Visa Starts New Brazil Venture to Enter Pix Market

Hey FinTech Fanatic!

Are you in Berlin this week? On Wednesday, we’ve got another FinTech Running Club meetup in the city. Our local host Robin Binder, recently featured in Manager Magazin, has been a big part of growing our FinTech community in Berlin! Let’s shut the laptops, lace up, and talk FinTech after getting some fresh air.

Run with us! Sign up here

Now, let's get our daily dose of FinTech:

Visa has launched a new company in Brazil called Visa Conecta, marking a step in its strategy to move beyond cards and build a stronger presence in real-time payments, starting with Pix.

Visa Conecta will operate as a Payment Initiation Provider (PIP), enabling users to complete Pix payments directly on e-commerce platforms without the need to scan a code or switch to a banking app. This follows a new one-click payment flow introduced by Brazil’s Central Bank in February.

The company applied for a Central Bank license in November 2024 and expects approval by November 2025. Until then, it plans to begin operations in September using the license and infrastructure of local partner Celcoin, while the experience will be fully branded and delivered by Visa.

The platform will rely on Tink's tech, the open banking firm Visa acquired in 2022 for €1.8 billion. All of Visa’s future open finance products in Brazil will be developed under the Visa Conecta brand.

Leonardo Enrique Silva, who will lead the new company, said the launch follows extensive conversations with clients. “Almost all of [our clients] told us the Achilles’ heel of Pix is conversion,” he said. The goal is to reduce friction and improve checkout performance for merchants.

Revenue expectations have not been disclosed, but Enrique noted the new venture is expected to become “an important pillar for Visa, both in terms of revenue and reach.” He also confirmed that additional open finance products are already in development.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Stay on top of FinTech trends. Subscribe to FOMO now and catch the week’s most important news and updates.

FINTECH NEWS

🇳🇴 Klarna in tough times: Complaint filed for violation of rules. The Norwegian Consumer Council believes that Klarna is violating regulations by not informing consumers about the actual cost of credit purchases. The case will now be forwarded to the Norwegian Consumer Authority.

🇺🇸 The Circle IPO leaves $1.72 billion on the table and is the seventh-largest underpricing in decades. If competition rises and times get tough, Circle and its shareholders may sorely miss the extra almost $1.7 billion that went to first-day gains for the underwriters’ clients and not into its coffers. That’s over ten times its profits from last year.

🇺🇸 Bankrupt FinTech Synapse asks to convert its Chapter 11 case into liquidation, or dismiss the matter entirely, after the FinTech failed to find a buyer for its assets. It filed for bankruptcy in April 2024, resulting in several frozen funds from customers who worked with a litany of its finance app partners.

🇮🇳 E-commerce major Flipkart has received a Non-Banking Financial Company (NBFC) license from the Reserve Bank of India (RBI), allowing it to offer loans directly to customers and sellers on its platform. This marks the first time a major Indian e-commerce player has secured such authorisation.

