UK Campaigner Launches £1.5Bn Legal Action Against Apple Pay

Hey FinTech Fanatic!

Apple is facing a major legal challenge in the UK.

A £1.5bn class action has been launched against Apple, targeting Apple Pay and what campaigners call hidden fees and blocked competition.

The claim argues Apple Pay has been the only contactless payment option for iPhone users in Britain for nearly a decade. According to the case, the lack of choice allowed Apple to charge banks fees that were passed on to consumers.

Not just iPhone users. Everyone. The lawsuit is now with the Competition Appeal Tribunal, which will decide whether it can move forward.

Apple says the case is misguided and insists Apple Pay does not charge consumers or merchants. But the timing matters. Regulators have already been scrutinising digital wallets more closely...

Another Apple story is unfolding in parallel 👇

Apple has also started distributing payments from a separate £69.7m settlement linked to Siri.

The case alleged Siri recorded private conversations without consent and shared them with third parties for quality checks. Apple denies wrongdoing here as well. Still, users are now receiving cash.

Up to £100, depending on how many devices were claimed. A rare moment where a Big Tech privacy case results in real money landing with consumers.

If you’re watching how the FinTech industry is evolving, scroll down to see what else is moving 👇 I’ll be back tomorrow with more updates in your inbox.

Cheers,

BREAKING NEWS

🇺🇸 Zerohash is in talks to raise $250 million at $1.5 billion valuation after walking away from a Mastercard takeover. The raise comes amid rising demand for enterprise-grade crypto infrastructure, as more financial institutions move to offer tokenized assets, stablecoins, and on-chain settlement at scale.

