Western Union to Buy Intermex for $500 Million

Hey FinTech Fanatic!

Western Union will acquire International Money Express in an all-cash deal worth about $500 million, paying $16 per share.

The move strengthens its LATAM corridors and expands U.S. retail presence, adding 6 million customers and reinforcing agent relationships.

It is expected to boost digital customer acquisition and deliver $30 million in annual savings within 2 years.

“This acquisition is a disciplined, strategic step that strengthens our North America operations and expands our presence with key consumer segments across the U.S.,” said Devin McGranahan, President & CEO of Western Union. Closing is expected by mid-2026, pending approvals.

Scroll down to read the full story and get your daily dose of FinTech 👇

Cheers,

QUIZ

🤔 Think you know FinTech?

Test your knowledge with the latest Connecting the Dots in FinTech quiz by Marcel van Oost! 11 tricky questions. One perfect score. Take the quiz now

INSIGHTS

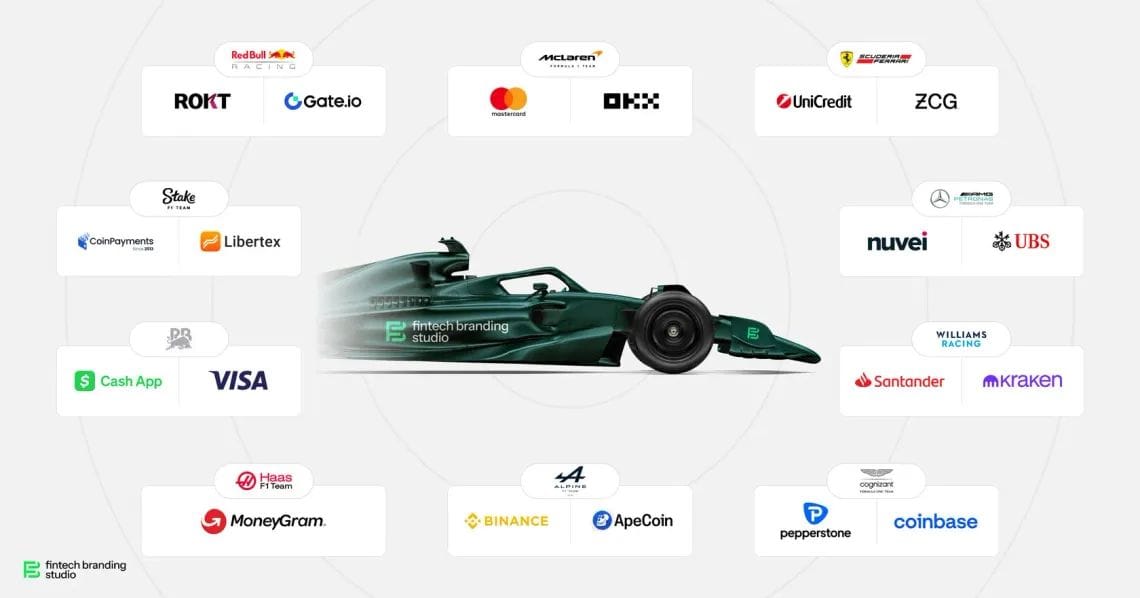

💰 FinTech firms have injected over $500 million into Formula 1 sponsorships for the 2025 season 🤯

🇵🇹 Cards and MBWAY dominate digital payments in Portugal. The report highlights a rapid change in habits among Portuguese consumers, who are abandoning physical cash in favor of more agile and integrated methods. Only 8% of banked Portuguese choose cash as their primary method of in-person payment.

🇬🇧 The UK FinTech Investment dips to $7.2B in the first half. Britain's FinTech sector raised $7.2 billion during the first six months of 2025, marking a modest 5% decline from the $7.6 billion raised in the same period last year. Read more

FINTECH NEWS

🇺🇸 ACI Worldwide was named to CNBC’s World’s Top FinTech Companies and TIME’s America’s Best Mid-Size Companies 2025 Lists. ACI Worldwide recently held its FinTech Awards, celebrating innovation and excellence in the global payments industry. The event honored financial institutions and technology partners that have delivered impactful, real-time payment solutions using ACI’s platforms.

🇨🇭 Geneva Set the Pace at the Horloge Fleurie! Rony Meyer, host of the Geneva FinTech Running Club, led a scenic 5 km run from the iconic Flower Clock, with Lake Léman and the Alps as the backdrop. The crew ran through Geneva’s historic heart, mixing steady strides with sharp FinTech talk, and wrapped up with coffee and great company.

