Venmo Moves Beyond Bill-Splitting, Eyes the Everyday Wallet

Hey FinTech Fanatic!

Venmo, once the go-to app for splitting drinks and rent, is now chasing a bigger prize: daily consumer commerce.

Backed by PayPal, the platform just unveiled major upgrades, from 15% cash-back rewards on the Venmo Debit Card to expanded checkout access at retailers like TikTok Shop, Uber, Instacart, and Domino’s. The move signals Venmo’s pivot from P2P transfers to full-service FinTech.

“We’re transforming from a payments app into a full-service commerce experience,” said Diego Scotti, EVP of PayPal’s Consumer Group.

While Venmo’s debit card usage is still in the single digits, it saw a 40% increase in monthly active users and $75.9B in total payment volume in Q1. “Pay with Venmo” transactions alone jumped 50%. Revenue is up 20% YoY.

But competition is stiff: Cash App’s debit card handled $152B in 2024, dwarfing Venmo’s $13B, and Zelle now dominates U.S. P2P with 66% market share.

Still, Venmo’s bet on brand loyalty, social roots, and mobile-first consumers is clear. With DoorDash, Starbucks, Lyft, and Walmart already in the mix, and a push into Europe, Venmo is hoping to become your everyday checkout option, not just your weekend transfer tool.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

#FINTECHREPORT

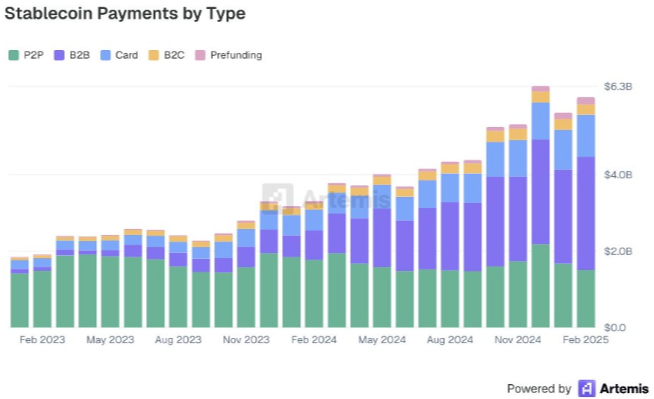

📊 Stablecoin Payments from the Ground Up.

FINTECH NEWS

🇳🇱 XTransfer to open European HQ in Amsterdam. The agreement signals the firm's strategic move to expand its footprint in the European cross-border payments sector. The signing marks a continuation of XTransfer’s international growth strategy. Continue reading

🇺🇸 Chime’s IPO may struggle to strike a chord with investors. Public investors, while calmer and more receptive to new listings than two months ago, can afford to be picky. That’s an obstacle to companies looking to recoup their peak valuations from a few years ago.

PAYMENTS NEWS

🇸🇬 Ant International rolls out AI-as-a-service for FinTechs and superapps. The company has launched its new artificial intelligence platform, Alipay+ GenAI Cockpit, as part of a broader AI strategy aimed at helping FinTech companies and super apps develop more secure and efficient financial services.

🇩🇪 Worldline initiates the launch of Wero in e-commerce starting this summer. This enables its merchants to accept Wero for online commerce in Germany. Wero is a cross-border payment facility with built-in buyer protection and is based on a scheme layered on the instant bank transfer.

🇺🇸 Venmo adds debit card perks and checkout options in push to catch rival Cash App. The changes include upgraded rewards for Venmo Debit Mastercard users, expanded checkout options at major retailers, and a new brand campaign aimed at positioning Venmo as a full-service commerce platform.

🇧🇷 Automatic PIX and the Central Bank of Brazil launch a new modality that allows customers to pay recurring bills, such as energy, telephone, school, gym bills, among others, without having to repeat the process each time the payment is due. Read more

REGTECH NEWS

🇨🇳 Hong Kong stablecoin law draws interest from mainland firms. Analysts expect an increase in tokenization projects in the city, with the law requiring issuers to obtain a license from the Hong Kong Monetary Authority (HKMA) and set to take effect later this year.