FEATURED NEWS

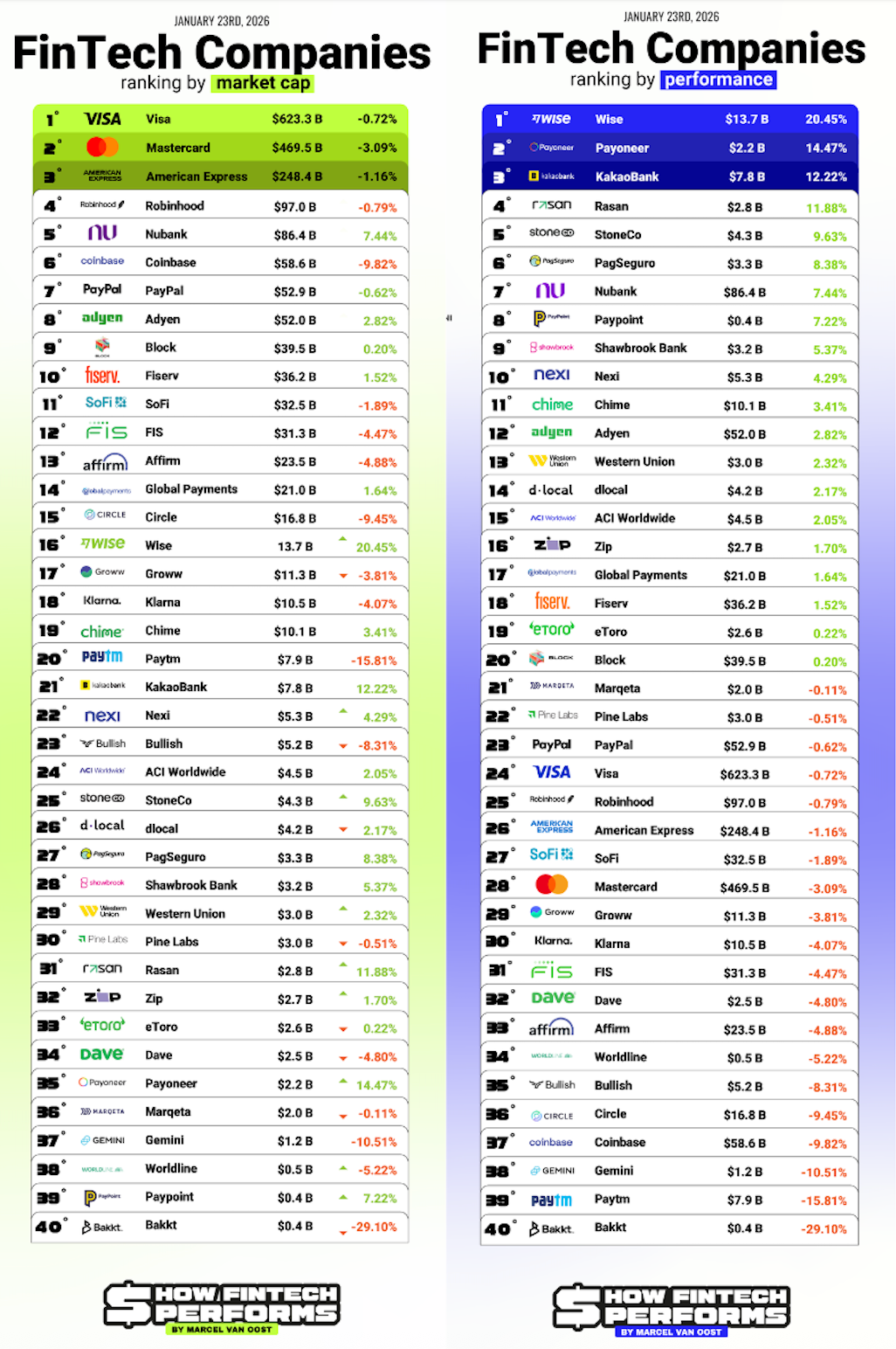

📈 The Public FinTech Companies ranking by Performance this week.

Here are the big movers of the week:

FINTECH NEWS

🇬🇧 Campaigner launches £1.5bn legal action in UK against Apple, claiming the US tech company blocked competition and charged hidden fees that ultimately harmed 50 million UK consumers. The lawsuit targets Apple Pay, which they say has been the only contactless payment service available to iPhone users in Britain over the past decade.

🇬🇧 FinTechs should avoid the trap of early IPO, warns top London VC investor. James Codling, managing partner at Volution, said companies should fully strengthen their business models before pursuing an IPO, arguing there is no issue with staying private longer if capital is available.

PAYMENTS NEWS

🇺🇸 Apple's Siri Payments begin after claims the assistant recorded personal moments. Apple's long-awaited payouts are now being distributed to individuals who filed claims, offering compensation for alleged privacy intrusions stemming from unintended Siri activations during personal conversations.

🇯🇵 UPI to debut in Japan. Japanese IT services firm NTT Data is partnering with the National Payments Corporation of India (NPCI) to enable UPI acceptance in Japan on a trial basis in fiscal 2026. In the initial phase, the service will be available to Indian tourists visiting the country.

🇮🇹 Nexi Group joins Agentic Commerce Alliance to shape the future of AI-driven commerce. As a member, Nexi will bring European scale, local payment knowledge, and real-world experience in securing the transactional layer for AI agents to help develop open standards that enable trustworthy, interoperable agentic systems.

🇺🇸 PayPal faces backlash as three affiliate networks suspend partnerships, Rakuten Advertising, impact.com, and Awin, following allegations of fraud and non-compliance. The move cuts Honey off from thousands of retail partners and follows claims that the tool interfered with attribution and misled users on discounts.

DIGITAL BANKING NEWS

🇪🇺 Monzo pumped €71m into Irish unit in successful bid for EU banking licence. Authorisation from the Central Bank of Ireland and the European Central Bank allows Monzo to passport services across the EU, supporting its European expansion plans despite recent leadership changes at the group level.

