Touchdown in NYC

Happy Monday FinTech Fanatic!

Fresh off the plane from sunny Curacao, I touched down in Newark this weekend. Ah, New Jersey – it instantly brings to mind one of my favorite Series, The Sopranos. Did you know they made a cool commercial for a Life Insurance back in the day?

Seriously, isn't this commercial the best ever? 🤣

Now, I'm setting up camp in NYC for a couple of weeks so let me know when you are up for a coffee when you are around. My agenda's filling up, but I've still got a few slots open for some caffeinated brainstorming.

Have a great start to the week and I'll be back with more FinTech industry updates tomorrow!

Cheers,

Marcel

SPONSORED CONTENT

FEATURED NEWS

🇸🇬 Thunes picks former Worldpay exec Floris de Kort as CEO. De Kort will be replacing Peter De Caluwe, who has been promoted to deputy chairman, Thunes said in a news release last week. De Caluwe expressed his satisfaction in teaming up with Floris to better position Thunes as the market leader. Read on

#FINTECHREPORT

The size of the payment orchestration market will be worth over US$15 billion by 2026. The total addressable market (TAM) for technical payment orchestration was US$9.9 billion in 2022, and it is expected to grow to US$15.2 billion in 2026 ― a compound annual growth rate (CAGR) of 11%. Download and read the full report here

FINTECH NEWS

🇺🇸 Future Fintech CEO Shanchun Huang charged with fraud by SEC for failing to share his ownership and transactions of Future Fintech stock shortly before he was appointed as CEO. The SEC alleges that in 2019 or 2020, Huang used an offshore account to engage in high-volume stock trading, making multiple buy orders within a short period to artificially inflate stock prices.

Deriv partners with BVNK to support Solana payments. As part of this partnership, Deriv has incorporated Solana payments for its 2.5 million customers globally. This collaboration marks a significant step in Deriv’s payment strategy, addressing the growing demand for digital currencies from their global customer base.

