮🇳 Fintech unicorn Zeta launches UPI-linked credit-as-a-service for banks. The product is based on the credit lines on UPI scheme that the Reserve Bank of India rolled out in September to reduce the cost of financial services and allow users to access pre-approved credit through their UPI-linked accounts.

PAYMENTS NEWS

🇨🇳 US card giant Mastercard, through a joint venture, has finally begun processing domestic payments in China. Last week, the Mastercard NetsUnion JV began processing payments made in China with Mastercard cards issued by the country’s banks. Read more

OPEN BANKING NEWS

🇬🇧 CLOWD9 selects tell.money as Strategic Open Ecosystem partner for confirmation of Payee Services for UK & EU markets. tell.money offers tailored solutions, including Confirmation of Payee (CoP) as a service and open banking compliance solutions, catering to FinTechs, EMIs, and banks in the UK and EU.

DIGITAL BANKING NEWS

🤯 This is WILD if true: "Revolut hit $2bn of revenue and $350m net income in 2023." This is the first time the net income figure has been mentioned.

This recording is from John Doran, interviewing Nik Storonsky, Founder and CEO of Revolut at the Dubai FinTech Summit. Check our the complete interview:

🇺🇸 Neobank Dave attributes best-ever credit performance to AI-driven underwriting engine. Dave said it improved its credit performance over the past year with the use of artificial intelligence. Between Q1 of 2023 and Q1 of 2024, it reduced its 28-day delinquency rate from 2.60% to 1.83%, the company said.

🇦🇺 New Judo Bank chief executive Chris Bayliss says Judo ready for diversification. New chief executive made his first public appearance in the role last Thursday, announcing a couple of senior appointments and providing a broad outline of his plans for the bank’s development.

🇺🇸 Mastercard, Citi, JPMorgan test ledger for settling bank money. Mastercard Inc. is joining with some of the largest US banks to test shared-ledger technology that would allow the common settlement of tokenized assets such as commercial-bank money as well as Treasury and investment-grade debt securities.

🇬🇧 Monument Bank latest challenger bank to sell "in a box" tech, as snaps up first client. Upmarket UK challenger bank Monument Bank sells its "building society in a box" tech to legacy financial institutions, joining others in offering its technology to third parties. Read on

BLOCKCHAIN/CRYPTO NEWS

🇨🇦 Canada fines Binance C$6m for AML violations. The Financial Transactions and Reports Analysis Centre of Canada says Binance failed to register as a foreign money services business. The company also failed to report large virtual currency transactions of C$10,000 or more in the course of a single transaction.

🇺🇸 Kraken fires back at SEC, arguing Agency’s case lacks proper wording. Kraken has intensified its legal battle with the United States Securities and Exchange Commission (SEC) by filing a reply to the agency’s April letter regarding the company’s motion to dismiss the case.

DONEDEAL FUNDING NEWS

🇮🇱 Israeli startup Panax raises a $10M Series A for its AI-driven cash flow management platform. This new round will help Panax scale its go-to-market approach and build a more robust AI and data team now that it has enough data for this, CEO Noam Mills said.

🇬🇧 London-based FinTech Farm raises $32m to expand its ‘neobank in a box’ model to India. “India is one of the markets you must be in these days,” says founder Nick Bezkrovnyy, ”The competition is quite intense there but now is a good time for us to enter.”

🇪🇬 Egyptian based FinTech startup MNZL secures $3.5 Million seed Funding. Armed with fresh capital, MNZL is poised to enhance its technology and scale operations, reaching more Egyptians in need of financial empowerment. Access the full piece here

MOVERS & SHAKERS

🇮🇳 FinTech company Simp has reportedly laid off about 160 to 170 employees across several departments. The layoffs come as the company faces high monthly burn and a slower rate of gaining new users. This has mostly affected the engineering and product developments roles focusing on higher-paying positions.

Wirex founder Pavel Matveev joins COCA Wallet. In his capacity as Strategy and Product Advisor at COCA, he will provide strategic insights and guidance on product development, leveraging his expertise to enhance COCA's offerings in the blockchain and cryptocurrency industry.

🇺🇸 BlueSnap appoints Brian Greenfield as chief financial officer. Greenfield joins BlueSnap’s executive team to lead financial operations as the company prepares to embark on its next phase of growth. Read the full article here

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()