Unlocking New Possibilities: PayPal's Next Move Amidst EU's DMA Rollout

Hey FinTech Fanatic!

PayPal is developing a fresh consumer application for its mobile users, hinting at its readiness to leverage the upcoming EU legislation, the Digital Markets Act (DMA), set to be implemented next month.

This regulation primarily targets major tech companies, including Apple, by designating them as "gatekeepers." A crucial aspect of the DMA for PayPal involves the opportunity for third-party applications to utilize the Near Field Communication (NFC) technology, which is the backbone of Apple Pay, for their mobile wallets.

Additionally, the new rules will allow iPhone users the flexibility to choose an alternative mobile wallet as their default option.

During its fourth-quarter earnings call, PayPal remained tight-lipped about its strategy regarding Apple's adherence to the DMA and its specific implications for PayPal.

You can find the highlights and stats from PayPal's Q4 and Full 2023 Earnings in a nice overview below in this email in the Payments section.

Enjoy more FinTech Industry updates I listed for you below and I'll be back in your inbox tomorrow!

Cheers,

P.s. Join ACI Worldwide in an exclusive joint webinar with TransUnion and Mastercard exploring the transformative power of digital identity validation.

Discover how digital identity validation is shaping the future where security meets success and paving the way for revenue growth, unlocking opportunities, and uncovering the hidden face of fraud.

Don't miss this opportunity to gain insights, identify new strategies, and unfurl real-world success stories, all in the realm of digital identity verification.

#FINTECHREPORT

Could Small Banks and Fintechs Give Big Banks a Run for Their Money? For the first time, ACI Worldwide and GlobalData have taken a deep dive look into some of the key real-time payment markets globally. Check out the complete research results here.

INSIGHTS

Regulation often paves the way to innovation, pushing fintech companies to build advancements that raise standards for the whole industry. A perfect example of this is the new set of EU rules on SEPA instant transfers. Read the complete deep dive article by Sarah Wachter to learn all about this.

FINTECH NEWS

🇬🇧 Wealthify selects ClearBank as its embedded banking partner to launch new savings account. The partnership allows Wealthify to provide this innovative savings account to its customers. The account tracks the Bank of England’s base rate and currently offers an interest rate of 4.91% AER (Annual Equivalent Rate) / 4.80% gross*.

🇬🇧 Swedish VC Kinnevik has written off its investment in Monese, adding to the financial woes of the FinTech startup. Kinnevik says the write down reflects more careful investee expectations and multiple contraction relative to public comparables. Read more

🇦🇺 Startupbootcamp expands fintech focus in APAC with Tim Poskitt as new program Managing Director. This strategic appointment bolsters SBC Australia’s commitment to nurturing the next generation of digital talent in finance, with a particular focus on sustainability and technological innovation.

PAYMENTS NEWS

The Saudi Arabia Payments Market is expected to experience a Compound Annual Growth Rate (CAGR) of 15.4% during the projected period of 2022 to 2027. Link here