🇺🇸 SoftBank selects banks for US IPO of payments app PayPay. The banks leading preparations for the listing are Goldman Sachs, JPMorgan Chase & Co., Mizuho Financial Group, and Morgan Stanley, the sources said. The PayPay offering is expected to raise more than $2 billion from investors when it takes place.

🇮🇳 BharatPe set to raise a $80-100 Mn pre-IPO round led by Coatue. The round will also see participation from some new and existing investors. This is aimed at strengthening the company’s financial position and setting the stage for an eventual public listing.

🇮🇳 RazorpayX puts artificial intelligence in the CFO's corner before market debut. The move comes as India’s financial technology giant, valued at $7.5 billion, prepares for a public offering within 18 months and seeks to stand out in the neobanking market.

🇨🇳 Hong Kong-based FinTech startup Infini extends white hat offer to $49.5M hacker. Infini has reached out to the hacker, acknowledging their skills and urging them to return 80% of the funds and promising no legal recourse. The hacker now has until August 13, 2025, to accept the offer or face legal consequences.

🇺🇸 Peter Thiel-backed Bullish targets up to $4.82 billion valuation in an upsized IPO. Bullish now aims to raise to $990 million by selling 30 million shares at a price of between $32 and $33 each. This compares with its prior offering of 20.3 million shares at a proposed range of $28 to $31 per share.

🇦🇪 Ant International partners with Abu Dhabi Investment Office and receives IPA from the Central Bank of the UAE to support local digitalisation and FinTech strategy. By leveraging its technological expertise to support the growth of Abu Dhabi's financial technology sector, it empowers local businesses with advanced digital tools and promotes financial inclusion and connectivity.

PAYMENTS NEWS

🇪🇸 PagoNxt simplifies payment reconciliation for UAX and Beyond. UAX Group, which handles over 20,000 tuition payments annually, faces challenges matching incoming payments to the correct student accounts. PagoNxt’s Digital Paying solution streamlines this process, enabling automated, error-free reconciliation with no coding needed.

🌍 Papaya becomes one of the first EMIs in Europe with direct SEPA access. This move places Papaya at the forefront of European payments innovation, eliminating reliance on intermediary banks and unlocking full control over euro transactions (both standard and instant) directly from its infrastructure.

🇺🇸 Blue Origin Spaceflights aboard New Shepard can now be purchased with crypto and stablecoins. Powered by Shift4’s seamless payments technology, consumers can pay with popular cryptocurrencies and stablecoins such as Bitcoin, Ethereum, Solana, USDT, and USDC for trips to space aboard Blue Origin's New Shepard.

🇺🇸 FunnelFox launches the industry’s first unified web billing solution. Designed to help growth teams navigate the complexity of Web2App monetization and overcome infrastructure blockers, FunnelFox Billing unifies the entire web payment flow into a single interface, from checkout to chargeback protection.

DIGITAL BANKING NEWS

🇭🇺 Revolut plans to open a branch in Hungary and may appoint a local manager in the "very near future", revealed Mariia Lukash, the company's Head of Growth. The company will not join the ATM installation program, but if there is customer demand, Revolut ATMs may still come to the country.

🇺🇸 Paxos to pursue national trust charter with the Office of the Comptroller of the Currency. This strategic move will place Paxos under federal oversight and underscores its consistent commitment to maintaining the highest regulatory standards of any blockchain infrastructure and tokenization platform globally.

BLOCKCHAIN/CRYPTO NEWS

🇪🇺 RedotPay launches instant fiat-to-stablecoin Onramps in the UK and the European Union. The new feature enables zero-fee stablecoin purchases using Euro and British Pound deposits, now live across all supported regions. The fiat deposit feature enhances the user experience by offering a more cost-efficient alternative with faster processing time and a safer approach.

PARTNERSHIPS

🇦🇺 Finastra and NTT DATA expand Lending Cloud Service to transform the banking experience. This collaboration will support Finastra's Lending Cloud Service, strengthening the delivery of managed services for financial institutions across the MAAP (Middle East, Africa, Asia Pacific) and LATAM regions.

🇺🇸 Ontop and Thredd partner to deliver a more modern, frictionless payroll and payments experience for global workers. The collaboration will give Ontop’s global workforce and clients a faster, more flexible, and modern way to access and use their earnings, delivering a more frictionless payroll and payments experience.

🇸🇦 Shahbandr and Tamara partner to empower over 18,000 online stores with BNPL solutions. Through this partnership, Tamara will provide its BNPL solution to all online stores on the Shahbandr platform, enhancing the shopping experience and increasing conversion rates by offering diverse payment methods and instalment options.

🇳🇱 payabl. Supercharges growth with Silverflow’s cloud-native processing platform. The collaboration marks a significant shift to more agile, API-first technology, unlocking faster time-to-market, operational reliability, and a shared vision for innovation.

