Visa and Mastercard Face Investigations in Türkiye and the UK

Hey FinTech Fanatic!

It’s shaping up to be a rough week for the card giants. Türkiye’s Competition Authority has launched an antitrust investigation into Visa and Mastercard, probing whether they have blocked local payment providers from facilitating international merchant transactions, thereby bypassing their fees.

Meanwhile, in the UK, a new multi-billion-pound class action lawsuit is targeting those two again, not surprisingly, over consumer card interchange fees. With legal heat intensifying across borders, Visa and Mastercard’s global dominance is facing renewed scrutiny.

Scroll down for what’s at stake and your daily dose of the hottest FinTech updates. 👇

Cheers,

P.S. Follow me on Threads for daily scoops!

#FINTECHREPORT

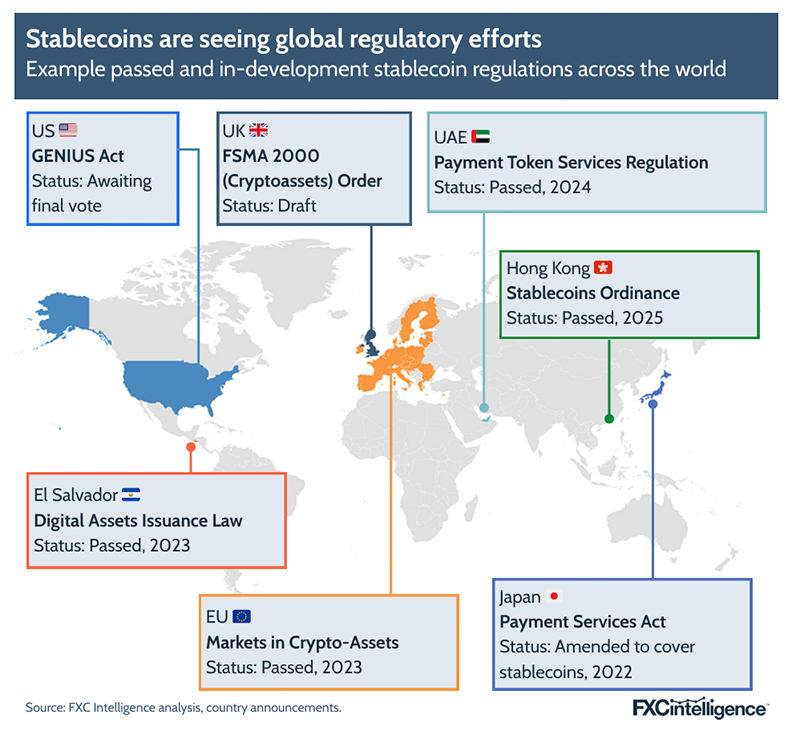

🌍 2025 is the year of stablecoins.

Here's a market map of Key Players 👇 Who's missing?

FINTECH NEWS

🇺🇸 Interactive Brokers fails to secure protective order for Thomas Peterffy in an engineering negligence lawsuit. The Judge explained that, after reviewing the plaintiff’s response and the supporting documents, the court concluded that the plaintiff has made an adequate showing that the requirements for an apex deposition are satisfied.

🇺🇸 US to investigate Brazil’s digital payment system. US Trade Representative Jamieson Greer said the investigation will review Brazil’s “tariff and non-tariff barriers,” saying the country offers preferential treatment to other trade partners while disadvantaging US exporters.

🇬🇧 JPMorgan’s legal action against Viva Wallet blocked by UK courts. In 2022, JPM took a 48.5% stake in Viva Wallet. But within a couple of years, the relationship between the two parties deteriorated, with both parties filing lawsuits against each other last year.