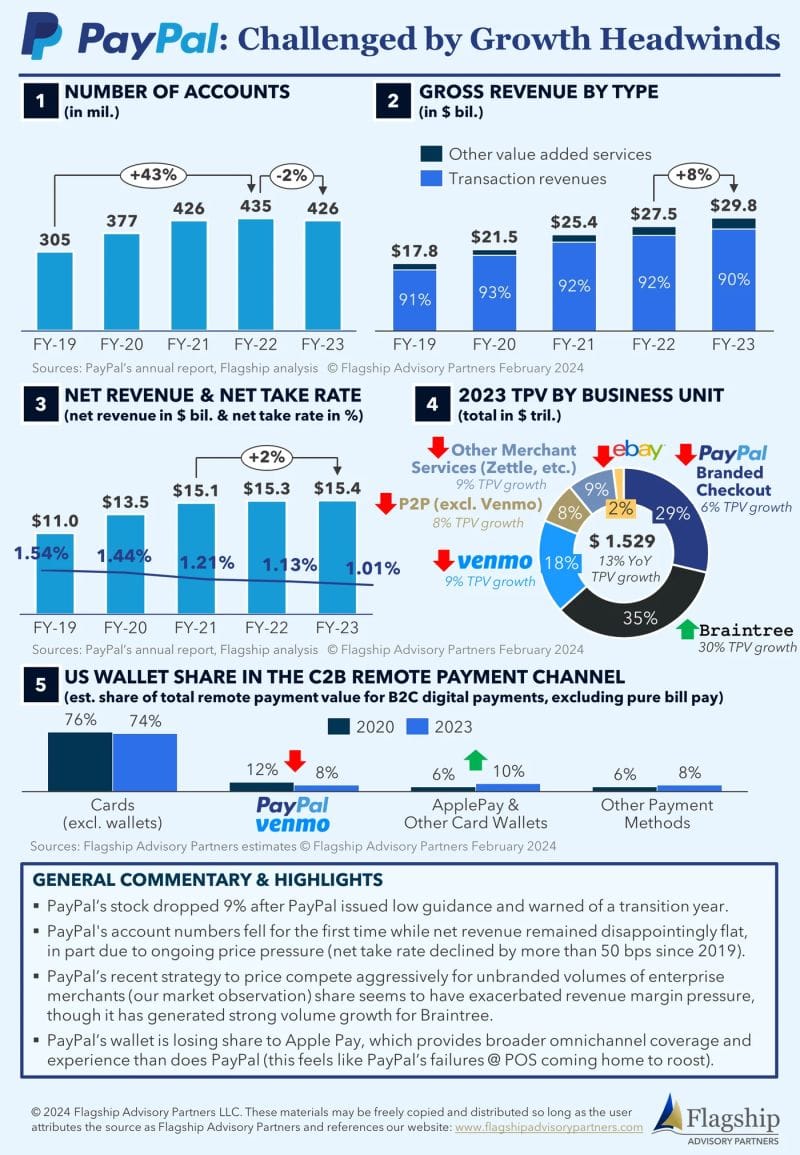

PayPal’s Q4 2023 and Full Year Earning Report is out. Here are the highlights👇

REGTECH NEWS

🇺🇸 Americans lost more than $10 billion to fraud in 2023, with investment scams accounting for nearly half of the losses, Federal Trade Commission data shows. The FTC received fraud reports from 2.6 million Americans in 2023, nearly the same amount as 2022.

DIGITAL BANKING NEWS

Revolut eyes EU growth with new business savings accounts. The company will start offering savings accounts to European businesses in the second quarter. Revolut’s business savings account has drawn £150m from UK firms in its first six weeks, as the fintech looks to grow its business-to-business offering.

🇺🇸 Amex gears up for bigger bank category. Card issuer American Express expects to be subject to heightened bank requirements this year, as the company’s recent growth moves it closer to facing more federal regulation, based on assets, the company said in a Friday filing.

