Visa Completes Acquisition of Pismo

Hey FinTech Fanatic!

I must start by expressing my sheer astonishment at the weather here in New York City. Waking up to a snow-covered cityscape was a surreal experience, especially since it's been ages since I last witnessed snow like this (aside of my snowboarding trip in the Alpes last year). Still loving it over here though!

Now, let's not waste any more of your time and dive straight into today's FinTech news I listed for you below👇

Cheers,

Marcel

SPONSORED CONTENT

Only 21 days left to get your Fintech Meetup tickets! Don't miss 45,000+ meetings at Q1's BIG Fintech Event. Room Block 60% Sold out - Register & Book Room before Feb 5 Deadline!

Get tickets today!

POST OF THE DAY

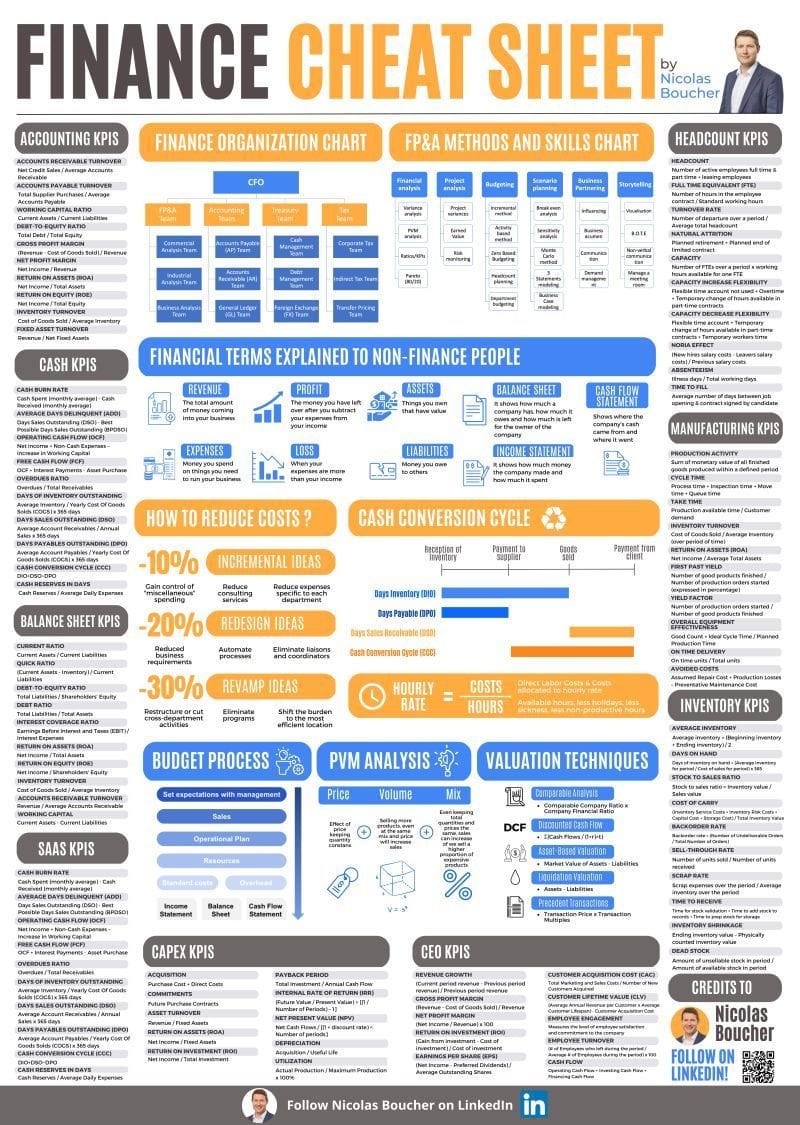

“Understanding your numbers is not just an option; it's a necessity.” - W. Buffet Become World Class at Understanding Finances:

#FINTECHREPORT

Here are the Top Trends in Payments for 2024 by Capgemini. Anticipate continued payments industry transformation in 2024, with frontrunners streamlining processes and leveraging DeFi and AI. Download the complete report for more interesting info.

FINTECH NEWS

Mangopay partners with Storfund to offer marketplaces an embedded cash flow solution for their sellers. Through the collaboration, marketplaces can offer sellers the opportunity to activate immediate payment for sales. This in turn can rapidly improve cash flow for businesses selling on the market.

