TPG Targets Nexi’s Digital Banking Division in €1B Deal

Hey FinTech Fanatic!

TPG, a firm specializing in alternative asset management, has made a binding offer of approximately €1 billion for the digital banking solutions unit of Italy’s Nexi SpA, according to Bloomberg sources.

The informants indicated that, after months of negotiations, a binding offer has now been submitted, giving the payments firm until mid-December to decide whether to proceed with the transaction.

Nexi, which had previously attempted to divest parts of its digital banking assets, confirmed it received an offer from TPG for certain assets within the digital banking group. However, TPG declined to comment.

The two companies had already explored a potential deal earlier this year, but discussions eventually slowed. With the new offer and deadline, a decision is now expected.

Have a happy Monday, and I'll be back with more FinTech industry updates tomorrow!

Cheers,

BREAKING NEWS

💰 Visa and Mastercard are near a deal with merchants that would change the rewards landscape. Visa and Mastercard are nearing a settlement with merchants that aims to end a 20-year-old legal dispute by lowering fees stores pay and giving them more power to reject certain credit cards.

INSIGHTS

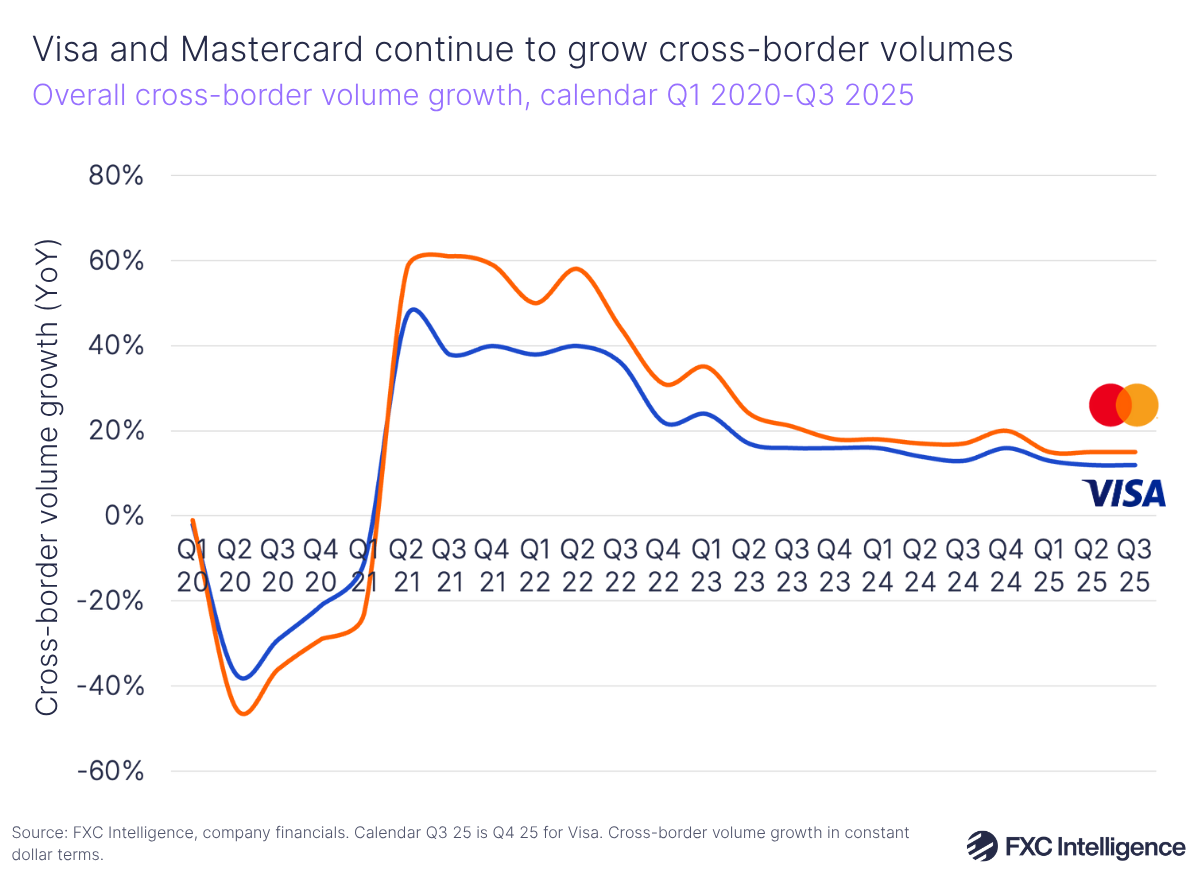

💰 Visa and Mastercard have shared their latest earnings, with cross-border volume continuing to be a key driver for both businesses.

FINTECH NEWS

🏃➡️ Q4's runs are here!🎉 Check out our newest November runs and join the community, hitting the streets from Munich to Hong Kong. 👉 See the full calendar and find your next run!