🇺🇸 CAB secures a license to operate a US representative office in New York City. The New York representative office will act as a regional business hub for CAB, enabling the Group to continue to serve its existing clients while driving new client business in the region.

🇺🇸 Thunes secures money transmission licenses to operate in the United States. The licence allows Thunes to deliver its comprehensive Pay and Accept suite of services directly to corporates, merchants, and digital platforms. By leveraging the new regulatory approvals, it gains the ability to contract directly with American businesses for real-time cross-border payments.

DIGITAL BANKING NEWS

🇪🇸 Revolut officially launched Revolut ATMs. The British-based neobank will launch its first phase on the main streets of Madrid and Barcelona, then move on to areas like Valencia and Malaga, to reach a total of 200.

Revolut officially launched Revolut ATMs

🇵🇹 Revolut Bank launches a branch in Portugal this summer. The banking license in Portugal, with which the bank's customers will now be able to have a Portuguese IBAN, Revolut intends to “have a more local product”, adapted to the national consumer, namely, integration into the Multibanco network and the MBWay network.

🇳🇱 ABN AMRO launches Neobank BUUT. Developed in collaboration with the Tikkie team, ABN AMRO built BUUT from the ground up in just twelve months, aiming to create a banking experience that fits seamlessly into the digital lives of the new generation.

BLOCKCHAIN/CRYPTO NEWS

🇰🇷 Korea becomes testing ground for central bank vs stablecoin supremacy battle. This competition in Korea could serve as a template for similar challenges worldwide, as central banks race to maintain monetary control in an increasingly digital financial landscape.

🇺🇸 Trump-tied ‘truth social bitcoin ETF’ inches closer after filing. Trump Media applied to trademark brands for investment products with themes that closely track the president’s policy priorities, including Bitcoin. The firm signed a formal agreement with a New Jersey-based firm, Yorkville Advisors, to shepherd the products through the approval process.

🇺🇸 Ripple CEO Brad Garlinghouse denies $5 billion bid to buy Circle amid speculation. Circle has consistently stated it is not for sale. The company is set to go public this week with a strong valuation of $7.2 billion, trading under the ticker CRCL.

🇺🇸 JPMorgan Chase set to accept Bitcoin, crypto ETFs as loan collateral. The decision is part of a strategy to allow select clients to borrow against crypto-related assets. The bank is said to be starting with crypto ETFs, particularly BlackRock’s iShares Bitcoin Trust, which has topped $70b in assets under management.

🇺🇸 Circle IPO is said to be likely to price above the marketed range. The IPO is expected to price on Wednesday evening, New York time, with Circle and selling shareholders offering 32 million shares at a range of $27 to $28 per share. Keep reading

PARTNERSHIPS

🇬🇧 ASOS finds the perfect fit with Checkout.com. This partnership will help ASOS further enhance the online shopping experience for its customers by increasing acceptance rates across key markets, reducing the risk of failed payments, and ensuring the checkout experience.

🇬🇧 Ecommpay simplifies payment processing for Travelopedia. The updated checkout experience provides customers with a variety of local and international payment options, including Apple Pay and Google Pay, ensuring they can select their preferred payment method regardless of their location.

🇺🇸 Mastercard and PayPal to partner on Mastercard One Credential to supercharge choice at checkout. Whether shopping online or in store, shoppers will be able to use a single credential, no more juggling between multiple cards or payment methods.

🇺🇸 Carta partners with Ramp. By integrating Ramp’s automated, real-time expense management with Carta’s fund admin, the platform helps firms modernize their finance stack so they can spend time on strategic decisions that drive returns. Read more

🇻🇳 Zalopay to offer Cake Digital Bank’s products to its 16 million users. Users will be able to access Cake’s credit cards, loans, and savings services directly through the Zalopay app. They can also reportedly obtain a virtual card within minutes and begin using it immediately for online purchases.