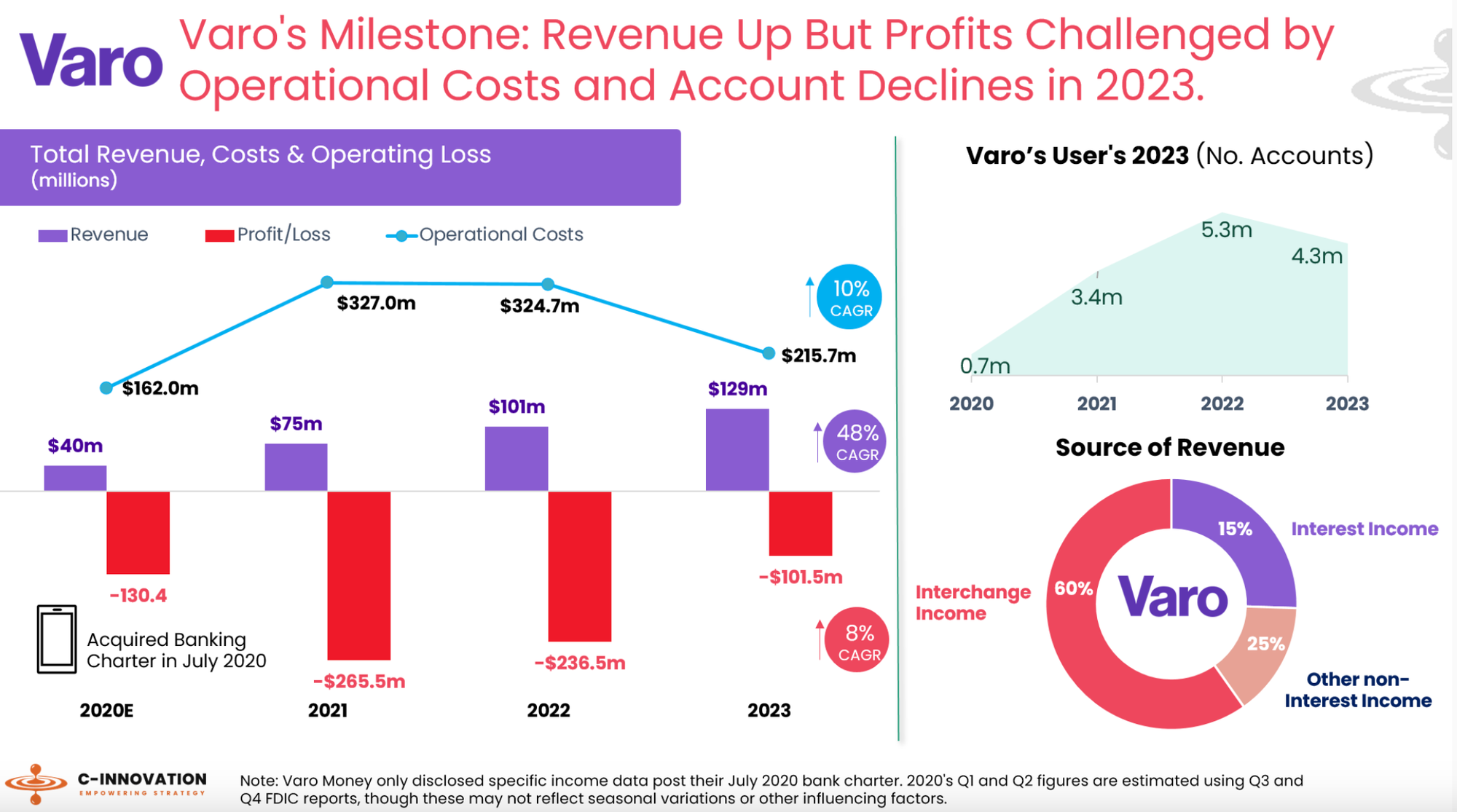

🇺🇸 Varo Bank's charter growth amid high marketing costs and account losses reflects U.S. market entry challenges. In 2023, Varo's revenue composition reveals that nearly 60% of its revenue for the year is derived from the interchange, indicating its reliance on this source of income. However, its interest income has declined by about 12% QoQ as its deposit and asset base shrinks.

DONEDEAL FUNDING NEWS

🇺🇸 Mia Share, a full-stack payments solution designed specifically to meet the tuition management and payment needs of trade and technical schools, announced that it has closed its seed round with $6.5 million in funding. Mia Share's revenue comes from a setup fee and a SaaS fee it charges schools for using its platform, as well as transaction processing fees.

🇳🇱 Finom, a European neobank aimed at SMEs and freelancers, has raised €50 million ($54 million) in a Series B equity round of funding. The Dutch startup is one of numerous players in a space that includes the likes of Wise, Qonto, and Revolut, but Finom’s fundraise further highlights the demand for SME financial services in a market that is still substantially dominated by big banks.

🇦🇪 Kema Raises $2m to Transform B2B Cash Flow in MENA. The investment will be utilised to launch its SaaS platform tailored to support the SME segment, expand its presence across the UAE, and recruit top talent to fuel its expansion efforts. Read more

Bitwala raises investment from Blockchain Founders Fund. The instant trading app with only a 1% transaction fee drives mainstream crypto adoption across Europe with hotspots in the Netherlands, France, and the Baltics. The strategic investment opens Bitwala’s low-fee trading and debit card service to global partnerships.

🇨🇦 Sibli secures US $4.5M seed financing. Toronto based Sibli is transforming the investment research process using AI. The company also announced a rebrand to better align with its broader perspectives and vision. Read on

🇨🇴 Plataform, a new Colombian fintech company, has successfully closed its first investment round, raising $3 million. With these resources, the fintech will seek to consolidate its portfolio of services to finance more than 100,000 Colombian and regional companies with a total amount of one trillion dollars during this and the coming years.

SVB strikes $50M debt deal with Toronto fintech Float. Toronto-based fintech Float has secured $50 million in debt financing from Silicon Valley Bank to help expand its corporate credit program. Click here to get the full article.

M&A

HiBob, a London headquartered HR unicorn, is acquiring UK payroll startup Pento. The acquisition came about after seeing the fragmented payroll market in the UK with HiBob opting to go one step further than integration, CEO Ronni Zehavi told Business Insider. More here

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()