PAYMENTS NEWS

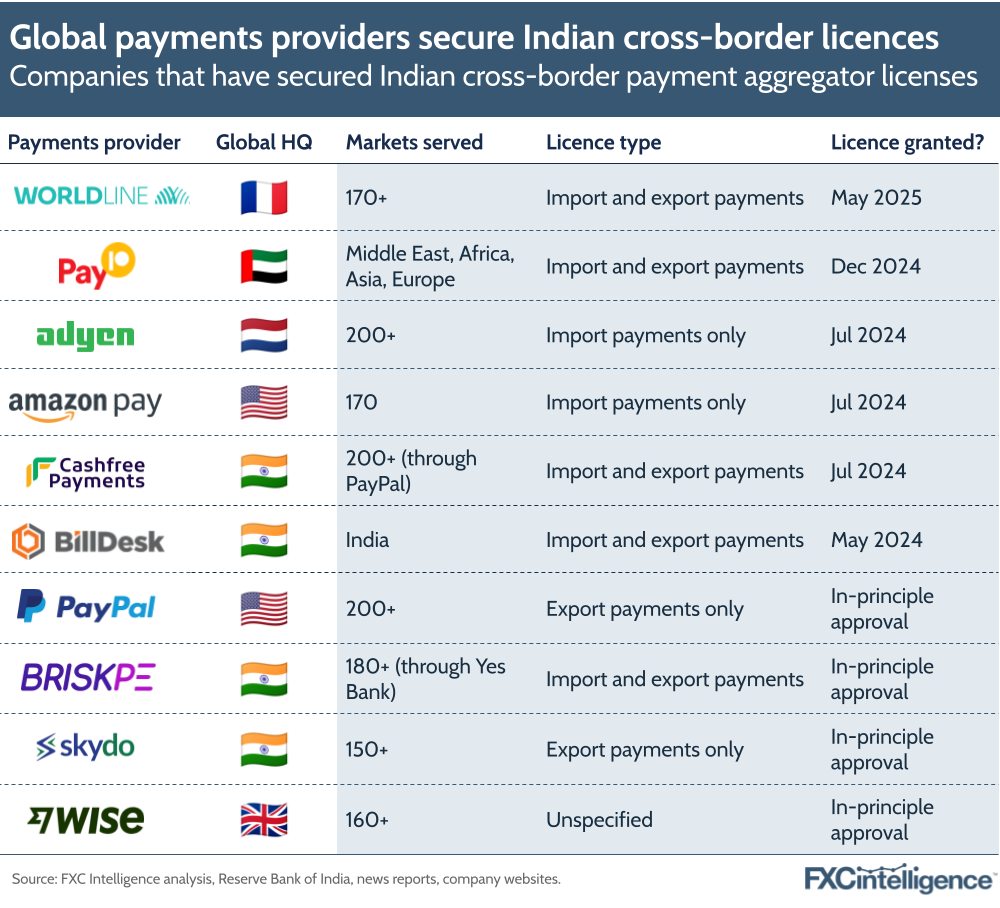

🇮🇳 PayPal and Worldline highlight growing India opportunity.

🇮🇳 IPO-bound PhonePe announces UPI payments on feature phones. This innovative feature-phone UPI app will provide essential capabilities such as peer-to-peer transfers and offline QR payments, specifically designed to cater to the often overlooked feature phone demographic.

🇧🇷 Visa launches new company in Brazil to enter PIX. The move is part of Visa's global strategy to transform itself into a financial transaction technology company, going beyond credit and debit cards. For e-commerce is the reduction of friction and the potential increase in conversion.

REGTECH NEWS

🇬🇧 UK financial watchdog to lift ban on crypto ETNs. The move would mean that cETNs could be sold to individual consumers in the UK, rather than just professional investors, if they are traded on an FCA-approved investment exchange. Continue reading

DIGITAL BANKING NEWS

🇸🇬 PEXX launches a Neobank, bridging USD and crypto for global users. The Singapore-based FinTech allows users to open USD accounts without US residency requirements, using only a passport and phone for instant onboarding. The platform integrates traditional banking with cryptocurrency capabilities, enabling deposits in USDT and USDC stablecoins.

🇫🇷 London’s FinTech hub reputation is under fire as Revolut opens its HQ in Paris. Ten years after a surge of FinTech startups emerged in the UK, London's status as a global FinTech leader is beginning to wane, according to journalist Sally Hickey. Read the complete article

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Uber eyes stablecoins to cut global payment costs, CEO Dara Khosrowshahi says bitcoin is a 'proven commodity'. His comments come amid a broader push within the tech sector to evaluate the role of digital assets in everyday transactions, particularly those involving mobility and delivery Services.

🇺🇸 Crypto exchange Gemini confidentially files for US IPO. Gemini, which operates a trading platform enabling investors to buy, sell, and store more than 70 crypto tokens, said it has not yet determined the size or proposed price range for its offering.

🇩🇪 Deutsche Bank explores stablecoins and tokenized deposits. The bank is also assessing the development of its own tokenized deposit solution for use in payments, intending to improve efficiency. Read more

🇺🇸 Bitcoin ATM operator CoinFlip to explore sale. The Chicago-based company is working with a financial adviser to seek a buyer. CoinFlip is considering seeking at least $1 billion in the sale, though it’s unclear if it will be able to achieve that valuation.