PAYMENTS NEWS

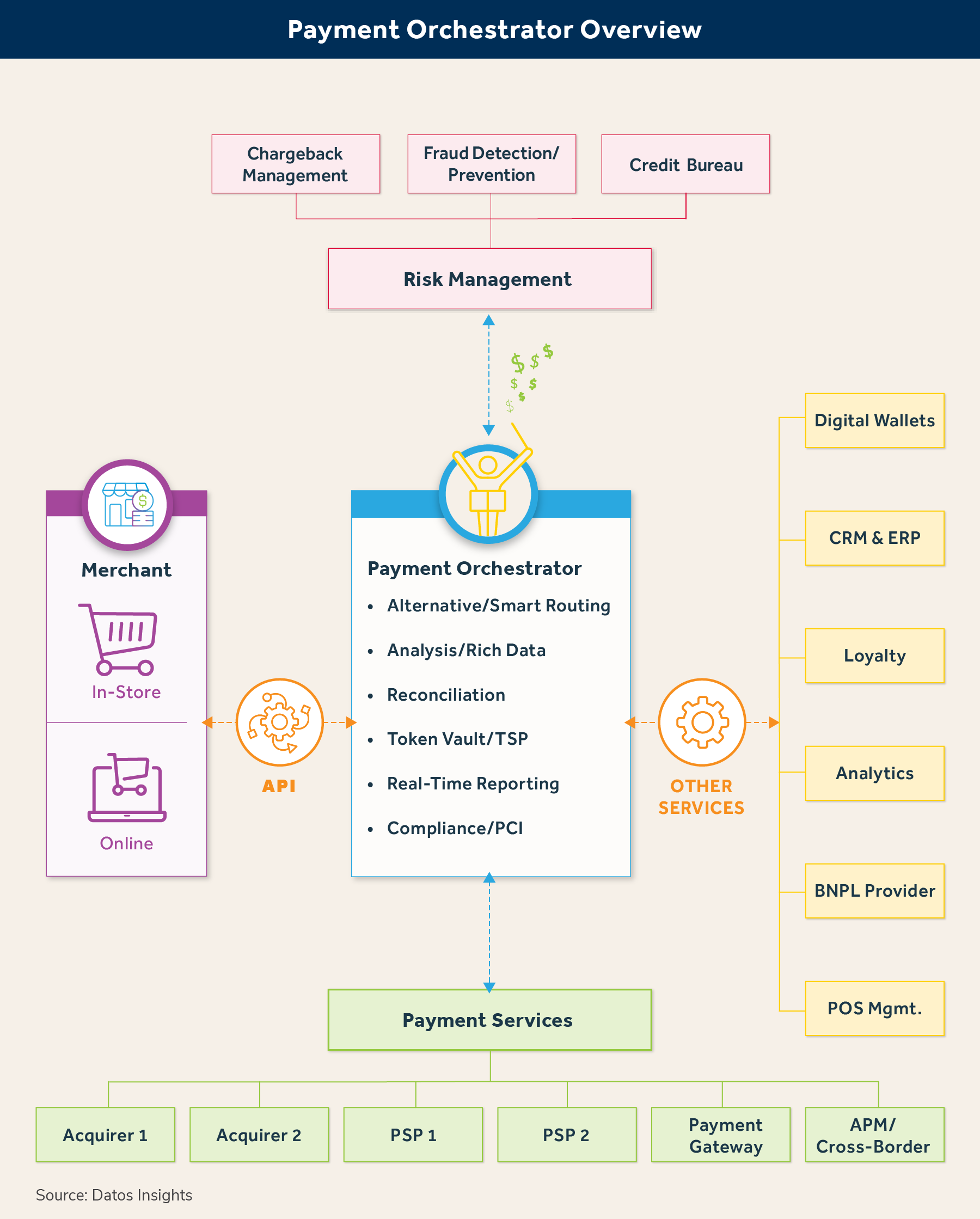

Here's how a Payments Orchestration Platform streamlines various connections for maximum efficiency and effectiveness: A Payments Orchestration Platform enhances global coverage with multiple gateways, manages service providers for optimal rates, ensures robust fraud prevention, and more. Read the full piece here