🇬🇧 Wise hikes profit guidance as customers sending cash overseas surges again. In a recent update, the firm said the gross yield on balances was 4.2 per cent over the three months, up from 3.8% in the previous quarter.

Jabil partners with Revolut. Both companies are scaling the production of Revolut Reader, a mobile POS solution for seamless and secure in-store or on-the-go payments. The partnership addressed evolving customer needs and market demands, ensuring compliance with local laws and requirements.

🇳🇬 Nigerian fintechs prepare for central bank’s new licensing regime. Yemi Cardoso, Nigeria’s central bank governor, announced plans last November to comprehensively review licenses granted to financial institutions, particularly those in “the technology-driven payment services sector.”

PAYMENTS NEWS

Worldline and Google announce strategic partnership to enhance digital payments experiences with cloud-based innovation. In addition, both partners will jointly address go-to-market opportunities, and provide new and enhanced digital customer experiences for merchants and financial institutions.

Payment Orchestration is one of the hottest things in FinTech right now. To understand the difference between Payment Gateway and Payment Orchestration, delve into this in-depth update based on an insightful piece by Linas Beliūnas.

OPEN BANKING NEWS

🇬🇧 Open Banking in the UK: Where are we after 6 years? Primarily impacting payments up until this point, the Open Banking mandate was intended to boost competition amongst service providers and open a raft of opportunities for both consumers and businesses. Keep reading

DIGITAL BANKING NEWS

Here’s an updated look at the largest US banks by market cap.

🇿🇦 TymeBank swings into profitability in under five years. The milestone marks a pivotal moment as SA’s only black-controlled bank. This, as the branchless bank consistently acquires 150 000 customers each month, breaching the eight million customer mark.

🇺🇸 Current to offer free in-app tax service; partner with Column Tax to save money for majority of Americans living paycheck-to-paycheck. This partnership will save millions of Americans much-needed money this tax season through a highly accessible and affordable embedded tax filing experience.

Revolut has started to offer Avios for debit card spending in five European countries (Spain, Portugal, Croatia, Greece and Malta) via its new RevPoints loyalty scheme, which is a feature. Users can choose to round-up any card transaction to the nearest whole number and exchange the difference for points.

Here are the world’s lowest-cost remittance markets in 2023: For a send value equivalent to around $200 to the world’s largest 35 remittance destination markets, for all pay-in and pay-out methods across cash and digital, FXC Intelligence found that Croatia climbed the rankings significantly this year to become the lowest-cost market to receive remittances globally.

🇲🇽 Nu México has announced the integration of its app with Dinero Móvil (Dimo), Banco de México's (Banxico) new transfer platform. This integration simplifies digital transactions, allowing commission-free money transfers using only the recipient's ten-digit mobile number.

Bank valuations could rise by $7 trillion in five years, BCG study finds. Lenders could roughly double their current valuations if they pursue growth and improved price-to-book ratios despite obstacles, the consultant said. "The largest driver of pessimism about the banking sector has been the significant drop in profitability," added.

🇺🇸 Goldman scores a win with sharply higher earnings. Profit was up 51%, a welcome change after eight quarters of declines. The strength was asset and wealth management, where Goldman CEO David Solomon has pinned much of its hopes.

African neobank Kuda raised $20M at flat valuation in 2023, missed user milestone projection by 3M. The CEO said that Kuda had achieved a notable milestone, with 7 million retail and business customers as of today. However, the figure falls short of the fintech’s projections when it saw fresh investment last year.

🇬🇧 Number of SMEs switching banks using CASS hits 10-year low. The Current Account Switch Service (CASS), has been used four times less by small and medium businesses than it has by personal customers, with just 33,000 UK SMEs using the service. Read on

Revolut denies wrongdoing In Allianz Travel Insurance deal. Online banking business Revolut Ltd. has denied unlawfully backtracking on a deal with Allianz over travel coverage for the financial technology company’s customers arguing it did not cause the insurer any loss.