🇺🇸 Internal messages reveal how Klarna scrambled to fix a glitch that exposed customer data. Internal Slack messages, seen by Business Insider, show the Sweden-based company dealt with a problem caused by the absence of login protections for recycled phone numbers, when mobile carriers reassign a number after a previous owner gives it up.

PODCAST

🎤 T-Shaped Experts in FinTech: Buzzword or Backbone? by Dashdevs. In the episode of FinTech Garden, Igor Tomych interviews Jeremy Takle, CEO of VEMI and co-founder of Pennyworth. They discuss the rise of AI-native engineers, the balance between deep expertise and cross-functional thinking, the complexities of building teams in regulated digital banking, and why T-shaped skills will be essential for next-generation wealth tech. Watch the full episode

T-Shaped Experts in FinTech: Buzzword or Backbone? by Dashdevs

PAYMENTS NEWS

🇺🇸 Leapfin partners with Airwallex. The partnership combines Airwallex’s world-class financial infrastructure with Leapfin’s AI-powered revenue accounting platform to help global businesses unify payments, accounting, and revenue recognition. The two companies give finance teams the automation and accuracy they need to scale without compromise.

🌍 Click to Pay reduces abandonment rates for Ecommpay merchants across the UK and Europe. Peter Stearn, Director at Wellbeing Escapes, highlighted that the feature has eliminated the need to manually collect card details, allowing clients to pay instantly from any device. He described the integration as simple and seamless, even for complex bookings.

🇮🇹 Bancomat announces EUR-BANK stablecoin to combat European payments fragmentation. The stablecoin will be designed to be used in cross-border payments, instant liquidity management, and secure tokenised savings such as government bonds.

🇹🇷 Türkiye advances digital lira with legal framework and pilot tests. The Turkish Central Bank is accelerating development of a digital Turkish lira, with plans to conduct simulations and establish regulatory guidelines in 2026. The project aims to create a national digital currency that will strengthen the country's financial technology ecosystem.

🇳🇬 Flutterwave’s payment superhighway. At CNN’s Global Perspectives Summit, Flutterwave CEO GB Agboola urged the creation of a “payment superhighway” to unify Africa’s fragmented financial systems. Through a partnership with Polygon to build a stablecoin payment network, Flutterwave aims to make cross-border transactions seamless and position Africa as a global FinTech leader.

REGTECH NEWS

🇩🇪 Germany's financial watchdog slaps a record fine on JPMorgan of $52 million. BaFin said that JPMorgan had "systematically" filed so-called suspicious activity reports late in the period from October 2021 through September 2022. Keep reading

🇨🇦 KOHO has officially become a registered Payment Service Provider with the Bank of Canada. Under the Bank of Canada, KOHO now operates within a nationally recognized framework designed to safeguard user funds, manage operational risks, and ensure ongoing accountability and reporting compliance.

🇮🇳 RBI grants in-principle approval for PPI license to Junio Payments. Junio’s new Prepaid Payment Instruments authorization expands its ability to deliver secure, innovative financial solutions for teens and young adults. The license allows users to scan QR codes, make payments, and transact without a bank account.

🇧🇷 Central Bank authorizes Stone to have an investment distribution company. The new license comes at a time when FinTech is seeking to diversify its funding sources. Continue reading

🇧🇷 Ame cancels its license with the Central Bank. "After several rounds of interactions with potential interested parties within the scope of market sounding conducted by Americanas, there was no firm offer to acquire the CNPJ, the Payment Institution license, or Ame's other assets," the institution wrote.

DIGITAL BANKING NEWS

🇬🇧 Monzo beats Chase, Nationwide, and Starling in UK customer satisfaction. The survey took place from September 2024 to August 2025, forming scores based on responses to the question: “Of which of the following banks would you say that you are a satisfied or dissatisfied customer?” Monzo topped the charts, with a net satisfaction score of 71.7.

🇧🇷 Nubank announces a new hybrid model for 2026. This decision follows the last five years of a remote-first model, where teams met at least a week every quarter. Acknowledging the challenges for some staff, Nubank CEO David Vélez said Nubank will offer an eight-month transition, new offices, and relocation support to ease the change.

🇬🇧 Five UK banks unite with Shelter to help homeless people open bank accounts. According to a statement by the UK Treasury, this strategy aims to establish "a national plan to make financial services work for everyone. Keep reading

🇬🇧 Atom bank launches tax-efficient Easy Access ISA. The new ISA will offer a tax-free variable rate of 4% AER on new deposits. The account was formed as a result of increased customer demand for a tax-efficient savings product, and the potential cut to the annual tax-free cash ISA limit announced in the UK.

🇺🇸 Mercury, valued at $3.5 billion, and clocks $650 million in 2025 annualized revenue. Mercury CEO Immad Akhund said FinTech is experiencing a strong resurgence after a post-2021 slowdown. Akhund noted the company has been GAAP profitable for three consecutive years, emphasizing that profitability builds trust, crucial for a FinTech managing billions in client funds.