🇰🇿 Kazakhstan’s National Bank rolls out crypto card for instant conversion to fiat. Kazakhstan’s crypto card is designed as a non-cash payment solution within the Astana International Financial Centre (AIFC). Users need a crypto wallet from a licensed digital asset service provider to use the card for everyday transactions.

🇺🇸 Apple, X, and Airbnb among growing number of Big Tech firms exploring crypto adoption. The interest from Big Tech comes as stablecoins have attracted millions in venture funding and lawmaker attention as Congress weighs two bills that would regulate the asset class.

PARTNERSHIPS

🇺🇸 Fasten partners with Visa's Fast Track Program to launch a rewards card. This card is designed to provide value to both consumers and dealerships by simplifying car payments and fostering loyalty in the automotive industry. Fasten is granted access to various resources, simplified onboarding, risk, and fraud management solutions.

🇧🇸 Commonwealth Bank and Mastercard bring Apple Pay to customers in the Bahamas. Customers can use Apple Pay on iPhone, iPad, Apple Watch, and Mac to make faster and more convenient purchases in apps or on the web without having to create accounts, card details, or shipping and billing information.

🇺🇸 ThetaRay and Spayce team up to fight financial crime using cognitive AI. Spayce has integrated ThetaRay’s solution into its global payment infrastructure, optimising its financial crime detection capabilities. This solution analyzes large volumes of transaction data, identifying subtle suspicious activities and uncovering financial crime schemes with precision.

DONEDEAL FUNDING NEWS

🇧🇷 Agibank raises $350M through FIDC to expand credit operations. It will use the funds to finance new credit operations. Agibank offers digital accounts, credit cards, and loans to the underserved population in Brazil. Continue reading

🇮🇳 FinTech startup Decentro raises Rs 30 crore and will shift domicile to India. The company intends to move its base from Singapore to India. Decentro aims to enhance its products and expand its enterprise adoption. They offer APIs for KYC, payments, and debt collection.

🇺🇸 PopID closes equity financing. The additional capital will allow it to work with its partners to build critical infrastructure to support an open-loop, global biometric network that can connect point-of-sale solutions to any loyalty program, card payment method, FinTech wallet, BNPL platform, stablecoin product, or PBB scheme.

