Walmart Rebuilds Card Program With Synchrony, OnePay

Hey FinTech Fanatic!

After ending its credit card partnership with Capital One, Walmart is moving forward with a new program supported by its in-house FinTech firm, OnePay.

Capital One had served as the exclusive issuer of Walmart’s credit cards since 2018, but the relationship was cut short when Walmart filed a lawsuit in 2023 to exit the agreement early. At the time, Capital One alleged the move was intended to transition transactions to OnePay.

Formed in 2021 through a joint venture with Ribbit Capital, OnePay is now partnering with Synchrony to issue and underwrite two new credit cards: a general-purpose Mastercard and a Walmart-only store card. OnePay will handle the customer experience through its app, keeping the interaction within Walmart’s ecosystem.

Walmart, the largest retailer in the world, appears to be aiming for more control, scale, and broader national reach. Through OnePay, it’s assembling a comprehensive suite of financial products, including credit, debit, savings, P2P, and BNPL, the last supported by a recent partnership with Klarna.

Walmart’s card program previously reached 10 million customers, with $8.5 billion in outstanding loans last year. With Synchrony behind the infrastructure and OnePay managing the front end, the company is now reasserting its presence in a market it already knows well.

“Our goal with this credit card program is to deliver an experience for consumers that’s transparent, rewarding, and easy to use,” said OnePay CEO Omer Ismail.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Stay on top of FinTech trends. Subscribe to FOMO now and catch the week’s most important news and updates.

INSIGHTS

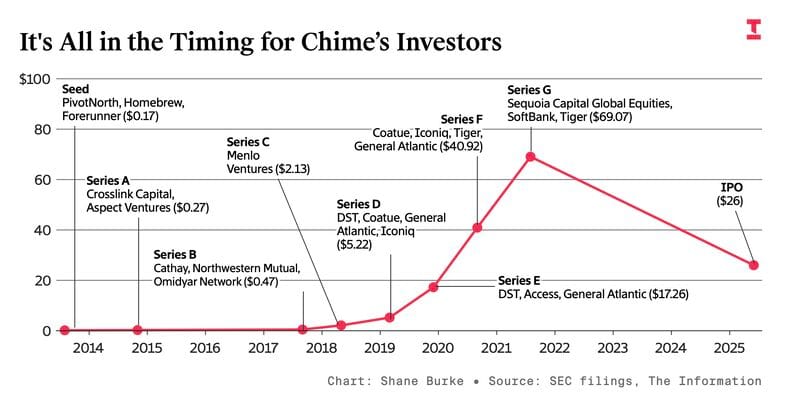

📈 Chime’s IPO Will Have Big, Big Winners and Serious Losers.

FINTECH NEWS

🇺🇸 Robinhood extends rally as speculation over S&P 500 inclusion grows. The rebalancing is set to be announced after the close of regular trading. Robinhood shares rose 3.3% in the session, bringing their gain to 17% over six trading days. Read more

🇸🇬 Singapore to block access to trading platforms Octa and XM. The Singapore Police Force and the Monetary Authority of Singapore stated that the two platforms were offering leveraged foreign exchange trading, commodities, indices, and equities to customers in Singapore without the required licenses.

🇺🇸 FINRA imposes a $100k fine on DriveWealth. In June 2020, DriveWealth arranged with a clearing firm to transfer customer accounts via ACATS, as DriveWealth wasn’t eligible. By failing to take timely action on customer transfer requests, DriveWealth violated FINRA Rules 11870(a) and 2010.

🇱🇺 Luxembourg left out of Revolut’s new payment rollout. The rollout will enable customers to send and receive money instantly via the Wero digital wallet. Wero will support mobile numbers from France, Germany, and Belgium, but the platform aims to expand its reach.

🇺🇸 Walmart is using its FinTech firm to offer credit cards after parting ways with Capital One. OnePay is partnering with Synchrony, a major behind-the-scenes player in retail cards, which will issue the cards and handle underwriting decisions starting in the fall, the companies said.

PAYMENTS NEWS

🇳🇱 Buckaroo is joining EPI Company as a principal member to deploy Wero. This initiative aims to create a European payment solution that is secure, seamless, and sovereign. Keep reading

🇬🇧 Mercuryo integrates Passkey to boost Web3 payment speed and security without inputting a Time Passcode (OTP) delivered via text message or email. Passkey, available on iPhone, Android, or Windows, will be rolled out across Mercuryo’s 200+ partner network, including non-custodial wallets.

🇳🇬 PayU GPO strengthens Africa presence with A2A rollout and senior appointment. The solution allows consumers in Nigeria to pay merchants directly from their bank accounts without the need for a card. The benefits include lower transaction costs, real-time transactions, a frictionless user experience, and accessibility and choice for consumers.

🌍 Onafriq links 1 billion connected mobile wallets, 500 million bank accounts across Africa. Onafriq has transformed into a full omnichannel payments network. It facilitates cross-border disbursements, collections, card issuance and processing, offline agent banking services, and FX & treasury services.

🇺🇸 Plaid now offers instant pay-ins and payouts through its multi-rail platform, Plaid Transfer. In partnership with Cross River, the solution features real-time settlement, Plaid Link bank authorization, account verification, balance checks, and smart routing via a single integration.