🇬🇧 Lloyds deploys an agentic AI framework across 21m accounts. The generative AI infrastructure is designed to automate financial guidance on spending, savings, and investments before expanding across its complete product portfolio. Its new system processes natural language queries and executes tasks without requiring users to provide structured input.

PARTNERSHIPS

🇩🇪 Klarna and Sparkassen-Finanzgruppe introduce Variable Recurring Payments. This innovation enables all Klarna users with current accounts at participating savings banks to make recurring payments directly from their bank accounts, quickly, easily, transparently, and securely.

🇺🇸 MoneyGram partners with Oscilar to build the future of AI-powered risk intelligence for global payments. Through its partnership with Oscilar, MoneyGram is enhancing its platform with real-time, adaptive risk intelligence to stay ahead of the evolving threat landscape and set a new industry standard among global financial institutions.

🇨🇦 Nuvei expands Payout offering with Visa Direct for account integration. The new functionality expands Nuvei's portfolio of faster payout solutions, enabling businesses to provide customers with quick, reliable, and convenient access to money wherever they are.

🇮🇳 Paytm partners with Groq to power real-time AI for payments and platform intelligence. Integration of Groq’s purpose-built LPU technology will enable faster and more cost-efficient AI inference compared to traditional GPU-based alternatives, strengthening Paytm’s data-driven decision-making and product intelligence

🇺🇸 American Express and Emburse announce expanded partnership and new ways to automate expense management for Emburse Enterprise customers. Customers can quickly issue Amex Virtual Cards within Emburse’s platform, and finance teams gain increased visibility into spend as it happens.

🇺🇸 Visa and Transcard collaborate to deliver advanced embedded working capital solutions in Freight & Logistics. This alliance puts embedded credit and working capital solutions in the hands of freight forwarders and airline carriers on WebCargo by Freightos.

DONEDEAL FUNDING NEWS

🇺🇸 fomo raises $17m in Series A funding. The company intends to use the funds to expand operations and its development efforts. Fomo is a social-first cryptocurrency trading app featuring social trading, multichain support, self-custody, no gas fees, and built-in analytics.

🇪🇸 Madrid’s Devengo raises €2 million as EU Instant Payments Regulation accelerates A2A innovation. The funding will allow Devengo to accelerate its geographic expansion across the SEPA zone (Single European Payments Area) and strengthen its position amid growing demand for instant payments in Europe.

🌍 Hawala raises $3m to launch its app and power financial infrastructure across MENA. The fund will be specifically deployed to reawaken the platform and power the Hawala app. The platform allows users in more than 200 countries to create a U.S. account and routing number or a European IBAN.

🌍 Stripe-backed startup Tempo leads $25 million raise for crypto infrastructure firm Commonware. The Stripe-backed project will work with Commonware to develop methods to process blockchain payments more quickly, Paradigm general partner and CTO Georgios Konstantopoulos said.

🇺🇸 Upward announces Seed+ investment round to redefine FinTech infrastructure; announces strategic partnership with Mastercard. The investment will fuel Upward's mission to make it radically faster and easier for businesses to launch and operate financial products, reducing the cost and complexity that have slowed innovation in financial services.

🇺🇸 Freya raises $3.5M seed round to automate business conversations. It provides a platform for designing, testing, and deploying AI agents for inbound and outbound calls, with a focus on sectors such as banking, fintech, and insurance. Freya’s solutions support both cloud and on-premise deployments.

M&A

🇮🇳 RUGR acquires Saraswat Infotech Private Limited to build a stronger banking ecosystem. This acquisition brings together SIPL's trusted legacy in the BFSI industry with the AI-powered and cloud-based ecosystem of RUGR. It will allow banks to enhance their operations using scalable and compliant technologies.

🇮🇹 TPG said to make €1 billion binding bid for unit of Italy’s Nexi. After months of talks, the investment fund submitted the binding bid to the firm, giving it until mid-December to decide whether to proceed with a transaction. Read more

MOVERS AND SHAKERS

🇺🇸 ACI Worldwide appoints Todd Ford and Didier Lamouche as Independent Directors. Ford brings to the company extensive financial and operational leadership experience in SaaS and cloud-based software companies, while Lamouche offers deep international technology and digital payments expertise.

🇵🇹 FinTech Rauva appoints Nuno Zigue as its new CEO. The company said the decision reflects the need for “an experienced CEO from the banking sector” as Rauva transitions from a FinTech startup into a fully licensed bank. Continue reading

🇧🇷 Neon brings in Ramon Martinez, formerly of Nubank, to lead risk strategy. According to the company, he will be responsible for leading the company's risk strategy, focusing on sustainable growth, operational efficiency, and sound governance.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()