🇺🇸 Interactive Brokers signals Irish banking licence interest. CEO Milan Galik said a European licence would bring benefits, following the firm’s recent application for a national trust bank charter in the US. Keep reading

🇦🇺 Australian digital bank in1bank to cease operations. The bank says customers have until 4th February 2026 to transfer remaining balances to alternate bank accounts, adding on its website: "Please note that the in1bank app will no longer be in service, effective at 5 pm AEDT on 5th February 2026."

🇦🇪 Revolut prepares to offer crypto services in the UAE. This comes months after it received its in-principle approval for Stored Value Facilities and Retail Payment Services licenses from the Central Bank of the UAE. Continue reading

🇧🇷 Nubank will invest more than R$ 2.5 billion over five years in office expansion for a new phase of growth. This movement reinforces the company’s commitment to development and innovation in the country. This movement accompanies the announcement of the new hybrid work model, which starts in July 2026, when around 70% of employees should work in the office two days a week.

🇧🇷 DólarApp wants to expand in Brazil. The FinTech aims to serve the Latin American public that uses stablecoins for international transfers and payments, charging a total fee of 0.5% on the transaction. Currently, it has almost two million users in Mexico, Argentina, and Colombia.

BLOCKCHAIN/CRYPTO NEWS

🇸🇻 Tether posts largest crypto revenue in 2025: $5.2B from stablecoin dominance. Tether alone accounted for 41.9% of all stablecoin-related revenue in 2025, outpacing competitors. The results show that dollar-backed digital currencies have become the most durable revenue engine in crypto, even as market conditions fluctuated throughout the year.

🇺🇸 A16z-backed crypto startup Entropy to shut down, refund investors. Entropy founder and CEO Tux Pacific says that, after four years and multiple pivots, the project was unable to find a scalable business model. Continue reading

🇮🇪 CoinJar picks Dublin for European base with €5m investment. The Australian-founded digital asset platform said the Irish operation would serve as its central base for European activities, working alongside existing teams in London and Melbourne. The approvals allow the company to offer regulated crypto services across the bloc under the EU’s evolving digital assets framework.

PARTNERSHIPS

🌍 Finby signs up for Wero. Developed by the EPI, Wero aims to create a common digital payment solution across Europe, reducing fragmentation and strengthening European payment sovereignty. By working with EPI, Finby reinforces its role as a payments partner focused on scalable, local-first, and future-oriented technologies.

🇦🇪 Checkout.com expands its enterprise footprint with a deal with Majid Al Futtaim. According to Checkout.com, the implementation has delivered a 3% uplift in payment acceptance rates across the group, centralized fraud visibility with real-time detection, reduced cross-border costs through localized acquiring, and consolidation of payments into a single platform.

🇺🇸 Fiserv and Affirm join forces to bring pay-over-time capabilities to debit card programs for financial institutions. This collaboration empowers thousands of Fiserv U.S. bank and credit union clients to meet growing consumer demand for flexible payment options without needing to build new lending products.

🇦🇪 UAE's Wio Bank inks partnership with Global FinTech Pine Labs to modernise merchant acquiring infrastructure. The collaboration is going to build a modern acquiring infrastructure for Wio Bank with no legacy tech dependency, enabling faster merchant onboarding, real-time settlement capabilities, and seamless multi-mode payment acceptance at scale.

🇬🇧 Amazon Web Services extends Nationwide partnership to power digital banking transformation. The partnership will enable the building society to accelerate innovation and deliver more personalised experiences to its 17 million customers whilst maintaining "industry-leading" security standards.

🇸🇦 Ripple signs MOU with Jeel, Riyadh Bank’s innovation arm for blockchain solutions. Ripple and Jeel plan to develop several financial technology applications under the agreement, including cross-border payments and digital asset custody. Keep reading

🇨🇭 Yuh becomes the main partner of the BSC Young Boys men’s team. The move builds on the existing relationship between the two organisations. Partnership expands from the 2026/27 season, building on existing support for the YB women’s team.