🇻🇳 Visa introduces Click to Pay with leading banks and payment facilitators in Vietnam, transforming the online shopping experience. It provides consumers with a fast, secure, and convenient checkout experience with global acceptance, as Click to Pay is now enabled in even more places where cardholders want to shop online.

🇧🇷 Pix registers new daily record for transactions. According to the Central Bank, there were 276.7 million transactions in a single day, surpassing the 252.1 million operations recorded on December 20, 2024. It also reported that the financial value of these 276.7 million transactions is R$135.6 billion.

DIGITAL BANKING NEWS

🇲🇾 KAF Digital Bank goes live on Temenos SaaS to elevate Islamic digital banking in Malaysia. With Temenos SaaS, the bank is set to deliver innovative Shariah-compliant financial solutions that simplify financial management and enhance digital convenience with a cutting-edge, user-centric banking experience.

BLOCKCHAIN/CRYPTO NEWS

🇸🇻 Tether’s $500 billion valuation sparks IPO rumor. Despite the valuation buzz, CEO Paolo Ardoino insists Tether has no plans to go public, emphasizing confidence in its private structure. Continue reading

🌎 Cetus protocol relaunches after $220m hack and restores liquidity. These users’ liquidity provider (LP) functions will resume as normal, and their position NFTs will serve as certificates for claiming CETUS compensation, even if the liquidity is fully withdrawn in the future.

🇬🇧 Sam Altman-backed eye-scanning ID startup launches in UK. The initiative uses a spherical eye-scanning device called the Orb to verify identities. By scanning a person’s iris and face, the device generates a unique code to differentiate humans from AI.

🇺🇸 NeverPay introduces 'buy now, pay never' crypto payments, allowing users to leverage the yield generated by their staked crypto to fund real-world purchases. The staked crypto remains intact, and users regain access to the original amount after the staking period.

PARTNERSHIPS

🇳🇿 Westpac partners with Akahu to boost open banking access. With this new connection, open banking will quickly come to life for Westpac customers who will be able to seamlessly and securely link their accounts to an established ecosystem of innovative financial tools and services.

🇬🇧 UK finance watchdog teams up with Nvidia to let banks experiment with AI. The Financial Conduct Authority said it will launch a so-called Supercharged Sandbox that will “give firms access to better data, technical expertise and regulatory support to speed up innovation.”

🇬🇧 Santander partners with Worldpay to support business banking and corporate customers. The partnership will offer Santander customers secure, scalable, and efficient merchant payment solutions. For business customers, a wide range of solutions will be available for all point-of-sale, e-commerce, and integrated payment needs.

🇺🇸 Selfbook chooses PayPal as a commerce partner. It will integrate PayPal and Venmo as payment options for its hotel customers. The partnership will advance travel booking into the age of agentic AI by leveraging conversational AI to help customers book and pay.

🇨🇦 Trust Payments partners with Trulioo to streamline verification, reduce onboarding costs, and accelerate global growth. In addition, both will continue to focus on meeting the needs, preferences, and demands of clients and users in an ever-evolving market.

🇬🇧 iDenfy partners with SpaceCore to offer client verification. Leveraging iDenfy’s AI-driven identity verification suite integration, SpaceCore aims to improve platform security, align with global compliance requirements, and offer secure, user-friendly tools.

DONEDEAL FUNDING NEWS

🇵🇭 Atome to get $75 million from lending Ark as credit demand grows. The financing will help Atome to broaden its credit offerings and expand financial access in the Philippines. Atome offers insurance, savings, cards, and lending services. Continue reading

🇺🇸 Parlay Finance secures $2 million in Seed funding. This capital positions it to continue scaling its technology nationwide, helping community lenders unlock substantial growth in the $1.4 trillion small business lending market. The platform's capabilities include digital customer onboarding, information verification, and an AI-powered decision management system.

🇫🇮 Finland’s FinanceKey secures €3 million in funding to expand into new markets. The new funding will be used to drive product development, strengthen the team, and expand across Europe, while accelerating FinanceKey’s mission to transform the global treasury infrastructure.

M&A

🇮🇳 Zaggle to acquire Dice Enterprises for $14.7m, eyes SaaS expansion. By integrating Dice’s skilled tech talent, Zaggle aims to accelerate innovation and enhance the feature set of its platform. The deal is expected to be finalised within 90 days.

🇳🇬 First Ally Capital acquires majority stake in Mines.io Nigeria, operating under the brand name Migo, a FinTech company. The acquisition aligns with First Ally’s strategic objective to drive the application of technology in the delivery of financial services to a larger proportion of the population.

🇺🇸 Nasdaq-listed FinTech Netcapital acquires crypto native protocol Mixie. The acquisition was touted for enhancing “synergies between Mixie’s tokenization capabilities and Netcapital’s browser-based security offering,” the company said. Keep reading

MOVERS AND SHAKERS

🇺🇸 ACI Worldwide appoints Robert Leibrock as Chief Financial Officer. Thomas Warsop, President and CEO, said: “His extensive experience leading finance organizations in global, complex environments will be invaluable as we continue to execute our growth strategy. His strategic acumen and proven financial expertise position him well to drive our financial discipline and operational excellence.”

🌏 Western Union appoints Vince Tallent as Senior VP, Head of Asia Pacific. Tallent said: “This is an exciting opportunity to build on Western Union’s growth momentum in the region by delivering customer-centric, innovative solutions that empower individuals as they send and receive money, ultimately making financial services accessible for all.”

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()