M&A

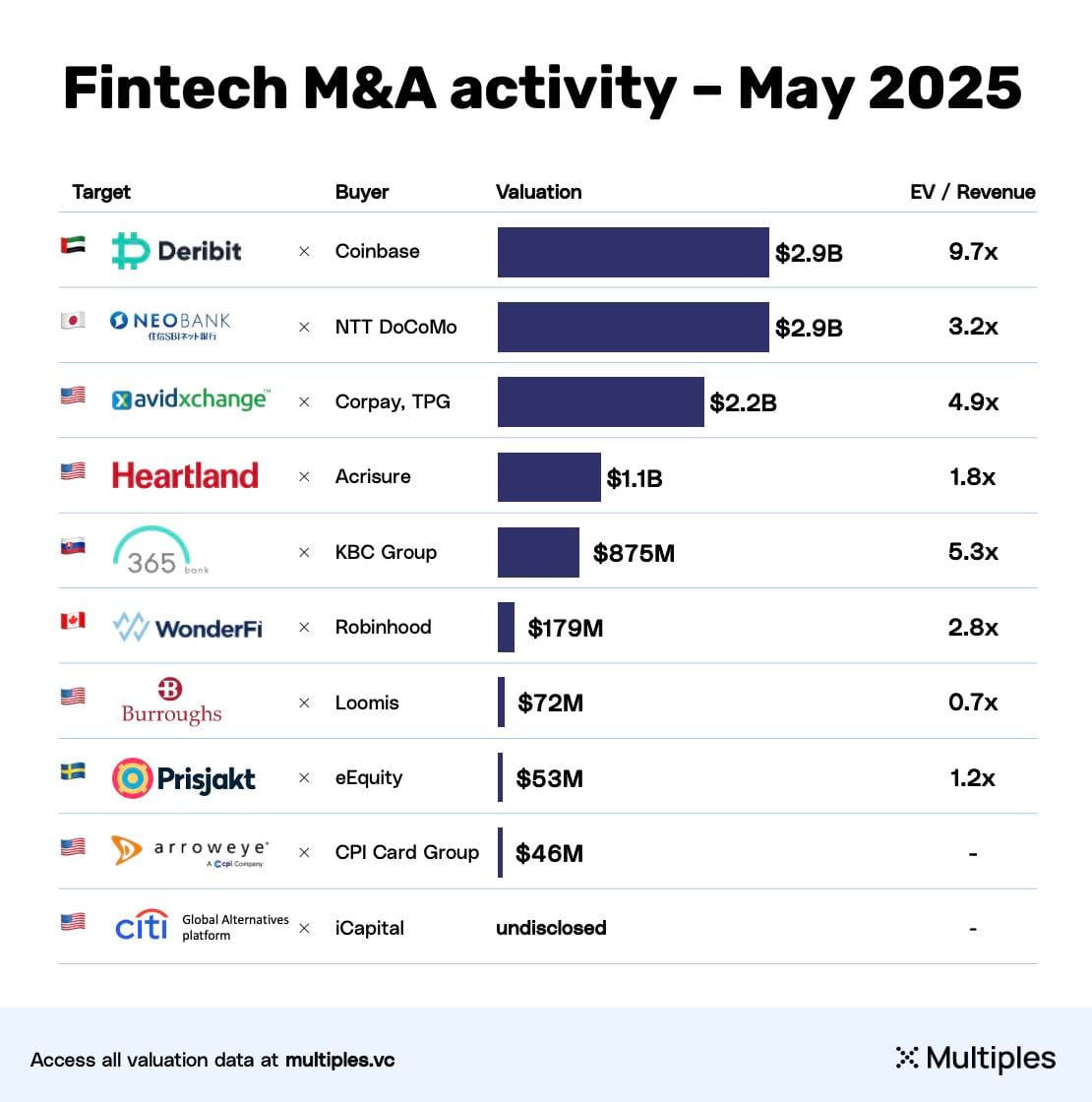

💰 Four $1B+ M&A transactions happened in FinTech last month👇

🇰🇷 Naver Pay makes first move into proptech with Asil acquisition. FinTech arm aims to expand presence in property market with 30 billion won investment. Analysts say the acquisition aims to combine Naver’s broad property listings with Asil’s analytics capabilities to improve platform competitiveness.

🇮🇪 Fiserv to acquire AIB Merchant Services. Focus remains on delivering market-leading solutions to SMEs across Ireland and the broader European market. The transaction is subject to regulatory approvals and closing conditions and is expected to close in the third quarter.

🇫🇷 Lemonway acquires PayGreen’s Business. This acquisition enables Lemonway to extend its expertise to e-commerce sites, complementing its historically marketplace-focused offering and third-party account payment solutions. The team of 11 employees will now form Lemonway’s e-commerce department.

🌍 Tether backs Shiga Digital to boost blockchain finance across Africa. The partnership supports blockchain-based financial tools designed for businesses in emerging markets. This move signals Tether’s broader intention to enhance financial access through USDT in underserved regions.

🇺🇸 Shift4 further extends previously announced tender offer to acquire Global Blue. The offer is subject to certain conditions, among other things, satisfaction of a minimum tender condition, for which the ninety threshold has been met, the receipt of regulatory approvals in certain jurisdictions, and other customary closing conditions.

MOVERS AND SHAKERS

🇺🇸 Former Stripe exec Will Larson named new Imprint CTO. In his new role, Larson will oversee Imprint's engineering team and technology strategy, focusing on enhancing the company's cloud-based credit card and banking platform. His responsibilities include implementing AI and machine learning capabilities across the organisation and its systems.

🇳🇬 Binance Compliance Chief, Tigran Gambaryan, Leaves Binance after detention in Nigeria. Gambaryan is officially parting ways with the crypto exchange after enduring eight months of detention in Nigeria over money laundering allegations.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()