🇦🇪 ADSS has partnered with SGX FX to strengthen its market-making capabilities and expand its foreign exchange presence across the EMEA region. The agreement allows ADSS to act as both a market maker and buy-side participant on SGX FX platforms, supporting rising FX trading demand in hubs such as Dubai and Abu Dhabi as SGX FX continues to broaden its liquidity network.

🇬🇧 Landbay partners with AI-assisted Conveyancer for new BTL range. Landbay aims to launch a new range of five-year fixed buy-to-let remortgage deals with free legals and valuations. Conveyd uses artificial intelligence alongside human technical expertise with the aim of speeding up the process.

DONEDEAL FUNDING NEWS

🇺🇸 Superstate raises $82.5 million in Series B funding, cashing in on Wall Street's tokenization Bonanza. Superstate bets investors will use tokenised stocks in DeFi for lending and liquidity, not just passive holding. Read more

🇳🇬 Nigerian FinTech OneDosh secures $3m to expand stablecoin payments. Operating in both the U.S. and Nigeria, the platform enables rapid transfers, stablecoin storage, and payments via Apple Pay and Google Pay-compatible cards. The capital will fuel expansion into new payment corridors and the growth of its engineering teams.

🇮🇪 Dublin-based FinTech Zen Pensions eyes €1.5m raise. Zen aims to have 20,000 users on its pension app platform by the end of this year, and Dooley is confident in the business's growth potential. Continue reading

🇦🇪 Vennre completes $9.6M round to grow private market platform in MENA. Vennre plans to use the capital to expand its client base, launch new platform features, and strengthen its presence in Saudi Arabia, in line with ongoing financial sector liberalisation and FinTech growth.

🌍 Jelou raises $10M to build transactional AI for WhatsApp. At the centre of Jelou’s strategy is Brain, a platform designed to help businesses build operational agents that carry out real tasks rather than just provide scripted responses. With the new funding, Jelou will expand Brain across the Americas and deepen its capabilities around secure transaction execution inside messaging interfaces.

🇧🇷 Lerian, a core banking firm, raises US$5.5 million to beat Visa's Pismo. The funding will increase investment in technology and staff so the startup can compete with giants like Pismo and Matera. Keep reading

🇸🇬 Fingular announces SGD 10 million debt financing round. The financing marks an important milestone in the company’s growth strategy and will support further scaling in Malaysia. The deal was structured via Kilde, a licensed platform connecting family offices, funds, and accredited investors to private credit opportunities across Europe and Asia.

🇨🇦 Float lands $100m to scale business banking. The non-dilutive capital will allow Float to expand its high-yield business accounts and scale its Charge working capital product for Canadian businesses. It will also use the funding to scale Charge, extending flexible working capital to thousands more businesses and unlocking more than $1.5 billion in annualised spending power.

🇫🇷 French FinTech Quideos invests in agricultural hedging and receives R$ 28.6 million. Quideos aims to expand the scale of its agricultural product price protection solution, with the goal of safeguarding industry players against market volatility.

🇺🇸 Mine is announcing a $14 million in funding in a 359 Capital-led Series A. Mine offers a debit-like card that helps users build credit without overspending, alongside an AI-powered financial advice app called MoneyGPT. Continue reading

M&A

🇰🇷 Coinone may be up for sale as Coinbase targets South Korea. Coinone confirmed that it has been in touch with overseas exchanges and domestic financial institutions. Still, the talks are in line with Coinbase’s 2026 “everything exchange” strategy. That strategy is focused on growing into new regions and asset classes.

MOVERS AND SHAKERS

🇮🇹 Nexi appoints Piergiorgio Pedron as New Group CFO, effective April 1, 2026. At the same time, Nexi revealed that Bernardo Mingrone will take on the role of CEO of Nexi Payments and Chief Regional Officer for Italy. Read more

🇦🇺 Perth FinTech Miconex appoints Idong Usoro as new Chief Digital Officer. Idong will lead on driving digital maturity, investment and operational transformation at the Perth-based FinTech, following 7 years of supporting Miconex in a strategic advisory capacity.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()