BLOCKCHAIN/CRYPTO NEWS

🇳🇱 Zero Hash joins United Bitcoin Companies Netherlands (VBNL) to promote trust, reliability, and best practices for the Netherlands crypto market. The company aims to apply its regulatory compliance expertise from the U.S. to the Netherlands while joining forces to build trusted bridges between members, industry participants, regulators, and policymakers.

🇺🇸 Coinbase, SEC set for courtroom face-off today. Oral arguments on Coinbase’s motion to dismiss the SEC’s lawsuit, filed last June, will kick off in Manhattan Wednesday (Jan 17) morning. Legal experts and crypto fans say the exchange has a solid chance at getting its way.

🇮🇳 Google removed several crypto apps in India, following Apple. This action follows a series of warning notices sent by the Indian finance ministry to nine virtual digital assets (VDAs) service providers last month, citing potential violations of the country’s anti-money laundering regulations.

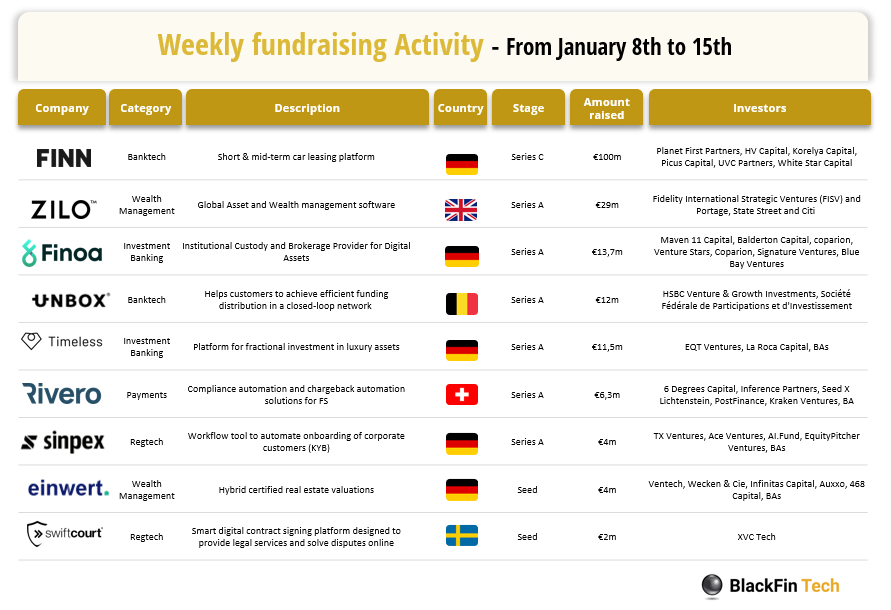

DONEDEAL FUNDING NEWS

Fintech funding halved last year, but VCs are excited about these areas and deals in 2024. Index Ventures’ partner Mark Fiorentino targets 3 key investment areas in financial services for potential significance in 2024: The next generation of fintech infrastructure, finance tech for underserved industries, and the CFO software stack. More here

🇬🇧 Onboarding platform Detected raises £2m follow-on investment round from Thomson Reuters and Love Ventures. The new funding will support the development of the company’s growth strategy in 2024 following its expansion into the US last year.

Late-stage funding to financial services and FinTech startups in 2023 totaled only $25 billion, the lowest since 2017. Learn more

🇩🇪 Pliant concludes a successful 2023 with a €33 million Series A extension and €100 million debt facility. Pliant has developed multi-currency capabilities, and can now offer its services in 11 currencies to enable customers to be billed in currencies other than Euros.

🇧🇷 Brazil is home to a third of all Latin American FinTech deals in 2023. Here are the key Latin American FinTech investment stats in 2023. Link here

🇬🇧 Car finance fintech Carmoola raises $15.5 million. The new capital arrives as many existing lenders face the prospect of an FCA probe into the potential mis-selling of car finance, a move that could open the floodgates to compensation claims from millions of drivers.

M&As

Visa completes acquisition of Pismo. With the transaction complete, the combination of Visa and Pismo will provide clients with core banking and card-issuer processing capabilities across all product types via cloud native APIs. Read more

MOVERS & SHAKERS

Gigs hires Steven van Bommel as Head of Finance. Van Bommel - who served as head of strategic finance at payments giant Adyen - will be responsible for Gigs' financial operations, including building out the accounting and finance teams. Read more

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()