PAYMENTS NEWS

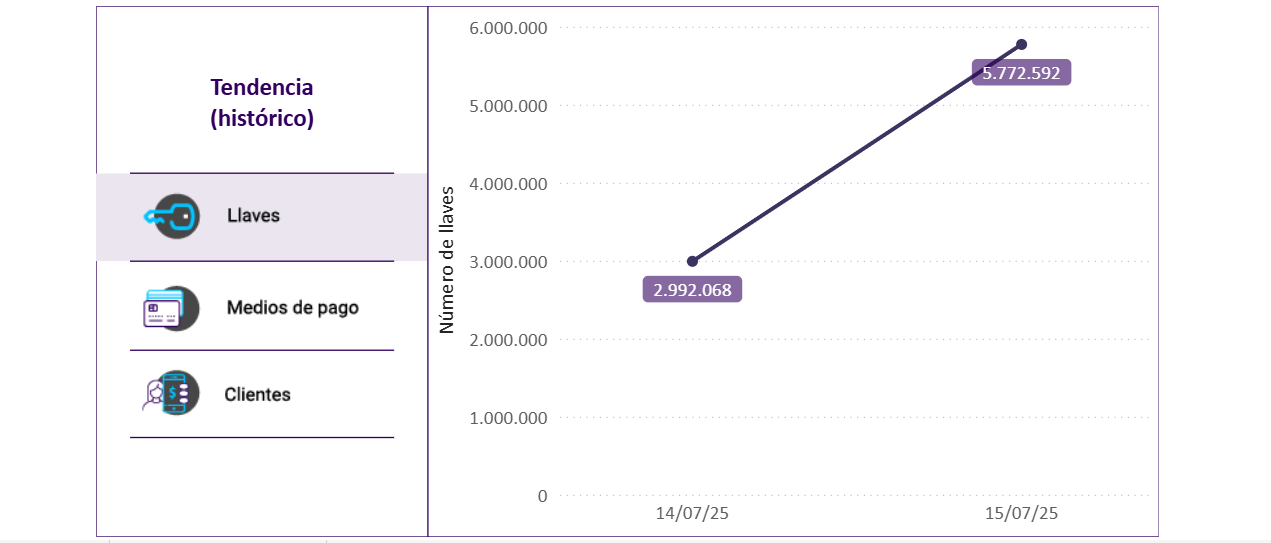

🇨🇴 Bre-B recorded 3 million new key registrations on its first day of operation. According to the central bank, in the first 24 hours, Bre-B had 5.77 million active keys, 3.37 million were linked to payment methods, 2.67 million were individual users, and these users made an average of 1.2 payments per person.

🇺🇸 Real-time payments are soaring in the U.S. TCH, which operates the largest instant payments system in the United States, said that it averages 1.18 million payments each day, worth $481 billion, a 195% leap in value from the previous quarter.

🇰🇪 Kenyan BNPL startup Wabeh halts operations as defaults rise and cash flow tightens. The move follows growing claims of customer defaults, cash flow strain, and the lack of regulatory approval from the Central Bank of Kenya (CBK). Read more

🇲🇽 Amex beats estimates as premium clients keep spending on cards. Chief Executive Officer Steve Squeri said the company saw record card member spending in the quarter, demand for premium products was strong, and credit performance remained best in class.

🇹🇷 Türkiye’s watchdog launches probe into Visa and Mastercard. The board said that the investigation was launched in order to determine if the companies violated competition rules by means of complicating the operations of payment service providers offering international payment solutions by disallowing overseas businesses the use of the payment/POS infrastructure.

🇬🇧 Visa and Mastercard face another UK class action suit over card fees. The claim alleges that unlawful and anti-competitive multilateral interchange fees charged on Mastercard and Visa consumer debit and credit card transactions should be repaid to UK businesses.

REGTECH NEWS

🇪🇬 Ex-employee defrauds Egyptian FinTech and exposes gaps in offboarding practices. The suspect, identified only as a former staff member, contacted clients while posing as a representative of the company, claiming he needed to update or reactivate their wallets. He was able to extract login credentials and one-time passcodes, which he then used to withdraw funds.

🇬🇧 FCA sets out BNPL oversight proposals. After years of wrangling, in May, the government finally outlined its plans to clamp down on what it describes as the 'wild west' of buy now, pay later lending. Read more

🌍 Citi adopts Fenergo Platform to digitize select transfer agency services for funds in Europe. Using Fenergo’s market-leading platform, Citi now enables customized policy-driven risk assessment for Anti-Money Laundering and Know Your Customer checks for clients while making investor onboarding more seamless.

🇹🇼 Line Pay Taiwan approved for standalone e-payments. The move comes as Line Pay prepares to separate from iPass at the end of this year, per CNA. FSC officials said the iPass Money feature will be removed from the Line app, but users will still be able to access iPass directly via its app, with stored funds unaffected.

DIGITAL BANKING NEWS

🇮🇪 AIB launches a digital investment advice tool on its app. The feature, which appears via the AIB life hub on the bank’s mobile app, allows customers to access investment guidance and products. It offers access to regulated investment advice and appropriate products.

🇬🇧 New bank Afin aimed at African immigrants, cleared to sell mortgages. It will offer home loans to foreign nationals without sufficient credit or residency history for high street banks, and more widely to the self-employed. Keep reading

🇮🇳 Super.money plans broking foray, bets on UPI and AI to simplify investing. “We are reimagining stock trading for the next wave of investors. We believe investing shouldn’t feel intimidating, cluttered, or built only for the ‘experts”, founder Prakash Sikaria said.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 PayPal brings PYUSD to Arbitrum for faster payments. By deploying PYUSD onto Arbitrum, developers will be able to seamlessly expand smart contract deployment from the Ethereum mainnet to Arbitrum without rewriting code, allowing for easy migration of dApps while also providing developers with Ethereum-compatible tooling and established DeFi protocols.