🇬🇧 FIS and Episode Six launch the FIS International Issuing Hub to power the next era of payments. It is the answer for banks and issuers looking to navigate complex business environments, rising competitive pressure, and growing demand for seamless digital experiences. This new platform gives institutions the tools to innovate and scale without being held back by existing systems.

🇱🇹 FinTech Zen.com partners with Lithuanian SME Bank. Through cooperation, Zen.com is to expand the network of regulated partners and strengthen operational resilience in key areas of activity. Keep reading

🇨🇷 Banco de Costa Rica selects Finastra to transform its international transaction automation processes. The two solutions will enhance foreign trade and international payments practices, driving innovation and operational excellence. Additionally, the project will fully automate BCR’s international transaction processes.

🇶🇦 QIB and Visa partner to facilitate B2B cross-border payments. The partnership signifies QIB’s continued commitment to collaborate with its partners to facilitate trade across various international payment corridors by giving customers cost-effective, efficient, reliable, and secure money transfer services.

🇲🇾 Temenos powers KAF Digital Bank in its mission to offer Shariah-compliant financial management and enhance digital convenience with a user-centric banking experience. This includes comprehensive core and digital banking services together with payments, analytics, and Temenos Data Hub on Microsoft Azure cloud infrastructure.

🇬🇧 Stablecoin Connector BVNK partners with Chinese cross-border payments firm LianLian. Through this partnership, LianLian Global's merchants can transform idle digital assets into instant cross-border payment fuel. Keep reading

🇺🇸 Global Payments and Sage launch embedded vendor payments solution. The new solution is designed for ease, security, and control, addressing the complexity of managing payables across disconnected systems. AP teams can eliminate syncing delays and the need for separate logins.

DONEDEAL FUNDING NEWS

🇨🇦 FISPAN raises $30m Series B to accelerate embedded banking innovation for mid-market businesses. This new capital will accelerate FISPAN's mission of seamlessly integrating banking services directly into businesses' enterprise resource planning (ERP) systems and accounting software.

🇺🇸 Palla raises $14.5M Series A to expand payments platform. The platform will use the funding to expand its existing payment corridors and open new ones, both for sending and receiving transfers. It also aims to launch new products and money-movement solutions.

🌏 FinTech Ovanti raises $1 million via two-tranche placement. OVT said funds would be used to support ongoing legal proceedings, fund its US buy now, pay later (BNPL) operations, strengthen working capital, and cover placement costs. Keep reading

🇨🇱 Tether invests in Chilean Crypto Exchange Orionx to drive Latin American adoption. Joel Vainstein, Orionx's CEO, said that the collaboration marks a turning point in the company's B2B vision and that it will produce more cost-efficient solutions for payment collection, distribution, and treasury management.

🇬🇧 HSBC deepens ties with Token.io through strategic investment. This new financial backing will fuel FinTech’s growth while accelerating the development of real-time, bank-initiated payment options that challenge traditional card-based methods.

M&A

🌍 Zest snapped up by Finnish FinTech Epassi Group. Epassi said the move supports its vision to be the leading European tech platform for the employee benefits and engagement ecosystem. Zest complements the company’s existing operations in the UK and will significantly expand the product suite available to existing and new customers in the UK and Europe.

🇰🇪 Moniepoint secures approval for 78% stake acquisition, marking Kenya market entry. Moniepoint is extending its footprint into East Africa through this strategic acquisition. Sumac, a Kenyan microfinance institution, offers services ranging from lending and deposit-taking to insurance and forex trading.

MOVERS AND SHAKERS

🇺🇸 Ex-JPMorgan, Credit Suisse banker Charles Harman joins Ninety One board. He will take a spot on the fund house’s audit and risk and human capital, and remuneration committees from 24 July, according to a statement. Continue reading

🇺🇸 FCA Chief Operating Officer Emily Shepperd resigns. The Financial Conduct Authority’s COO is leaving the regulator, Financial News has learned. Shepperd, who previously held senior operations roles in banking, resigned last week after a four-year stint, according to people familiar with the situation.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()