This Week's Top FinTech Funding Deals Across Europe

Hey FinTech Fanatic!

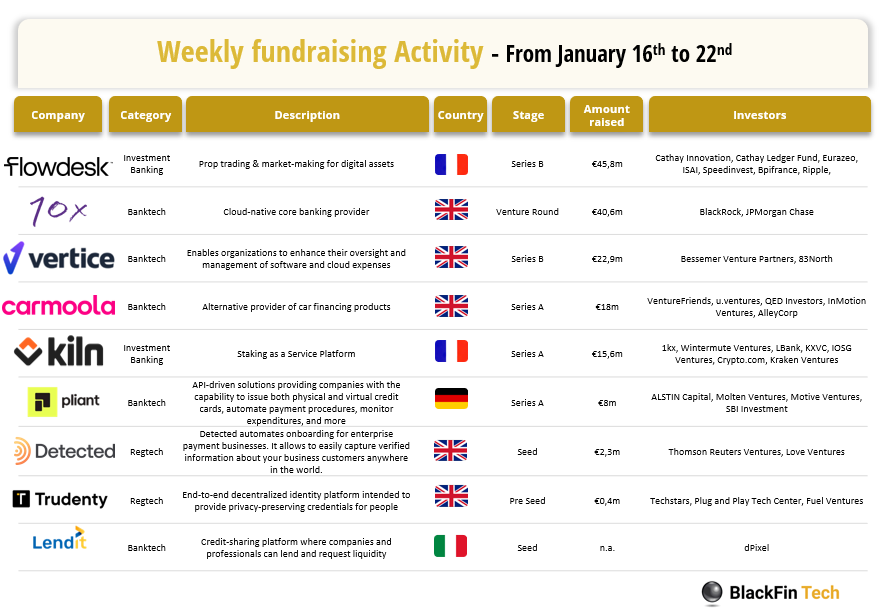

In the past week in Europe, the FinTech stage was alive with the sound of deals, totaling an impressive €153.6 million across nine transactions.

The spotlight shone brightly on the UK, hosting five of these financial feats, while France, Germany, and Italy each presented their own noteworthy acts.

Taking center stage was France's Flowdesk, a master in prop trading and market-making for digital currencies, which elegantly secured €45.8 million in a Series B round led by Cathay Innovation. Also deserving a round of applause is 10X banking, which successfully gathered €40.6 million, with BlackRock leading the investment ensemble.

And let's not forget Vertice, the savvy platform transforming how organizations manage software and cloud expenses. They celebrated a significant €22.9 million funding round, backed by the expertise of Bessemer and 83North.

Enjoy more FinTech Industry news I listed for you below👇 and I'll be back in your inbox tomorrow!

Cheers,

P.s. don't forget to sign up for my Telegram channel to be the first to get the latest FinTech News on your phone!

FEATURED NEWS

Building Nubank, The World’s Largest Neobank with Co-founder Cristina Junqueira.

🇬🇧 LHV Bank has launched a Savings Account solution that makes saving up even more convenient and flexible. LHV will pay 2% interest on the funds deposited into the Savings Account, and funds from the account can be withdrawn at any time.

PODCAST

During the pandemic, Klarna became Europe's most valuable startup ($46B). However, the market shifted, and Klarna's valuation dropped. In a podcast by OMR, Sebastian Siemiatkowski, highlighted the importance of this transformation phase despite the temporary losses. Listen to the full podcast episode here

FINTECH NEWS

🇮🇳 Flipkart is launching super.money – a FinTech platform with a $20 Mn investment, aiming to offer lending, insurtech, and other FinTech products and services. But why the change of pace? Find out here

Nova Credit helps Ukrainians in U.S., U.K., Canada get credit through a partnership with CreditInfo, the fifth-largest credit bureau in the world. The effort makes the credit histories Ukrainians have built up in their home country usable and readable by banks in their new homes.

🇦🇪 Mastercard collaborates with ADGM for SME payment cards in the UAE. The partnership will empower SMEs to meet their growth potential through Mastercard’s technologies and resources. Under the collaboration, Mastercard and ADGM will offer SME cards to qualified businesses.

🇨🇦 Liberis brings “4-click funding” solution to small businesses in Canada. The company announced its expansion into the Canadian market, which marks a significant step forward in providing small businesses in Canada access to faster and more flexible funding. Keep reading

Fidesmo integrates with Mastercard's Token Connect and partners with German neobank VIMpay. This groundbreaking partnership enhances security and convenience in digital payments, making Fidesmo Pay the first tokenization platform for passive wearables to implement Mastercard’s latest innovation successfully.

PAYMENTS NEWS

FXC Intelligence mapped out all MPI licence holders in Singapore👇

🇰🇪 Visa and Pesaflow want to improve digital payments in Kenya. This collaboration could significantly improve the effectiveness, transparency, and inclusivity of public services while also encouraging financial inclusion. Read more

As the Buy Now, Pay Later (BNPL) sector continues to reshape financial landscapes, Saudi Arabia is witnessing a remarkable surge in innovative startups catering to diverse segments. Click here for more information.