🇺🇸 Real-time interest-bearing settlement network Lynq launches. This major milestone follows more than 18 months of market research, input, and collaboration with leading digital asset firms. The first transaction included the recording of clients’ assets on the Avalanche blockchain, followed by a successful account-to-account settlement on the Lynq network.

🇺🇸 Bitget and Ondo Finance partner for seamless access to tokenized RWAs. This development aims to take a significant leap forward in leveraging tokenization to democratize access to real-world assets (RWAs). This integration further strives to empower more than 120 million users to utilize tokenized U.S. stocks.

🇺🇸 After Kraken, Bybit, and Robinhood, KuCoin launches tokenized stocks. The assets are now available for trading on KuCoin and are denominated in USDT. KuCoin mentioned that the tokenized equities are issued by a Swiss-based firm. Continue reading

PARTNERSHIPS

🇺🇸 SoFi brings financial wellness to the Paychex Payroll Program. Paychex employees now have direct, streamlined access to SoFi’s financial wellness tools right from their payroll portal. Both companies see student loan relief and personalized financial guidance as key benefits amid a competitive labor market.

🇸🇦 Alkhabeer Capital unveils partnership with Fasanara Capital, a $5bln global asset manager, to unlock Saudi FinTech private credit. By leveraging data-driven lending models and next-generation credit infrastructure, Fasanara aims to deliver scalable, transparent, and risk-conscious solutions that address the growing demand for alternative fixed-income strategies in the Kingdom.

🇺🇸 Aethir and Credible introduce an AI-backed credit card for ATH holders in a big partnership. The project offers its customers the freedom to recharge credit cards with ATH or even stable tokens such as USDC that they can use to spend in the real world out of Web3 funds.

🇸🇬 Citi and Ant International pilot AI-powered FX tool for clients to help cut hedging costs. The pilot program, developed initially for aviation clients, has already been used in live transactions with a major Asian airline, able to reduce cost in its fixed FX hedging for online ticket sales, the companies said.

🇺🇸 PairSoft and Finexio renew partnership on embedded payments for accounts payable. The combination enabled by this partnership provides AP payments solutions designed for greater operational efficiency, increased digital payment yield, and reduced fraud risk, the companies said

🇹🇼 Cathay United Bank taps Avaloq to launch onshore private banking operations. The Financial Supervisory Commission (FSC) in Taiwan recently established a hub to help further the domestic development of onshore wealth management and private banking.

DONEDEAL FUNDING NEWS

🇨🇳 KUN raises $50M in Series A funding to expand stablecoin cross-border payments. This latest funding achievement brings KUN’s total capital raised to over $50 million within just 20 months of launch, reinforcing its first-mover advantage and solidifying its leadership in the rapidly evolving stablecoin payments landscape.

🇨🇳 Alchemy Pay invests in a company in Hong Kong that holds SFC type 1/4/9 licenses and will apply for the upgrade of the SFC type 1 license. The SFC's Type 1, 4, and 9 licenses are widely regarded as the foundational trio for full-spectrum financial service offerings, encompassing the key activities of securities trading, investment advisory, and asset management.

🇺🇸 Eton Solutions secures $58M Series C, eyes AtlasFive expansion. Eton Solutions says it will use the funding to fuel the further development of its wealth management platform, AtlasFive, and "expand its suite of products targeting the PE and funds industry".

M&A

🇺🇸 Stripe’s buying spree continues with the acquisition of Orum.io. CEO and Founder Stephany Kirkpatrick said: "After thoughtful consideration, it became clear that we have a rare opportunity to accelerate Orum’s mission and greatly increase our impact by becoming part of Stripe." Keep reading

🇰🇷 Kakao Pay backs out of acquisition deal for Shinsegae’s SSG Pay and Smile Pay. Kakao Pay recently notified Shinsegae of its decision to withdraw from the deal just ahead of the final signing, despite the two sides having agreed on most of the terms, including a price estimated at over 400 billion won ($287.2 million).

🇨🇦 WonderFi shareholders approve acquisition by Robinhood subsidiary. WonderFi shareholders will receive $0.36 per share, while broker warrant holders will be compensated based on the Black-Scholes value of their warrants. The acquisition marks a significant step in Robinhood’s expansion into the Canadian FinTech space.

MOVERS AND SHAKERS

🇮🇪 AIB promotes CTO Graham Fagan to COO amid tech reorganisation. According to the bank, the appointment will unite the technology & data and operations & business services functions into a new single function - enterprise delivery.

🇮🇳 Paytm Money set to get a new Chief Executive Officer. Sandiip Bharadwaj, who was the Chief Operating and Digital Officer at HDFC Securities, is set to occupy the corner office at Paytm Money. Rakesh Singh, the current Chief Executive who joined the firm last year, will assume a different role within the group.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()