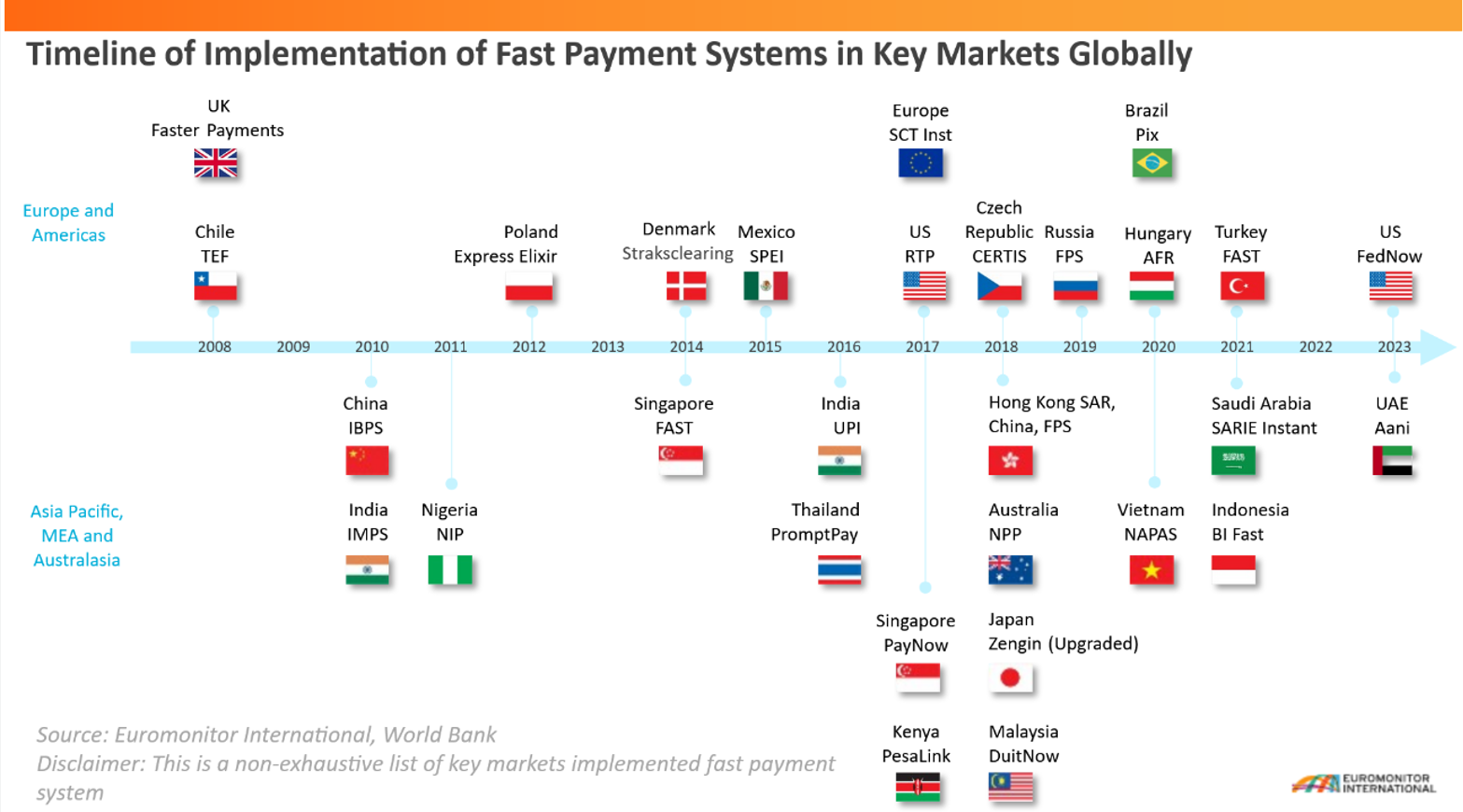

Navigating the Global Fast Payment Frontier. Fast payments (“FP”, i.e. near real-time payments) are transactions whose messaging and fund transfer are conducted in near real time (less than 20 seconds, typically) on a 24/7 basis. Learn more

OPEN BANKING NEWS

🇬🇧 TrueLayer first to participate in SEPA Payment Account Access Scheme. The initiative is designed to further advance the open banking ecosystem beyond compliance with the EU’s PSD2 regulatatory framework, and offer banks an opportunity to develop open banking APIs.

DIGITAL BANKING NEWS

🇺🇸 Fiserv seeks special purpose bank charter. The payment processor has applied to obtain a merchant acquirer limited purpose bank charter in Georgia, enabling the company to authorize, settle and clear payment transactions for merchants, according to a company spokesperson.

🇫🇷 Revolut aims for 20 million customers in France by 2028, and CEO is talking about opening physical branches in France. During a visit to Paris, Nik Storonsky, the CEO of the British neobank, expressed his ambitions for the French market, which is Revolut's second-largest market after the United Kingdom. Read more

🇪🇸 A Deep Dive into Spain's Digital Banking Landscape: 2023 Recap and Projections for 2024. The digital-only banking players in Spain have captured a remarkable user base exceeding 14 million, signaling a seismic shift in the banking sector. Spanish digital-only banks have carved a successful niche in retail banking, yet they encounter a different landscape in the business banking sector.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 After Bitcoin, will the SEC greenlight spot Ethereum (ETH) ETF this year? Speculations emerge about the SEC considering a similar move for an Ethereum ETF amid the existing presence of numerous Bitcoin ETFs on US stock markets. The SEC, though, keeps delaying the decision, with most applications now having to wait until May.

🇺🇸 SEC’s bitcoin ETF tweet fiasco may end in fraud charges, lawyers say. The agency gaffe will likely be followed by investigations into the hacker, the SEC, and maybe even X itself. “Accessing someone else’s account illicitly without their permission or using it to do anything is a federal crime,” Brian L. Frye, law professor at the University of Kentucky, said.

DONEDEAL FUNDING NEWS

🇺🇾 Prometeo raises $13M from PayPal, Samsung and more to bring open banking to Latin America. The companies backing Prometeo in this round underscore not just who wants to grow their business in the region, but who believes open banking could help them get there. Read full article

🇬🇧 The Bank of London, a new clearing bank which boasts Lord Mandelson on the board, has raised £25m after falling to a second annual loss. Losses at the bank widened to £41.8m for the year ending December 2022 from £15.7 million, new accounts show. A hiring spree and spending on technology helped push the bank into the red.

🇺🇸 Roanoke, VA-based KlariVis, raises $11M in Series B funding. The company, specialized in data analytics solutions for community banks and credit unions, intends to use the funds to further advancements in engineering, product development, customer success, and sales and marketing. Read more

🇲🇽 Finbra secures US$2.3M financing line to continue supporting SMEs in Mexico. With approximately a year of operations, Finbra has become a key player in SME loans, particularly focusing on automotive-backed SME loans. With the funds, Finbra aims to grow its team and solidify its position as a leading financial institution for SMEs in Mexico.

MOVERS & SHAKERS

🇦🇺 Stake appoints Jon Howie as new CEO as it scales to greater heights. Howie has over 20 years of financial services experience and will lead the business into its next chapter of growth. Read on

🇺🇸 InvestCloud names former Fiserv CEO Jeff Yabuki as Chairman and CEO. Yabuki brings extensive experience in the financial technology industry and will lead InvestCloud’s strategy and operations, the firm said in a recent press release. Interim CEO Richard Lumb will remain with the board of directors.

🇬🇧 Metro Bank CFO James Hopkinson exits after less than 2 years. Hopkinson is departing for personal reasons, according to a bank spokesperson. Cristina Alba Ochoa will act as interim CFO from Jan. 15, and the bank has started looking for a permanent successor to Hopkinson, who joined in 2022 during Metro Bank's turnaround efforts following a 2019 accounting scandal.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()