OPEN BANKING NEWS

PayTabs Group partners with Fintech Galaxy. Following this announcement, the partnership will focus on leveraging the benefits of Open Banking for instant account verification, in order to integrate it as one of several connections to the PayTabs payment orchestration platform.

DIGITAL BANKING NEWS

🇬🇧 Perenna to offer a green discount for customers who decarbonise their homes. Unlike other green mortgages, the Perenna Retrofit Mortgage will focus on homes that need to be upgraded, rather than homes which are already energy efficient. The project will last for 12 months. The consortium plans to launch its pilot in summer 2024.

🇬🇧 Revolut has rolled out a new feature aptly named ‘Mobile Wallets’ to make it quicker and easier for its customers to send money abroad. The new feature will offer customers a low-friction way to make international transfers, requiring just a recipient’s ID.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Bankman-Fried's FTX to get bankruptcy examiner to probe collapse - US appeals court. A federal appeals court on Friday ordered the appointment of an independent bankruptcy examiner to investigate the Nov. 2022 collapse of FTX, the cryptocurrency exchange once led by the convicted Sam Bankman-Fried.

🇺🇸 Crypto startup figure seeks SEC approval to issue Interest-Bearing stablecoin. Figure Technologies Inc., a blockchain and lending startup founded by former SoFi Technologies Inc. Chief Executive Officer Mike Cagney, is seeking approval from US regulators to issue an interest-bearing stablecoin.

DONEDEAL FUNDING NEWS

🇬🇧 11:FS to launch fintech VC fund led by Fronted founder Jamie Campbell. Taking the challenger consultancy beyond tech to invest in and support fintech startups is a bold move. The venture arm will leverage 11:FS's teams, tech, and reach to support the invested startups and those in its accelerator program.

🇺🇸 Goldman Sachs doubles loan facility to Hong Kong fintech start-up FundPark to US$500 million. The company plans to use the investment to provide loans to SMEs, which often have their requests for trade finance rejected by banks, creating a trade financing gap of US$2.5 trillion globally for small business.

Fintech heavyweight Kaspi.kz valued at $17.5 bln in tepid Nasdaq debut. Kaspi.kz operates through three segments - payments, marketplace and fintech - and caters to both consumers and merchants. Its app lets customers access buy BNPL debt, renew their driving licenses and register their businesses.

🇨🇴 Approbe, a Colombian fintech company specializing in connecting credit seekers with willing lenders, has successfully secured a seed investment round of US$2.3 million. This peer-to-peer (P2P) lending platform involves not only individuals but also corporations or even payment gateways.

🇮🇳 FinAGG raises $11m to expand MSME financing in India. FinAGG has reached over 85,000 borrowers in 100 Indian cities, disbursing over 52 billion rupees (US$629 million) to date. The company also provides loan management systems customized to the needs of local and international financial institutions.

🇫🇷 Flowdesk, a French digital asset firm, has raised US$50 million in a series B funding round. The company will use the fresh funds to expand its over-the-counter (OTC) offering and secure digital asset trading licenses in Singapore and the US. It also plans to open more offices in financial hubs and hire for key roles.

🇭🇰 HashKey claims 'unicorn status' after raising US$100 million for one of Hong Kong's two licensed cryptocurrency exchanges. Existing and new investors took part in its new Series A round, giving HashKey a pre-money valuation of US$1.2 billion, the Hong Kong-based company said in a statement, without disclosing any names.

🇶🇦 Qatar's Karty raises $2m for digital wallet. Karty is building an e-wallet for payments, instant peer-to-peer money transfers, oversight of daily spend, and the ability to track spending patterns through interactive charts. Keep reading

🇺🇸 Tandem raises $3.7M in seed funding. The Chicago, IL-based provider of an app for couples to manage their finances together, intends to use the funds to expand operations and its business reach, and develop the platform with additional features and build the Android app.

M&As

🇫🇷 Crédit Agricole acquires minority stake in Worldline. The French bank says the transaction demonstrates its intention to support Worldline’s development and implementation of its strategy as a key European payment services provider. Read more

MOVERS & SHAKERS

🇺🇸 Synchrony hires former Santander exec Pierre Habis as the new general manager and head of its consumer banking business. Confirming the appointment via LinkedIn, Habis says he has been tasked “to lead the charge to grow the bank”, effective from this month. More info here

🇵🇭 Tonik Country President Long Pineda retires, replaced by Group CEO Greg Krasnov. In her tenure as President, Ms. Pineda has been instrumental in securing Tonik’s position as the first digital bank in the Philippines, marking a milestone in the nation’s banking history.

🇬🇧 The Bank Of London appoints Anne Grim to the UK bank board. Anne brings more than 30 years of experience at board level with an extensive track record in business transformation strategy development and execution across technology and financial services.

🇺🇸 American Fintech Council elects Martha O’Malley chair. An accomplished attorney with broad experience working in fast-paced and highly regulated environments, O’Malley serves as an Assistant General Counsel and senior advisor on legal issues relating to fintech consumer financial services.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()