🇳🇿 New Zealand's Co-operative Bank selects 10x Banking for core replacement. The partnership will deliver leading core banking infrastructure for The Co-operative Bank (through a phased full-platform migration), which will position the bank for future growth and continue to enable better banking for its 180,000+ customers.

🇵🇹 Akurateco announces new integration with Whitepay to enable crypto payments. This collaboration allows all Akurateco customers, ranging from payment providers to acquirers and enterprise merchants, to start accepting crypto payments from their end users, offering new levels of flexibility at checkout.

🇧🇷 Stripe users can now accept Pix in Brazil via EBANX. Businesses on Stripe can now offer Pix, the popular instant payment method developed by the Central Bank of Brazil. They are now able to process Pix payments from Brazilian customers, with settlements available in the merchant's domestic currency.

DONEDEAL FUNDING NEWS

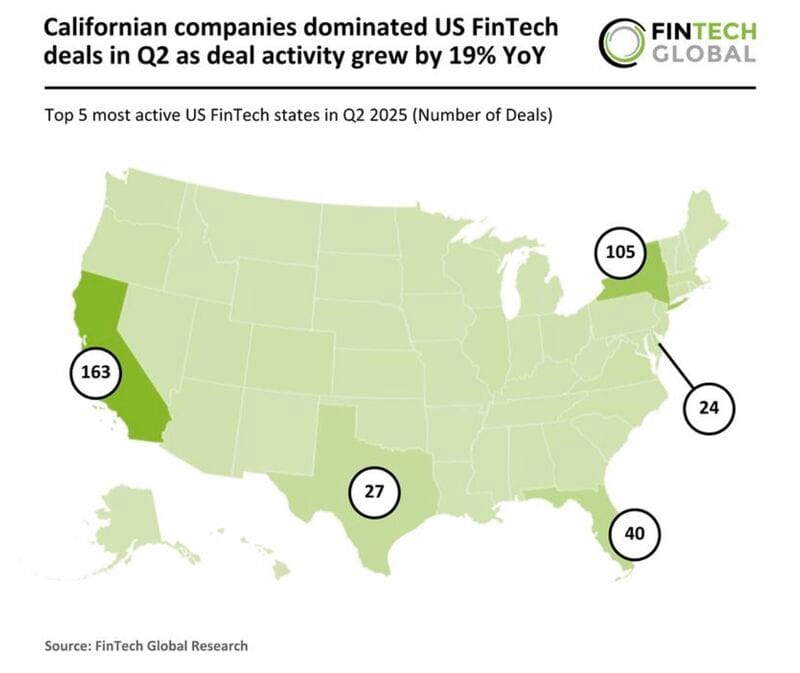

🇺🇸 California dominated US FinTech deals in Q2 as deal activity grew by 19% YoY.

Other Key US FinTech Investment Stats in Q2 2025:

🇬🇧 British crypto startup BOB raises €8.1 million to cement Bitcoin’s role in decentralised finance (DeFi). The funds raised will accelerate the development of BOB’s hybrid chain infrastructure, expand ecosystem integrations, and support institutional adoption.

M&A

🇺🇸 Western Union to acquire International Money Express, Inc. This acquisition strengthens Western Union’s retail offering in the U.S., expands market coverage in high-potential geographies, and is expected to accelerate digital new customer acquisition.

🇲🇽 Finsus acquires Anticipa Tech to boost SME liquidity in Mexico. This acquisition strengthens Finsus’ commitment to providing SMEs with digital-first, tailored financial products that support growth and enable faster, more transparent access to capital.

MOVERS AND SHAKERS

🇺🇸 PayPal has appointed Ben Volk as SVP & GM of PayPal Consumer. He joins from Google, where he served as VP & GM, Google Pay and Google Wallet. Volk also spent 15 years at Amazon, holding various roles over the years, including VP, Payments.

🇬🇧 Tandem appoints David Shrimpton Davis as the New MD of Motor Finance. Shrimpton Davis brings with him deep-rooted experience in leading and growing a motor finance business, having formerly led Moneybarn, the successful motor finance arm of Vanquis Banking Group.

🇨🇲 Wave appoints Joël Bertrand Ndjodo to lead Cameroon operations. This move signals Wave’s intention to leverage local expertise to challenge established players like MTN and Orange. Continue reading

🇺🇸 Thread Bank names Marty Miracle as new CDO. In his new role, Miracle will take responsibility for the bank's technology strategy, engineering, infrastructure, and cybersecurity operations. His mandate includes ensuring system resilience and regulatory readiness, and enabling seamless integrations with banks.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()